Data indicate that the pace of startup value creation reached a fever pitch in 2021. According to venture capital data collected by PitchBook, prices spiked for startup equity across the maturity spectrum last year. The result of those rising prices was a huge gain in the pace at which paper wealth was generated.

The rising velocity of value creation may indicate that rich entry prices for early startup investments will math out as similar pricing dynamics play out in the later stage of company development.

PitchBook cites rising inflows of nontraditional capital to the startup market as part of the changing landscape for startup prices and the pace at which they create illiquid equity value. Larger venture capital funds are also a driving force behind the pricing dynamics uncovered by the data.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

The dynamic of rising prices accelerating value creation at once undercuts the viewpoint that startups are too expensive today — pricey early-stage companies do not appear to be struggling to raise later-stage capital, if markups are any indication of investor appetite for recently funded early-stage upstarts. More simply, it appears that the market has decided that startups are worth more than they once were, by a material multiple.

This prompts a simple question: Were startups dramatically undervalued in prior years and decades? The former, yes. The latter, maybe.

Caveats abound. Underneath the wave of capital flowing into startups in recent years — and especially the blowout 2021 calendar year for private-market investments — is an expectation that eventual exit prices will make preceding investments for startup equity math out to the positive. There’s some concern in the market today that it won’t.

Caveats abound. Underneath the wave of capital flowing into startups in recent years — and especially the blowout 2021 calendar year for private-market investments — is an expectation that eventual exit prices will make preceding investments for startup equity math out to the positive. There’s some concern in the market today that it won’t.

We aren’t here to throw stones, but instead figure out why startup prices have risen so much and whether the huge gains are reasonable, insane or more a sign of a changing software market.

Up and to the right

A few venture maxims to get us started: Every deal that a venture capitalist invests in is fairly priced; every deal that a venture investor takes a stab at but loses is overpriced; any following investment into a portfolio company of a venture investor is a reasonable markup for value created.

When we apply those rules to the following charts, we can reach some very interesting conclusions:

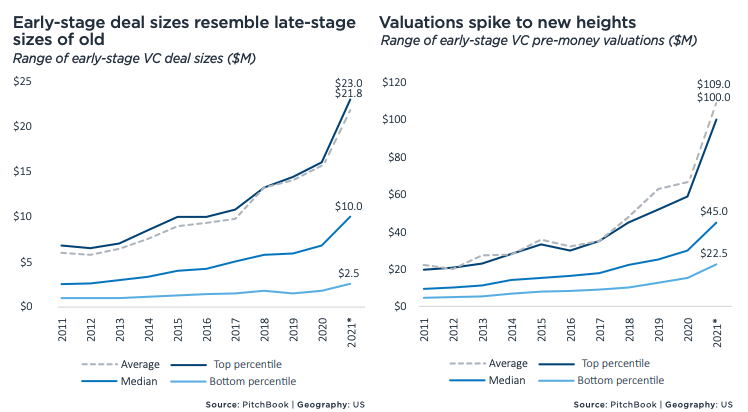

In the early 2010s, the size of early-stage startup deals rose somewhat linearly (observing the median line), largely in keeping with valuations. This continued, with what appears to be some modest acceleration into the 2017-2018 era until the lines (especially the top-percentile data set) essentially went vertical last year. (The private-market data provider defines “early-stage” as investments into startups through Series B and “late-stage” as any investment thereafter.)

Given that every deal a venture capitalist invests in is fairly priced, we can generally view the above as indicative of the fair market value of startup equity. Which means that either startups have become far more valuable in recent years — and especially 2021 — or that they were underpriced in preceding years.

Our response to those two possibilities is that it’s more the latter than the former; put another way, it appears that more competition helped unlock a more fair market price — yes yes, irony — and that startups are now getting their dollar’s worth earlier on.

The scale of the change is somewhat breathtaking when considered from a historical perspective. PitchBook writes:

The median early-stage pre-money valuation reached $45.0 million in 2021, a YoY growth of 50%. Though already high, that figure is even more astounding because the median late-stage pre-money valuation did not reach that level until 2018, when the stage notched a median valuation of $50.0 million.

So we are effectively seeing 2018 late-stage pricing for early-stage deals now, a marked shift in the value of startup equity for more nascent companies.

Yes, but

Arguing that venture capitalists’ capacity to pay far-greater prices for startup equity than before is not just pointing out that when capital was more scarce, investors were able to drive harder bargains for startup shares. With strong exits in the 2020-2021 period, more room was created for early-stage investments to cost more as eventual liquidity appeared more certain than before; higher exit prices and more frequent liquidity events generate room for early-stage investors to pay more for shares because their multiples requirements can still be met — and risk may appear to be lower more generally for the riskiest stage of startup investment.

That doesn’t mean that startups weren’t underpriced before, merely that the gap between, say, 2015 and 2021 startup valuations is not entirely investor greed. Just a good portion of it.

Competition has a way of shaking value loose, in other words. If we had to take a stand, looking at the data, it’s hard to say that in 2010 startup prices were incredibly unfair, given that exit values were lower than they are today (visible in that era’s public SaaS revenue multiples, essentially). More recently, it seems that late 2010s deals that are reaching maturity today are potential goldmines, having raised early-stage capital when deals were far more parsimonious, but exiting at a time when software valuations are still rich, recent selloffs aside.

Will 2021 startup prices math out in five years’ time, when early-stage successes are set to reach liquidity events? We don’t know. But we may find out that 2021 startup prices were in fact too high, which would be an inversion of trailing norms.

Recognizing this is getting a bit complicated, a summary;

- After the financial crisis of 2008, startup prices were modest, but with exit values nowhere near today’s prices, perhaps that made some sense.

- Startup valuations and round sizes drifted higher in the 2010s as the value of software revenues accelerated.

- However, in the pandemic era, the value of software revenues (the most common startup product) shot higher, meaning that deals struck in prior years suddenly became cheap.

- Prices rose perhaps too much due to a few factors in the last year.

Hey, you are saying, wait a minute. How are venture investors to blame for paying too little for startups back in the day if our view is predicated on future repricing of the value of the underlying asset?

Relax; we get to have high standards for investor acumen. They were wagering on the value of software revenues being strong in future periods. Therefore, if they were somehow more right than anticipated, that doesn’t mean that they weren’t underpricing startup equity in the middle-2010s, just that they were a little smarter by accident.

Are 2021 startup prices the correct, stable point for private-market valuations? Or, after lagging the true value of the asset being built, have startup prices actually exceeded their real value? We’ll find out.

Comment