Even though Kevin Busque is a co-founder of TaskRabbit, he didn’t get the response he was hoping for the first time he pitched his new venture to Felicis Ventures’ Aydin Senkut. Nonetheless, he said the outcome was one of the best things that could have happened.

“I’m kind of glad that he didn’t invest at the time because it really forced me to take a hard look at what we were doing and really enabled us to become Guideline,” said Busque. “That seed round was an absolute slog. I think I spent seven or eight months trying to raise a round for a product that didn’t exist, going purely on vision.”

Eventually, that idea evolved into Guideline, which describes itself as “a full-service, full-stack 401(k) plan” for small businesses. Eventually, Senkut did write a check — Felicis led Guideline’s $15 million Series B round. Today, Guideline has more than 16,000 businesses across 60+ cities, with more than $3.2 billion in assets under management. The company has raised nearly $140 million.

This week on Extra Crunch Live, Busque and Senkut discussed Guideline’s Series B pitch deck — which Senkut described as a “role model” — and how they built trust over time.

The duo also offered candid, actionable feedback on pitch decks that were submitted by Extra Crunch Live audience members. (By the way, you can submit your pitch deck to be featured on a future episode using this link right here.)

We’ve included highlights below as well as the full video of our conversation.

We record new episodes of Extra Crunch Live each Wednesday at 12 p.m. PST/3 p.m. EST/8 p.m. GMT. Check out the February schedule here.

Episode breakdown:

- How they met: 1:30

- Building trust: 11:30

- Inside Guideline’s Series B deck: 16:00

- Pitch deck teardown: 33:00

How they met

Senkut and Busque met nearly a decade ago, when Busque was still at TaskRabbit. Several years later, Busque launched out on his own and went fundraising for his original idea. Even though he got a no from Senkut, it wasn’t an easy decision.

Looking back, Senkut said he had much more freedom to follow his instincts while angel investing.

“As an institutional fund with LPs, we were feeling the pressure of checking all the checkmarks,” explained Senkut. “It’s amazing how, sometimes, being more structured or analytical actually does not always lead you to make better decisions.”

When Busque came back around after the pivot, looking to raise a Series B, Senkut called it a “no-brainer,” particularly because of the type of CEO Busque is.

“My opinion of Kevin as a person is that he’s an excellent wartime CEO, but also he’s a product visionary,” said Senkut. “We call them ‘missionary CEOs.’ There are mercenary CEOs who can extract every ounce of dollar from a rock, but we are gravitating much more toward CEOs like Kevin who are focused on product first. People who have a really acute vision of what the problem is, and. a very specific vision for how to solve that problem and ultimately turn it into a long-term scalable and successful company.”

Busque said he was drawn to Senkut based on his level of conviction, explaining that Senkut doesn’t always have to go by the book.

“If he wants to write a check because the founder is great or the product is great, he does it,” said Busque. “It’s not necessarily that he has to see a certain metric or growth pattern.”

Building trust

Obviously, years of staying connected and communicating (and not just about Guideline) laid the foundation for building a relationship. Busque said the honesty in their conversations, including Senkut’s initial rejection, lended itself greatly to the trust they have.

“The trust starts in the pitch deck,” said Busque. “You can see when we talked about competition, we weren’t trying to hide the ball anywhere. If something’s bad in your deck, just call it out and explain what you’re going to do about it. That’s where trust really begins.”

Busque said he always strives to follow through on the things he says he’s going to do and that keeping his word has helped build a lot of trust between him and his board.

“Over time, you repeat that numerous times and they will start to give you the rope that you need to operate your company,” he said.

Senkut said part of the reason he started Felicis was to create a venture firm that prioritized trust and empathy over metrics and numbers. He said an existing relationship, before an investment was ever contemplated, gave him a specific context through which to examine the deal when it was finally presented to him.

It was this context that made a difference when he looked through the Guideline pitch deck for Series B.

He noted that Busque’s plan to innovate on business model was something other VCs may view as a risk. Guideline charges a base fee and then $8/month/user, whereas most financial services businesses price based on assets under management.

“It’s much easier to make money taking a tall assets under management fee, but it destroys the people and the retirements,” said Senkut. “You need to have a lot of faith to say, ‘I’m going to take, in the short term, a less exciting business model, but it’s the right the thing to do for people’s retirements.’”

How should SaaS companies deliver and price professional services?

Having an understanding of Busque’s ability to execute also made a difference when examining Guideline’s go-to-market strategy, said Senkut. The company had decided to partner with payroll providers, and at the time of the Series B, a significant portion of revenue was coming from a single provider, with several in the process of onboarding.

“Even though that number, at that moment, looked a little bit scary, the idea was brilliant,” said Senkut. “We had faith that Kevin was going to execute. That’s something that other people got hung up on. So, the point that I’m trying to make is that you can look at the same data points, and some people connect them and see the future. Some people look at them and only see risks.”

Guideline’s Series B deck

Busque walked us through his original Series B pitch deck (which you can check out below), giving feedback about what he felt worked well and what he would change. We also got to hear what stood out to Senkut, who ultimately led the round.

