Chicago’s startup scene is finally getting the attention it long felt it deserved.

By now it’s common knowledge that 2021 is shaping up to be a breakout year for the startup and venture capital worlds, surpassing years of strong results in a long-term bull market for tech-focused business upstarts. But no boom is equally distributed.

Different markets are seeing differing amounts of activity, driven in part by their startup ecosystem’s maturity and the ease with which external capital can be deployed. African startups will set fresh venture capital records this year, for example. But markets closer to the leading hubs of venture capital are seeing even stronger results, as Latin America demonstrates. China’s venture capital market, meanwhile, is easing as others accelerate.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Even inside the United States, there is divergence in how individual markets are performing. Chicago is an outlying benefactor from accelerating venture capital activity and the rise of remote investing. Data collected by CB Insights, for example, indicates that Chicago’s ability to attract venture funds has risen to new heights in the first half of the year.

While we anticipated Chicago might do well in a generally warm environment for startup investment, its results were better than we expected. To more fully understand just what is going on in the Windy City, The Exchange corresponded with M25, a Midwest-focused venture capital fund; Moderne Ventures’ partner Liza Benson (fresh off her firm raising $200 million for its second fund); Scott Kitun, of the Technori community and investing platform that has roots in the city; and Brian Barnes, CEO of M1 Finance, a local unicorn in the fintech space that TechCrunch has covered extensively.

The picture that emerges from their comments is one of a city long underfed in capital terms leaning into a changing investing market. And the investors don’t expect that the back half of the year will be too different from the first. That means Chicago-based startups are in the middle of their best year of raising capital ever. Let’s talk about how that came to be.

The picture that emerges from their comments is one of a city long underfed in capital terms leaning into a changing investing market. And the investors don’t expect that the back half of the year will be too different from the first. That means Chicago-based startups are in the middle of their best year of raising capital ever. Let’s talk about how that came to be.

A venture capital run for the ages

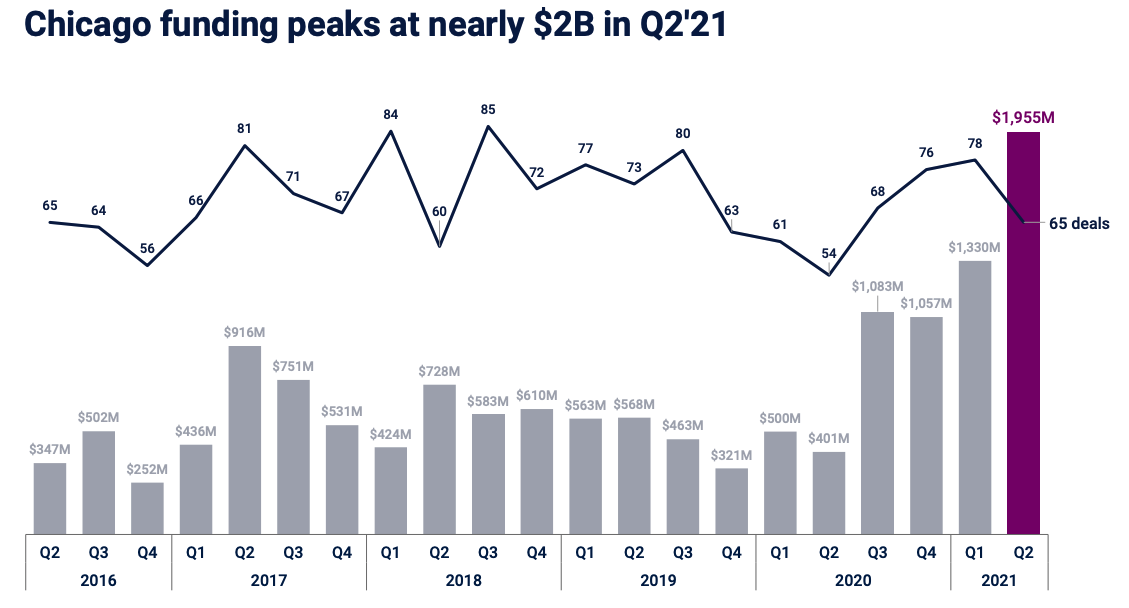

The pace at which Chicago-area startups have raised capital reached a new, high plateau starting in the second half of 2020. In historical terms, data indicates that Chicago was a beneficiary of an accelerated pace of venture investment that took hold globally once investors, concerned that startup growth could slow, shrugged off initial COVID shocks.

In short, startups were not affected as many feared, with many young tech companies actually accelerating during the pandemic’s first quarter of lockdowns, as many traditional businesses had to lean into software solutions and other services that startups sold.

The early boost to Chicago’s venture totals in the final two quarters of 2020 was easily bested in the first quarter of 2021. And then the second quarter of this year crushed that record.

Don’t fret about the round count figure slipping in Q2 2021; round counts are a laggy data point in the venture world, and we expect that number to rise as more deals are announced.

