A much-anticipated market downturn may finally be here, and investors have been preparing for it by diversifying their portfolios away from the traditional stock and bond holdings, and into alternative assets such as collectibles. Thanks to tech companies such as Masterworks (physical art), Vinovest (wine) and Rally Rd (classic cars, sports memorabilia, etc), retail investors can now put their money into alternative assets with relative ease.

Many of these collectibles have been unlocked in the past few years, but one major market has remained difficult for tech startups to crack — luxury gems. That’s the opportunity a new fintech startup called Luxus, co-founded by two women with experience in both finance and luxury fashion, is hoping to bring to investors.

“People have been trying to make gems an investable asset class since 17th-century Venice, which had done this with gold, and nobody could figure it out,” co-founder and CEO Dana Auslander told TechCrunch in an interview. Auslander, who has spent 23 years working in the hedge fund industry, said that her background in structuring financial products informed her approach to founding Luxus with this very goal in mind.

Precious gems are non-fungible, meaning that like a precious artwork or classic car, they can’t be easily divided and retain their value, which is why Auslander thought offering investors fractional ownership in gems would be a more effective way to market them.

“As a product person, as soon as I discovered the JOBS Act and Reg A+, I was like, “this is how you do it,” Auslander said. Reg A+, introduced under the JOBS Act in 2015, allows companies to raise capital in a process similar to an IPO but with fewer reporting requirements, meaning companies typically pay less to launch an offering and can market their securities to a broader investor pool than in a traditional IPO.

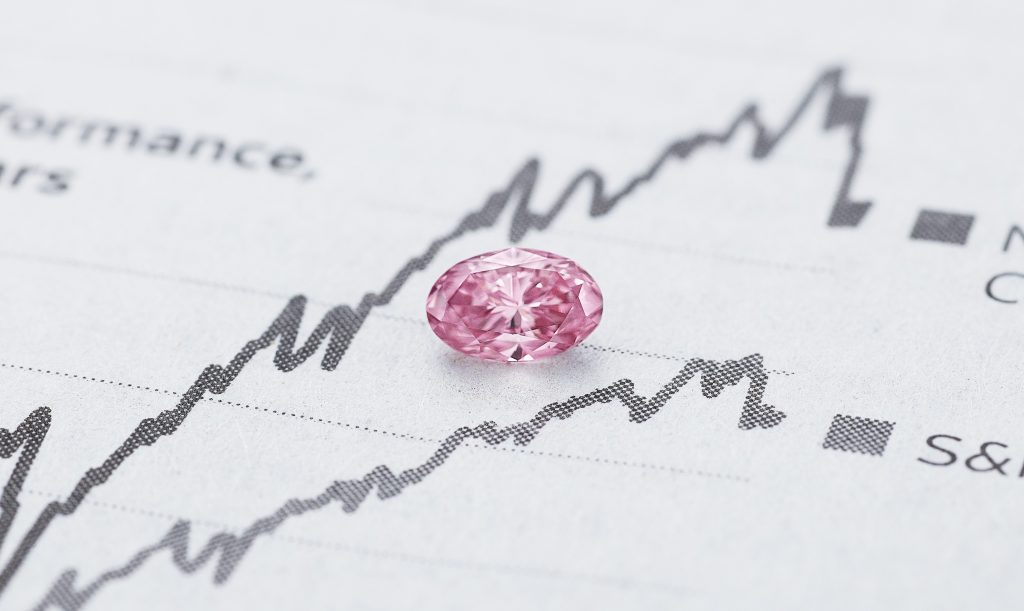

Auslander teamed up with her friend, Gretchen Gunlocke Fenton, a luxury and fashion professional with experience at Glamour Magazine as well as high-end brands Tod’s and Chanel, to start Luxus last summer. The platform is officially launching today and plans to debut its first investment offering to investors later this month, pending SEC approval — a rare argyle pink diamond mined in 2016 in Kimberly, Australia, Auslander said.

Luxus has valued the diamond at $400,000 and will be offering 2,000 shares at $200 each to investors, according to a document the company shared with TechCrunch. It is launching the offering in partnership with jeweler Kwiat/Fred Leighton, which, like all the suppliers Luxus plans to work with, is handling the security and custody of the diamond itself.

Auslander said that colored diamonds, particularly pink ones, are super-rare, representing 0.001% of diamonds mined globally. Because of their scarcity, they have historically had a low correlation to traditional markets and have provided a stable return during periods of broader volatility and inflation, according to Auslander.

“This particular stone has returned [11.5% per annum] from 2005 to 2020, beating both the S&P 500 and gold by more than 200%,” Auslander said.

To prepare for its launch, the company has raised $2.5 million in pre-seed funding from investors including fashion entrepreneur Veronica M. Beard and current and former senior executives at Blackstone, Auslander said. The company also won the NBA Full Court Pitch Competition for startups in February and got to present at the league’s All-Star Weekend, beating out a golf company and a sneaker company in front of a panel of all-male judges — an achievement Auslander recounted with pride.

Brands will pay Luxus a small fee to list their assets on the platform, and Luxus will charge a 50-75 basis point management fee to investors. Auslander added that the platform will have a “buy it now” feature, effectively making it a sales channel for the jewelers.

Its target investors are similar to those participating in crypto, Auslander said — retail investors, collectible lovers and people who are fans of events like the Met Gala or the Oscars who not only read editorial coverage of those events but also want to participate in the ownership of related assets. Institutional macro investors who want to diversify their portfolios with hard assets are also a key demographic for Luxus, she added.

Gemstone mines across the globe are predicted to continue closing as most of the gems have already been extracted, so the inherent scarcity of the product should also drive up value, according to Auslander. All the diamonds on its platform will be required to be compliant with the internationally recognized Kimberley Process to ensure they were ethically mined, she added.

“We’re trying to create a new asset class just like Masterworks did, but we’re really much more of a commodity, and we’re not manmade. It’s a little bit more bordering the lines of commodities, luxury and collectibles,” Auslander said.

When I asked Auslander why another platform such as Masterworks hasn’t already waded into the luxury gems market, she explained that suppliers can be particularly tough to access.

“It’s really a very concentrated industry, and these are really deep relationships of mine and Gretchen’s. We have some [suppliers] as investors, we have some other brands that we’re lining up … It’s also a very risk-averse, private industry,” Auslander said.

One other key difference between Luxus and a platform like Masterworks is that Luxus plans to use a Series LLC structure, grouping assets for accounting purposes, rather than offering each gem as a separate entity, Auslander explained. The benefit to the Series LLC structure is that it allows for greater efficiency and speed, she said, noting that the holding period for gemstones is typically much shorter than it is for artwork, at 18 months to three years, because the market moves much faster.

“I think in the next 18 months, three years, five years, there will be substantial institutional demand — we just want to make sure that we are able to come up with a supply,” Auslander said.

Comment