The U.S. Midwest generates a lot of wealth and is home to myriad huge corporations. With corporations come pension funds, foundations and other collections of great wealth. One of the ways that those pots of cash are being invested is through venture capital, which means the money flows to the coasts — New York, Boston, Silicon Valley. For the past decade, Gener8tor has been working to shift that by spinning up accelerators in local communities that have money but are underserved in terms of startup support.

We spoke with the Gener8tor founders about why they are passionate about thinking about the startup ecosystem a little differently.

“One of the challenges we face that I don’t think is talked about enough is that much of the capital in Boston or Silicon Valley comes from pension funds and foundations based in our communities,” said Joe Kirgues, co-founder of Gener8tor. “These communities are taking their dollars and investing it elsewhere. And then bringing back pennies on the dollar to do charity in our communities. And it’s fueling a lot of the discrepancies we see in the country.”

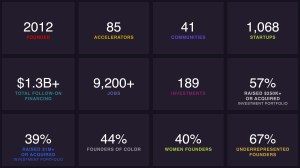

Gener8tor has flown under the radar a little despite putting a lot of points on the board: It has been operating for more than a decade and has had 34 exits (including Pretty Litter, Curate, GrocerKey and Bright Cellars). More than 1,000 companies have cycled through its accelerator, and it was named 2022’s VC firm of the year by The International Trade Council. And yet, the name isn’t as well-known as other comparably sized accelerators.

Gener8tor has some impressive stats under its belt: 80% of its startups are outside of major tech hubs, and more than two-thirds of the companies in the accelerators are led by underrepresented founders. It’s a hell of an operation, too. Headquartered in Madison, Wisconsin, the accelerator has 147 full-time employees, accelerators in 41 locations across 22 states, and $1.3 billion in total funding deployed.

The company told me that 1,068 startups have graduated from one of its 104 annual accelerator programs, including:

- Gener8tor investment accelerator is a standard cash-for-equity accelerator that has helped more than 200 companies raise more than $800 million.

- Gener8tor gBETA is a free accelerator that accepts five startups into a seven-week program. More than 700 companies have gone through gBETA.

- Gener8tor Skills is a partnership with Gener8tor, Microsoft and TechSpark that focuses on upskilling workers who want to train for roles in high-demand fields such as customer service or software development. The company said more than 1,000 people have gone through the program, with half securing new careers in the past 24 months.

- The Gener8tor OnRamp Conference is a series of vertical-specific events, including education, insurance, agriculture, manufacturing, and healthcare.

As a business, the company claims to be doing just fine, too, showing some pretty impressive investment metrics:

I talked with the co-founders, Troy Vosseller and Joe Kirgues, to learn more about how it all hangs together and what it sees as the future of its operations.

“Both Joe and I were lawyers, and we met working on transactions together, both on the startup and the investor side. Joe and I hit it off, and shared the perspective that there was a lot of lacking efficiency for an entrepreneur to go from an idea to incorporating a business, growing that business, raising venture capital, so on and so forth,” Vosseller said. “We’re both admirers of the accelerator model, starting with Paul Graham and YC. Reading his original essays about the program provided a lot of inspiration. And it dawned on us that we could do that here in Wisconsin. Joe and I quit our jobs. We found a group of angel investors out of the Milwaukee area who share that same vision and passion. And we’ve been doing Gener8tor ever since then — that was 10 years ago.”

The team’s first program was in Milwaukee in 2012, and for a while they alternated running annual programs in Milwaukee and Madison. Work with startups, invest in startups, help them grow. Lather, rinse, repeat.

Although YC may have been the inspiration for Gener8tor, the duo tells me things were a little different a decade ago.

“I think there were more local accelerators between 2012 and 2014 than there are today. To some degree, there has been a sifting and winnowing. I think the same is playing out on the national scene. I think there’s been some coalescence around a handful of programs,” Vosseller explained. “We’re bumping into the likes Techstars, 500 Startups, MassChallenge and Alchemist, of course, but it’s a much smaller grouping than what it was 10 years ago.”

500 Global’s take on the rising competition among startup accelerators

Both Kirgues and Vosseller are obviously passionate about driving local ecosystems forward.

