Another day, another unicorn public offering.

Today it’s Acorns, a consumer fintech service that blends saving and investing into a freemium product. It’s a company that TechCrunch has covered extensively since its birth, including through the pandemic’s impact on its business, both good and bad.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Acorns fits inside the larger savings-and-investing boom seen over the last four or five quarters as consumers buffeted by the economic changes brought on by COVID-19 turned to stashing cash and boosting their equities investing cadence.

By now this is old news, but we haven’t had a clear picture of the economics of consumer fintech startups accelerated by the pandemic. Now that Acorns has decided to list via a SPAC — more on that in a moment — we do.

By now this is old news, but we haven’t had a clear picture of the economics of consumer fintech startups accelerated by the pandemic. Now that Acorns has decided to list via a SPAC — more on that in a moment — we do.

So this morning, we’re unpacking the Acorns deal and its investor deck, but we’re also trying to better understand why venture capitalists have poured so very much money into the space and the resulting economic picture that arises from the companies that they have funded. Acorns is our test subject, then.

We’ll start with a quick overview of its SPAC-led deal before getting into its results. Into the breach!

The Acorns SPAC deal

If your eyes are blurring as we review yet another SPAC transaction’s details, I get you. Let’s be brief. Here’s what you need to know:

- Acorns is merging with Pioneer Merger Corp., a public blank-check company.

- Acorns CEO Noah Kerner and “Pioneer’s sponsor” are each giving 10% of their equity to select customers.

- When combined, the entity will trade on the Nasdaq under the ticker symbol OAKS.

You know, the thing you plant acorns to grow. Har har.

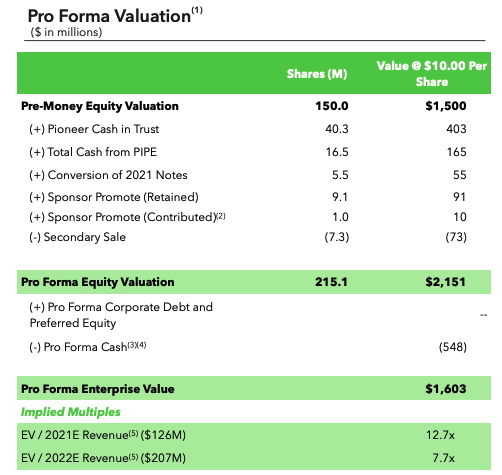

Here are the financial details of the transaction, via the company’s investor deck:

OK, so: $403 million in cash from the SPAC, another $165 million from a raised private investment in public equity, or PIPE, and a small amount of secondary in the mix as well. This all boils down to an equity valuation of $2.15 billion, or an enterprise worth of $1.6 billion.

Now, into the numbers.

Is Acorns’ business any good?

Yeah.

But it’s also very expensive, which makes it an interesting company to understand. Acorns is building a high-value consumer SaaS business with modest churn, good customer lifetime value and additional revenue streams to supplement its software incomes. It also has a good growth outlook and high cash burn.

Acorns’ economic profile is an odd mix of the good and the bad, but we couldn’t find any ugly parts; the SPAC deal will provide it with years of capital, so there’s no concern about its ability to self-fund to sufficient scale to raise more capital if it ever needed to.

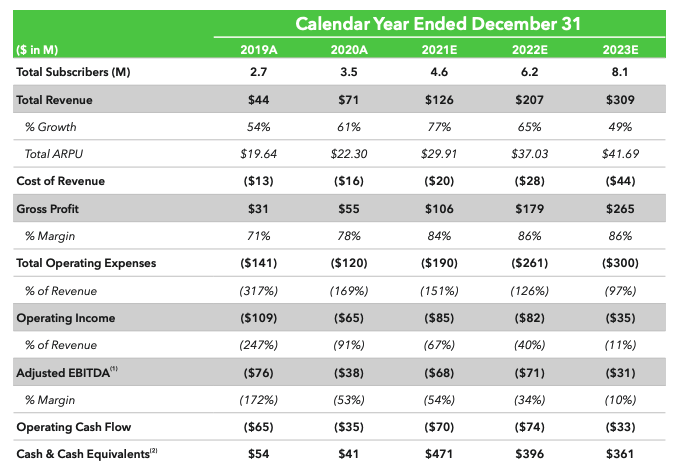

Here’s the historical and forecast data:

From 2019 to 2020, Acorns grew 61% from $44 million in revenue to $71 million. Its gross margin improved from 71% to 78% over the same time frame. That 61% growth number, in the abstract, is not that impressive for a venture-backed startup in a growth market at a sub-$100 million revenue scale.

