TX Zhuo

Insurtech companies have certainly fallen from grace over the last year. This tweet my friend Rick Zullo sent before the recent tech fallout well summarizes the market sentiment around the industry:

You can now buy $ROOT, $HIPO, $MILE, $CLOV, $OSCR and $LMND for the combined price of just over $5b. These companies collectively raised >$10b. — Rick Zullo, Feb 23, 2022

How is it possible that an over $5 trillion industry growing at more than 6% cannot seem to attract investment capital? Have investors picked the wrong business models, or are there pockets within insurtech that have been ignored?

Attempts to replace legacy insurance systems have seen mixed results, at best. Perhaps seeking to optimize, rather than override, these legacy systems is the more defensible approach. Perhaps a coverage system implemented nearly 60 years ago presents the ideal scaffolding to build upon today.

Enter Medicare…

Medicare is a formidable market, both in terms of people and dollars. About 11,000 people turn 65 every day in the U.S., and Medicare spending is expected to reach $1.5 trillion in 2030. Enrollment in private Medicare has doubled from 2010 to 2020 and is expected to accelerate further over the next 10 years.

We’re not the first to realize the size of this market, so it must be an exciting space to invest in, right? Well, not quite.

GoHealth, a marketplace for Medicare plans, had a blockbuster IPO in 2020, raising $914 million in a massively oversubscribed offering. Today, its market cap is slightly more than $160 million off over $800 million in annual revenue, and its CFO resigned abruptly earlier this year.

A legacy player in the space since the late ‘90s, eHealth has also struggled a fair bit — its stock is down over 90% from its peak.

So why are we even discussing Medicare as an investment opportunity? We’ve distilled our perspective/thesis to six key factors:

High complexity creates an opportunity for acquisition

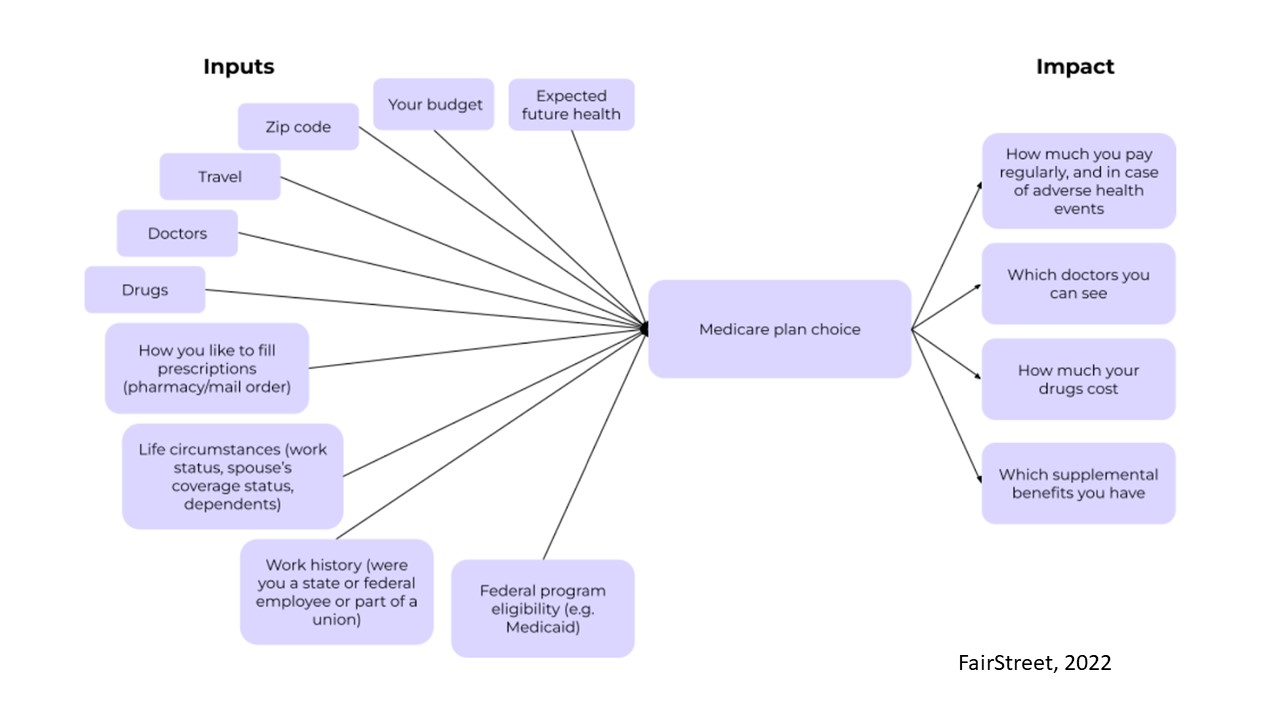

Purchasing Medicare is a complex choice with a plethora of inputs and downstream impacts. The average senior must choose between 57 different plan options, and most can’t tell them apart.

It is exciting to see companies like EasyHealth and Chapter receive backing, as they have facilitated decision-making with a data-enabled approach in what is a high-stakes choice with irreversible consequences for patients. Helping seniors understand the scope of coverage and cost options streamlines the acquisition process and leads to more loyal customers.

Poor business models don’t equate a poor market opportunity

Now, let’s revisit GoHealth and eHealth. Why do these two companies that are printing revenue ($1.6 billion between the two in 2021) struggle in the public markets? The answer lies in the quality of revenues.

It takes slightly over two years before a covered senior is profitable for an insurance carrier due to expensive marketing and policy placement expenses. For seniors who enroll through DTC channels like eHealth, carriers typically see a 40% disenrollment rate, a double-whammy given the high acquisition cost of onboarding these seniors in the first place.

The other dirty secret is that a lot of these companies find seniors from the same lead list, so one might see a customer churn as they’re enticed away by another platform before they’re fully enrolled.

The scale that GoHealth and eHealth have achieved from a revenue standpoint shows that there is a real market opportunity here, just not the right approach.

Unit economics trump other insurance categories

There is a longstanding debate in the personal insurance business about which line of coverage is the most desirable: life, home or auto.

For life insurance, carriers get a one-off large upfront commission that covers most of the customer acquisition costs, but payments are negligible thereafter. Home and auto insurance, on the other hand, present carriers with similar-sized recurring payments annually, though the lion’s share of the initial acquisition costs falls on the carriers’ shoulders.

Medicare arguably combines the best of both worlds: upfront commissions are up to $715 per year and renewal commissions are up to $358 per year. There are also several easily accessible revenue streams, such as ensuring patients attend their annual wellness visit, which helps lower patients’ RAF scores and moderate potential costs (claims) for insurance carriers.

Carriers are so enthused about adherence to wellness visits (driven by “value-based” principles, i.e., more proactive than reactive care) that they’re willing to pay up to $400 in commissions to the agent who enrolled the covered senior in the first place.

That brings us to a key question: What is the ideal, high-leverage “wedge” into the Medicare market?

