You know what’s a huge pain where the =sum()don’t shine? Financial reporting, planning and analysis. I often go on and on (and on and on) about startups not getting their financials and operating plans right in their startup pitch decks, so … not gonna lie, I picked Austrian startup Helu.io, which completed a €9.8 million round in July, in the hope that a company that focuses exclusively on FP&A (that’s “financial planning and analysis,” for those who aren’t up to their eyeballs in financial lingo) can show the rest of us how it should be done.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

When Helu submitted its deck, it did so with a note that revenue and unit economic information was removed.

Also worth noting (because I’ll be honest, I had to Google it, and I’m all about saving you a Google search or two) what “DACH” stands for, because it appears in the slides below. D is Deutschland — that one is easy. A is for Österreich (Austria) and CH is for … Switzerland. DACH is a somewhat commonly used term for the cluster of countries in Europe that have German as its Sprachraum — in other words, where German is predominantly spoken.

- Cover slide

- “Helu is for CFOs what Personio is for HR” — market opportunity slide

- “The CFO’s pain is Excel” — problem slide

- “Good-bye Excel sheets” — solution slide

- “Our approach is unique and different” — product slide

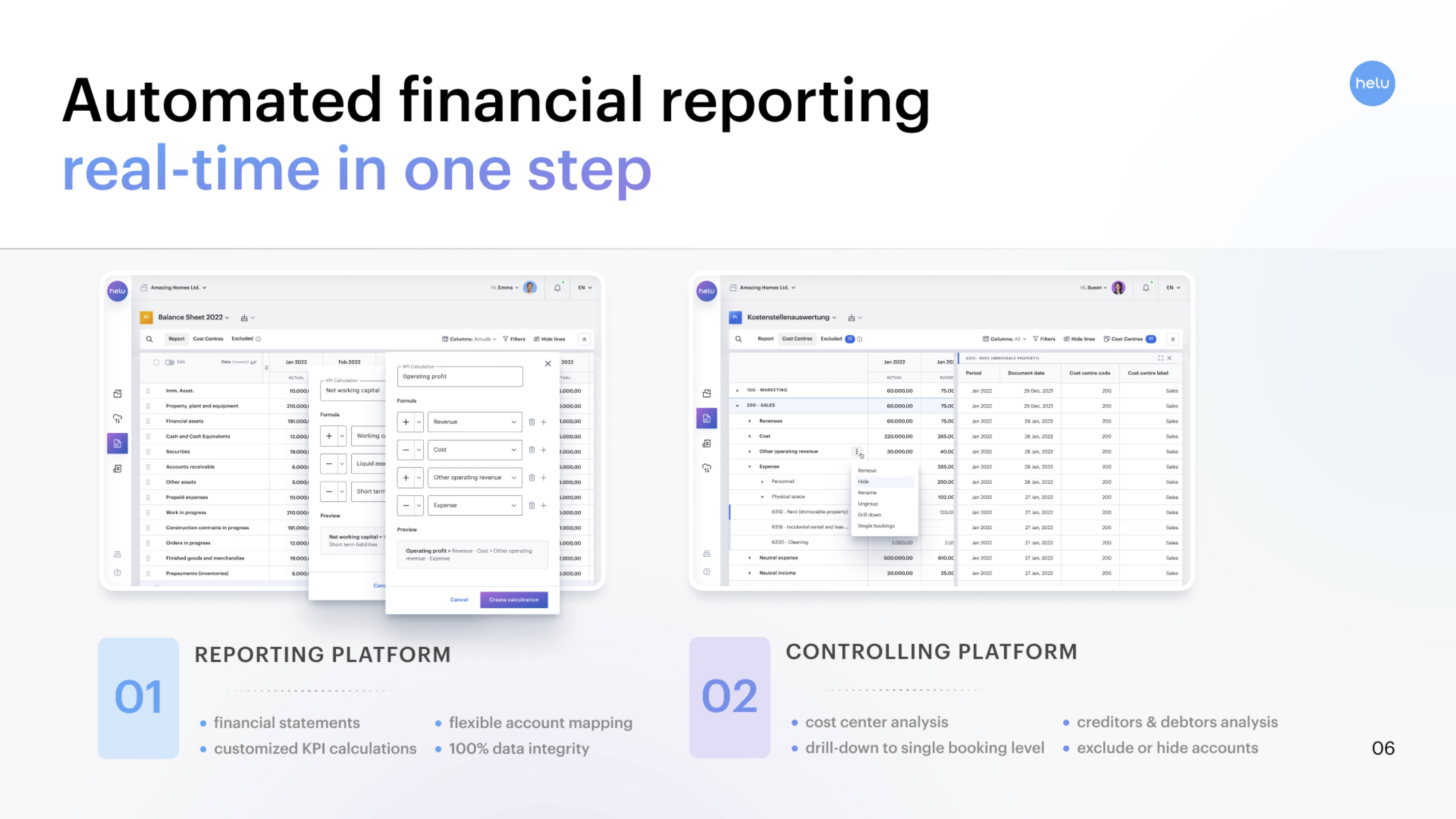

- “Automated financial reporting: real-time in one step” — value proposition slide