But if you observe the company’s 2019 growth rate, you’ll note that Acorns’ pace of revenue expansion has accelerated from 54% in 2019 to 61% in 2020. And the company anticipates that it can scale that figure to 77% this year. That’s much better than a flat 61% figure.

Toss in the company’s expected gross margin improvement to 84% this year, and things look pretty healthy — until we turn to the company’s losses and cash burn, at least.

Acorns expects its operating income to worsen by $20 million this year, to -$85 million. As a percentage of revenue, the metric is an improvement; that’s only modest comfort at a company that still expects to generate an operating loss of more than two-thirds of its revenue. Even worse, Acorns expects its operating cash flow to get doubly bad this year. From -$35 million in 2020 to -$70 million in 2021.

(We lack a breakdown of the company’s operating expenses, but we suspect that product work and sales and marketing costs are high at the company compared to its present-day revenue base; that’s standard startup work, of course, but still worth recalling as we parse the rest of its deck.)

After 2021, things get mostly better, according to Acorns’ estimates. Operating income is expected to improve in 2022, along with the company’s cash burn essentially flattening out in gross-dollar terms. Because Acorns anticipates having around $400 million in cash at that point, all things should pencil out for the company under its own timeline. So its near-term losses over the next few years are not so scary.

Acorns feels like a company going public a year or two early, which is a bit of the point of SPACs, frankly. We’re seeing Acorns’ final private unicorn years in bloody GAAP ink.

That’s why I’m trying to treat the company not as if it is a fully mature business. It isn’t. What we care about most is Acorns’ growth (medium-good, accelerating) and revenue quality (good, improving). Things like near-term operating losses are not that worrisome when a company has around a half-billion in cash with which to fund its own growth, as Acorns will when the deal closes.

Now, quickly, let’s talk about how Acorns is driving its growth and margins at the same time.

How Acorns makes money

Something nice this morning is that the Acorns SPAC deck is not a hot pile of horseshit. It’s actually pretty understandable.

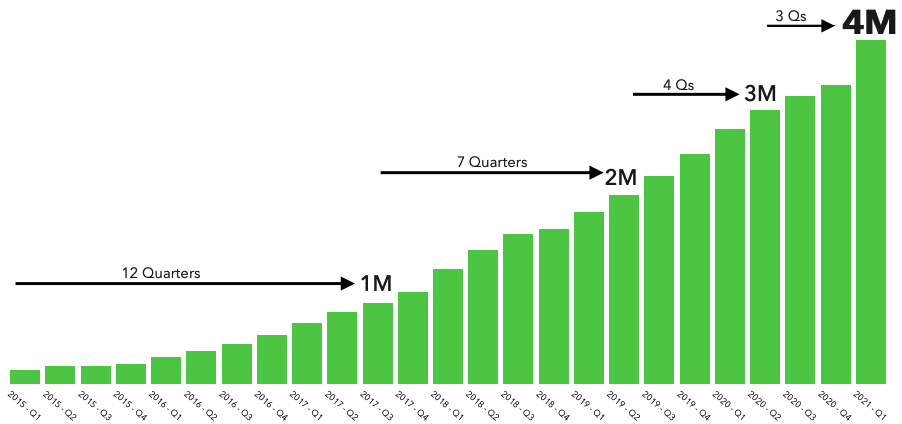

Thanks to that fact, we have three charts to take in. Here’s the first, showing an accelerating pace of Acorns’ net subscriber adds over time:

I wonder how the 2020 curve of this chart would compare to the pace at which Acorns signed up new free customers. Regardless, we can see that Acorns has stepped up the rate at which it adds its sequential million subscribers over time.

