Over the years, Mike Butcher has covered Hour One a number of times here on TechCrunch. The company is using AI to create text-to-video solutions with realistic-looking human avatars. The space seems to be exploding, and Hour One has been on quite the trajectory. The company raised $5 million back in 2020, was taking on the language learning vertical and raised another $20 million in a round that closed in April of this year.

I’m pretty excited to take a closer look at the deck Hour One used to raise its most recent round, so let’s dive right in!

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Hour One raised its $20 million round with a tight 11-slide deck. The company shared its deck, dated November 2021, in full, without edits or redactions, so we can see what the investors saw as they were reaching for their checkbooks.

- Cover slide

- “At a glance” summary slide

- Solution slide

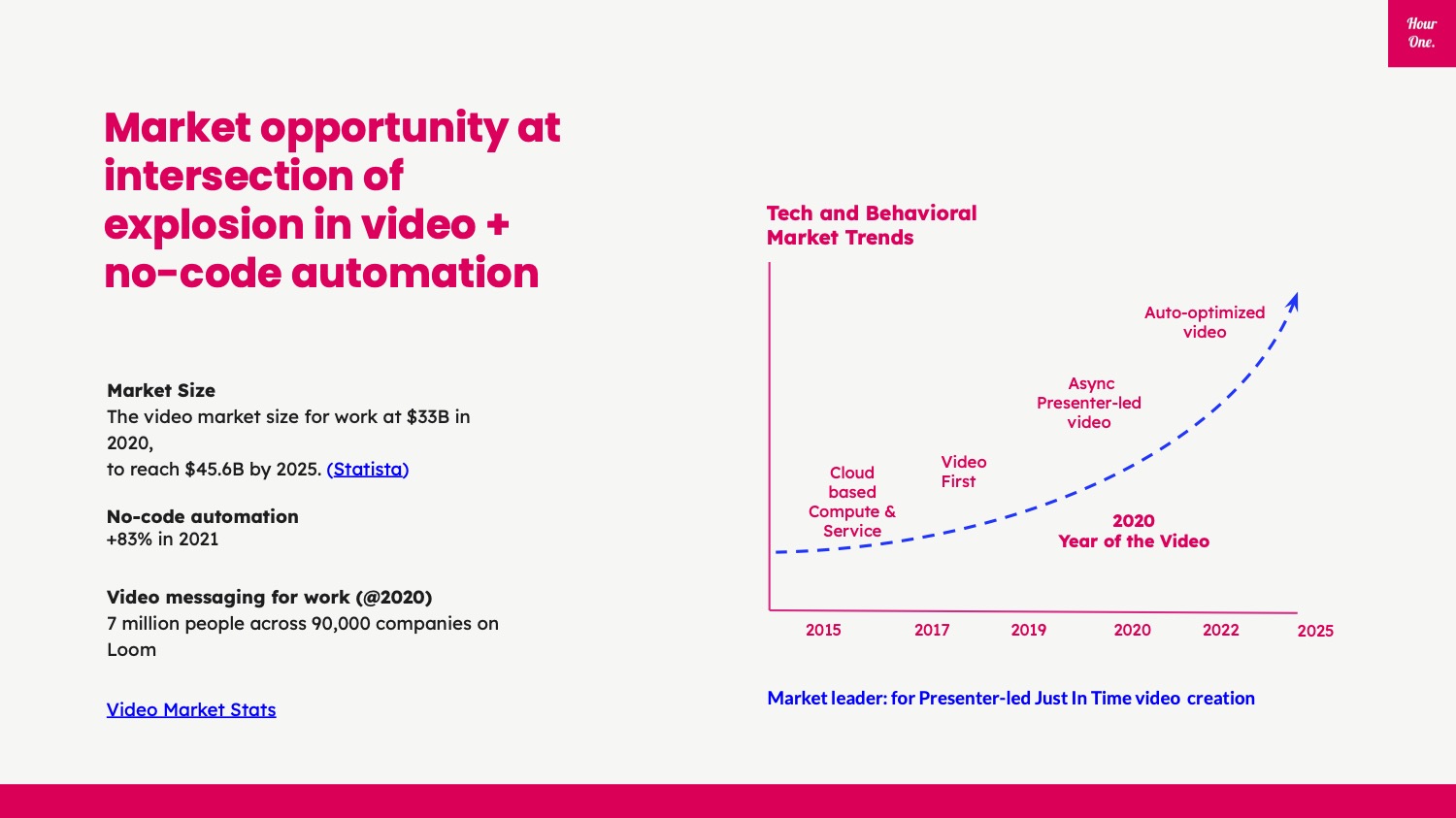

- Market size slide

- Value proposition slide

- Product slide 1

- Product slide 2

- Target audience slide

- Case study slide

- Team slide

- Closing slide

Three things to love

I love a deck that is able to distill its story to the bare essentials. Most of the decks I’m seeing these days, both through my consulting practice and through the pitches submitted to TechCrunch, are a lot longer than the 11 slides Hour One used here. The question is … did they go too far into sparsity? Let’s find out!