Independent agents are key to effective customer acquisition

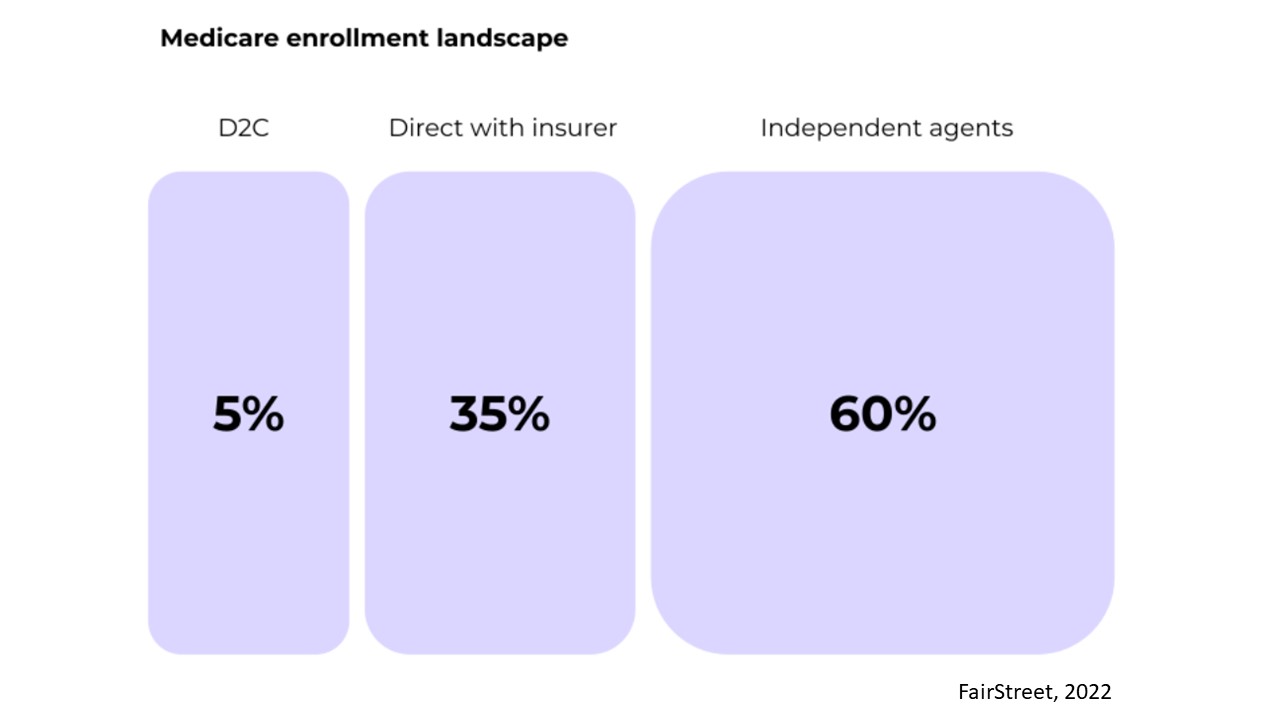

Independent agents are the largest enrollment channel for Medicare programs, onboarding 60% of the covered population. These agents are self-employed (i.e., they work for independent agencies), are carrier agnostic and their incentives are aligned with the seniors in terms of finding the best-suited coverage plan.

Given Medicare selection is still a high-stakes, consultative sale, where agents are seen as essential advisers, we believe independent agents will continue to be the dominant enrollment channel. Given the higher level of trust and personalized relationships they bring, customers acquired through this channel are less likely to churn.

Instead of competing with independent agents head-on, there is a much bigger opportunity in forging win-win alliances between startups and agents. Ultimately, the policyholders should benefit the most from discovering and enrolling in the right Medicare program.

A high value-add approach is the only way to prevent churn

Because Medicare program selection is difficult to understand, the average senior gets targeted by at least five to six Medicare marketplaces every year.

The key to retention is building data or product hooks to strengthen platform reliability among seniors. Such hooks can take the form of storing OTC prescription information or improving on-platform access to their favorite vendors (e.g., physical therapist or nursing agency). Helping patients establish contact with a suitable primary care provider is a good way to build trust but ensuring consistency of care is what solidifies the relationship.

Companies navigating the space should prioritize building long-term relationships rather than extracting value from one-off transactions.

Better tooling is needed for all stakeholders

Connecture has done a great job of building the quoting engine for Medicare, but there are several tooling gaps that still need to be addressed:

- Seniors still need to manually submit information about their prescriptions and doctors, and the application for each insurer is different.

- Each payer has their own CRM solution that is hard for agents to use.

- Medicare plans turnover each year, and during the Annual Enrollment Period, agents have just seven weeks to reevaluate whether they have chosen the best plan for every single one of their clients.

There is a clear opportunity to provide more transparency and a simpler onboarding process for seniors, as well as a single operating platform for agents to run their business.

So where does this leave us?

It probably isn’t fair to assign Medicare the responsibility of saving the entire insurtech market. That said, it is definitely a bright spark, given (a) its market persistence (65 million lives and growing), and (b) its resemblance to the broader insurtech market of the early 2010s, when there was scant online education, minimal operational tooling and nascent back-end infrastructure.

We believe the Medicare market is large enough to see multiple winners, but players in this space should not repeat the mistake of shortening customer acquisition cycles at all costs. The ones that focus on long-term customer relationships and complementing existing distribution channels will find the path to success.

Comment