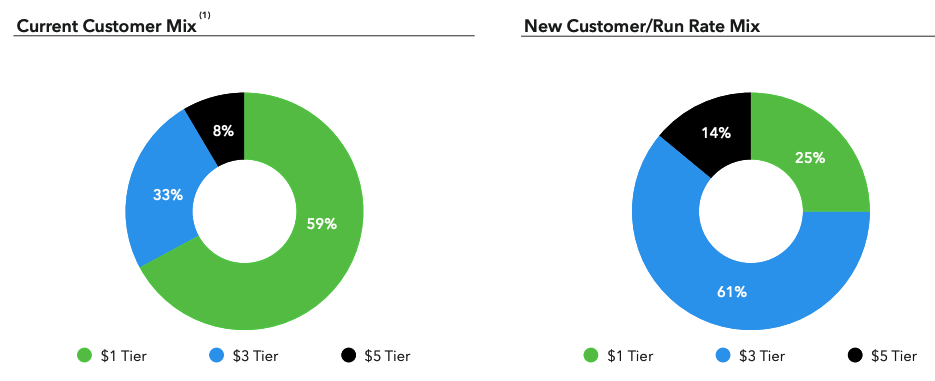

The customers noted above are also increasingly willing to spend more over time. The following set of charts shows how Acorns is adding more, higher-paying users thanks to its newer cohorts, who pay more than their predecessors:

This helps explain the company’s recent revenue acceleration; it is bringing on more customers, more quickly, at a higher price point. With a sufficiently small revenue base, you can boost growth rates with such a formula rather easily.

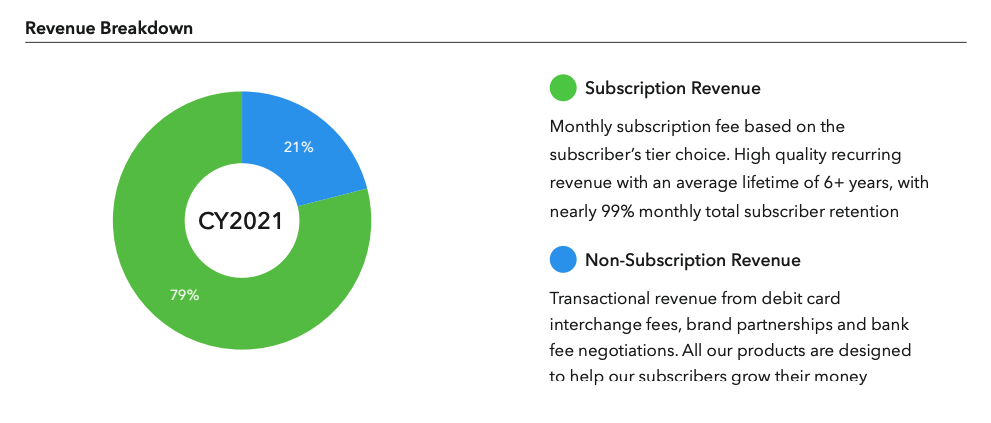

But what about nonsubscription revenue? Doesn’t Acorns make money from interchange and deposits and all that other stuff? Yep. But it’s by far its minority income source. Here’s our final chart, digging into the company’s revenue mix:

I didn’t expect it to be so lopsided, frankly. This is a 2021 number, so it’s only partially earned, but the extreme bias in Acorns’ business toward SaaS incomes was a surprise. Acorns has long had a larger savings focus than spending focus, perhaps limiting its interchange incomes.

We’re way over our word count this morning, so let’s pause here. The Acorns SPAC deck makes it clear that consumer SaaS in the fintech world is possible and attractive. And that it is very expensive. Let’s see what the public markets think of paying roughly 17x Acorns’ anticipated 2021 revenue for shares in its business.

Comment