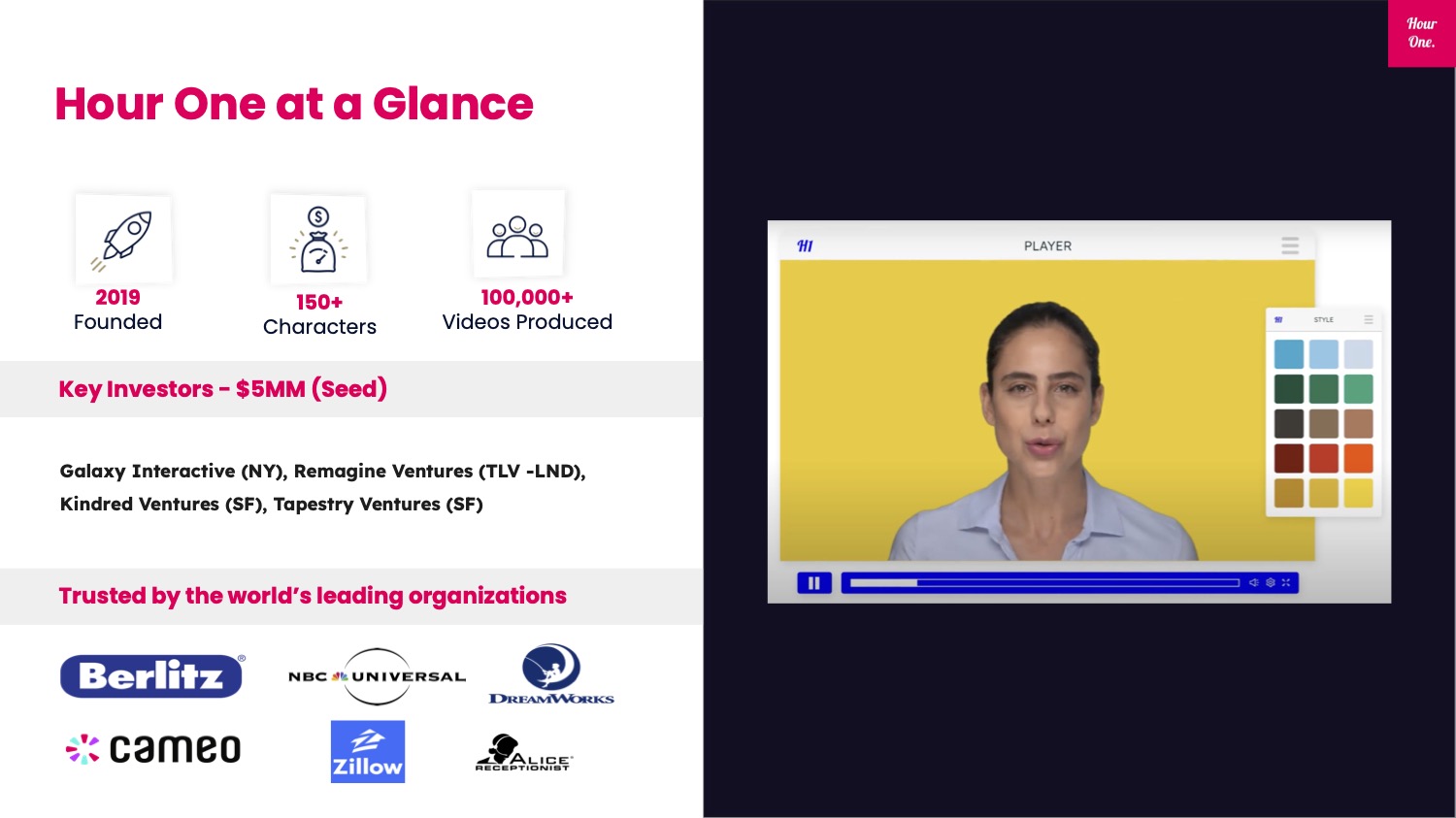

Love the “at a glance” approach!

Let’s admit it: One of the main reasons startup founders need a deck in the first place is to help potential investors figure out whether they want to take a meeting with you. Having a summary slide can help investors figure out if you are in the right vertical and company stage — in other words, you can help them decide if you fit their investment thesis. This slide gets a few of those things right.

By leading with traction (characters and videos produced), customers and funding history, along with a screenshot showing how the interface works, this slide goes a long way toward setting the stage. Personally, I would have added a couple of additional points:

- A one-line summary about what the company does (“Human-like AI character videos at the click of a button” could work.)

- Make explicit the business model (B2B SaaS).

- Make explicit how much money you’re raising (“Raising $20 million Series A”).

The lesson here is to include all the pertinent information about your company in one place, as early in the story as possible.