“My joke is that when you write $20,000 checks to a bunch of 20-somethings and expect them to build a $100 million company from it, that’s what it’s like to be crazy, but not self-aware. Building a startup is a hard task in any market, but even more so in these nascent ecosystems. What we found is if you try to close the soft skill gap first — if you get the founders in the room with investors, and if you help them prepare for it — there’s just as many bright people born in a community as any other,” Kirgues said. “If you work on solving that problem, just on a one-to-one basis, you can get a lot further than then I think we realized at the time.”

The duo became hyper-focused on building up emerging ecosystems, starting with Madison and Milwaukee, and later broadening the approach to more and more cities.

”I think we have a sense for the challenges and opportunities that come with working in markets where the amount of venture capital is a fraction of what you’d find on the coasts,” Kirgues said. It’s a distinct set of problems and a distinct set of solutions. […] If you look at how we run events or how we run our programming, it’s all designed to be that solution to a defined problem of, ‘Hey, there’s not a lot of capital around place, race and gender, and if you were to optimize for that, what would you do differently?’”

As a startup founder, you really need to understand how venture capital works

How the programs work

The main accelerator is a 12-week program, where the team goes out into the local ecosystem to find the best startups at the right stage. A lot of the work is outbound: actively finding the startups the accelerator wants to work with.

“Per program, we’re typically getting between 300 and 1,000 applications, and then from that we’re selecting five to six companies. I think that’s another differentiator for us: We call it a concierge approach, in that we are just working with five to six companies,” Vosseller said, underscoring that the local economies are crucial to Gener8tor’s success. “We’re not in New York, we’re not in Silicon Valley, we’re not in LA. Even if we had 10 great companies, most likely their initial seed rounds are going to be coming from investor pools within some geographic vicinity. And we’re not doing anyone a favor if we can’t meaningfully get 10 companies funded. For us, the focus has been on this concierge approach and we make up for it in terms of volume by running more programs and more cities throughout the country specifically in these underserved markets.”

The program itself is 12 weeks, roughly broken into three sections. In the first month, the company runs a “mentor swarm,” where each of the founders connects with a number of potential mentors (subject matter experts, investors, etc.) in a speed networking format. That’s how I found out about Gener8tor: One of the folks running the Reno accelerator reached out to me after reading my Pitch Deck Teardown series and was curious whether I’d be willing to volunteer to help. I’ll be honest — until that moment, I had never heard of Gener8tor. Curiosity won, I participated, and I had a good time getting to know the startups. It was only later that I realized Gener8tor was a lot bigger than I thought, so I reached out to the team to learn more.

Month two focuses on company-building and giving the participating companies access to the broader network of mentorships, advice and potential customers. Month three is the investor swarm, and the goal is to get the startups ready for investment.

“Because we only have these small cohort sizes, we’re able to schedule dozens of one-on-one pitch meetings between investors in our network and each of the five startups. I think that has been a meaningful part of our secret sauce,” Vosseller said,” adding that investors aren’t allowed to pigeonhole themselves. “What we found is that by asking them to meet all five companies, even if they’re in different industries and different business models, we’ve had a more even distribution of interest on the investor side, including investors who would have made some of those investments, if they were to pick the companies they meet themselves. So it’s an interesting way of disintermediating that funding market.

The business model

“More often than not, we are the initial, exclusive check into these companies. I think that same dynamic and that same social relationship applies between venture hubs and the rest of the country. Where we invest, there was not a lot of capital yesterday. There’s not a lot of capital today and there won’t be a lot of capital tomorrow. As a result, things are a little bit more grounded. We have entrepreneurs who don’t believe that they’re going to be the ones getting a $20 million term sheet at the early stage of revenue,” Kirgues explained. “And I think that’s been something that it’s hard to explain, but it certainly makes the job almost entirely different from what I think people may suspect on the coast.”

The Gener8tor team believes that the discrepancies and imbalances in the country stem, in part, from the economic dynamics inherent in the classic venture capital hubs of California, New York and Massachusetts. After those first three, there’s a real steep drop-off. The unfairness of it all is encapsulated in Gener8tor’s mission: “To be the best partner for a community to invest in its best and brightest.”

“If we’re not the most passionate about our next generation, what does that say about our priorities and about our own future? You have tens of millions of people that are getting pennies on the dollar relative to what you see in that same community elsewhere in Silicon Valley or LA,” Kirgues said. “Just look at the research universities in the Big 10 or in the South that are taking in large amounts of dollars and producing incredible innovations but are not seeing those same innovations translate to venture dollars in their community. And that looks like opportunity to us.”

