Grant Easterbrook

This article follows a piece I wrote that looked at six fintech ideas from the first decade of fintech that failed to go mainstream — algorithm-based buy/sell/hold advice, trade mimicking, P2P lending, P2P insurance, on-demand insurance and standalone financial planning apps. But there’s more to the story. Given the intense interest in the fintech sector, it’s worth examining three more concepts that initially seemed promising but largely failed to change the financial services industry.

Before diving in, it is important to once again first define how we are categorizing “failure.” This article is not focused on highlighting the demise of individual high-profile fintech startups or various failed fintech initiatives undertaken by large corporations (such as BloombergBlack or UBS’ SmarthWealth).

Rather, this piece will focus on fintech ideas that received some degree of initial hype and momentum but ultimately failed to change the way the average person manages their money. So, with those caveats, here are three more fintech concepts from the last 10 years of fintech that did not succeed.

Independent financial adviser search and matchmaking tools

In the early 2010s, approximately 15 firms launched an online search or matchmaking service designed to help individuals find a financial adviser that best met their needs. The traditional approach to financial advice — where wealthy individuals usually find an adviser through friends, family or a local financial adviser’s proactive sales outreach — lags behind modern online product search trends. Every day, consumers shop online and pour over user reviews. The logic behind this early wave of startups was that the experience of finding a financial adviser should mimic the way consumers look for other products and services online.

Financial adviser matchmaking startups generally took one of two approaches. The first approach was to offer a search tool that let users find local financial advisers based on parameters such as assets under management, experience, rating, gender, etc. Here’s an example of a financial adviser’s profile on the now-defunct financial adviser search tool Tippybob.

The second approach was to offer an online financial adviser matchmaking service. Prospects were asked to enter basic information about their income, age, assets, needs, etc. and the firm would introduce them to a local financial adviser who was selected as a personalized fit for their needs.

As of 2023, there are still a few independent sites (such as SmartAsset and Zoe Financial) offering some kind of financial adviser matchmaking tool. And of course, Googling “financial advisers in my area” will yield paid ad placements. In general, however, independent financial adviser search and matchmaking tools failed to go mainstream. Most wealthy individuals still find their financial adviser via traditional methods rather than relying on web-based approaches.

This idea failed to catch on for two reasons. First, these startups were unable to overcome the difficulty of building a two-sided network for a product with a slow sales cycle. Advisers didn’t want to join these matchmaking services unless there’s a large number of users on the platform. Without a significant number of advisers on the platform, however, these services struggled to attract users. This chicken-or-the-egg problem was compounded by the very slow sales cycle of financial advice.

Secondly, financial advice is fundamentally different from other types of goods and services sold online. There are potentially massive negative consequences if a consumer chooses the wrong financial adviser and they receive bad investment advice. Ordering a pizza or a pair of shoes online does not carry the same level of risk.

Consumers who would like to work with a financial adviser seem inclined to only want to hire someone with whom they have a high level of personal trust. Thus, the financial adviser business model has proven resilient to disruption by online product search and comparison services that have upended so many other industries.

Online independent retirement advice services

For most Americans, their employer-sponsored retirement plan (e.g., 401(k)s, 403(b)s, etc.) is their main retirement nest egg. The average American often struggles to understand these jargon-heavy corporate retirement plans, however. Americans must also choose how they would like to invest their money. With these challenges in mind, several fintech startups launched free, freemium or paid online advice to help American consumers better manage their employer retirement plan.

