Europe, long viewed as a relative backwater to the U.S. startup market, has been on a tear in recent quarters and years. Akin to many startup markets around the world, Europe has seen its venture capital totals rise, its unicorn ranks swell, and even a few major public exits.

How hot is the market for European startups this year? This morning, TechCrunch reported that Flink raised $750 million. The “Berlin-based startup that sells food and other essentials at supermarket prices and aims to deliver them in under 10 minutes,” as we described it, is now worth $2.85 billion. And unless you are very familiar with the instant grocery market, we doubt that you were too aware of Flink.

The European startup market is now sufficiently robust and varied that it’s easy to lose track of its unicorns.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

The Exchange has been tracking Europe’s startup acceleration for years now. So, consider our general delight when Atomico, a European venture fund, and Dealroom, a data-tracker with a solid European data set, dropped a huge sheaf of numbers concerning its performance earlier this week.

Tied up as we were with our book guides (here and here), we’re just now getting to the data. So, instead of snagging just high-level numbers that paint a more general picture, we’re teasing out a few things that you might have missed in your own read. If you care about the state and the health of the European startup market, this is for you.

Tied up as we were with our book guides (here and here), we’re just now getting to the data. So, instead of snagging just high-level numbers that paint a more general picture, we’re teasing out a few things that you might have missed in your own read. If you care about the state and the health of the European startup market, this is for you.

We’ll take a look at exit volumes and what we can infer for 2022, how talent issues aren’t landing equally around the continent, why there’s good and bad news for gender diversity in Europe, how pension fund money is still on the sidelines, and which collections of former employees are founding the most companies.

Sounds good? Let’s rock.

Good news for 2022 European exits

European technology M&A is having a good year. The Atomico/Dealroom report details that the total value of tech M&A in Europe through the third quarter of 2021 has crossed the $100 billion mark. For reference, that figure was below $10 billion in Q2 2019, Q3 2019, Q4 2019 and Q2 2020.

But not every tech exit fits into the venture capital model. Venture-backed exits for European tech companies are a smaller figure, but one that is still rising. Per the same data set, in the first three quarters of 2021, VC-backed tech M&A worked out to $54.9 billion. That’s a hair more than the full-year 2020 number of $54.8 billion. Throw in Q4’s numbers, and not only will 2021 be a record year for VC tech exits – this data doesn’t include IPOs, mind – it will be one by a comfortable margin.

But all that’s the past. We care more about the future. And that’s where the data set pushed our eyebrows higher. Atomico wrote the following:

In the third quarter alone, the aggregated value of tech M&A activity exceeded $45B, making it the largest Q3 on record. At time of publication, preliminary numbers for Q4 imply at least another $50B in aggregate value.

If those numbers hold up, we could see roughly 50% of the 2020 total European M&A in Q4 2021 alone. That, and incremental gains from quarter to quarter, implies that Europe is starting 2022 on its strongest non-IPO exit footing in history. Bullish!

The UK’s talent issues are notable, worsening

Remember Brexit? If you don’t live in the U.K., the political and economic decoupling of the island from the continent may have receded into the back of your mind. It’s an SEP to some degree: someone else’s problem. But while we may think about it a bit less, U.K.-based startups have not forgotten.

That’s because Brexit is having an impact on the U.K.’s ability to hire. Of all European countries detailed in the Atomico/Dealroom report, the U.K. has the highest reporting percentage of founders saying that “the depth of the talent pool” is now worse than one year ago, at 37%. Holland clocks in at a similar 36%. The next highest number is 23% of German founders agreeing the depth of the talent pool is worse.

Notably, France fared best in this category, with 54% of founders saying that talent depth has improved in the last year and just 19% saying it’s worse. Italy is the only other European country we have data for in which more than half of founders say that the depth of the talent pool got better in the last year.

Naturally, the above is not entirely due to Brexit, or any other factor. But a declining talent market for U.K. startups could ding its growth over a longer time horizon. Something to keep in mind.

Better gender balance, if you can keep it

When it comes to the gender balance of tech founders and tech leaders, the data tends to be somewhat depressing. Despite obvious inequities, much of the startup world remains dude-heavy. This means that tech fundraising and value creation are not yet meritocratic; this not only implies that money is being left on the table, but also that some of the best companies are starving for lack of capital.