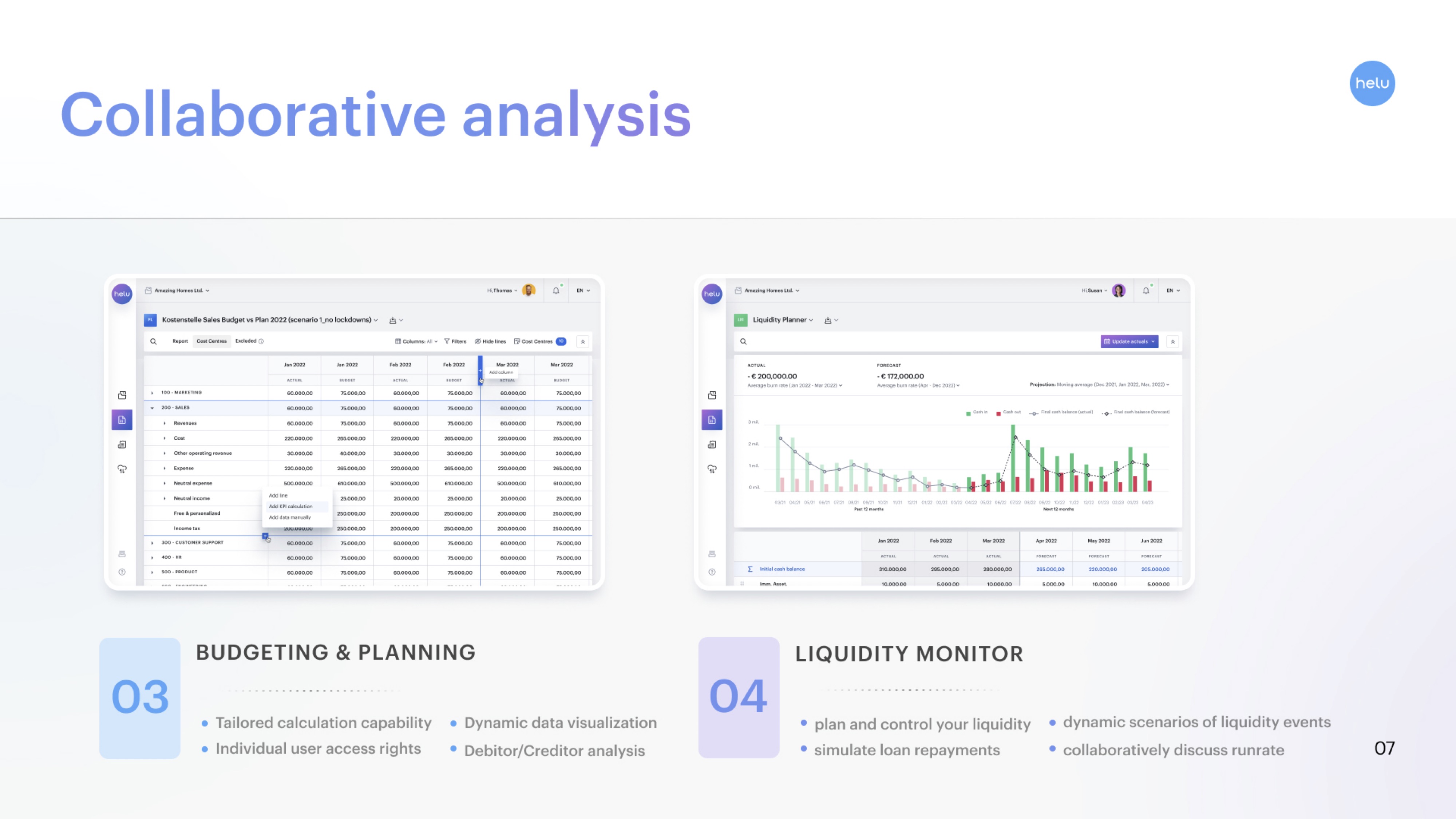

- “Collaborative analysis” – value proposition slide

- “Addressing a 100bn B2B SaaS market globally” — TAM slide

- “Multi-billion market in DACH alone” — SAM slide

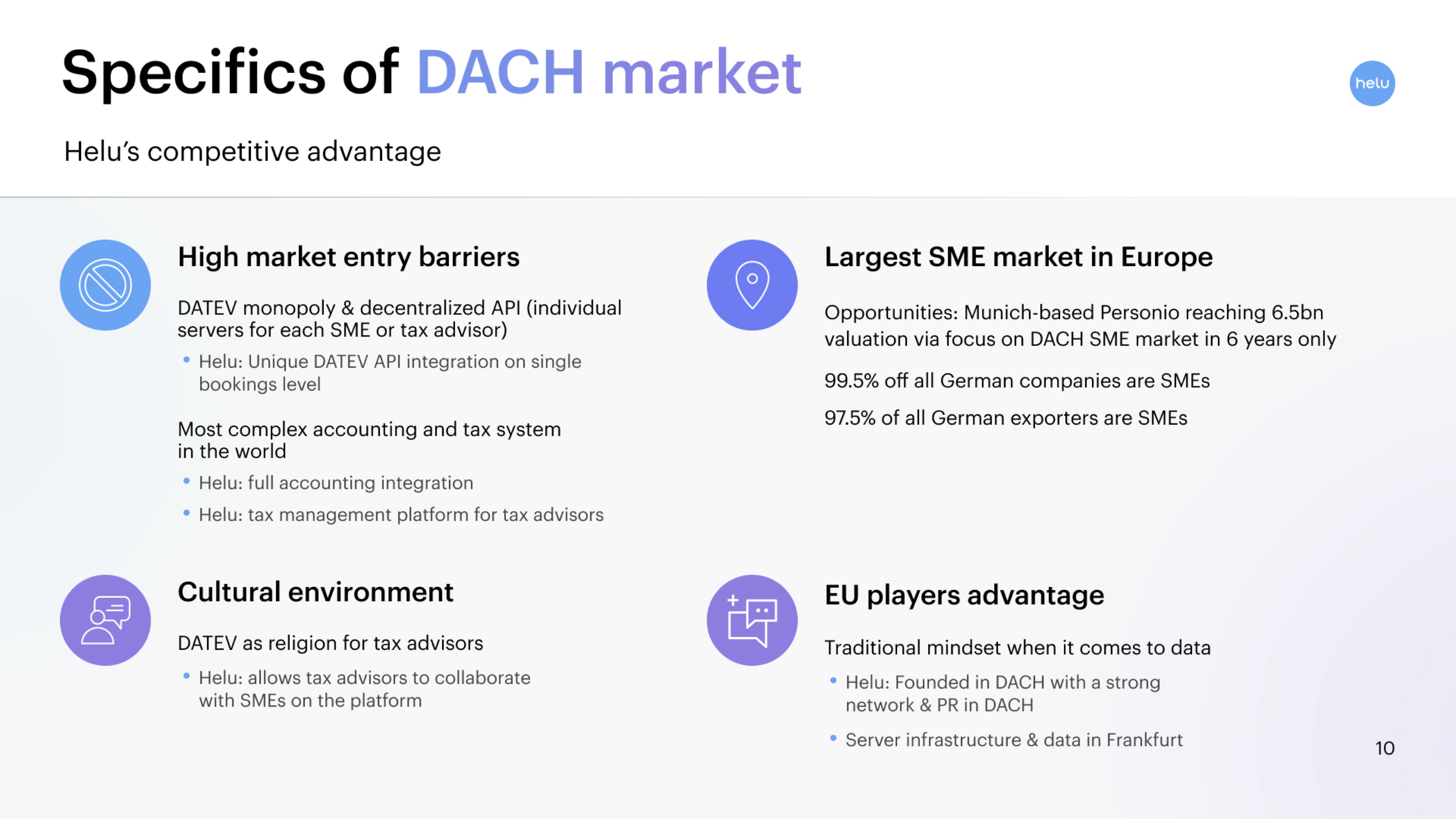

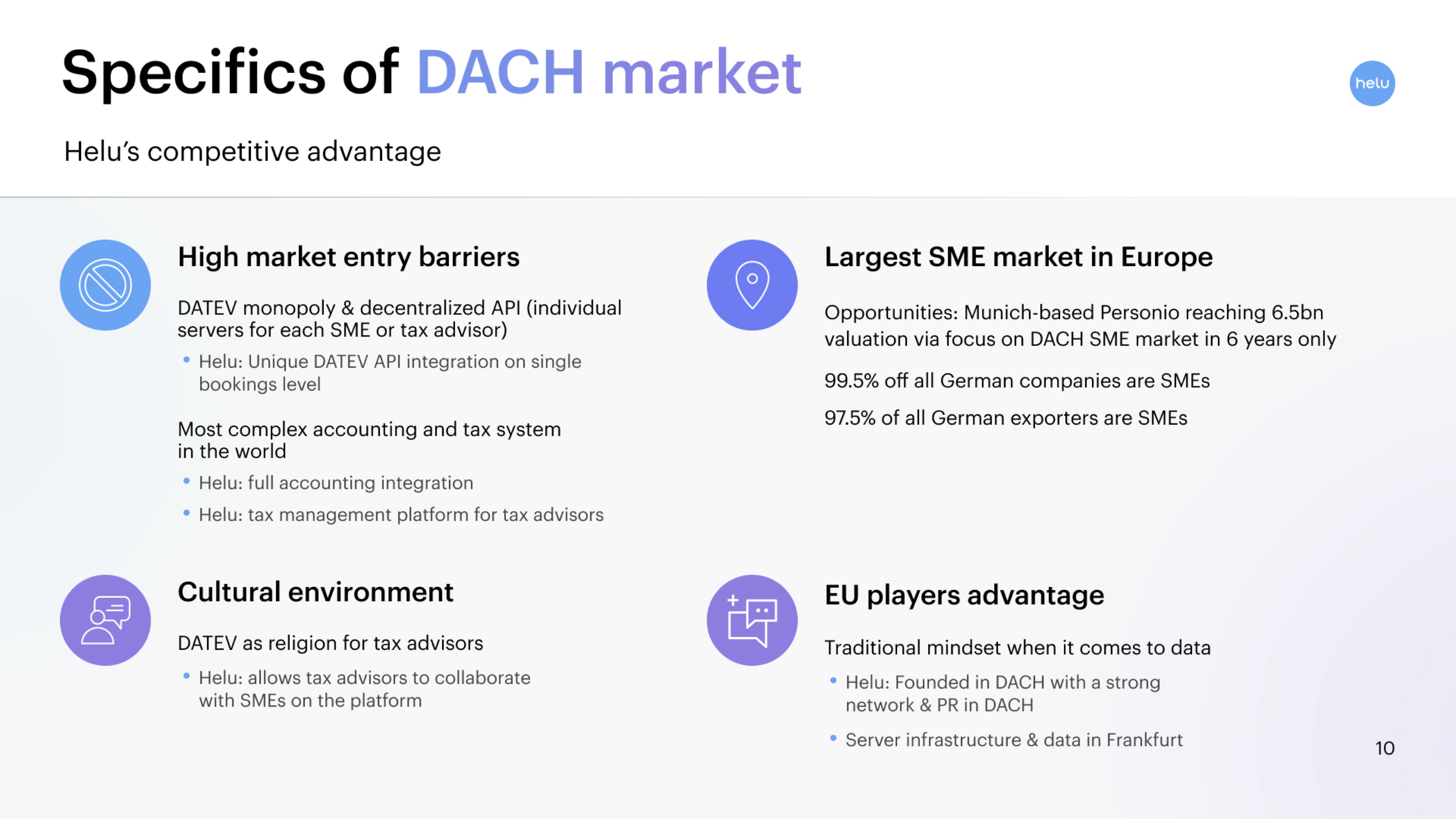