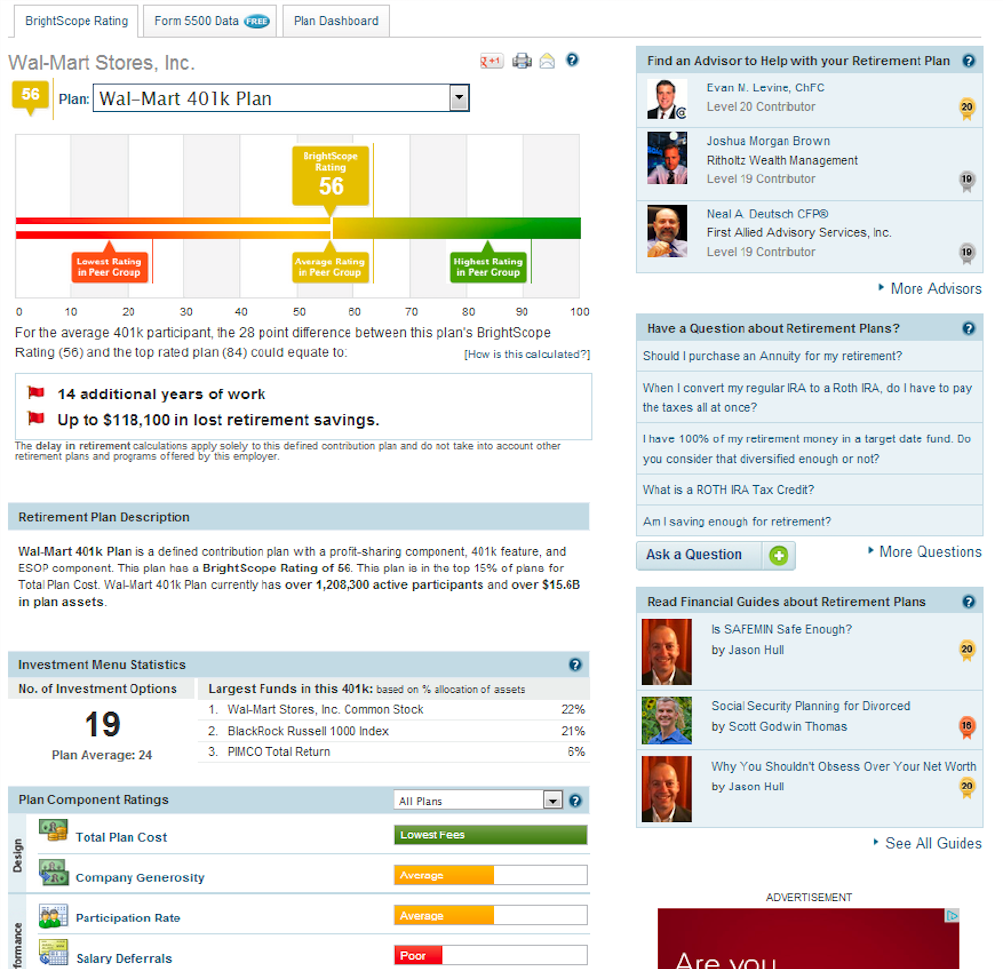

The level of advice provided by these online firms varied. Free advice typically included a user-friendly description of the retirement plan’s rules, fees and investment options. These retirement plan profiles tended to emphasize the fees and costs of the plan. Some of these independent online retirement plan advisers even included a proprietary plan ranking where they evaluated the user’s plan compared to those in its peer group. Below is an example of Brightscope’s plan profile and ratings from 2013. Note that the upper-right hand corner of the screenshot below also includes a financial adviser search function.