Apart from the geographic differences, the company focuses on the other disparities across the ecosystem.

“The example we give is that if you look at Black women and Latina-led startups, you see pennies on the dollar. I think it’s 18 cents out of 100; whatever it is, it’s way below their proportion in the community,” Kirgues said. “Another way to frame that is to imagine if we were able to help bring those communities to parity in the national venture market — how much opportunity the country has missed, and how much those founders have an opportunity to produce an internal rate of return. That’s worth investing in.”

How Up.Labs threads the needle between corporate venture capital and accelerators

Talent is everywhere

One of the classic pushbacks from VCs about investing outside traditional hubs is the alleged lack of talent availability. I asked the Gener8tor team about that and was met by two deeply annoyed faces. Clearly, this topic ruffles their feathers.

“Much of the balance sheets that ultimately get invested as LP commits into coastal venture funds come from the Midwest, whether it’s corporations, university endowment, state pension funds, etc. And that money was created by the talent in those communities,” Kirgues said. “I think a lot of these communities have been foolish in terms of how they’ve allocated that funding. When they are not watering the tree in their own backyard, it creates these compound problems.”

It’s hard to get to know a hundred different local ecosystems and root out the best opportunities, the company argues; nobody goes hunting for the best Georgia, Nebraska, Kentucky or Alabama startups. But the company is creating a one-stop shop, comparing itself to a grocery store, and claims it’s finding a bunch of success in that. The supermarket of startups is open:

“Now a VC can come to Gener8tor, and we can direct them to the appropriate startups that have a good fit for them. It is as if you’re a VC and you had a grocery shopping list of 100 different items, and you had to go to a different store for each item,” Kirgues said. “When you come to the Gener8tor store, we have all 100 items on the shelf. We have an Omaha shelf, a Cincinnati shelf, a Milwaukee shelf, Minneapolis shelf, etc.”

Finding new ecosystems, bridging the cultural gaps

After a decade, Gener8tor is often invited into local ecosystems to help build accelerator programs.

“We essentially have two different flavors of what we do. We have an accelerator called gBETA. It’s free, meaning we don’t invest. We don’t take equity, we don’t charge fees. And typically that program will work exclusively with local startups or, in some cases, we’ll partner with a university exclusively to work with students, faculty, staff and alumni of that university,” Vosseller explained. “Our second model is our investment accelerator, our flagship program, where we are investing cash for equity. If we believe that talent is evenly distributed throughout the country, and throughout the world, and if we can find people where they are, we give them a pathway to get the resources and venture capital growth capital to achieve the milestones that they set out to achieve. I think they would prefer to stay where they are.”

Of course, the strength of this model is to lean on the local talent and ecosystems in the communities the individual accelerator serves, whether the regional strength is agriculture, manufacturing, insurance, healthcare, financial services or something else entirely.

“Our mantra is always ‘never self-defeat.’ But in these communities that are historically not participating in the VC asset class, there are unintended consequences from decades of not being included. I don’t know if it’s imposter syndrome or just a lack of awareness, but it inhibits confidence from our founders to not just be in the room but to pitch as if they should be in the room,” Kirgues explained. “I think a lot of that is mistaken for talent gap. I believe it is just as much a cultural difference. If you help people bridge that, they can accomplish.”

The team suspects there’s a reason there hasn’t been a lot of interest around Gener8tor in the national press or among tech/startup media outlets.

“We always feel like we are best as part of the story, not the story itself. Our goal is to get capital redistributed in the communities,” Vosseller said. “I think where Silicon Valley has really gotten it right is that they’ve entered this flywheel where people have made money and put it to work. It recycles both institutional knowledge, talent and, most importantly, capital back into that ecosystem. Everyone else is an outsider, saying, ‘Oh I want to be invited to that party.’ And so that’s why we see corporations, pension funds and foundations investing in that, versus their own communities.”

A sore point for the Gener8tor team is a bit of research it did into Russia divestment.

“We recently did kind of a light dive into where states invest. It turns out tha the State of Minnesota Pension Fund had $53 million invested in Russia,” Vosseller said, shaking his head. “To my knowledge, that is more than they’ve invested in Minnesota startups. A logical conclusion of that is that the state of Minnesota Pension Fund thought investing in Russia was a better investment and long-term opportunity for their constituency than investing in entrepreneurs in their own state. It’s wild.”

Comment