- “Specifics of DACH market” — SOM slide

- “Unique position in DACH” — moat/competitive advantage slide

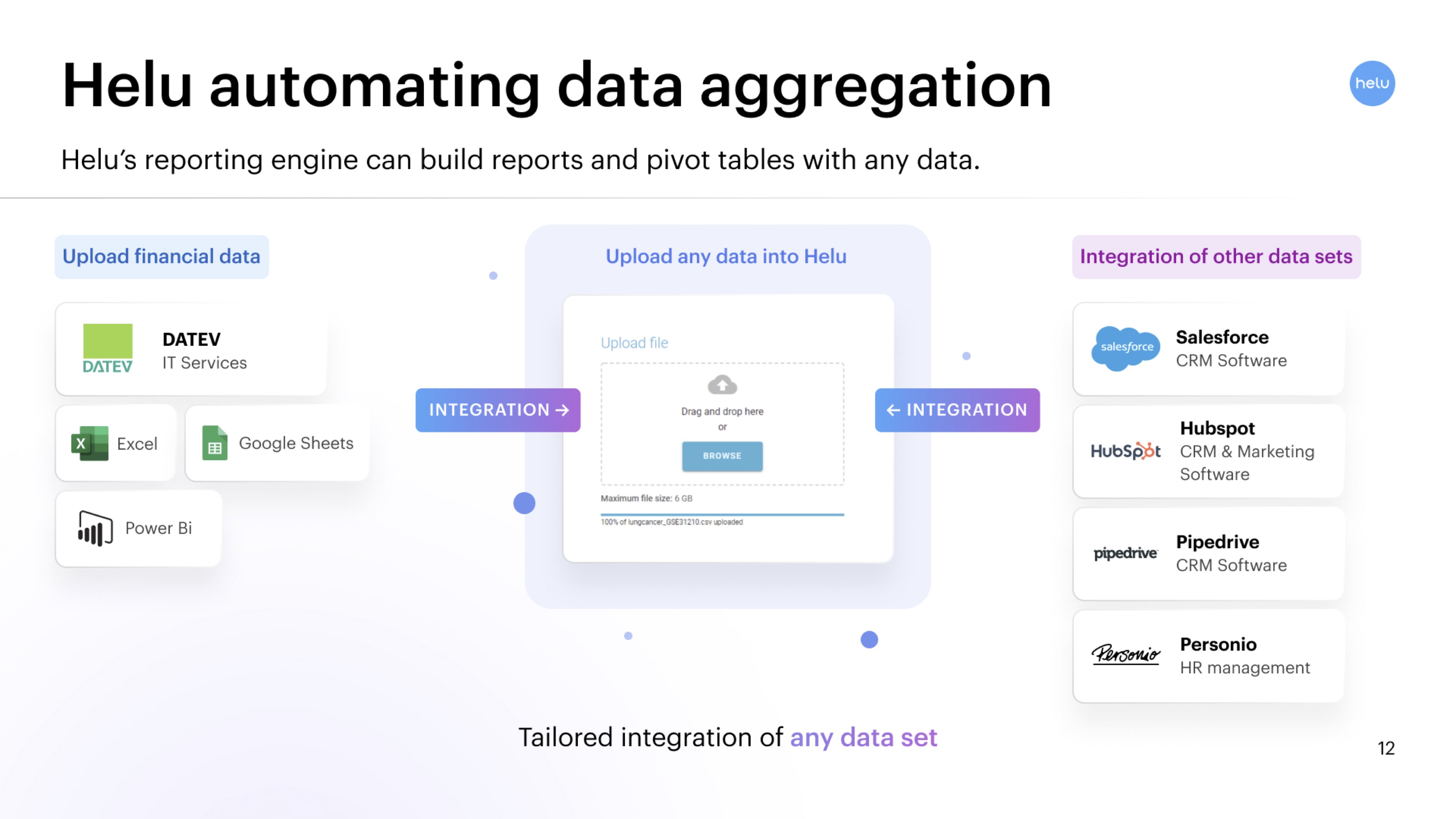

- “Helu automating data aggregation” — product slide

- “Helu’s typical customer” — customer profile slide

- “Top notch international team” — team slide

- “Backed by strong investors and advisors” — investors and advisors slide

- Closing slide

Three things to love

Overall, Helu’s slide deck comes across as a little strange seen through Silicon Valley eyes. Having an English-language slide deck focusing on German-speaking countries, without really saying anything about an English-language expansion plan, is oddly unsettling. There are also some notable things missing from this slide deck — but I’m getting ahead of myself. Let’s take a look at the things that work great, first of all.

