Peyton Carr

When a founder sells their company, its valuation gets a lot of attention. But too much emphasis on valuation often leads to too little consideration for what stockholders and stakeholders pay in taxes post-sale.

After an exit, some founders may pay a 0% tax while others pay over 50% of their sale proceeds. Some founders can walk away with as much as two times the money as other founders at the same sale price — purely due to circumstances and tax planning. Personal tax planning can ultimately impact a founder’s take-home proceeds as much as exit-level valuation changes can.

How does this happen? Taxes owed will ultimately depend on the type of equity owned, how long it’s been held, where the shareholder lives, potential tax rate changes in the future and tax-planning strategies. If you’re thinking about taxes now, chances are you’re ahead in the game. But determining how much you’ll owe isn’t simple.

In this article, I’ll provide a simplified overview of how founders can think about taxes as well as an easy way to estimate what they will owe in tax upon selling their company. I’ll also touch on advanced tax planning and optimization strategies, state tax and future tax risks. Of course, remember that this is not tax advice. Prior to making any tax decisions, you should consult with your CPA or tax adviser.

How shareholders are taxed

Let’s assume you’re a founder and own equity or options in a typical venture-backed C-corp. A number of factors will determine whether you will be taxed at short-term capital gains (ordinary income tax rates), long-term capital gains, or qualified small business stock (QSBS) rates.

It’s essential to understand the differences and where you can optimize.

