City Spotlight: Boston

- Register for the free event here!

- 5 investors discuss Boston’s resilient tech ecosystem

- Boston’s university-to-startup pipeline defies downturn to grow and diversify

In order to build a startup culture, a city or region needs some key elements in place — like an innovation engine to drive startup ideas. It needs a couple of successful exits, which in turn drives angel investing as entrepreneurs growing increasingly wealthy look to help new founders building companies reach their own goals. It requires accelerators and incubators and coworking spaces to help nurture early ideas, and it needs VC firms investing across stages.

Success begets success, and before you know it, a startup scene is born.

Boston has all of these elements, starting with a long history of innovation, perhaps not surprising when considering the 44 colleges and universities located in the metro Boston area, including Boston University, Tufts, UMass, Northeastern, Harvard and MIT, all of which act as an engine for startup activity.

It also has a long history of innovation and a rich tech legacy.

Attend the TechCrunch City Spotlight: Boston event on February 27, 2023.

Register for the free virtual event here.

Route 128, the highway that runs outside of Boston, was once known as “America’s Technology Highway,” rivaling Silicon Valley for influential tech companies. Consider that mini computer companies like Digital Equipment Corporation, Wang and Data General were born and thrived in metro Boston for a time before falling by the wayside of technology history.

And while we saw a generation of brave founders launching companies from the ’60s to the ’80s, it was probably more typical for engineering students coming out of Harvard and MIT to go to big companies like IBM, Texas Instruments and Motorola, with dreams of stability and steady income, rather than starting a company of their own. As such, Silicon Valley remained the tech standard bearer.

In the ’90s a new generation of Bay State startups started focusing on areas, like chips, storage and memory. By the time the new century came around the area began to shift to look like a modern startup scene. Over time the Boston area watched the development of a robust technology startup ecosystem across industries like cybersecurity, robotics and biotech, with companies like HubSpot, Wayfair, Rapid7, Boston Dynamics and Moderna, to name but a few.

We are also seeing the rise of a green tech startup scene, with companies like Commonwealth Fusion Systems, which has raised $2 billion, Form Energy, which has raised $816 million, and Boston Metal, which has raised $200 million, as three examples.

All of these industries have something in common. They require a lot of raw engineering smarts, and Boston has an abundance of that.

What is Boston like today and why should founders think about launching their companies here? We spoke to several people who have been investing in this region for years, and while Boston isn’t perfect — let’s face it, no city is — it has its charms, and we talked about what kinds of companies and industries have thrived here and why.

Boston by the numbers

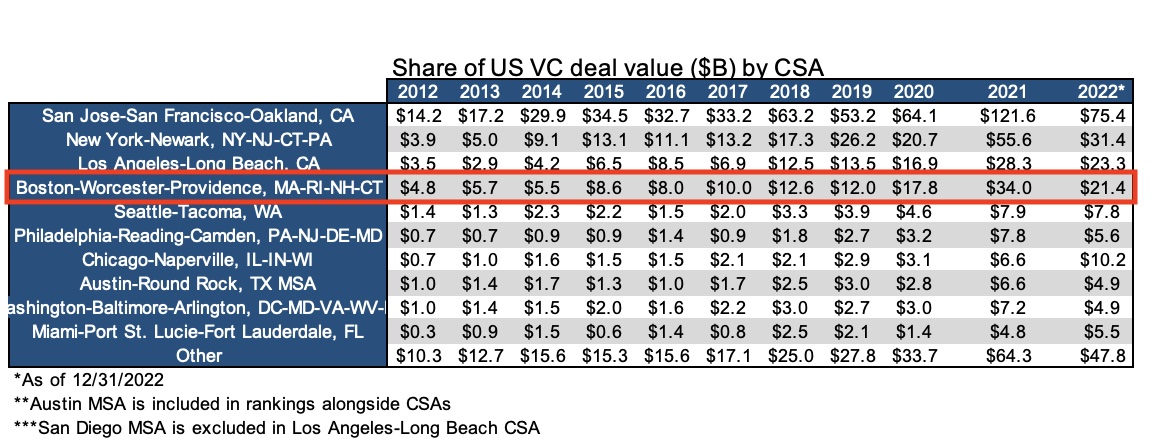

The chart below shows Boston fluctuating between third and fourth place in overall venture capital investment over the last several years, moving back and forth with the Los Angeles area startup scene.

Boston had a steady investment growth trajectory until it dropped off (like everyone else) in 2022 as investment overall slowed in an uncertain economic environment. After topping out in 2021 at $34 billion in total investment, doubling its 2020 output, it dropped to $21 billion last year, behind San Francisco, NY and LA.

Cait Brumme, CEO at early-stage tech accelerator MassChallenge, says that Boston was not immune to the vagaries of investment cycles in 2022. Citing those PitchBook numbers, Brumme noted that area investment growth was down close to 40% last year.

“I think that’s a good directional indicator of the fact that the funding environment has slowed and therefore it’s much more challenging, for sure,” she said.

But she says if you have a good idea, there’s still money out there. It’s just harder to come by than earlier years. “What we hear is great companies will get funded. And the onus is really on founders to lay out a good process, meaning they know what they’re going to accomplish. They’re hitting really strong metrics, they built a good team and they’re solving a problem that has clear customer traction or demand.”