Solid value proposition

For founders working in a space that is a little inside baseball, it can be really tempting to over-explain what a product does. The truth is that the investors don’t really care what your product does. Not really. What they care about is that the customers are happy enough to keep coming back and to get that part of the story across, you need to explain what the customer gets out of it. You do that by sharing the benefits, or the value proposition. The Helu team does that well over the course of two slides:

On Slide 6, the team shows a pair of screenshots of its product, cutting it finely between explaining features and benefits. If they were trying to sell this product to me, as someone who runs their own business, I’d like to see it more benefit driven, but they aren’t — they are “selling” shares in the company to institutional investors, who tend to be very clear on how financial reporting works.

The second part of the value prop argument is more of the same, but it helps highlight the strengths of the software package. Most importantly, I can totally see how this is crucial for operating concerns; you need to drill down into, simulate and analyze various scenarios. This package has you covered. Excel can do this, of course, but good luck resetting the model to pre-scenario states.

Now, these slides aren’t complete slam dunks; I’d have loved more consistency. In Slide 7, the bullets on the left have capital letters and the ones on the rest start in lowercase. The slides flip-flop between using “&” and “and” to tie things together. But overall, they do the trick.

Show me the money. And take my money.

I’m an Excel/Google Sheets nerd, and I think many investors are, in general. Ingesting data and keeping it up to date is excruciatingly hard, and the ugly little secret is that a lot of us are working with snapshots of data. These snapshots may or may not get updated. Working entirely on anecdotal data? I suspect most of the time the snapshots do not get updated. That means that you’re making huge, strategic financial decisions based on outdated information. It doesn’t take an MBA to realize that that ain’t the best way to run a business. This slide got me very excited indeed, and the data geek in me actually wanted to see what this looks like in real life. It’s rare that a slide deck both makes me aware of a whole new product category and makes me want to play with financial modeling.

I think this slide is masterful; it shows the power of Helu’s tools in a way that helps a potential investor understand why this is so important. I wouldn’t be at all surprised if the investors asked one or more of their startups to try out Helu’s tools for their financial modeling and reporting; they fall in the center of the bullseye for the product, and if it works as well as it looks like it might, it’s an obvious win. The slide itself is understated and simple, but if I squint my ears, I can hear a founder deliver a voice-over with an example or two showing how powerful this can be.

Excellent moat

OK, so this slide is one of the best and one of the worst in this deck. We’re talking about the top three things I loved, so in this section, we’ll talk about that, but, spoiler alert: This slide is making a comeback in the “three things that could be improved” section below. If you’ve read a couple of my pitch deck teardowns in the past, here’s a chance to do an exercise: What’s wrong with this slide? Yes, it has too many words on it, but that’s not the problem — see if you can figure it out!

What I do love about this slide is that it paints a picture of how, once Helu gets a solid foothold in this market, it will be essentially unbeatable; and I suspect $10 million and a solid product will help it in this. It’s not going to get competition from overseas anytime soon, on account of having “the most complex accounting and tax system in the world.” I’m sure someone from the Internal Revenue Service reads that and will start to feel a little competitive, but I buy that it’s likely a rather unique landscape of rules and regulations.

With an additional twist: The German Mittelstand is a powerful force to be reckoned with. These are thousands of small but efficiently run businesses that are hard to imagine in any other country; in the U.S., small companies tend to get rolled into bigger ones. As the company points out, 99.5% of all companies and 97.5% of all exporters fall into the SME category. That’s a landscape most international SaaS businesses don’t really know what to do with; local and cultural knowledge and building tools that work very well for this specific subset of companies mean that Helu could end up with a formidable moat. The company doesn’t come straight out and say that this is a “winner take all” market, but I think that’s what they are getting at.

In the rest of this teardown, we’ll take a look at three things Helu could have improved or done differently, along with its full pitch deck!