Inherent issues with venture capital data reporting aside, Chicago startups raised around as much in Q2 2021 as they did in all of 2019, at least in dollar terms. And each of the last four quarters in the city would stand as a record going back to at least 2016 were it not for their similarly impressive peers.

But it was that final bar in the chart that drew our attention. To see Chicago’s startups get to $1 billion in quarterly investment was eye-catching. To see the city double again from Q3 2020 to Q2 2021 made us wonder: Who raised all that money?

Leading Chicago startups

More venture dollars, more unicorns. That seems to be a global truism, and it’s bearing out in Chicago.

The city has seen 10 of its startups reach a $1 billion valuation this year. That’s nearly half of the city’s 21 unicorns in a single year. Of course, exits come to bear on those figures, but the ratio of new to existing startups in the city with 10-figure valuations is still sharp; Chicago is creating more leading startups than ever.

M1 Finance is a perfect example. After raising an $11.2 million Series A in 2018, per Crunchbase data, the company was a neat (if lesser-known) startup in venture circles. Then the world changed. In June 2020, M1 announced a $33 million Series B. Then, in October of the same year, the company closed a $45 million Series C.

It was just getting started. In March 2021, M1 Finance raised a $75 million Series D. Then it put together a $150 million Series E this July, thanks to SoftBank’s second Vision Fund. From its first known venture capital in 2016 to the start of 2020, we’re only aware of just over $20 million in total funding for M1. Since the middle of last year, the company has raised over $300 million.

As the company’s CEO, Brian Barnes, told The Exchange, “M1 is one of 10 Chicago companies to become unicorns in 2021. That’s the third most of any U.S. hub, only behind the Bay Area and New York.” That means that Chicago pulled ahead of Boston, a traditional venture capital hub in the U.S., this year.

Of course, M1 Finance is more than just a venture capital story; the company’s consumer-focused fintech service caught the same wave as Robinhood and others when it came to the burgeoning interest in saving and investing. But when M1 accelerated, instead of being forced to fuel itself with small meals of expensive capital, the Chicago-based company was able to unlock enormous checks in rapid succession, something that wasn’t possible until the pandemic.

What are the other unicorns from Chicago that we should know about? Consumer video service Cameo, after raising $100 million earlier this year. E-commerce logistics upstart ShipBob, after raising $200 million in June. ActiveCampaign raised $240 million this year at a valuation of more than $3 billion. Project44 raised $202 million from Goldman Sachs, doubling its valuation to $1.2 billion. Fintech startup Amount raised $99 million at a $1 billion valuation. The list goes on.

And some local players expect the pace of unicorn creation to only accelerate. Per Barnes, since the current generation of Chicago unicorns were founded, “significantly more companies have been started in Chicago that are on a similar trajectory, just earlier into their lifecycle,” he said. In the future, the exec added, he expects “Chicago to have as many high-growth startups as any other major tech hub in the country.”

Where should we look for that next generation? M25 investors Victor Gutwein and Mike Asem cited transport and logistics as areas of notable activity, along with fintech and insurtech.

Technori’s Kitun cited insurtech as well, along with real estate startups and, again, fintech. Kitun also mentioned media, which surprised us, along with food-focused tech and robotics.

And Moderne Ventures’ Benson cited “SaaS and technology-enabled companies in a variety of industries.” Our read of the mix? That there is a lot of activity in many startup niches and verticals in Chicago. It’s not a single theme. Instead, the city’s startups seem to be working on nearly every market space that we care about.

Chicago was ready for the Zoom era

Now that we have explored who benefited from the rise in funding and investor interest, let’s talk about how it came to be. M25 provided us with a handy TL;DR: “There [was] a built-in stable of high-performing but underfunded/undervalued Chicago startups that overnight received a national audience for their financing rounds, and everybody was a buyer.”

In other words, the pandemic shift to venture capitalists investing over Zoom was a boon to Chicago startups when it came to fundraising.

But let’s take a minute to sum up the pre-pandemic situation. “Chicago (and the Midwest as a whole) had always struggled with raising venture capital because it [lacked] significant local capital sources,” M25 recalled. As a result, Chicago’s startups often looked different from their counterparts in trendier hubs; in order to meet the requirements of local investors and be worth the extra effort for outside investors, “they tend to have better metrics (revenue, users, unit economics, etc.) than similarly valued companies in SF [or] NYC,” the firm explained.

Better metrics for the same value is another way of saying that Chicago startups were undervalued — and that’s still somewhat the case, Benson said. “Valuations, while rising, are still far below the traditional tech centers.”

Chicago Ventures raises $63M to back seed-stage startups located anywhere but Silicon Valley

This obviously played a role in attracting investors’ attention in a Zoom deal-making era, but it is only part of the picture, M25 told TechCrunch. Once it becomes “just as easy to do a deal in your same Silicon Valley suburb as it is to do a deal in Chicago,” there’s a clear advantage for “more efficient, high-traction Chicago/Midwest startups without the insane price tag.”