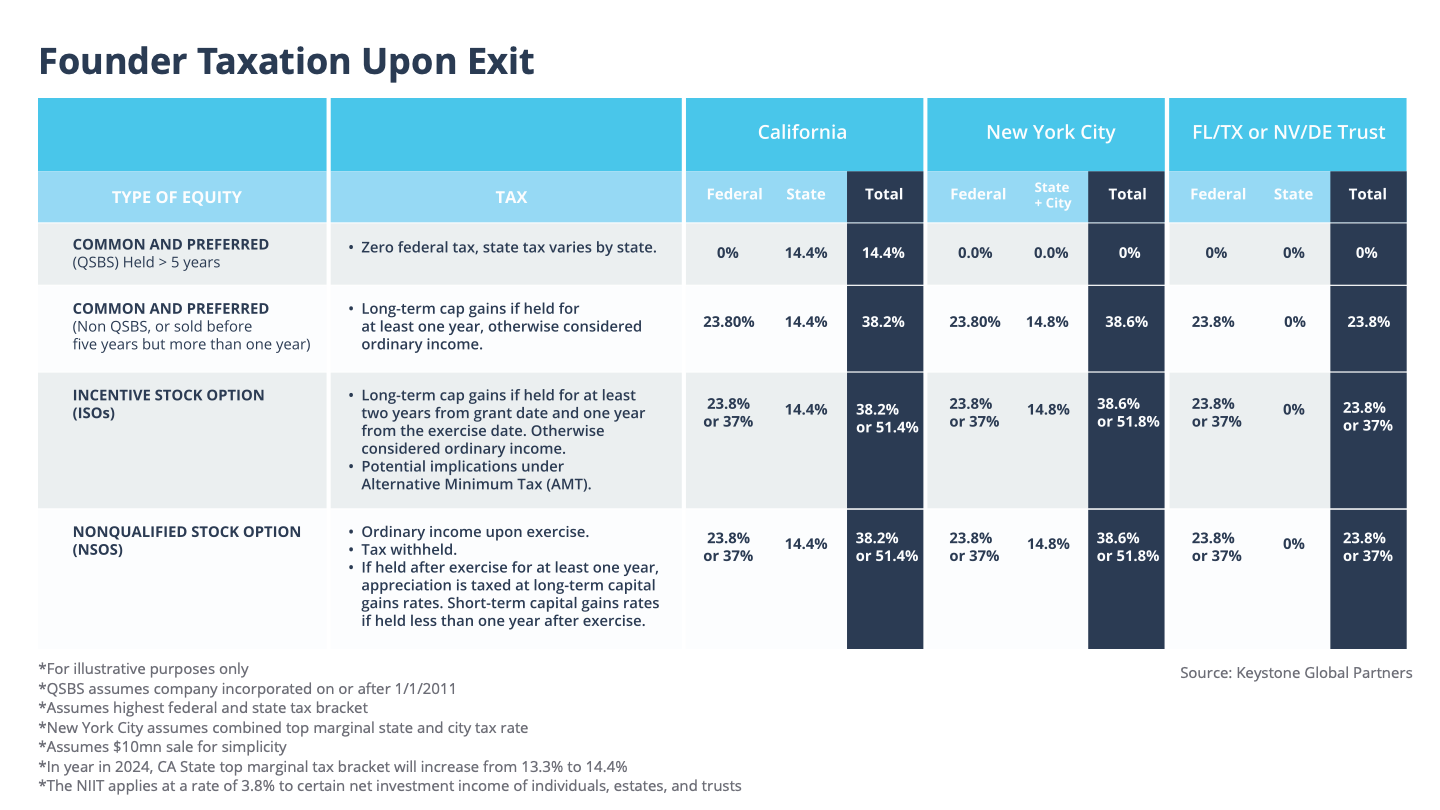

Below is a chart summarizing different types of taxation and when each applies. I further break this down to show the combined “all in” federal + state + city taxation, if applicable.

Founders with exits on the horizon that will raise more than $10 million should explore some of the advanced tax strategies I covered in one of my previous articles, since there are opportunities to multiply or “stack” the $10 million QSBS exclusion and minimize taxation further.

As you can see above, some of the more common levers that influence how much tax a founder owes after an exit include QSBS, trust creation, which state you live in, how long you’ve held your shares and whether you exercise your options.

Charitable planning is not shown in the chart above but can produce excellent tax outcomes for founders with large exits. Typically, when an exit involves an IPO or public stock, the founder can donate a portion of that stock to a foundation or donor-advised fund to get the fair market value deduction of the stock without realizing the gain.

QSBS and risk to QSBS tax rates

When it comes to minimizing capital gains tax, QSBS can be a game-changer for people that qualify. In case you’re not already familiar with QSBS, here is an overview, including what you need to qualify for it.

If you qualify for QSBS and meet the holding period requirements by the time you sell in the future, you could be in great shape. QSBS is the most significant personal tax savings lever in most transactions.

Currently, a taxpayer can exclude up to $10 million, or 10x basis, whichever is greater. You will also have some advanced tax planning opportunities to exclude more than $10 million, depending on your situation.

However, there’s the possibility that the QSBS exclusion could change, and founders should be familiar with the history of QSBS and what could happen in the future. QSBS has only been at the 100% exclusion rate since late 2010, which has worked out favorably for many tech founders. However, some current lawmakers are looking to cut the exclusion in half. The first version of the Build Back Better Bill included a reduction from 100% to 50%. The legislation was killed, but there is a possibility this could happen in the future.