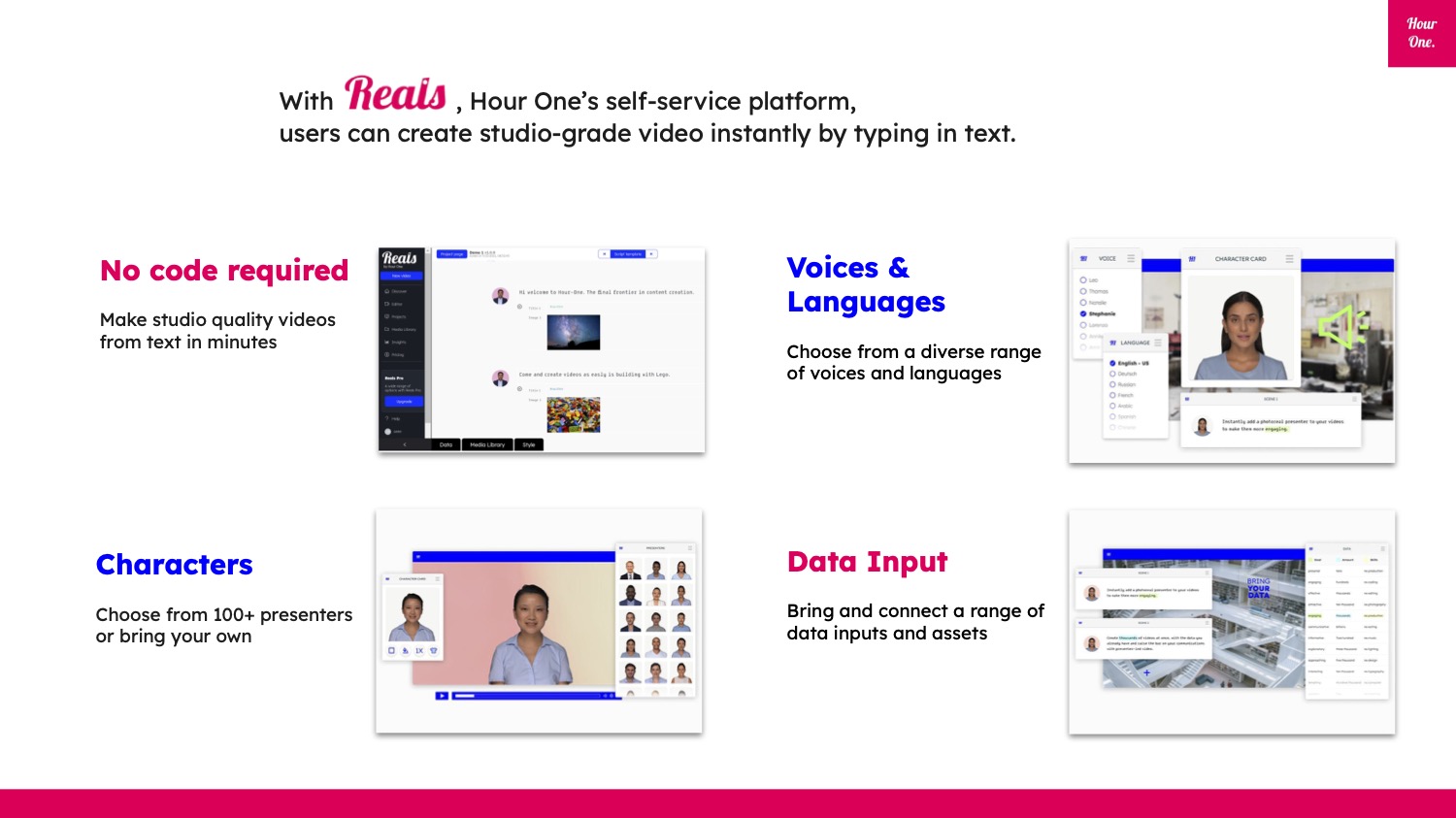

Great product summary

Apart from the great pun in the name for its product, this slide is jam packed with really good content, offering a really clear summary of the product complexity Hour One has already built through a simple, user-focused story. To make this slide even better, I’d have preferred that the story was benefits driven rather than feature driven, but it does a lot of heavy lifting as-is.

The reason why benefit-driven product stories work better is obvious: You help the investor connect the dots. It isn’t about what the user can do, but about why they might do these things to save time, money and frustration. Here’s how that might have looked:

- No code required –> “Anyone can make AI character videos.”

- Voices and languages –> “Connect with your audience in their language.”

- Characters –> “Embrace diversity by choosing from more than 100 presenters.”

- Data input –> “Customized content on the fly by easily pulling in data from external sources.”

Incidentally, I’m confused about this slide: On the summary slide, we are talking about 150+ characters, and on this slide, it’s 100 presenters. Are presenters and characters different? If so, how? And if not, why are the numbers different? I presume that the founders would be able to talk about this more as they pitch the story, but it would have been better if it were more obvious why there’s a difference here.

