A lot of my work as a consultant involves helping founders come up with a good fundraising story, but a surprising number of founders seem to get stuck on the next step: Finding the right investors and landing a meeting to pitch their companies.

That’s a problem. It’s no good reading nearly 50 pitch deck teardowns and crafting the perfect pitch if you don’t have anyone to present it to.

So here it is: A sure-fire way to get in front of the right investors, at the right time.

In this article, I will cover:

- How you can identify your strike zone (what you are actually looking for in an investor).

- How to identify investors that invest in your space, stage and geography.

How to identify your strike zone

Investors use an investment thesis to identify what they should invest in. In an ideal world, you won’t waste time meeting investors whose thesis you don’t qualify for.

To figure out if you fit someone’s investment thesis, you need to have a firm grasp on what you do as a company.

Your investor has an investment thesis. Here’s why you should care

Where are you located?

Some investors limit their activities to a specific region: Some might invest only in Silicon Valley, others may focus only on Germany, and some accelerators will be based in a specific region or city. Do your research and leverage your location as best you can.

Of course, an increasing number of companies are going fully remote, which makes it harder to argue that you have a local affinity. However, if 70% of your team is based in Europe, but the CEO is in San Francisco and the company is a Delaware C-corp, don’t make the mistake of describing yourself as a European startup.

Do you have school affinities or any other “special sauce”?

Some investors may invest predominantly in certain niches: women, people of color or founders who went to MIT, Stanford, Harvard or the like.

In fact, most universities have investment clubs or connections with investors who have a particular affinity with higher learning institutions.

Which industry are you in?

Are you in finance, healthcare, consumer hardware or climate tech? Some investors specialize in specific industries that others will avoid at all costs.

I’ve seen people make the mistake of describing a finance play as a healthcare startup because there is an indirect link to health. Gofundme, for example, is often used to fund medical expenses but it’s a crowdfunding or financial tech platform. If its founders had used the medical angle to tell the company’s story, some investors might have had a problem.

What’s your business model?

Are you a direct-to-consumer consumer packaged goods company like Native or Blueland, or are you a SaaS company like Growfin or Primo? Are you a business-to-consumer (B2C) company? Do you run a marketplace model like Sourceful or MBP? Or do you have a more exotic business model such as Ampersand, which serves SaaS companies specifically (B2SaaS, perhaps?)

It’s important to understand the dynamics of your market because investors will want to know. Many investors focus only on certain business models and may not entertain you if you don’t fit that definition. For example, some only invest in marketplaces while others will run for the hills as soon as you say “marketplace.”

It’s crucial to be clear about what applies to you.

Which stage are you in?

I had a really interesting conversation with a founder who was raising a $3 million Series A. They figured it was a Series A because they had already raised an angel round and a very small institutional round, but it transpired that the company wasn’t ready to scale yet.

Naming rounds is pretty useless, honestly, but here’s a rough guide:

- A pre-seed round is typically the first money invested in a company that is typically busy building a product and doesn’t have any revenue yet. Amounts at this stage vary between $200,000 and $3 million, depending on the complexity of the problem you are solving.

- A seed round is usually raised when your product is beginning to materialize. A startup at this stage may have some customers and some revenue but wouldn’t have cracked the product-market fit or have a repeatable business model. Amounts raised at this stage typically range from $1 million to $15 million.

- A Series A round is usually raised when a startup begins to see significant traction and its founders need money to drive further growth. A very small Series A round could be around the same size as a seed round (about $1 million), but they’re usually $10 million and up.

How much are you raising?

You’ve probably figured out that the name of the round doesn’t directly correlate with the amount of money raised. That said, with a clear ask and a tight operating plan, you can probably get a decent idea of how much you should raise. That’s another data point you need to be clear about before you’re ready to raise money.

In the rest of this article, we will map the information gathered above to investors and explain how you can use it to create a list of the perfect investors for you.