According to Kitun, this means that Chicago startups are still incentivized to prove higher ROI potential.

“Previously it was to satisfy our investors’ demands to raise ANY capital — now it’s because we recognize being fiscally conservative but still focused on growth is massively attractive to outside money … because outside funds aren’t used to seeing such strong revenue/P&Ls at seed and Series A stages.”

As for later stages, investors are also discovering strong bets that they had previously ignored. M1 could belong to that list, Barnes said. “M1 was a little overlooked in the first few years of operation, some of which was caused by not being on the West Coast.”

Over time, things changed: “As we achieved more meaningful scale, investors started to take note and realize that M1 can be this generation’s Schwab. They bought into the Chicago ethos of being systematic and disciplined to create a large and enduring institution. Over the past year and a half, M1’s users and assets have grown by more than fivefold — making it clear that our Chicago HQ wasn’t the hindrance some may have expected it to be.”

M1 also found out that Chicago’s talent pool is particularly attractive. “M1 has been able to hire 80% of the workforce local to Chicago, many of whom are new college graduates from Chicago universities.”

Others have taken notice, however: “With the new hybrid hiring norms around the country, we find we are competing for talent, not only with Chicago-based companies, but also with companies from New York, the Bay Area and all of the companies that offer 100% remote work.”

Furthermore, Kitun warns that “the old-school mentality of ‘works in the office’ is still very strong” in Chicago, and that the city “will lose a ton of talent if our founders, investors and CEOs do not more warmly embrace [working from home].”

Luckily for Chicago, it also has the potential to attract talent, Barnes said.

“We are able to recruit people from all over the country and we are attracting candidates that love our product regardless of where they live. Chicago has done a great job of working with local universities through their programs like P33 and attracting founders and startups through incubators and accelerators like 1871. These programs provide M1 with a talent pipeline and that hasn’t stopped over the last year and a half. We are able to make local hires with a larger channel of inbound applications than ever before.”

Overall, we get the sense that Chicago’s work from before is now paying dividends and that those efforts will likely take the form of future exits.

Capital recycling at last

When The Exchange explored the Brazilian startup venture capital and exit market recently, we were told by local players that invested capital could recycle back into the nation’s early-stage ecosystem from exits, driven in part by rising IPO volume leading to more startup M&A. Capital recycling is a key factor that has helped keep Silicon Valley atop the global startup game for decades; by taking winnings from prior successes and plowing the cash into new startups, individual ecosystems can get more bang for their buck — and better control their own destiny.

According to M25, that is now happening in Chicago. The firm’s pair of investors who answered our questions noted that “Chicago has always had a few big outcomes sprinkled in,” including names like Groupon, Grubhub and Braintree. But the capital jockeys added that it “took a while for both those seasoned operators and angel [and] venture capital [returns] to be recycled,” the slower pace of which was driven by a lack of venture capital in the Chicago area.

Things have changed. “Finally,” Asem and Gutwein said, “money started to be recycled, talented team members joined or started the next big thing, and the flywheel took shape.” Half of the writing team for this particular piece spent parts of their formative youth in Chicago’s tech scene, making this particular evolution extra notable, as it was not the case — painfully so — back in the early 2010s.

What evidence of that flywheel taking shape do we have? Per the M25 duo, you can see its impact in “how much local capital has seeded these big unicorns,” including Chicago Ventures backing Project44, G2 and Cameo. Other local investors have backed M1, ShipBob and others. M25 itself is an investor in Kin Insurance, which is going public via a SPAC (TechCrunch covered the company in 2017).

No brakes

Don’t expect a Chicago slowdown anytime soon.

“Q3 continues to come in very strong” in venture capital terms, Benson said, with Moderne expecting that “Q4 will continue the trend given the venture dollars raised out of Chicago.” If the third and fourth quarters of 2021 are even as good as the first quarter of the year — let alone its monster Q2 — the city will have finally outgrown the chip on its shoulder.

Sure, the venture capital market in Chicago is not perfect. There’s always room for more early-stage funding in any market. And Chicago is likely not immune from traditional venture inequities, like funding discrepancies along gender or racial lines. But those issues don’t erase the raw numbers that the city is currently putting up.

And more mega-rounds could be on the way. M25’s duo agrees with Benson that the current pace of deal-making will continue. And while low-hanging fruit in the form of “the biggest spread between great traction/unit economics and valuation” in Chicago and other markets has “already been taken up,” the firm said that it knows “there are a lot of promising Chicago [and] greater Midwest startups that haven’t yet raised mega-rounds but could later this year,” or in 2022 and 2023.

So buckle up, Midwest. You finally have a venture champion that can stand toe to toe with any other. At last.

Comment