Three things that could be improved

There were a few things I really loved about this deck, but, goodness, there were some serious head-scratchers, too. Basically, I suspect we are running into some cultural differences here, in terms of how companies are built. This pitch deck wouldn’t fly in Silicon Valley. I hasten to add that it didn’t have to, so it’s possible my feedback is way off the mark. Still, let’s take a peek at some of the things that stood out here.

Whoa whoa, whoa. That’s not your market size.

When I first saw this slide, my heart jumped; is this company going after a $100 billion market that I somehow hadn’t seen? Are accounting services really that lucrative? Then a closer look gave me the answer; the $100 billion number is the entire SaaS industry in 2021. A couple of Google searches confirm that all of SaaS is worth roughly that number. And I don’t buy it on a number of levels: Not every SaaS company is going to want to use Helu.io as its FP&A tool; some are simply too big and need custom reporting tools. But also, Helu.io isn’t going to compete with Twilio, Salesforce, Atlassian, CrowdStrike, Zoom, MongoDB and Autodesk.

At best, this slide gives an indication of where the biggest homes of SaaS companies are, but the $100 billion number is irrelevant, and I’m really struggling with how the company would defend this slide in its deck: It’s not the TAM. It isn’t even the customer base (because they could also serve a large number of non-SaaS companies).

I would also give the company a medium amount of shit for not putting a Swiss franc, U.S. dollar or euro sign in front of its market size, but it turns out the franc and the euro are within rounding errors of being worth a dollar these days, so the joke is on me. Still, it’s good practice (and using a euro symbol would explain using the full stop as a thousands separator; in Germany, they use a comma as the decimal point, so where we would write $1,123.56, they’d write €1.234,56. It’s details, for sure, but it’s details I’d expect an accounting company to get right, and I think it really harms the company’s credibility in this case.

Where’s your ambition?

The slide deck looks good, and it’s peppered with numbers, but I found myself suddenly wondering: Wait a minute, why does it only talk about a handful of countries? In a world where I see pre-product, pre-revenue companies spin wild dreams of global market domination, the deck overall, but this slide, in particular, comes across as pretty defensive. I celebrated Slide 10 earlier in this article, and … I’m sorry, I’m going to have to do the opposite here.

I get that Helu is a particularly good fit with the DACH markets, but the total GDP of those three countries is $5 trillion. A fifth of U.S. GDP and only about 1/17th of global GDP. If you’re building a globally focused SaaS company, I’d expect there to be plans of how market expansions are going to take place. Possibly with a timeline.

Look, there’s nothing wrong with building a software startup that tackles a local market — and as Helu points out, Personio, also based in Germany, is focusing just on Europe and is valued at $8.5 billion. The big difference is that Personio is clear about its pan-European ambitions, whereas the Helu team seems to be weirdly shy about how it’s going to tackle the rest of the continent.

Wait, where the franc are your figures?!

As I mentioned in the intro, I got super excited to get a deck from a financial reporting company. If there’s one category of startup that I’d trust to get financial reporting right, it’s a company that does <checks notes> financial reporting and analysis. When I finally made it to the end of the deck and realized that the company has no projections, no metrics, no financial statements, no operating plan and no real traction numbers, I had to walk a couple of laps around the block. Are you kidding me?!

This is a SaaS company, servicing other SaaS companies. It raised nearly $10 million. I know there must be dashboards out the wazoo, and these kinds of companies will be raising money on performance indicators and numbers. If they were working with me as a pitch coach, I’d do some moderately aggressive swearing, give them an F (both the expletive and the grade) and send them back to their room to finish their homework.

Startups, this isn’t good enough. At the very least, you’ll want:

- Customer acquisition cost (CAC).

- Average lifetime value (LTV).

- Churn rate (customers leaving).

- Upchurn (customers promoting themselves to higher pricing tiers).

- Downchurn (customers switching to lower pricing tiers).

- Monthly or annual revenue (MRR/ARR).

- Overall revenue figures (although I recognize that the company removed those).

- An operating plan for the next 18 months or so.

- A financial model and projection for the next three to five years.

- What you’re going to do with the money you’re raising.

Regarding the last point, even Tech EU quoted the CEO on the company’s future plans: “The startup will utilise the new cash infusion to expand its product offering with a budget planning module … to set up a seamless experience throughout the budgeting, controlling and reporting processes” — but there’s nothing in the pitch deck that even hints at why the company is raising money and how it will look different after it has deployed the raised funds.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!

Comment