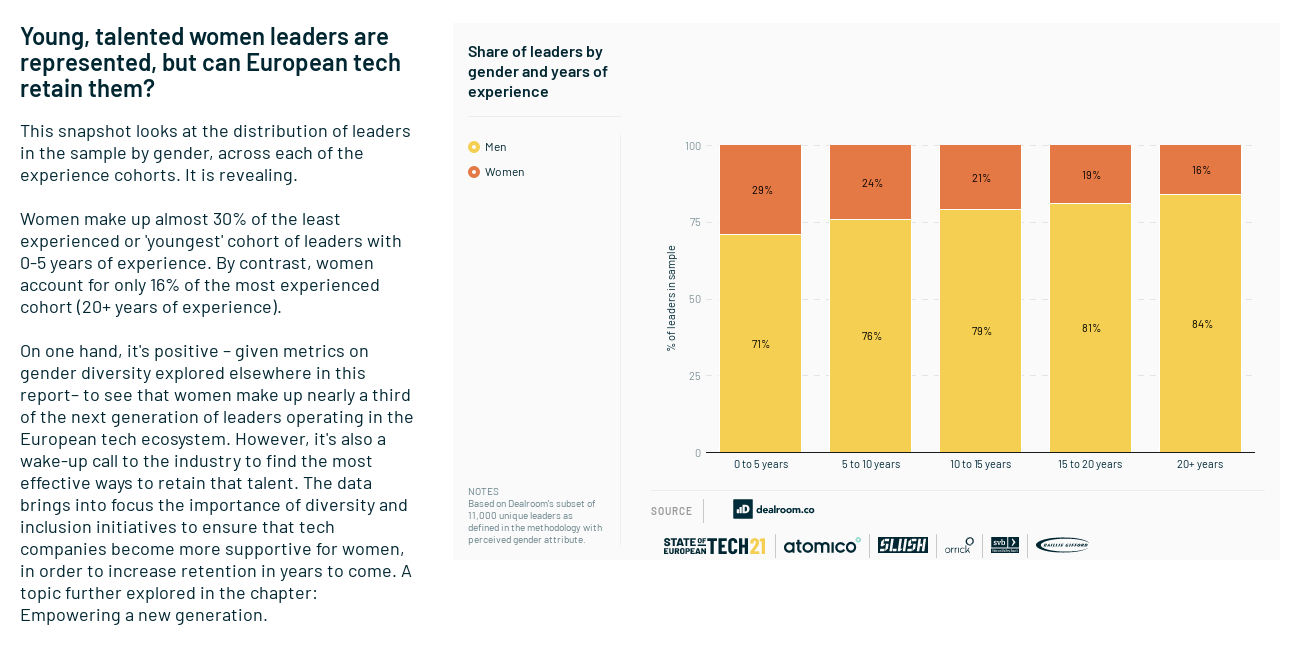

But there is some possibly good news in the Atomico/Dealroom report. Namely that the proportion of leaders in tech that are women is sharply higher with younger talent. Observe:

There are two ways to read this chart. On one hand, it’s good news that more young leaders are women. The data speaks to a more diverse cohort of future leaders. However, the steady decline in the proportion of tech leaders that are women indicates that the industry is shit at retaining them.

Europe has an opportunity to rebuild its tech leadership in a more diverse direction if it is able to hold onto its current set of young women leaders. If it fails, expect men to continue to dominate in tech leadership roles, and, therefore, technology wealth.