Boston strengths

It’s clear Boston’s universities are a unique differentiator over other top startup centers like NYC and SF. These schools, both private and public, act as an engine for ideas and producer of engineering and business talent.

Greg Dracon, a partner at .406 Ventures, a venture capital firm that focuses on Series A investing, says the schools are a huge advantage for Boston.

“Boston’s always been a great technology town in my opinion, and it’s hard to beat [all the] colleges and universities with more STEM grads than in any state in the U.S. So it’s always been really good at technology,” he said.

He says it’s particularly good at cybersecurity with almost 100 startups headquartered in the city, per PitchBook data. Examples of security companies based in the city include Snyk, a late-stage startup, Rapid7, which IPOed in 2015, and Carbon Black, which VMware acquired for $2.1 billion in 2019.

“I would argue even in the 2007 time frame when we started our firm, we specifically focused on things we think Boston excels at. I lead our cybersecurity investing, and I can talk for hours about cybersecurity. If I were to start a cybersecurity company, there’s no place in the world I would start it other than Boston,” he said.

While New York has easy access to Fortune 500 companies, Dracon says Boston is close enough that the distance isn’t appreciable.

“New York’s got all these big companies, which is true. But if you’re building a startup, especially something that sells to enterprise, those are perfect early adopters and proofs of concept. So it’s a train ride down to get access to any big decision maker,” he said.

“You have the talent in Boston as you start to scale because universities are spitting people out like crazy. And what’s different today than 2006 when we started the firm is that we now have very big companies that have gone public or were acquired,” he said, noting these large companies and their founders often act as a startup feeder system.

Ajay Agarwal, a partner at Bain Venture Partners, has been investing in startups since 2007, and he says one of Boston’s biggest strengths is in the sciences. We saw Moderna, a Cambridge, Massachusetts pharmaceutical company, emerge from relative obscurity in 2021 when it developed an early COVID vaccine.

“I think that the Boston scene, first and foremost, has always had incredible strength around hard science…You think about the stuff that Katie Rae is doing at The Engine, the whole world of life sciences — we have a separate fund here at Bain Capital that’s focused on life sciences — and I think the hard sciences, given the MIT roots, have continued to be a real strength of the city,” he said.

Brumme says her firm tries to take advantage of the city’s strengths in terms of the types of startups the accelerator accepts. “We’ve been working hard in and around the area of fintech and digital health for long periods of time, given some of the institutional industry leaders that have characterized Boston’s corporate landscape and are seeing a lot of momentum in those categories,” she said.

She also mentioned robotics, green technologies and what she calls bio-convergence, a cross pollination between robotics and biotech. “If you think of MIT’s AI unit coming together with the Broad Institute’s biotech [focus], and just really fascinating companies [are being created] at that intersection of biology and computer science, and we think Boston has a chance to be a real global leader in that adjacent area as well,” she said.

It’s not for everyone

Boston clearly has a lot going for it, but it’s not all things to everyone, and the folks we spoke to said for whatever reason, it hasn’t been a great place to start a consumer company. There are exceptions, of course, like Wayfair selling furniture online and Tripadvisor running a travel site that was launched in the Boston area, but overall it’s not as well suited to consumer technologies.

Dracon thinks that could be because of the deep tech knowledge in the city, again due to the colleges and universities. “If there’s one industry that’s lacking, its consumer, and it kind of goes with the same thing. We’re an enterprise, deep tech, somewhat risk-averse town. That’s more of an enterprise-type of product and sale,” he said.

Agarwal agrees, saying the city lacks consumer focus for some reason. “I think the city, good or bad, tends to focus on companies that are real, they’re adding real values that fundamentally have a defensible value proposition,” he said. “Consumer tech is lighter-weight technologically under the hood, and is based more on the application or UI design.”

“The city doesn’t have a ton of consumer DNA. It’s never really been the strength of the city,” Agarwal said.

But Boston has had its share of successes over the years with companies like Rapid7, HubSpot and Wayfair going public in high-profile IPOs. There have also been a number of billion-dollar acquisitions led by EMC, which was based outside the city and was acquired by Dell in 2015 for $67 billion, still one of the largest tech acquisitions in history. IBM acquired Lotus 1-2-3, an early spreadsheet company for the PC, for $3.5 billion in 1995, VMware bought cybersecurity company Carbon Black for $2.1 billion 2019 and Vista Equity Partners bought Acquia, the commercial company built on top of the open source Drupal project, for $1 billion, also in 2019.

It’s fair to say that Boston lacks some of the glitz and glamor of other cities, and there has been a history of Yankee frugality that perhaps has led to a reputation of being risk-averse when it comes to investing in consumer-facing companies. There has also been a tendency to not want to toot its own horn that has allowed Silicon Valley to grab the spotlight and the attention, especially in the ’90s. Over the last 15 or 20 years, Boston has built an ecosystem to rival Silicon Valley and NYC, making it a place where startups can launch and grow and thrive with a deep pool of talent in their own backyard.

Boston’s university-to-startup pipeline defies downturn to grow and diversify

Comment