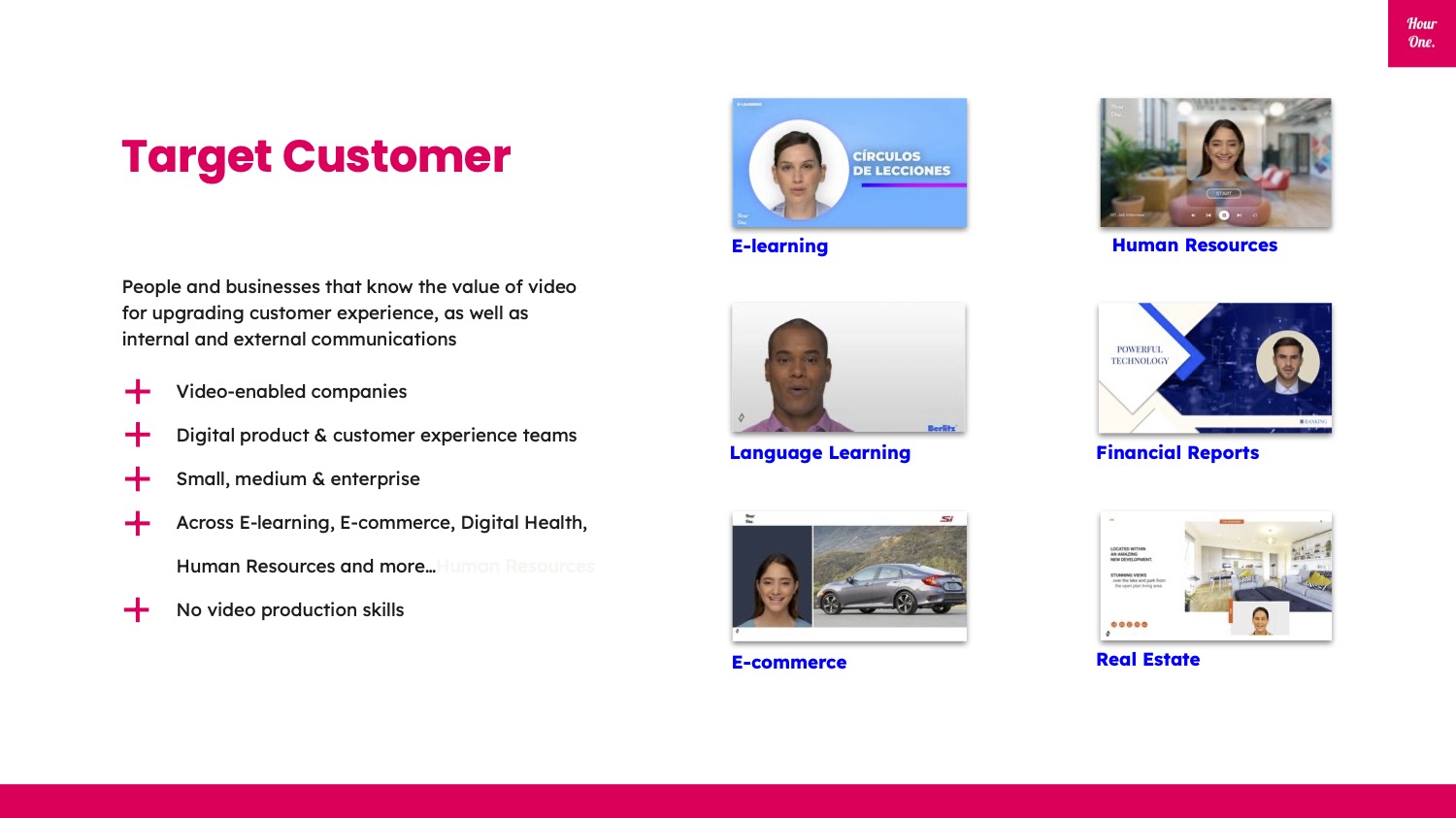

A variety of target customers

The very best companies create a product that works well for one set of target users, and then expand the user base to capture a broader market share. Hour One tells that part of the story on its eighth slide:

What really works about this slide is that Hour One is able to show the breadth of its appeal; each of these categories could be big enough to build a successful company, but by being vertical agnostic, Hour One is able to build up a little fear of missing out (FOMO) in me as an investor: I can easily see how the company could be on an extraordinary growth trajectory.

Apparently, I’m in a nitpicking mood today, and as good and as clear as this slide is, I think it would be even better if they combined the target customers with their outcomes. Imagine how much stronger this part of the presentation would have been if the company had used actual case studies for each of these categories.

Here’s how that might look:

- E-commerce companies: +15% average basket value.

- Real estate: +19% of inquiries.

- Language learning: +40% vocab retention.

Obviously, I’m making up the numbers here, but as a founder, these are the kinds of slides where you can really show off how deep your market understanding is. Another approach might be to make it more benefits driven, connecting the customers with the use cases. “E-commerce uses Hour One to connect with customers” and “CFOs use Hour One to make their financial reports come to life.”

For a gold star, combine them for even deeper narratives: “Company X uses Hour One to make its internal training programs, resulting in a 35% increase in completion of new training initiatives.”

As a startup founder, what you can learn from this slide is to always be on the lookout for ways that you can show the depth of your knowledge, both in terms of domain expertise and market context. Understanding your customers deeply and that your product solves real problems for them is an indication that there’s something special about you and your team; being uniquely positioned to solve a problem becomes part of your “moat” — the reason why nobody else could be doing what you are doing.