An addressable lack of institutional capital

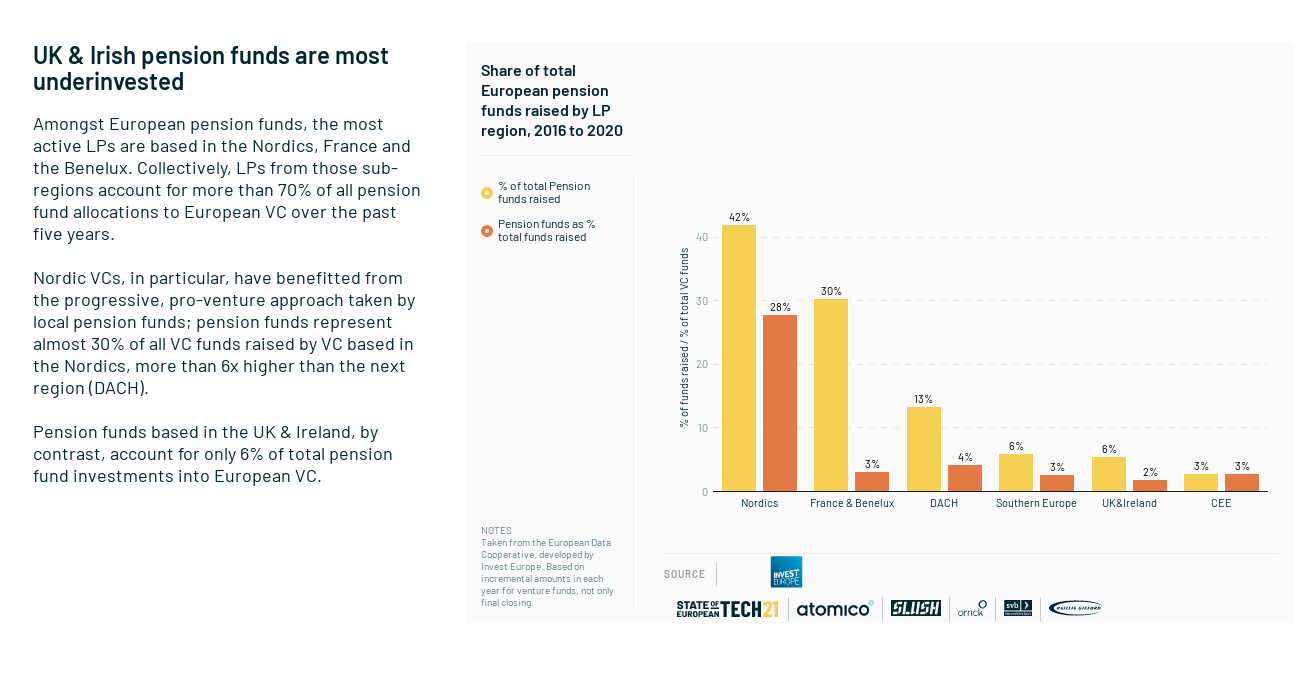

In answer to a question about “the main regulatory hurdles limiting the growth of startups and scaleups in Europe compared to other large markets like the U.S. and China,” both venture capital investors and LPs cited the lack of allocation of pension funds to Europe’s venture asset class as one of their top concerns.

The data shows that this underfunding isn’t just in people’s heads: “European pension fund capital allocation to VC in 2020 represents just 0.018% of their total assets under management,” the report notes.

That’s obviously a very small fraction, but on the plus side, it leaves plenty of room for growth. With more than $3 trillion in AUM, and considering the current returns from venture capital, maybe European pension funds will consider increasing their allocation in 2022? This would bring them closer to other markets such as Canada, where OMERS VC Harry Briggs noted that “pension funds are more enlightened” – for instance playing a role in the country’s AI boom.

Furthermore, European pension funds are lagging behind their foreign counterparts even when it comes to investing in European funds, with “only around 50% of total funds raised by VCs from pension funds [coming] from European pension funds specifically.”

The report also unveiled geographic discrepancies within Europe, with the U.K., Ireland and CEE lagging far behind the Nordics, France and Benelux.

While the report doesn’t mention this directly, we’d be curious to know how much of France’s overperformance is tied to its Tibi Initiative to get insurers to invest in La French Tech. In an August review, the Treasury wrote that “despite the COVID-19 crisis, the Initiative was rolled out rapidly and partner investors have already pledged over €3.5 billion. When supplemented by the remaining subscriptions, made by third-party investors, all the approved funds account for more than €18 billion out of an initial target of €20 billion.”

That’s still small compared to AUM, but big for venture capital. As Atomico and Dealroom note, if European pension funds increased their allocation to just 1%, this would represent “a seismic shift.”

