Sequoia is one of the most sought-after VC firms in the world, and predictably, it sees plenty of startups competing for its attention.

In a recent episode of TechCrunch Live (formerly Extra Crunch Live), Sequoia partner Stephanie Zhan and Nick Fajt, founder and CEO of social gaming platform Rec Room, explained what the venture capital firm looks for in consumer-facing startups. We even took a look at Rec Room’s earliest pitch deck, the seed that ultimately grew into a business that has raised nearly $150 million.

This episode also featured the ECL Pitch-Off, where founders in the audience pitched their products and services to our expert guests to get their live feedback. You can check out the whole episode as well as the Rec Room pitch deck below.

Love is the answer

Sequoia, alongside almost every other VC firm, prizes one factor when deciding to investing in a consumer-facing company: User love.

There are a handful of ways to measure user love, from NPS scores to retention and engagement metrics to reviews of the product.

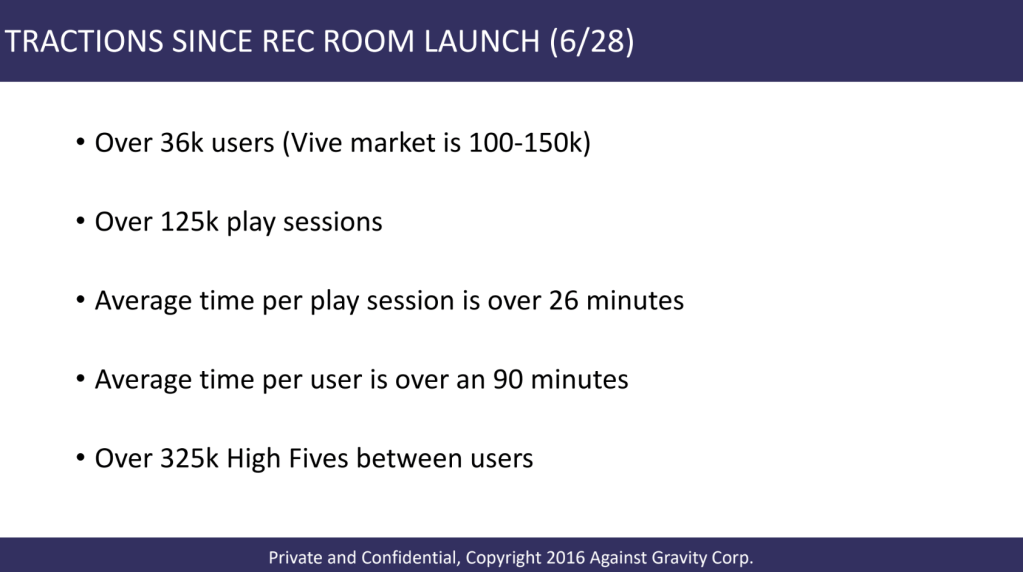

Just a few weeks after it launched, Rec Room was seeing users average 26 minutes per session and around 90 minutes per user every day, which meant that many users were coming back for multiple sessions.

Bear in mind that we aren’t talking about tens of thousands of users. But in small numbers, the product was resonating, so it stood to reason that it would also resonate with more people. Sequoia was very drawn to this, and Zhan noted that in consumer companies, user love is the most important thing she looks for.

“This wasn’t just people coming in, saying hi and popping out,” said Zhan. “There was real engagement here, even in relatively small numbers. That’s what stood out most. That was the real magic.”

Alongside time per session, Sequoia used Rec Room’s “high-five” metrics to evaluate user love.

High-fives don’t actually have any value in Rec Room games themselves. You don’t win or earn anything by giving a high-five. But the metrics around high-fives continued to go up as more people played.

Zhan elaborated:

Nick had been thinking a lot about what forms of communication and interaction matter. One of the things that I had forgotten about, but I remembered rereading some of our internal communication at Sequoia from while we were evaluating Rec Room at the time, was that we kept talking about this notion of high-fives. It’s interesting. I literally had a count of the number of high-fives that the current user base had at the time. And I wondered why do high-fives matter?

