As venture capital investments slowed down in 2022, some startups turned to private credit, including debt capital, as a way to supplement their operations in the meantime. However, the policies and procedures paperwork that goes with these deals aren’t always easy to understand.

Finley CEO Jeremy Tsui told TechCrunch that private credit is a $1.2 trillion industry and accounts for 90% of all corporate debt in the middle-market. However, while working in debt capital at Goldman Sachs, he witnessed two things: private credit, or lending by non-bank parties, filling the gap for banks making fewer corporate loans, and then companies finding it challenging to understand the hundreds of pages in their agreements.

“With consumer credit, we’ve seen a lot of innovation, but business credit or business lending has really been stuck in the past,” he said.

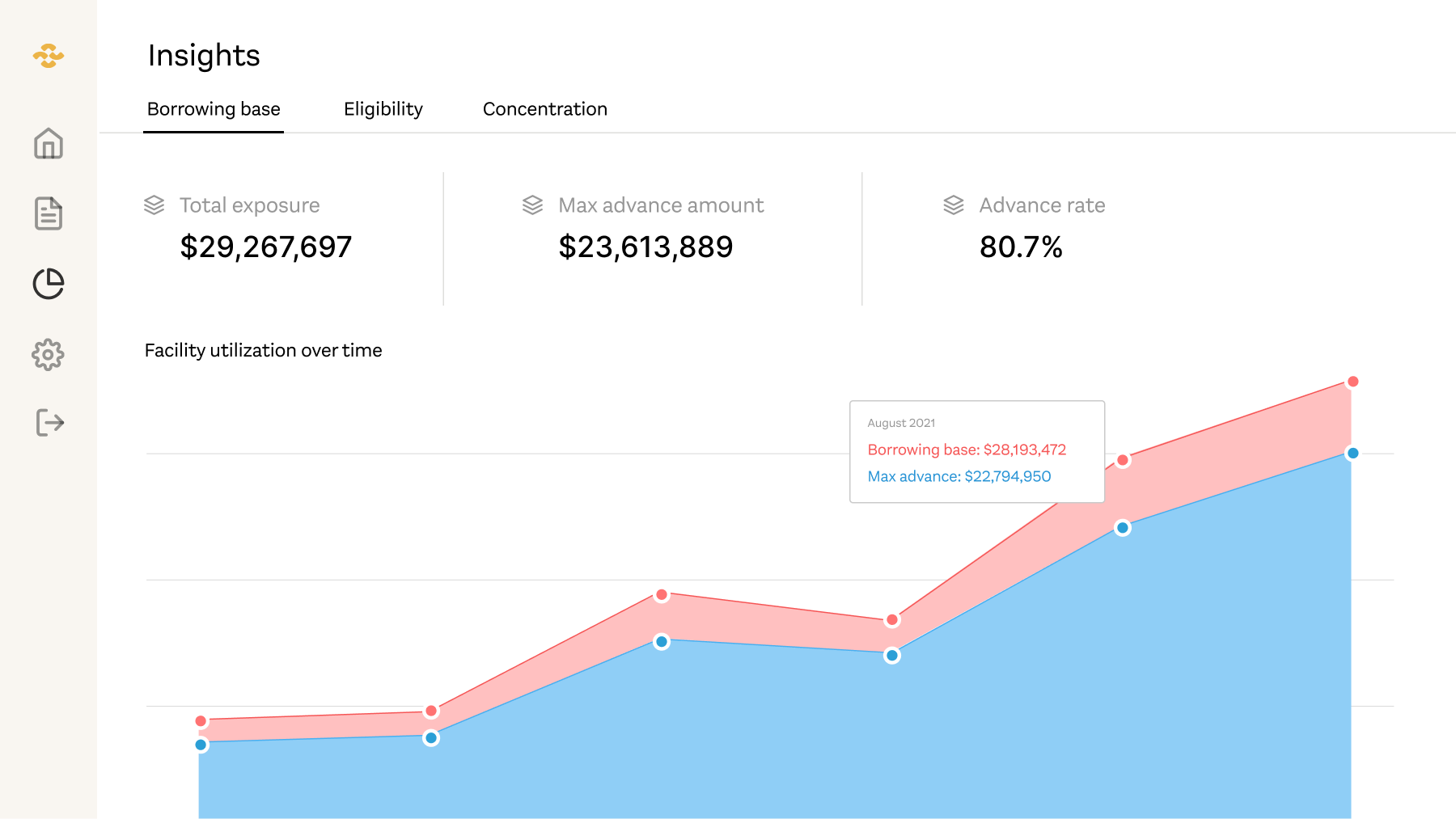

That’s when he came together with his brother, Josiah Tsui, and friend Kevin Suh in 2020 to create Finley, a software company that helps clients manage their private credit loans, turning hundreds of pages of documents into digestible bites, including storing key dates, so that companies taking these kinds of loans can more easily comply with the loan terms and reporting requirements.

Finley raised $3 million back in 2021 and has now closed on $17 million in Series A capital after spending the past two years focused on building its product and hitting a few key revenue and product milestones, Tsui said.

CRV led the round, and as part of the investment, James Green, general partner at CRV, will join Finley’s board.

Green told TechCrunch he met Tsui and his co-founders in 2021 after they had just come out of Y Combinator and raised the seed round. What Finley was doing is similar to other investments the firm has made, including Mercury and Jeeves. He said interest in debt capital has grown, even among non-technology companies.

“The reality is with interest rates rising and cost of capital increasing, the requirements for debt have become more challenging, and there’s still plenty of it,” Green said. “But among the covenants and the warrants and documentation, the reporting is all much more complicated than it was when capital was much cheaper three years ago.”

Joining CRV in the round are existing investors Bain Capital Ventures, Haystack, Y Combinator, Nine Four Ventures and specialty lender Upper90.

Finley is working with companies like Ramp, Parafin and TripActions to manage hundreds of millions of dollars in debt capital and tasks like credit agreement digitization to fund disbursement to portfolio analysis.

“Finley is helping us manage our $300 million credit facility with Goldman Sachs,” said Loraine Tang, vice president of tax and treasury at TripActions, in a written statement. “There are many compliance, reporting, and optimization tasks to coordinate in order to make the most of our funding. Finley’s software helps coordinate these tasks by pulling in data from across our systems and streamlining many aspects of debt capital management for this facility.”

Meanwhile, the new funding will go to expanding into new verticals, hiring across the board and into new software offerings for debt capital providers and lenders, Jeremy Tsui said. In addition, the company doubled its headcount in the last year to 18.

Tsui declined to disclose hard revenue figures or valuation, but said last year the company grew revenue five times, was able to save one to two finance headcount for the average customer and unlocked access to capital that companies didn’t have beforehand.

“Having access to capital can be the difference between stagnation and growth,” he added. “We work closely with CFOs to make sure that they’re not only securing the loan, but do the reporting and compliance so they can maintain access to those loans.”

As venture capital rebounds, what’s going on with venture debt?

Comment