In the rest of this teardown, we’ll take a look at three things Hour One could have improved or done differently, along with its full pitch deck!

Three things that could be improved

Hour One gets an A+ for having an 11-slide deck, but some of them have way too much text on them. The problem with that is that your would-be investors will spend time reading the slides rather than listening to you, which is a huge faux pas. At best, it means that they are reading instead of listening to you, and therefore missing important points in your pitch. At worst, it means that misunderstandings sneak in. For a presentation deck, it’s a really good idea to keep the number of words to a minimum — use your mouth to share the words and use the slides to reinforce the main points about what you are saying, adding visual parts of the story that you can’t do in the voice-over alone. Graphs, photos, etc., are all great.

Careful with case studies

On Slide 9, Hour One includes a case study from language learning giant Berlitz. It’s a hell of a scoop for the company, but it lands a bit weird for me; a case study is great for selling to a customer, but an investor is likely more interested in how a solution can scale to hundreds of customers. The case study includes a video, showing what its software can do, along with interviews with Berlitz’s CEO. Parts of the video are fantastic: Seeing the videos the product can generate is a powerful addition to a pitch. However, the focus of the video seems to be more on convincing a customer to buy rather than seeing the company through an investor’s eyes.

Since the PDF (below) and the slide (above) can’t include video, I uploaded it so you can take a look separately:

Personally, I wish the company had made a 30-second highlights reel of what the software can do, perhaps with a link to the full case study; investors are likely to be able to tick the “yep, this works” box in just a few minutes of video; I would be very surprised if a single investor sat through the whole two-minute video on their own time, and I’ll be super honest: I sure didn’t. Life’s too short. If the founders hit “play” and made investors sit through the whole thing, it would feel like a significant chunk of pitch time wasted.

Videos are fine in send-home decks, but for in-person pitches, I recommend doing live demos or keeping video snippets extremely tight —10 to 20 seconds to show off the core technology is probably plenty in most cases.

No traction, no KPIs

One head-scratcher for a company raising $20 million is the complete lack of traction on this deck. The summary slide mentions that there are 150 characters and 100,000 videos created, but beyond that, the deck is completely devoid of any hard facts. I don’t know how many people work there. I don’t know how video generation has been accelerating.

The deck doesn’t mention revenue, customer numbers, anything about the business model or any other data points that an investor can use to conclude that the company is evolving in the right direction. That’s extremely problematic — a Series A is a growth round, and you’d expect the company to have a set of numbers it is planning to develop further. Not including that as part of your story seems almost suspicious. Not including revenue, growth or development metrics means one of two things: Either the numbers are awful, and I wouldn’t invest because, clearly, the company hasn’t figured out how to grow and thrive. Alternatively, the numbers are good, but the company’s founders are unaware that they are the single most important and most convincing data to help get investment consensus. In that case, I’d worry about how good the founders are and whether they’d need a lot of pressure from the board to perform.

Here’s $20 million, now what?

The company doesn’t have a single slide in the deck that talks about the future and doesn’t say anything about what it is going to do to grow the business. Is it doing a land-and-expand strategy? Is it going to invest heavily in geographic expansion? How much of the funds will go toward sales and marketing, and what are the product milestones on the horizon? In a nutshell, the way I read this deck is: “Hey, we need $20 million, but we don’t have a plan for what we’re going to do with the money.” That’s pretty underwhelming.

As a startup, you are probably raising money to unlock a new kind of growth — you need to outline what the plan is in your pitch, or you’re going to struggle to raise money. I’m willing to bet that Hour One ended up on the defensive on this front when it was pitching to investors; between the lack of metrics and the lack of plans in the pitch, a lot of the conversations would have needed to focus on those conversations. Having a clear plan and communicating it well saves you a lot of time and helps keep you in control of the conversation. Not including at least an outline of what happens over the next 12 to 18 months is unforgivable.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!

Comment