But it was interesting, because it gave you the sense that the people actually wanted to interact. It was fun and positive in nature. People wanted to do things together. And so I think Nick did a wonderful job of setting the tone for the type of social platform Rec Room wanted to be from the start. What type of social identity do we want people to have? What type of interactions do we want people to be able to have? I think it’s been a huge differentiator for Rec Room from the start.

But even with solid metrics to present to investors, founders must be able to communicate that current success can lead to even greater success. For Fajt, that meant using the pitch deck as a supporting document and not the main showpiece.

You can see the deck Rec Room used in the post below, and when you scroll through you’ll likely notice that it was a lot of media and art rather than information. That’s because Fajt was, and still is, determined to turn the presentation into a conversation.

He explained that the deck was a way of saying, “Here is where we are now.”

He recalled spending a lot of time talking about where the company and platform were headed. “The timing component was something that we were unpacking verbally,” said Fajt. “I was talking about how long term, this is where we’re going and this is why I think these trends are happening and why the timing and the inflection points of software are aimed in this direction.”

By talking through his vision and predictions for software, gaming and VR, with images of the platform running in the background, he allowed investors to both grow their own convictions around his predictions and get a taste for the product itself.

For Zhan, it worked. “There was a very distinct art style from the get-go,” said Zhan. “This was a company with clear personality, and we love that. It was fun and playful. And there was a tone that put you in the right mood if you were playing with your friends.”

The Sequoia team were excited about the aesthetics of the game, but they also liked the mechanics.

“In VR, at the time, it was hard to get the interactions right,” said Zhan. “The physics of a ball moving in the air and hitting off your racket — that was really impressive, how smooth the physics were. Especially at a time when most people would complain about nausea after spending time in a VR headset.”

Rec Room Pitch Deck by Jordan Crook on Scribd

Problem-solving

The art, the mechanics and the genuine user love all worked strongly in favor of Rec Room. But there were lingering questions about VR itself.

Fajt was peppered with questions around how the market would develop, and what if it didn’t? He’d seen firsthand, when he had worked on Hololens, how moving too early could pan out.

Remember, this was around the time that Facebook, Google and HTC were all working on their next-gen headsets.

“The thing that stood out to me about Nick was that he was super realistic about market timing with VR,” said Zhan. “He didn’t say that it’s all going to happen next year, because that was not true. He was realistic about what it might look like, and he was also flexible on his thinking around it.”

Fajt brought industry experience to his conversations around the VR market but was also candid about the things he didn’t know. “The thing I highlighted was that the team was really scrappy and very flexible,” said Fajt. “The progress we were showing in the deck was … we had started the company about three months earlier. This was not an app we’d been working on for years and years. We had been working on the app for about 100 days and spent maybe $50,000 to $70,000 getting to that point.”

He essentially said that there are two paths that the team was fully capable of taking.

“If it takes a while, we’re in it for the long haul,” said Fajt, recalling his conversation with Sequoia. “We’re a lean team and we can see it through those trials of disillusionment. If it takes awhile, this team is very flexible and can move this product in a different direction if that’s what needs to happen.”

He was careful not to make strong pronouncements about where VR was going to be but rather spoke to what the team was capable of. Looking back, both he and Zhan are happy those conversations started so early, even before the seed round closed, because they were conversations that carried on for years afterward.

Zhan added:

The most important thing when we’re evaluating whether or not to work together is actually just that. It’s whether we want to be working with you and figuring all these things out together for the next 10 years or maybe longer if we’re lucky. And the truth is that none of us know the answers to any of this. As Nick said, not you as the founder necessarily knows from day one, and not me as an investor who’s only been there for maybe an hour or a few hours with you.

So the most important thing is: Do we believe in where you want to go? Are you flexible enough in how you think about how you get there? Are you great at listening to feedback? And are you open to being challenged? Both ways, right? And can we actually figure this out together? Because so much of that is unknown. The thing that we’re signing up for is: Hey, do we want to be going on this incredibly long, highly volatile journey together? And the more successful, the more volatile this will be.

You can check out the full episode, including the pitch-off, in the video below.

Catch TechCrunch Live every Wednesday at 3 p.m. EDT/noon PDT.

Comment