“One of the important things that I want the audience to get from this is that, after doing this for 15 years, this is a fantastic deck,” said Senkut. “The deck itself is a role model. The reality is you have to capture the attention of your audience in the first 15 minutes and he did that.”

Busque remarked on his own TAM (total addressable market) slide (Slide 10) with some advice for the audience as well, saying that if there isn’t a “billion” in the TAM slide, you shouldn’t bother doing the pitch to an institutional VC.

Guideline Series B Deck by Jordan Crook on Scribd

Senkut and Busque both noted how important it was that the main differentiating factors of the company — in Guideline’s case, its pricing model and the technology — worked alongside one another in the deck and presentation. Not only did Guideline price itself differently from its competition, such as Fidelity, it also provided a full-stack solution.

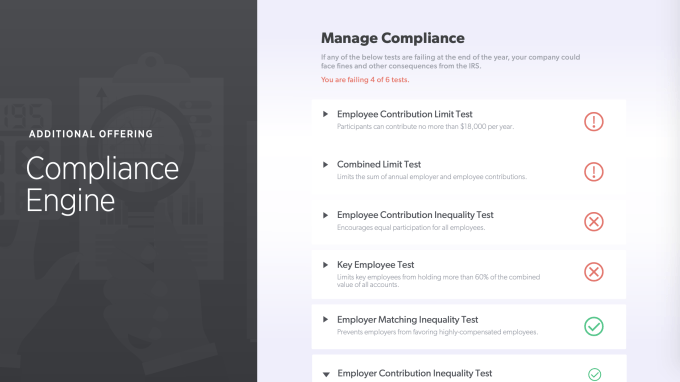

In the deck, Guideline dedicates an entire slide to its compliance engine (Slide 17).

Busque said that, as much as Guideline is a fintech company, it’s also a regtech company regulated by the SEC, the Department of Labor and the IRS. While the compliance engine took two years to build, it is a key factor that illuminates the potential of the pricing model, he said.

“The business model innovation would not be feasible if they didn’t have the technology to do it,” added Senkut. “Compliance is something that everybody hates, but the reason why Fidelity and others can solve it is that they throw people at the problem, and then they price it so that they can afford the people.”

That works just fine for big corporations using Fidelity for their 401(k) plans, but it prices out small and medium businesses, Guideline’s bread and butter.

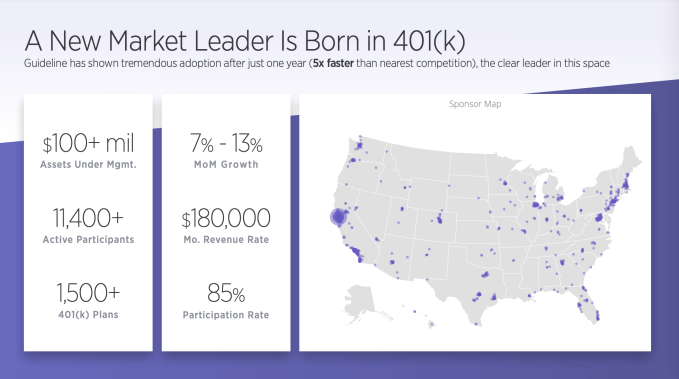

As with any deck, particularly that of a growth-stage company, the traction slide is incredibly important. Senkut said Guideline’s traction slide stood out for a number of reasons. The numbers around AUM, active participants and plans on the platform were impressive on their own, but the slide also included a U.S. map showing the geographic regions where Guideline was in use.

“Another really important nuance is that not only do they have traction, but people are using it all over the country,” said Senkut. “This was a very unique insight that we had from Fitbit and Rovio. For instance, gaming was doing okay in the U.S., but it was a huge hit internationally. Fitbit first started in the Midwest, and a lot of people on the coasts did not experience it and underestimated it. So, even the nonnumbers were interesting, intriguing and going in the right direction.”

Another standout slide for Senkut was the use of funds described in the deck (Slide 19). He said so many pitch decks have slides talking about using their funding for Google ads, Facebook ads and other marketing strategies. Guideline’s plan to use funding to build out the engineering team, building a better product and more scalable tech platform, caught Senkut’s attention.

It also fed into the plan to use payroll providers as a distribution model, which Senkut felt confident about based on knowing Busque’s ability to execute on his plans.

The Pitch deck teardown

- Show off what makes you unique

I think the one thing that I’m missing here is what makes you unique. Why can you do this better than anybody else?

- The team slide needs more than names and titles, but information on what makes this the right team to solve the problem

The team slide is really important. Some of the most memorable team slides are where there was also an understanding of why each person is in this company, solving this problem.

- Keep it simple

If you cannot articulate what makes your company great, and what makes you unique, so simply that even a high school or even elementary school student gets it, you’ve lost the battle. The main purpose of this deck is literally only one thing: Are you going to lure me in and make me curious and make me want to spend more time? The more complex the deck, or the more complex the product is, the more things that can go wrong.

- If you’re going to project future growth, explain why that should be trusted

There is a slide that is going up and to the right, but the up and to the right portion is the next two years. It’s all really great, except that we’re just barely in 2021. The steep part of the chart is in the future, which is not bad. We might get there. But it is very important to understand the why.

Check out the amazing speakers joining us on Extra Crunch Live in February

Comment