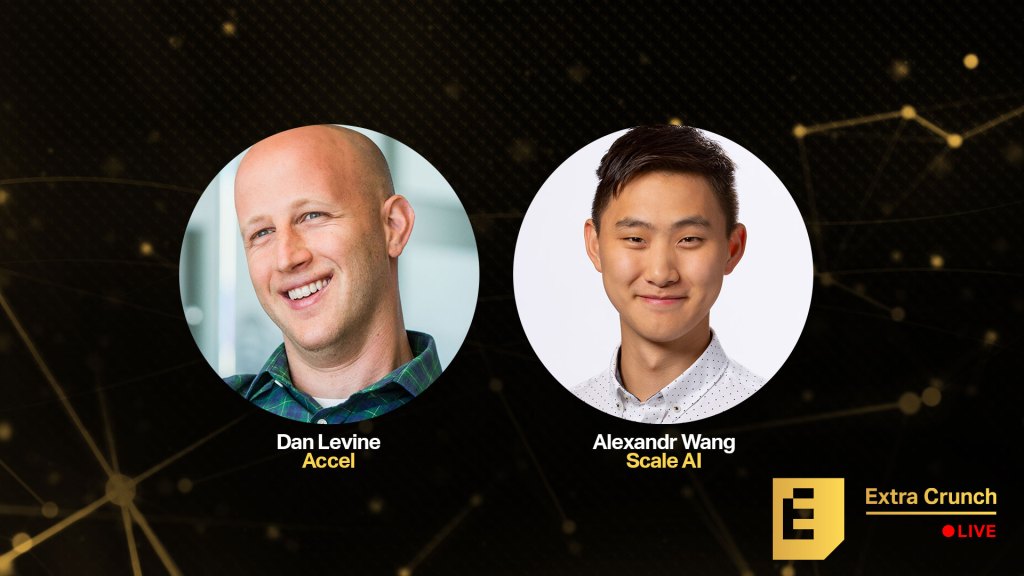

Few companies have done better than Scale at spotting a need in the AI gold rush early on and filling that gap. The startup rightly identified that one of the tasks most important to building effective AI at scale — the laborious exercise of tagging data sets to make them usable in properly training new AI agents — was one that companies focused on that area of tech would also be most willing to outsource. CEO and co-founder Alex Wang credits their success since founding, which includes raising over $277 million and achieving break-even status in terms of revenue, to early support from investors including Accel’s Dan Levine.

Accel haș participated in four of Scale’s financing rounds, which is all of them unless you include the funding from YC the company secured as part of a cohort in 2016. In fact, Levine wrote one of the company’s very first checks. So on this past week’s episode of Extra Crunch Live, we spoke with Levine and Wang about how that first deal came together, and what their working relationship has been like in the years since.

Scale’s story starts with a pivot, and with a bit of rule-breaking, too — Wang went off the typical YC book by speaking to investors prior to demo day when Levine cold-emailed him after seeing Scale on Product Hunt. The Product Hunt spot wasn’t planned, either — Wang was as surprised to see his company there as anyone else. But Levine saw the kernel of something with huge potential, and despite being a relative unknown in VC at the time, didn’t want to let the opportunity pass him, or Wang, by.

Both Wang and Levine were also able to provide some great feedback on decks submitted to our regular Pitch Deck Teardown segment, despite the fact that Levine actually never saw a pitch deck from Wang before investing (more on that later). If you’d like your pitch deck reviewed by experienced founders and investors on a future episode, you can submit your deck here.

Knowing when to bend the rules

As mentioned, Levine and Accel’s initial investment in Scale came from a cold email sent after the company appeared on Product Hunt. Wang said the team had just put out an early version of Scale, and then noticed that it was up on Product Hunt — it was submitted by someone else. The community response was encouraging, and it also led to Levine reaching out via email.