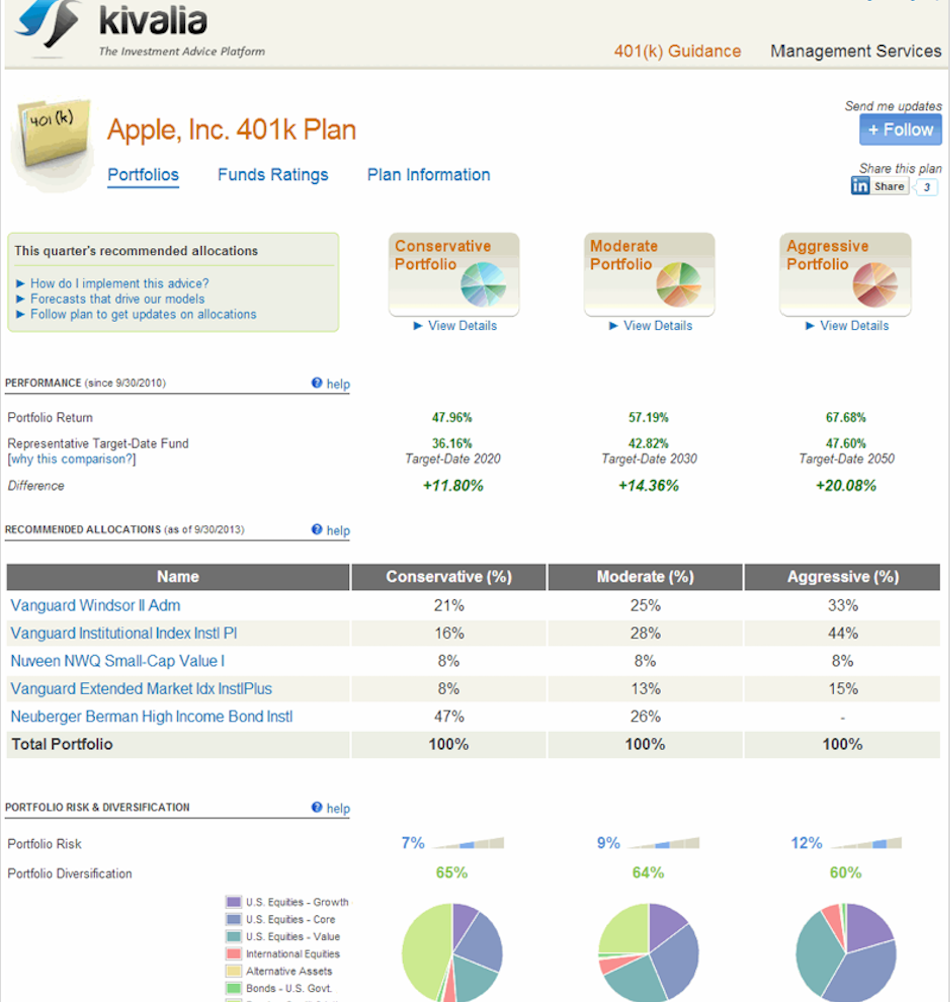

Firms with a freemium or paid model usually provided a recommended investment portfolio, although some firms gave investment advice for free. Clients followed this advice and the recommended portfolio allocation by logging into their 401(k) account. Below is an example of what this advice looked like.

Fast-forward to 2023, and almost all of these independent retirement advice firms have failed or pivoted. Bloom — long the last remaining major independent online retirement plan adviser — shut down their 401(k) advice service in November 2022.

Why did this idea not catch on? First, these fintech newcomers underestimated the cost of acquisition for a very specific client profile. Said another way, it was too expensive to acquire customers who were both financially savvy and had the kind of DIY mentality to take the time to manage their 401(k) by logging into a separate service. Most consumers simply don’t like thinking about money and want to minimize the amount of time they spend thinking about it — a recurring theme in fintech failures over the past decade.

Second, over the course of the last 10 years, an increasing number of corporate retirement plans started offering some kind of investment management/investment advice service within the retirement plan website. Firms like Financial Engines and GuidedChoice partner with major retirement plan record keepers and give employees investment advice behind the retirement plan login. As more and more retirement plans started offering some kind of advice solution under the same login, the market for independent advice services shrank.

Income-based student loan startups

The cost of college in America and the associated student debt burden has long intrigued entrepreneurs. At the start of the first decade of fintech, several startups touted the idea of an income-based loan service. Unlike a traditional loan — where graduates have to pay back a large lump sum with interest — income-based loans were meant to have graduates pay a fixed proportion of their income for a certain number of years.

At the time, advocates hoped this income-only approach would be less intimidating to students nervous about taking on debt to pursue higher education, particularly for those interested in less remunerative careers. Proponents pointed out that this approach would probably result in lower debt burdens for all but the highest earners. Income-based student loan repayment schemes were already working well in countries like Australia and the United Kingdom, so there was a belief that private companies could implement a similar approach for borrowers in the United States.

