Today we’re wrapping our multi-week exploration of the global venture capital market’s second-quarter performance. We’ve gone around the world, working to better understand the geyser of cash flowing into today’s startups. But we’ve saved the best for last: Latin America.

At a glance, the Latin American venture capital and startup market appears similar to what we’ve seen from other growing ecosystems. Like the U.S., Canadian, European, Indian and African startup hubs, Latin America is seeing venture capital activity set records.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

But inside the big numbers is a surprising picture of a startup market in the process of maturing while outside money hunts for breakout opportunities.

To help us in our exploration of Latin America’s epic second quarter, we collected notes and observations from NXTP’s Gonzalo Costa, Magma Partners’ Nathan Lustig and ALLVP’s Federico Antoni. We also have data from Dealroom, CB Insights, the Global Private Capital Association (GPCA) and ALLVP.

Today we’re digging into the data, yes, but also the human potential behind the startup rush. According to Antoni, the Latin American startup market of today “is a story about talent, not about capital.” Echoing the point in a recent piece about “the Latin American startup opportunity,” U.S. venture capital firm Sequoia wrote that it has “been blown away by the quality of founders in the current wave.” So we’ll have to do more than just read charts.

The union of talent and money is what startup markets need to thrive. But there are other reasons why Latin American startups are so frequently in the news today, including structural factors, such as strong digital penetration and quick e-commerce growth.

Those trends could have long lives. NXTP’s Costa made a bullish argument: The portion of “market capitalization from technology companies in Latin America is only 2.5% today compared to 40%+ in the U.S,” and his firm expects the two numbers to “converge in the long-term.” Our read of that set of data points is that there are a host of future Latin American public tech companies being founded — and funded — today.

Those trends could have long lives. NXTP’s Costa made a bullish argument: The portion of “market capitalization from technology companies in Latin America is only 2.5% today compared to 40%+ in the U.S,” and his firm expects the two numbers to “converge in the long-term.” Our read of that set of data points is that there are a host of future Latin American public tech companies being founded — and funded — today.

Let’s talk about Latin American venture capital data, dig into which countries are rising stars in the region, learn how quickly Latin American startups have to go cross-border, and explore how quickly capital is recycling in the ecosystem – always a key test for startup-market longevity.

A venture capital wave

Latin America is on pace for all-time records in venture capital dollars raised and venture capital rounds in 2021. According to CB Insights data, startups in the region have already raised $9.3 billion in 2021’s first six months from 414 deals. The same data set indicates that in all of 2020, startups in the region raised $5.3 billion across 526 deals. And in case you’re worried that we’re comparing to an unfairly COVID-impacted year, in 2019 the numbers were $5.3 billion (again) from 614 individual deals.

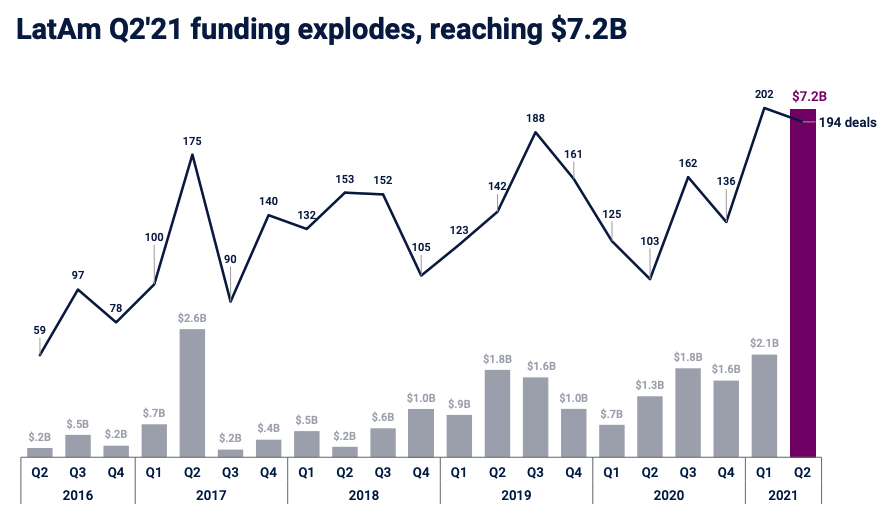

This year is different, and the second quarter of 2021 was simply an outlier event. With some $7.2 billion invested in Latin American startups, Q2 2021’s closest rival in terms of quarterly venture totals was the second quarter of 2017, when $2.6 billion was invested.