How to identify investors

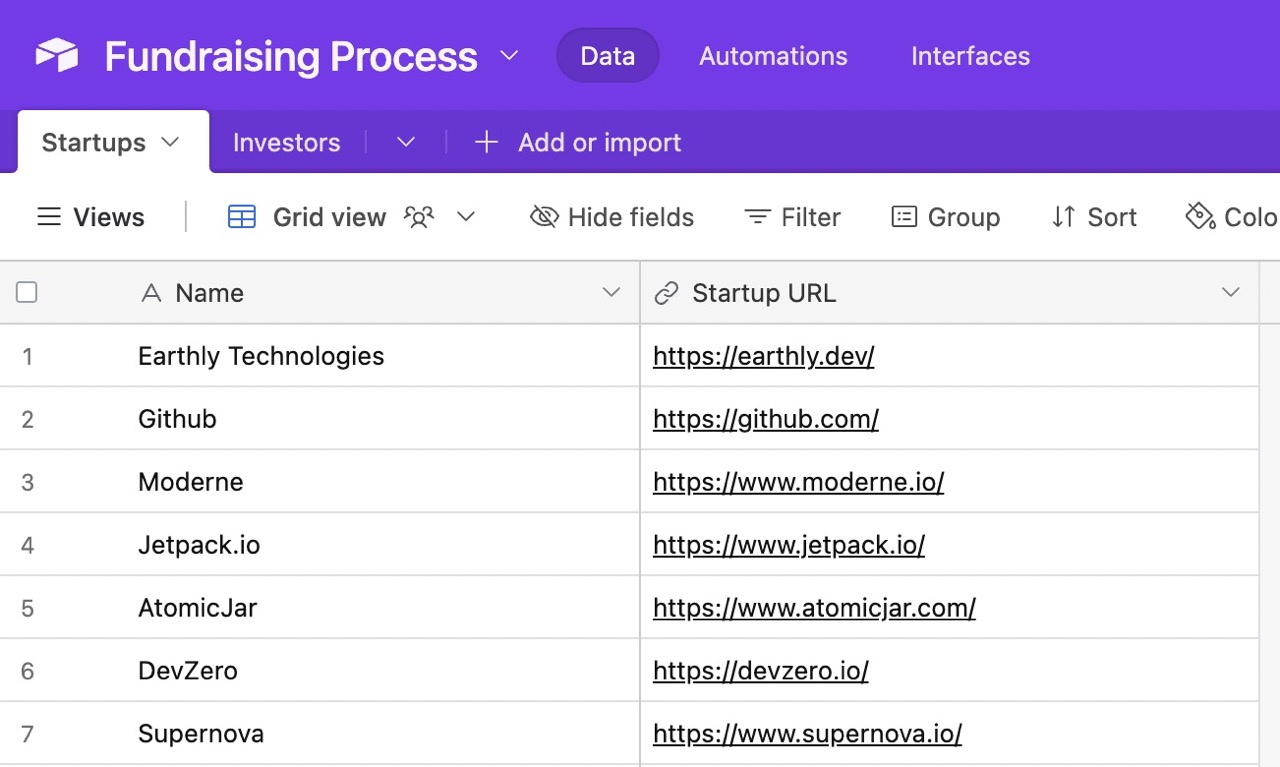

Let’s assume we’re researching investors for a dev tools SaaS company that’s based in New York and is raising around $2 million. I’ll be using Airtable to keep track, but you may also use a CRM system, a spreadsheet or a stone tablet and chisel. You do you.

Because I don’t know a lot about dev tools, I’m going to list the 20 most recently mentioned companies in articles with the Developer Tools tag on TechCrunch to find the first set of companies.

Step 1: List similar companies

A good starting point is to list 15-20 companies that are similar, but not identical, to yours.

If you are Lyft, don’t add Uber to the list; any Uber investor isn’t going to be investing in you. Instead, if you are Lyft, think about the sharing economy and transportation. Investors who invested in the likes of Airbnb, Turo, TaskRabbit or Postmates might be interested.

Feel free to choose companies that are far, far bigger than you even if they’ve had an exit, gone public, etc.

