Over the next few weeks, the venture capital industry will compile and release data concerning its Q4 2020 performance, capping a year that saw the world of private capital freeze, thaw and burn.

But we can get a peek at a critical part of the VC universe early, thanks to a preview of global fintech investment results from CB Insights. The dataset deals with worldwide investments into fintech companies from the start of October through December 12.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Given that the last two weeks of the year are not famous for productivity, the dataset we have should prove representative for this critical slice of the venture capital market. (For our look at the third-quarter fintech VC market, head here.)

To be honest, I didn’t plan on writing up this data when I first dug into it; I was prepping for later releases, hoping to ground myself ahead of the full numbers. However, the collected results aligned with several themes that cropped up during 2020, making it a representative capstone of sorts concerning the year’s venture capital market. So it was too interesting to not unpack.

What happened to fintech venture capital investment in Q4 and 2020? Some startup stages and regions did well, but amidst the good news, one of the hotter domestic segments of startup land is not set to have a good global year. Let’s get into the numbers.

A final warning: Although these results are missing a few weeks’ worth of inputs, we believe these numbers will prove more than directionally accurate when all results are tallied and released by the various organs of venture data tracking.

North America and Europe shine, Asia falls

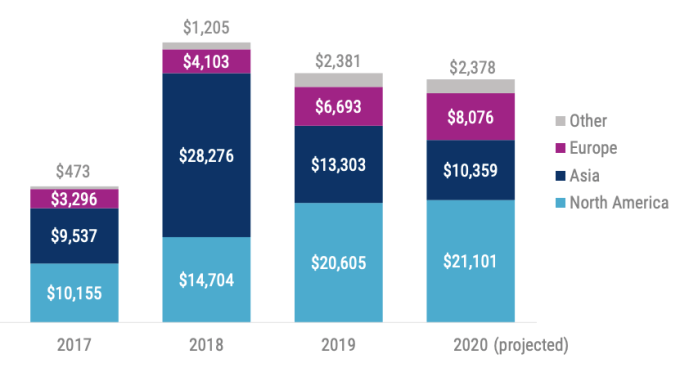

Using numbers that include projections for the rest of 2020, it’s clear that the fintech venture capital world is not equally distributed. If you are reading this in the United States, for example, or the U.K., you might be surprised to learn that CB Insights expects global fintech venture capital deal and dollar volume to fall in 2020. Surely not, with all the neobank and trading-platform deals we saw?

Yes, actually, because while fintech investment has risen in dollar terms in both North America and Europe, huge declines in Asia have overshadowed results in the other two regions. Here’s the clip of the preview chart:

The 2018 data includes that huge, $14 billion Ant Financial round. This means we can mentally deduct $14 billion from Asia’s total for that year. But even with that bit of math, we can see regular declines in Asian fintech venture capital results since 2018.

With Ant included, 2018’s fintech venture capital results are outstanding. Without Ant, 2019 stands tall. Regardless of which perspective you prefer, 2020 will prove a downgrade in total fintech venture capital investment from prior and recent records.

That doesn’t mean that all stages of deal-making suffered, however. One in particular had a crushingly good year.

Megarounds hold center stage

Nine-figure rounds into fintech companies had a great 2020, setting a record of at least 97 around the world. That’s up from 92 in 2019 and a prior record of 66 in 2018.

If you are still surprised that fintech venture capital isn’t having the year of its life, I bet you’re in the United States. Why? Because stateside there were at least 54 fintech venture rounds of $100 million or more in 2020, an all-time record for any country.

China, in contrast, saw seven, tied for its 2019 tally and far under its 2018 record figure of 17. China also saw nine fintech rounds that were $100 million or greater in 2015, 2016 and 2017, more than in recent years. You can see some of the decline in China’s venture capital industry through this particular dataset.

Seed’s surprising global struggle

Leaning on the data compiler’s own words, this: “Seed and angel [fintech] deals are projected to fall to 37% of total deal activity in 2020, down from 42% in 2019.”

Given that we’ve seen United States data indicate that seed investing was strong in the second half of 2020, this may seem surprising. When we get a country-specific breakdown of the figures, we’ll take a look, but it appears that the general lean in global venture capital toward later and larger rounds has persisted in the fintech space last year.

The aggregate fintech venture dataset shows an active sector with global demand from investors. But the demand is not even, making its changing picture interesting to watch. China went from the largest venture round of all time to a mere part of the third-largest market for fintech deals. North America, in contrast, has proven the rising global leader. And Europe has boosted its yearly fintech venture capital totals every year since 2016, perhaps indicating that early bets on the sector in the region have proved as fruitful as their early backers had hoped.

That’s that for now, but stick around as we’ll have oceans of Q4 data to dig into right before earnings season kicks off. That should be around when the IPOs come back. It’s going to be a busy January.

Comment