Masa Finance, a hybrid credit protocol and decentralized credit bureau founded by Pngme CEO Brendan Playford in late 2020, has raised $3.5 million in pre-seed funding. According to a statement, the company seeks to “disrupt traditional centralized credit infrastructure by providing individuals, businesses and developers with the tools to access credit” via blockchain technology.

The core principle for blockchain centers on the ownership of assets, including money and financial data. The system somewhat tries to reduce the control of traditional financial institutions such as banks and credit bureaus which have, for decades, collected and stored financial information of the world’s banked people.

Decentralized finance’s premise transcends this segment of banked people. Analysts have argued that the technology can reach places not covered by these financial institutions. According to them, blockchain can allow the unbanked to have faster access to services such as lending, borrowing and buying insurance.

Yet, there’s still room for collaboration between both worlds, or at least in Masa Finance’s case, even as it targets underserved people.

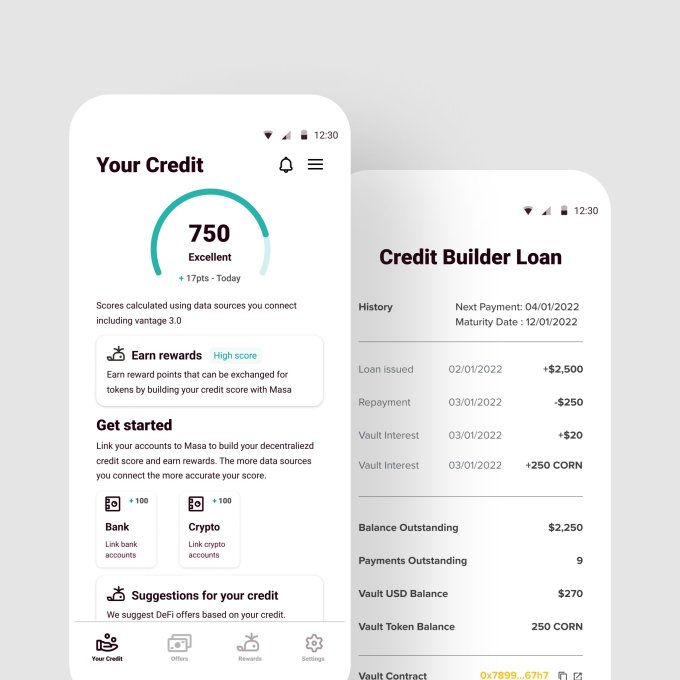

Masa Finance links traditional financial accounts and assets from credit bureau systems and bank data to crypto holdings of users. This connection allows the company to create non-fungible credit reports for users, which they can use to access credit and other financial tools.

“The vision that I’ve had for a very long time has been how do credit bureaus evolve and what would they look like in the future,” founder Playford told TechCrunch on a call. “The future of the Masa protocol is to be fully decentralized, turning governance and management into a DAO structure.”

Before starting Pngme, an open finance startup that has raised over $18 million in VC funding, Playford actively worked in the blockchain and crypto space for almost a decade. Last February, he revealed that this involvement led him to offer short-term crypto loans to entrepreneurs, particularly in Kenya and Tanzania — and traditional loans via Pngme before pivoting to an open finance play.

Masa Finance is the result of these collective ventures. According to Playford, the company is built on three blocks: unlocking financial data (which Pngme does), new sources of capital, and allowing individuals to own their credit history and share it with any lender themselves.

The startup’s web3 infrastructure works with over 10,000 off-chain data sources from credit bureaus, bank data aggregators, and alternative data across 78 countries allowing Masa to create on-chain credit scoring for its users.

Thus, by aggregating off-chain and on-chain data into a non-fungible credit report, Masa says it gives lenders, and developers access to the tools needed to evaluate borrower risk and launch lending products for individuals and businesses globally.

“The world we’re building for is where people’s data are owned themselves. This will connect an off-chain world with centralized data to a new on-chain world that will be growing over the next 10 to 20 years,” remarked Playford, who runs Masa with the chief of staff Dusty Swartz. “So you can connect different data sources to create a credit profile stored on Masa in a decentralized way and have sovereignty over your decentralized credit profile.”

Masa says its on-chain data covers 26 integrations, from exchanges to wallets — opening up a 4.95 billion-person market where 67% are credit invisible. These wallets include Binance, Coinbase, FTX, Gemini and Metamask.

“The reason why they’re partnering with credit bureaus is it increases coverage for the most number of users. Our mission is to bring the next billion people to DeFi by providing credit bureau reports. And to do that, you have to support existing infrastructure and partner with those currently in the market,” said Playford when asked why Masa chose a hybrid model instead of a full decentralized model.”

Playford said Masa is building on Celo and Ethereum, and the platform, which is launching out of beta, has 36,000 people signed up already. Most of its current users are based in sub-Saharan Africa — Nigeria and Kenya in particular. Users from these countries, including Uganda and the Philippines, are responsible for the highest volume of loans received in Goldfinch, a lending protocol Masa Finance hopes to partner with soon that raised $25 million from a16z and Coinbase Ventures in January.

Masa Finance says it has more than 2,100 node operators on its live testnet, supporting zero-knowledge private transactions and smart contracts. There are also up to 300 developer registrations, with seven projects registered to integrate. The first credit products launching on the protocol include a credit builder loan, uncollateralized loans and an SME line of credit through its app, the company said in a statement.

Aided by the new capital, Masa claims to have recorded double-digit growth each month since the start of the year. The round, which has no lead investor, comes from traditional and web3-focused VCs. They include Unshackled Ventures and Lateral Capital (backers of Pngme), executives from GoldenTree Asset Management, Flori Ventures, and GSR. Other participating investors are Decentranet Intersect VC, Peer VC, Alves Ventures and some angel investors in the fintech/blockchain space.

“This is Unshackled‘s second time backing Brendan Playford, and it’s no accident,” said Manan Mehta, founding general partner of Unshackled Ventures. “What Masa reflects is a more equitable future that provides access to capital to a global population, mostly overlooked by traditional finance.”

What’s next for Masa is to raise a seed round, it said in a statement. The subsequent funding will allow the company to hire more engineers, launch the protocol’s production release, conduct a public token sale, scale node operators, and bring developers and lenders to the platform.

African fintech Pngme raises $15M for its financial data infrastructure platform

Binance-backed Xend Finance launches DeFi platform for credit unions in Africa

Comment