Here’s a screencap of my list of dev tools SaaS companies:

Step 2: Find stage-appropriate investors

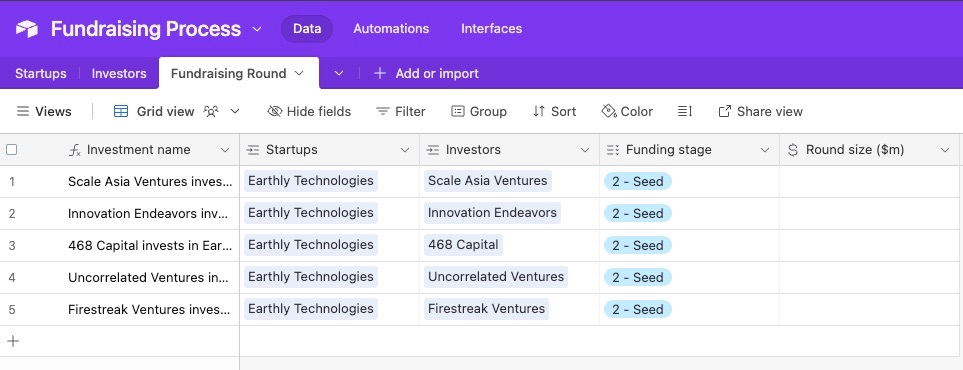

Once you have a list of companies similar to yours, use a tool like PitchBook or Crunchbase to find the investors who invested in each of these companies at roughly the same stage or round size as your company.

In the case of Earthly Technologies, Crunchbase has data on about $8.6 million worth of funding rounds, 12 investors and five similar companies. That’s quite helpful.

Make sure you note down:

- The name of the company.

- The name of the investor.

- The round size.

- The partner who led the deal: Google each investment to see if TechCrunch or other publications wrote about it and see if an investor is quoted in the article. That’s typically the investor who led the deal and the person you’ll want to reach. Note their name and job title.

After this, you’ll end up with a pretty beefy list of investors. This forms your top-of-funnel:

Again, use whichever tool you want. I’m using Airtable, so as I add the data for the various investors, the startups and investors lists are also populated. This will come in handy for our next step.

Step 3: Explore “Similar Companies”

Exploring “Similar Companies” on Crunchbase will let you find companies that are in similar industries, funding stages, etc. Add the most relevant companies to your list of startups, then repeat step 2 to add their investors as well.