A chart will help:

- Image Credits: CB Insights

Other data sources agree that things are accelerating in the region from a financial perspective. GPCA data shared with The Exchange estimates that H1 2021 venture capital activity in the region was up by more than 4x compared to H1 2020, for example. Dealroom data indicates that H1 2021 venture activity in Latin America rose by 5.5x since the first half of 2020.

But the data doesn’t indicate a merely optimistic market for future startup performance. Exits are piling up. Per CB Insights, the best four quarters for exits in the region were the last four, and the second quarter of 2021 was the second-best exit period that we have data for, only losing out to a slightly more active Q4 2020 result.

Peeling back one layer, if we look at the stage at which the capital is being invested in Latin America in deal volume terms, something notable happened in the second quarter. From the same data set, mid-stage venture activity rose to 14% of deal volume in the region during the second quarter, up from 5% in the first quarter. Early-stage deals slipped as a portion of total deal volume, while late-stage deals grew. What this tells us is that the Latin American startup market isn’t suffering today from a mid-market crunch; startups can raise seed capital, mid-stage funds and late-stage monies. That’s healthy.

Like the US, a two-tier venture capital market is emerging in Latin America

As with any collection of countries that we observe in aggregate, there’s nuance to the data. Some countries in Latin America are accelerating even more quickly than the region’s totals. Dealroom data on Colombia’s venture capital totals — measured in dollar terms — rose 9.2x in the first half of 2021 compared to the same portion of 2020. In Mexico, growth reached 8.6x over the same period. Brazil, Dealroom notes, saw a smaller if still impressive 4.3x gain.

Second-quarter data was even more extreme. Let’s dig into the country-specific aspect of the Latin American venture capital boom a bit more.

Beyond the leaders

When looking at a breakdown by country, “Brazil is the clear leader, capturing more than 50% of venture funding,” Costa said. This is in line with CB Insights’ report that out of the $7.2 billion regional total for Q2, $4.6 billion went to Brazil. It is also worth noting that this figure is nearly triple the amount raised by Brazilian startups in Q1 2021, which was already the highest in years.

As for Mexico, CB Insights reports that it notched a “billion-dollar quarter” — $1.307 billion, to be precise. And yes, $485 million went to a single mega-deal –car marketplace Kavak. But even discounting that, it would have been a record quarter.

Mexican unicorn Kavak raises a $485M Series D at a $4B valuation

In other words, Brazil and Mexico are more than ever the region’s leaders. But where else should we look? We asked our sources, and they had some suggestions: “There are two interesting markets to watch today, Colombia and Chile,” Antoni told us. As for Lustig, he highlighted Colombia and Argentina, suggesting the latter for its entrepreneurs’ ability to build global unicorns from there.

This again echoed the need to go beyond numbers and remember the human factor. In Costa’s words: “Tech talent is evenly distributed throughout the region, so for us, it is more important where startups are focused than where they are born or where they are based.”

And where they are focused often brings us back to the region’s largest markets: “While talent is everywhere, and big companies can be built from places like Uruguay and Ecuador, most if not all of these teams eventually target Mexico or Brazil to access the two biggest prizes in the region,” Antoni said.

TAM-TAM time

Is regional expansion a necessity for Latin American startups, or more of a nice-to-have? The answer, as we often find, is “it depends.” But on what? According to Antoni, “Two things: the country of origin but also the business model.” This is a departure from what we have often heard and are still hearing: that “if you’re in Brazil or Mexico, you don’t need to go to multiple countries,” as Lustig told us.

The disagreement here seems to focus on whether it’s a “need.” Happily, Costa provided us with some middle ground: “It is definitely not a requirement, particularly if the company is initially focused on the larger markets like Brazil or Mexico, but with so many opportunities across the region, even companies born in those markets usually have plans to expand to other markets.”