Alumni everywhere

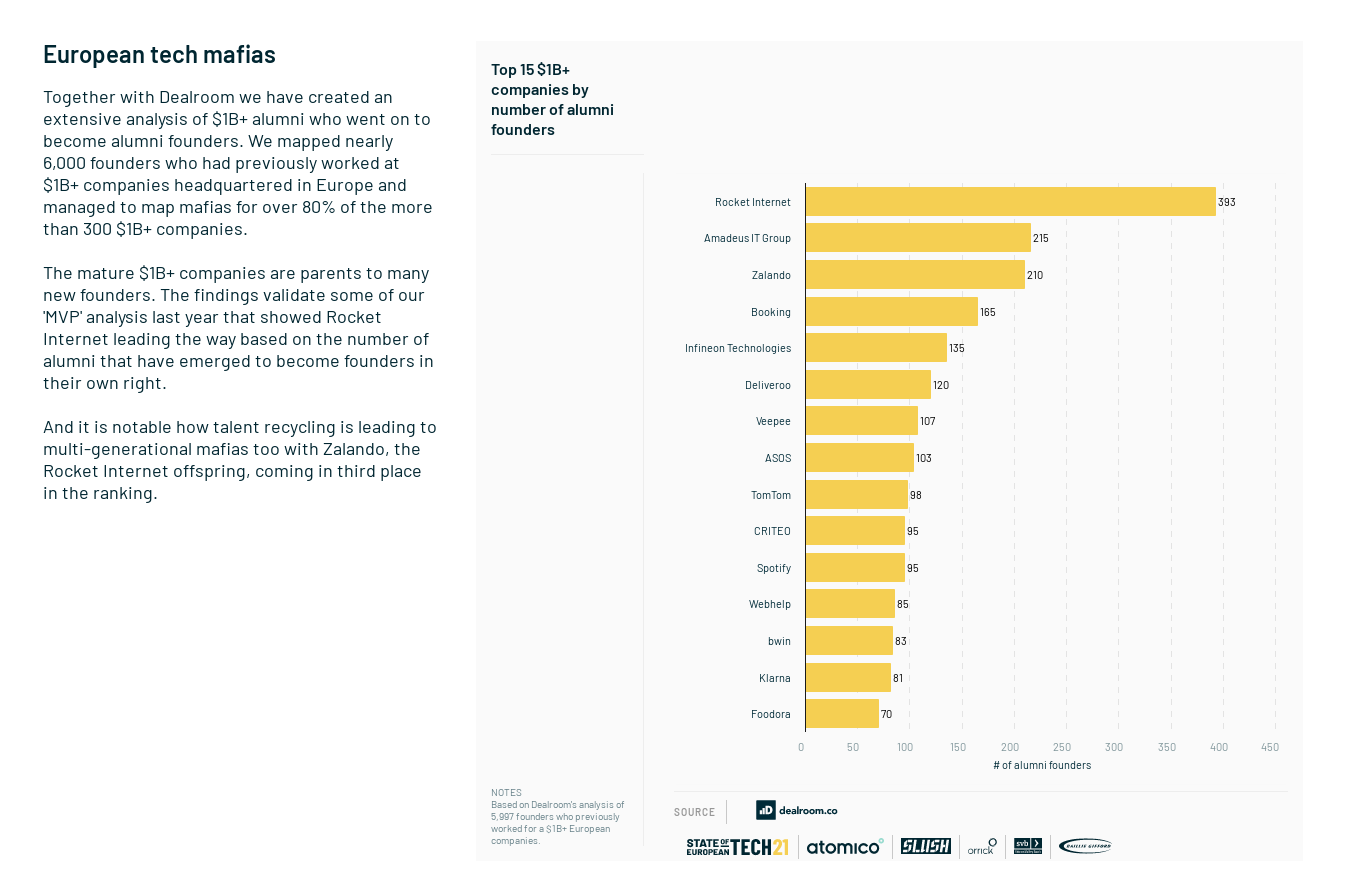

We have long known that many new founders used to be employees at a handful of tech companies – in the U.S., the most famous one is likely PayPal. But for all the talk about Rocket Internet alums turning into entrepreneurs all across Europe and beyond, it’s not just them. Look at this chart:

We don’t know about you, but we didn’t expect the top of the list to include more traditional tech companies such as Amadeus IT Group or semiconductor manufacturer Infineon Technologies. This goes to show that talent recycling goes even beyond what we thought, and is a good sign for Europe’s ecosystem: Founders are drawn from the ranks of former employees at startups, but also other tech companies.

Overall we’re bullish on Europe’s 2022, and perhaps slightly more so after digging through this particular data dump. More to come in January!

Comment