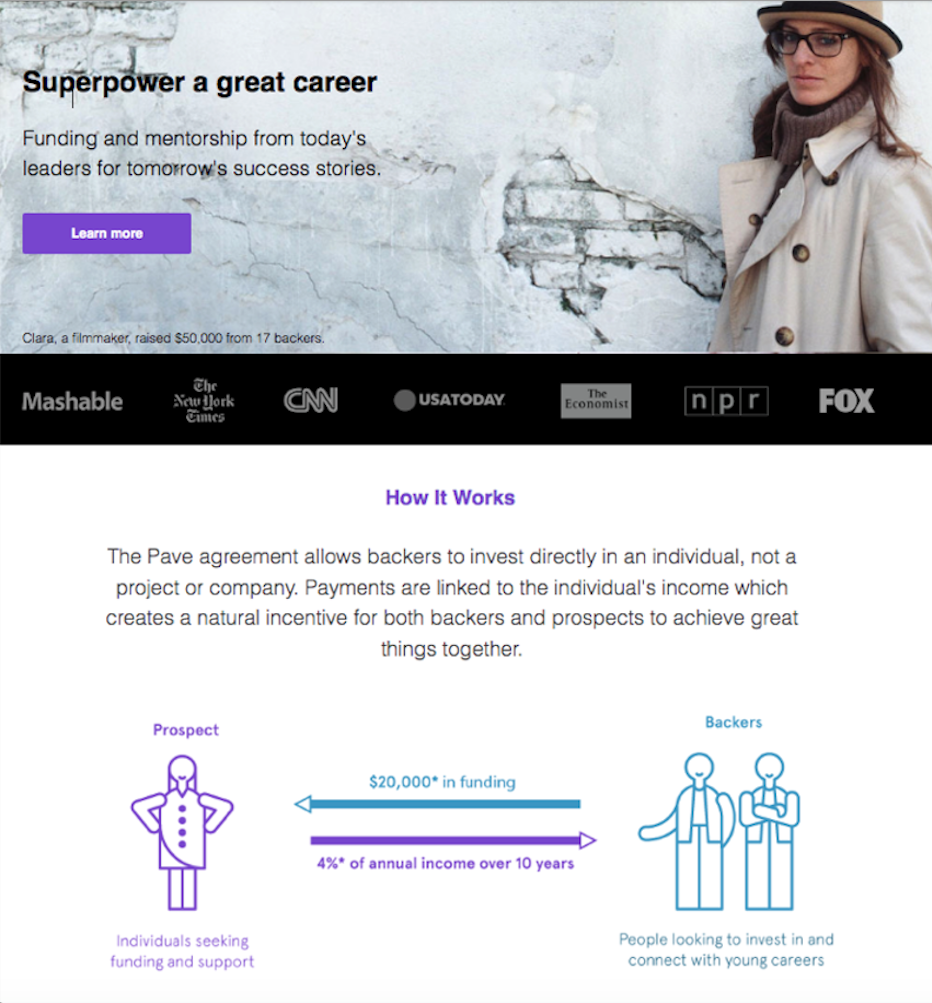

Firms like Pave and Upstart tried to bring this approach to America. These firms raised money from investors who were willing to lend money to a student for a stake in their future earnings. Income-based student loan fintechs firms typically vet students and set parameters on the percentage of income (usually between 3%-10%) and number of years (usually about 10) the student must pay back investors. Investors bear the risk that the student may not earn enough money for the desired return. On the flip side, investors also stand to gain if the student is exceptionally successful. A degree of mentoring and support was also sometimes offered, either from the investor who wants to see their students succeed or from the loan firm itself. Here’s a good article from 2013 that sums up the business model and the initial hype behind the idea.

What happened? The first big hit against the model was negative media attention. Highly critical articles compared this approach to loan repayment to indentured servitude or even characterized it as a modern form of involuntary servitude. The fact that income-based student loan repayment already worked effectively in other countries was lost in the sea of bad press, creating anxiety among potential borrowers that they were being taken advantage of.

In addition to the negative media scrutiny, the business model itself proved especially challenging. Unlike government lenders (for example, the Australian loan repayment program is interest-free and only adjusts based on inflation), private firms need to earn their investors a profit. How does a fintech lender structure an income-based student loan contract to protect investors if the student decides to join the Peace Corps after graduating? What rates would a fintech charge a pre-med student with years of graduate school ahead? What terms would a computer science major at an Ivy League university receive compared to an art history major at a lower-tier university with a poor graduation rate? These challenges proved difficult for income-based student loan fintechs to overcome, and they ultimately pivoted their business models.

Note that in the years since these startups pivoted away from income-based student loans, the Federal Government made changes to existing programs and rolled out the REPAYE income-driven loan option. These changes have made the Federal Government’s income-based loan programs more popular over the last few years, meaning it is now highly unlikely that a private American fintech firm will ever attempt this model again.

The financial services industry must not forget the lessons from the first decade of fintech

As previously noted, there is nothing shameful about failure. Pivoting to find product-market fit is a natural part of the startup lifecycle. The objective of these two articles is to remember what ideas did not succeed, and why, in order to avoid repeating the same mistakes.

The failures I identified in algorithm-based buy/sell/hold advice, trade mimicking, P2P lending, P2P insurance, on-demand insurance and standalone financial planning apps showed some hard-learned lessons when innovative concepts met the marketplace. Across those failed ideas, there are two main takeaways. First, fintech entrepreneurs must remember the essential principle that the average consumer doesn’t like thinking about money and often wants someone else to take care of it. Second, the industry must be realistic about the high cost of client acquisition. The online retirement plan advisers mentioned in this article also struggled with these two issues.

The other main lesson from this article is to remember that money and financial products have unique properties that makes them different from other sectors of the economy. A mistake — whether in the form of working with a bad financial adviser or accidentally taking out a more expensive student loan — can cost tens of thousands of dollars. The potential for huge losses means services must build a high degree of trust with prospects and clients. Given this reality, the modern online product search mentality may never come to traditional financial advisers. It also means that trying to change the established ways people borrow money can be hard — as the income-based student loan repayment startups can attest to.

Entrepreneurs who will lead the second decade of fintech must learn the lessons from the past as they look to build the next generation of fintech innovation.

Comment