Going back to Antoni’s point on business models, the investor pointed out that companies that will compete with international players will likely get pushed by growth investors to explore regional expansion earlier rather than later. This aligns with the message shared by VTEX co-founder and co-CEO Mariano Gomide: In a recent episode of “Like a Boss,” a Brazilian podcast in Portuguese, he encouraged Brazilian founders to think beyond Brazil, stating that “Brazil is not big.” This approach seems to have paid off, as the Tiger- and Softbank-backed e-commerce platform IPO’d on the NYSE earlier this month.

The international angle

A good chunk of the capital that Latin American venture capitalists are raising is coming from external sources, which is standard, mind — all startup markets eat partially off of funds raised in different regions. But before we get into how Latin American startups are funding themselves, let’s talk about external funding.

According to Costa, Latin American founders with backgrounds from venture-backed winners can raise capital in an aggressive manner, often with little actually built. “Experienced entrepreneurs, as well as founders with previous experience in high-growth startups” like Nubank, he cited as an example, “are extremely well-positioned to take advantage of today’s abundance of capital in the market.” What does that mean? The ability to raise “a pre-seed and seed rounds all in one” and to secure large checks “sometimes with only a deck.”

More simply, we’re seeing the global capital glut try to back folks in Latin America that have seen what it takes to scale a startup from the ground to the skies. Which makes sense: VCs love to pattern-match. (That’s a fancy way of saying that VCs are lazy.)

But global capital appears to have some blind spots in Latin America. According to Lustig, startups that are not based in leading markets Mexico or Brazil, or lack a founder from Harvard or Stanford, or haven’t been through Y Combinator are essentially invisible to U.S. money, for example. “You basically don’t exist” to those investors, he said, without one of the previously listed credentials.

Who gets hit by the biases? Startups in smaller regional markets, like Chile. “The vast majority of VCs are not willing to invest before a company proves it in a bigger market,” Lustig added, which may explain why going broad early is common among startups in the region.

Recycling success

Local money is playing a rising and critical role in how Latin America is funding its own startups, and exits are influencing the growth of domestic funding, especially in the earlier startup stages.

“Successful founders who have exited, or have taken secondaries, are becoming prolific angel investors,” Lustig said, adding that this type of backer is great for entrepreneurs. “More important than their money, they are providing connections, know-how and legitimacy to Latin American startups that might have a much harder time raising from U.S. VCs.”

Entrepreneurs becoming investors is not entirely a new thing in Latin America; for instance, the most active Latin American fund in Q2, according to CB Insights, was Kaszek Ventures, whose co-founders Hernan Kazah and Nicolas Szekasy are former MercadoLibre executives. However, the pace at which this is happening is arguably accelerating, and the halo effect is bigger.

Thanks to the “incredible growth in venture financing but also in exits and liquidity events through secondary offerings,” Costa said, “some funds are beginning to return capital to their LPs, in some cases with huge multiples, which in turn reinforces their appetite to continue investing in Latin America.” It is worth keeping in mind how much larger the exits have become over the years, with numbers previously unseen in Latin America.

Uber to become the sole owner of grocery delivery startup Cornershop

In addition, it’s not just founders who can become angels: Early employees, too, are following that path, with cohorts starting to form in the same mold as PayPal. ALLVP recently mapped out five of these, identifying clusters born from Rocket Internet/Linio, Domicilios, Groupon, Rappi and Grin/Grow. Kavak CEO Roger Laughlin is a good illustration of this trend: Not only did he go from working at Groupon and Linio to founding his own unicorn, but he is also an investor in several Latin American startups.

And according to Lustig, “it’s just getting started.”

Like in much of the world, the fundamentals powering the Latin American venture capital boom appear set to persist for some time. Money is not going to get more expensive, which should keep capital flowing. And the technology trends that have made a tech market out of many countries and regions — rising internet access, smartphone penetration and so on — should continue for some time. And with the regional talent pool only becoming more experienced and wealthy, there are a host of reasons to be bullish on Latin America.

Of course, the business cycle will eventually peak, but for now, it’s all systems go for startups.

Colombia’s Merqueo bags $50M to expand its online grocery delivery service across Latin America

Comment