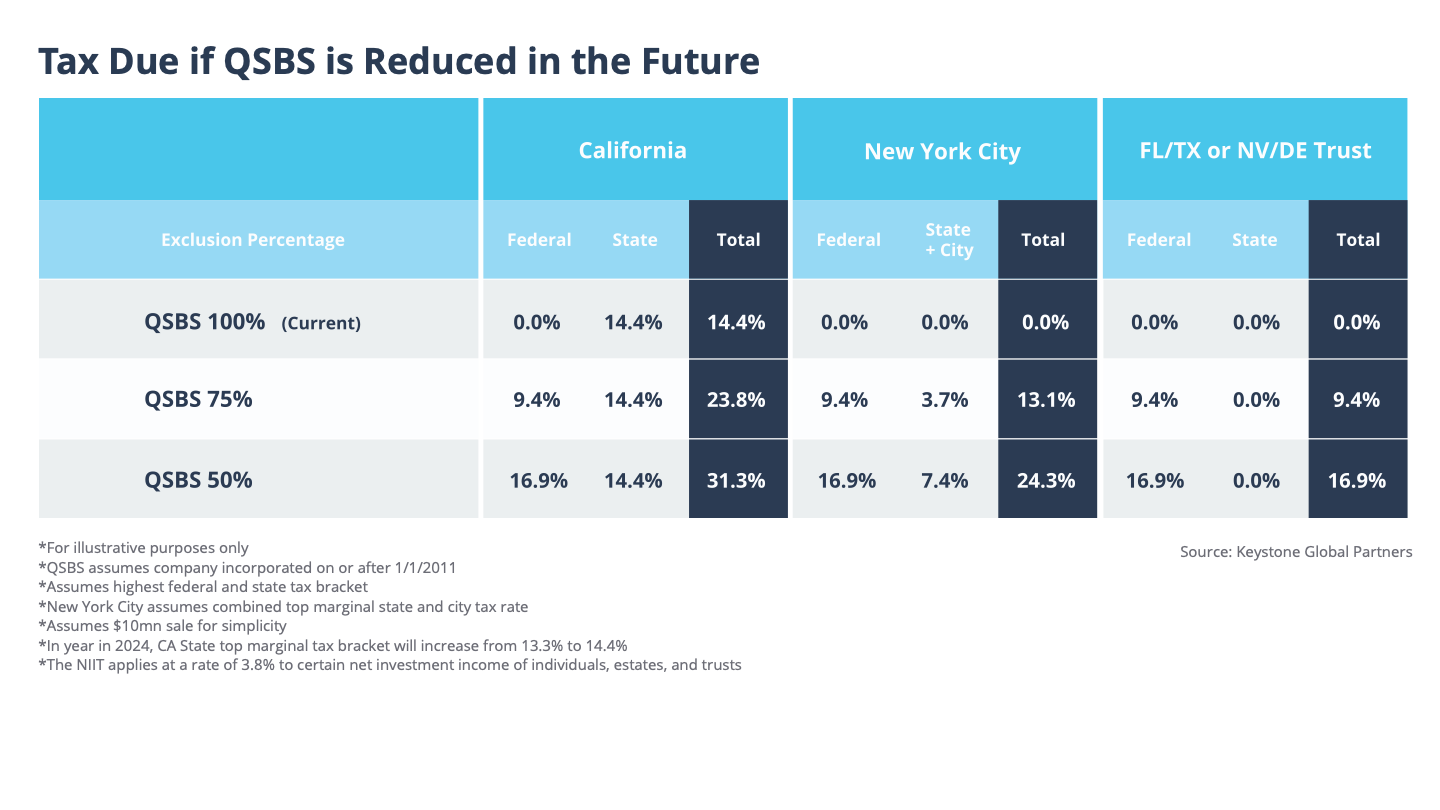

What would it mean for you if the QSBS exclusion decreases to 75% or 50% in the future? To understand how this would impact a founder upon an exit, look at the graphic below, which shows estimates of the total tax due (federal + state + city) based on the state where you may live after an exit.

Common questions regarding tax on selling a company

As you can see in the table, California founders, in particular, will face the most impact if this happens. Additionally, California recently increased the top marginal income tax rate from 13.3% to 14.4%, starting in 2024. California-domiciled founders and key shareholders throughout the state understandably should be thinking about this.

We often hear questions such as:

- What is the difference in tax if I wait the full five years to get QSBS versus selling now?

- Should I move to another state before my transaction?

- Should I set up a trust before my transaction?

- How can I optimize for tax before my transaction?

The answer to all of the above is: It depends.

You can use the charts in this article to run through various hypothetical situations that might be similar to your own.

On one end of the spectrum, a founder in New York City, Florida or Texas who waits to sell until meeting the QSBS qualifications and holding period requirements could see a big after-tax difference. Assuming 100% QSBS exclusion, a founder in NYC who waits would pay essentially 0% in tax. Without waiting, the NY founder would pay 38.6% and the FL or TX founder would pay 23.8%. So, waiting to sell could be advantageous, provided all else remains equal.

On the other end of the spectrum, a founder might not see that big of a difference. For example, if the QSBS exclusion is cut in half from 100% to 50%, a California founder who waits for the five-year mark instead of selling immediately would pay 31.3% instead of 38.2% — probably not worth the wait, since the tax benefit may not be material enough to influence the timing of the transaction.

It may be worth considering relocating to a different state. If the CA founder in the same scenario (QSBS at 50%) were to relocate permanently to FL and sell after they reached the five-year mark, they would pay 16.9%. That said, we don’t think upending one’s life to another state solely for tax purposes is the best qualitative decision. But, if there was already an intention to move to a tax-friendly state like FL or TX, it might be worth accelerating the timeline on the move.

Founders who don’t plan to move to a tax-friendly state do have other options, such as setting up a trust, although this needs to be carefully thought through and planned in advance.

The bottom line

As a founder, you’ll need to plan for your personal tax situation to optimize the opportunity set that is presented to you. The framework I’ve outlined in this article will help you think strategically about taxes, run through some hypothetical scenarios, both now and in the future, and have a more informed conversation with your tax adviser or CPA.

Disclaimer: The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

Comment