“One of the side effects of that, one of the outcomes, was that we got this cold email from Dan,” he said. “We really knew nothing about Dan until his cold email. So like many great stories that started with a bold, cold email. And we were pretty stressed about it at the time, because in YC, they tell you pretty definitively, ‘Hey, don’t talk to a VC during the batch,’ and we were squarely in the middle of the batch.”

Wang and the team were so nervous that they even considered “ghosting” Dan despite his obvious interest and the prestige of Accel as an investment firm. In the end, they decided to “go rogue” and respond, which led to a meeting at the Accel offices in Palo Alto.

”We kind of viewed it as an informal chat, which is naive, because now I know that every time you do that with an investor, it can be an informal chat, but it’s definitely an investment meeting,” Wang said. “[Dan] gave me a brain teaser actually in the first meeting, veiled as a business question or a business problem within the frame of Amazon, so I remember that reasonably vividly. Then, after that meeting, we met up again in a few weeks, and it was either in that meeting or in the meeting after that where we decided we wanted to work together.”

The whole process only spanned about a month, but ended up laying the ground work for a long and successful founder-investor relationship.

No single path to funding

Interestingly, the original investment in Scale that Levine led for Accel was presented as one of two options for Wang and his co-founders to consider. Typically, there’s a little more formality around the stage of investment when investors are coming in during a fundraise effort, but the deal was nothing if not unconventional.

“When I made the offer to Scale, I offered them either a Seed deal or a Series A, and I said you can pick either one you want,” Levine said. “In the Series A scenario, they got a little more capital and a higher post-money, but I got a little bit more equity. And in the Seed deal, you know, [it was] basically the reverse […]. Thankfully, Alex went with the Series A option, which I think hopefully worked out for everyone.”

Nearly five years later, with a valuation pushed to $3.5 billion in its most recent round from December led by Tiger Global, it looks like the deal has indeed worked out for everyone. That flexibility, combined with Dan’s willingness to close the deal quickly, were big reasons why Wang and Scale decided to sign the deal.

“From from our perspective, I think we were excited to do it just because — and I think this is a big reason why a lot of founders that I know [would prefer it] — we didn’t want to have to spend a lot of time away from the business process of raising money,” he said. “lf you want to do a full process, that can take months; you have to be really focused on it; it’s gonna eat away at you, and it’s going to be really stressful the whole time.”

The pitch deck teardown

Of course, each episode of Extra Crunch Live features the Pitch Deck Teardown, where our esteemed guests take a look at decks submitted by the audience and give live feedback. (If you’d like your deck to be featured on an upcoming episode, hit up this link.)

Here are some of the highlight takeaways Levine and Wang delivered about how best to craft decks that can win with investors:

- Start off with the team slide, particularly in early-stage pitching, because much of the decision to invest is informed by investor confidence in the people building the company.

I would bring the people forward as an example, I think, especially at the early stage, that’s really critical. And one of the things I always find fascinating as somebody who kind of sits in pitches all day is, you’re at the beginning, you kind of introduce yourself, organically. But often the team slide is at the end. It seems like logically, you’d want the team slide when you’re introducing yourself. (Levine)

- Keep things brief, and intentionally leave some things open-ended to prompt responses. A good deck presentation should be engaging in both directions.

Alex and I both kind of grew up in more of the Y Combinator school of thought around presentations and pitching and comms about your idea. And I think a focus on simplicity and brevity is one thing you learned from that. I think it’s very helpful. Also — especially with investors — if you give an investor a slide and pause, a lot of investors will respond to it. So you always want to think to yourself, “Is this like a slide that I would want a response to?” Or do you want fewer things, and tighter together? (Levine)

- Start with an idea of what you want to convey, and work from simplest to more complex. Don’t assume that you can fit your own pitch to an existing template and that it needs to contain a set number of slides or pieces.

Whether it’s a pitch deck or a customer deck, I always try to write down in sentences what is the narrative that I’m trying to get across. And then you translate that to “What is the slide deck that will help communicate that?” rather than I think what a lot of founders […] do is, they take a template, or they find some list online of all the things that you need to have slides about, then build sets of slides to support each of them. (Wang)

Comment