Step 4: Expand by investor

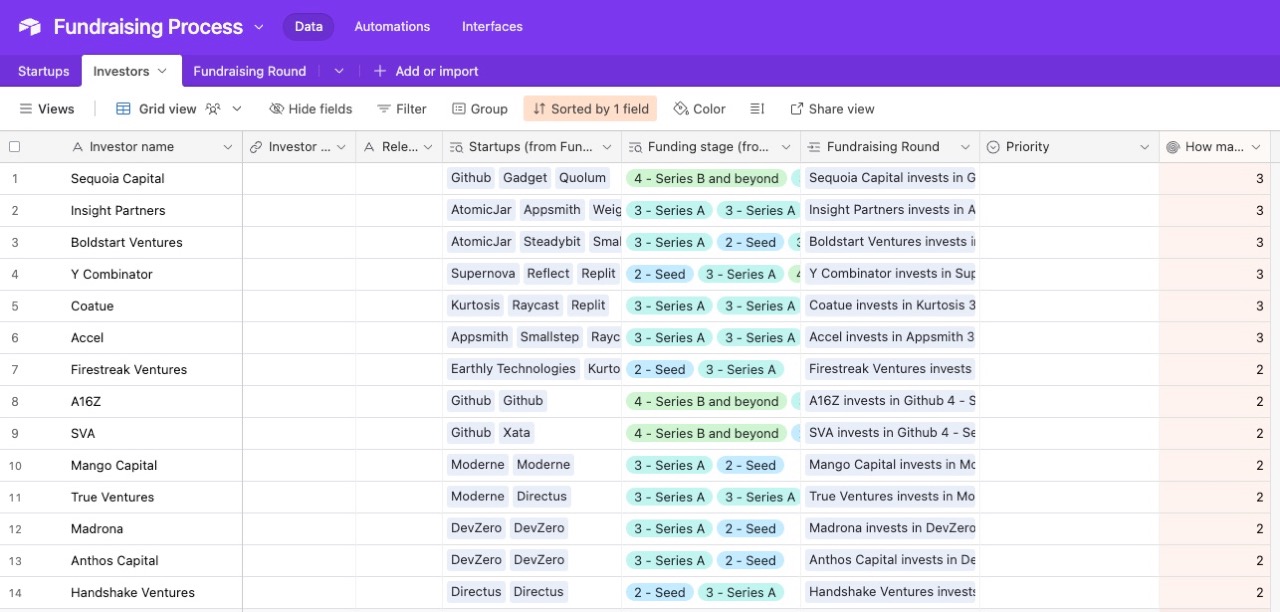

By this point, you’ve probably found 50 to 60 startups and 200 or so potential investors.

A few things will happen at this point: You’ll probably see the same investor names coming up over and over, which is probably a sign that these investors are particularly active in your space.

That’s good news for you. In your sheet, sort the list of investors by the number of companies they’ve invested in. Then, look these recurrent investors up on Crunchbase. You’ll probably find a bunch of companies that they’ve invested in.

Add these companies to your list, then go back to step 2 to add their investors and step 3 to explore similar companies. You’ll also find other investors that they tend to co-invest with. Keep updating your list of investors and startups.

Step 5: Prioritize

By now, you’ve probably started to get an idea of who the most active and most successful investors in your space are.

It’s time to go through your list of investors to see who you should prioritize: Who are the most active or most respected investors on your list? This is when befriending your fellow startup founders will come in handy as you can quickly get the lay of the land by asking around in the startup world.

Ask who’s the most active or respected investor in your space at mixers, meetups and social gatherings, and you’ll quickly start hearing a handful of names over and over. Those should be your top priorities.

Step 6: Use the hubs

Crunchbase creates some really helpful “hubs” for some segments. For our purposes, I found a list of “developer tools companies with fewer than 1,000 employees.”

In my experience, Crunchbase data can be hit or miss. It is very comprehensive in some categories and geographies but comes up fabulously short in others. Still, it’s worth double-checking to see whether you were able to find the bulk of the companies you might be looking for.

How well does this work?

I spent about an afternoon researching and found more than 100 investors that are active or have invested at some point in this space. In addition, I found some interesting things: The same names kept coming up repeatedly.

Qualifying the data

Once you have a list of investors, any additional information about their investment firms will start fleshing it out: Do you know whether they are still investing? Is there a partner at the firm who focuses on your vertical and stage? Which companies in their portfolio might be relevant to you? Learn everything you can.

Next, it’s time to overlay the information you have gathered about the potential investors with the information you identified about your own company at the beginning of this exercise: Do these investors invest in your geography, industry, business model, stage or funding target range? Who is the most suitable partner for you at each firm? Do they lead rounds or do they tend to follow? Could they potentially make an investment in your company?

After you’ve done that, it’s worth the effort to make one final sense-check: Did you miss anyone who might invest in you because of non-obvious criteria? Do you have connections to investors that might lead them to invest in your company even if you don’t strictly match their typical investments?

In a future post, we will go over how to get “warm introductions” to each investor you’ve found, and if you can’t, the best ways to make cold outreach work for you.

Yeah, this is a lot of work…

…but it’s pretty helpful for understanding what’s happening in your space. You can probably do all of the above work in an afternoon and build a pretty comprehensive mental model (and spreadsheet) of the investors worth talking to.

Crunchbase also has some tools that can simplify some of this research: You can “save” investors to a custom list or hook Crunchbase directly up to your CRM system and build a list of your would-be investors. Of course, this only takes care of the information-gathering part, and you’ll still need to filter and prioritize the list to ensure you have the right set of high-, medium- and low-priority investors to go after.

That said, doing deep research on the investors you contact can pay incredible dividends down the line, as it helps you build a really good overview.

This is the first of a series of three articles focusing on finding investors for your startup:

- How to find your investors.

- How to get warm introductions and leverage cold introductions (coming soon!)

- How to run your investment outreach process (coming soon!)

Comment