Thomas Rush

Revenue-based investing (RBI), also known as revenue-based financing, or revenue-share investing,1 is a natural next step for the private equity and early-stage venture investment industry. However, due to RBI being a relatively new model, publicly available data is limited.

To address this foundational gap in market information, we have developed a proprietary data set of 32 RBI investment firms, 57 distinct funds and 134 companies that have secured revenue-based investing.

Upon thoroughly analyzing the data, we’ve been able to identify the total number of investment firms and amount of capital that comprise the RBI industry, the specific verticals and business models that are most actively leveraging RBI, and the typical profile of companies that access this form of capital.

These findings are summarized below; a full industry-spanning report that defines the overall revenue-based investing market as it stands today is available to download here.

As context, the financial structures used by VCs haven’t evolved much since they first emerged in 1957. Today, the model is almost precisely the same, with only incremental changes such as more efficient capital markets and industry standards for structuring deals, pricing companies and more.

More recently, we have seen numerous new investment models and financing instruments, including shared earnings agreements and point-of-sale capital. One of the most prominent and popular new models for investors is revenue-based investing (RBI).

However, because the model is new, there is a lack of publicly available data, industry standards have not yet been fully established, and similarly to the equity investment market, there is little transparency into the cost of capital that investees truly pay in exchange for taking on a revenue-based investment.

Thankfully, there have been some notable efforts to drive transparency in the RBI market. For example, Bigfoot Capital open-sourced its RBI model, outlining it in a blog post and sharing their RBI financial model and anonymized term sheet, but a thorough, quantitative, industry-wide analysis has not been conducted until now.

In order to raise RBI, the company must normally be generating revenue, but is not necessarily required to be profitable, although profitability, or at least a near-term path to profitability, is often an important criteria for many investors. “For startups with revenue, RBI may be a good option because, even though the startup may not be profitable, it can reduce dilution — especially for founders,” said Emily Campbell of The Campbell Firm PLLC, a law firm that represents serial entrepreneurs and venture-backed businesses.

“Taking in some smart equity or convertible debt and balancing that money with other financing can be a good strategy for a startup,” she said. Profitability decreases the risk of default and assures that the investee has the ability to service the debt.

In regards to the applications that are best suited to RBI, B2B software-as-a-service (SaaS) companies rise to the top of the list primarily because one is able to — in essence — securitize the revenue being generated by a company and then lend capital against that theoretical security. In addition to SaaS companies, RBI is being used quite frequently in the impact investing community as it solves the problem of a lack of normal M&A or IPO exit paths for impact-driven companies and are sometimes marketed as a nonextractive form of investment structure.

Beyond B2B SaaS and impact investing, many other verticals are adopting the model as well, including e-commerce/D2C, consumer software, food and beverage, and more. It ought to be noted, however, that regardless of the specific business model a company employs, the investee is typically required to have repeatable sales and a track record that demonstrates a strong revenue stream, and therefore a clear ability to return the capital to the investors.

The U.S. RBI landscape

We have identified 32 U.S.-based firms actively investing via a revenue-based investing instrument, with those firms managing 57 distinct funds representing an estimated $4.31 billion in capital. Through our analysis of those firms, funds and investees, we found that:

- The number of firms and the amount of capital committed to RBI is increasing, and we forecast that this trend will continue.

- B2B software was not surprisingly the largest consumer of RBI,

- There was a surprising amount of activity across industries that are not yet typically associated with revenue-based investing such as food and beverage, consumer products, fashion, and healthcare.

Firms were included in the data set (and by extension, determined to be actively making revenue-based investments) if they:

- Invest in companies using an instrument where the return is generated from the principal plus a flat fee that is paid back via a fixed percentage of revenue.

- Payments to investors are made on a monthly (or longer) basis.

- The payback period is expected to be longer than 12 months.

The specific number of firms we believe to be quite accurate, representing only active, U.S.-based revenue-based investing firms. The number of funds, however, may be underestimated. This is due to the fact that, although each firm is associated with at least one fund, we did not include additional funds beyond that unless they were confirmed through other sources, such as the firms’ public communications, their SEC Form D or other sources as outlined in the methodology section at the conclusion of the full report.

The total amount of RBI capital that has already been allocated to companies across all firms and all years is $2.1 billion. However, it should be noted that this includes the outliers in our dataset, namely Kapitus, Clearbanc, Braavo and United Capital Source. Once we remove those firms, the remaining 28 firms, representing 51 funds, have allocated $592.8 million.

This figure of $592.8 million is almost certainly an underestimate due to the fact that only 19 of 32 firms had a known “amount of allocated capital,” whereas the remaining 13 firms have unknown values (i.e., zeros) for the amount of capital they have allocated thus far. Therefore, if all 32 firms had a valid and confirmed amount of allocated capital, we can logically conclude that the number would rise dramatically from the current figure of $592.8 million.

Increasing popularity of RBI

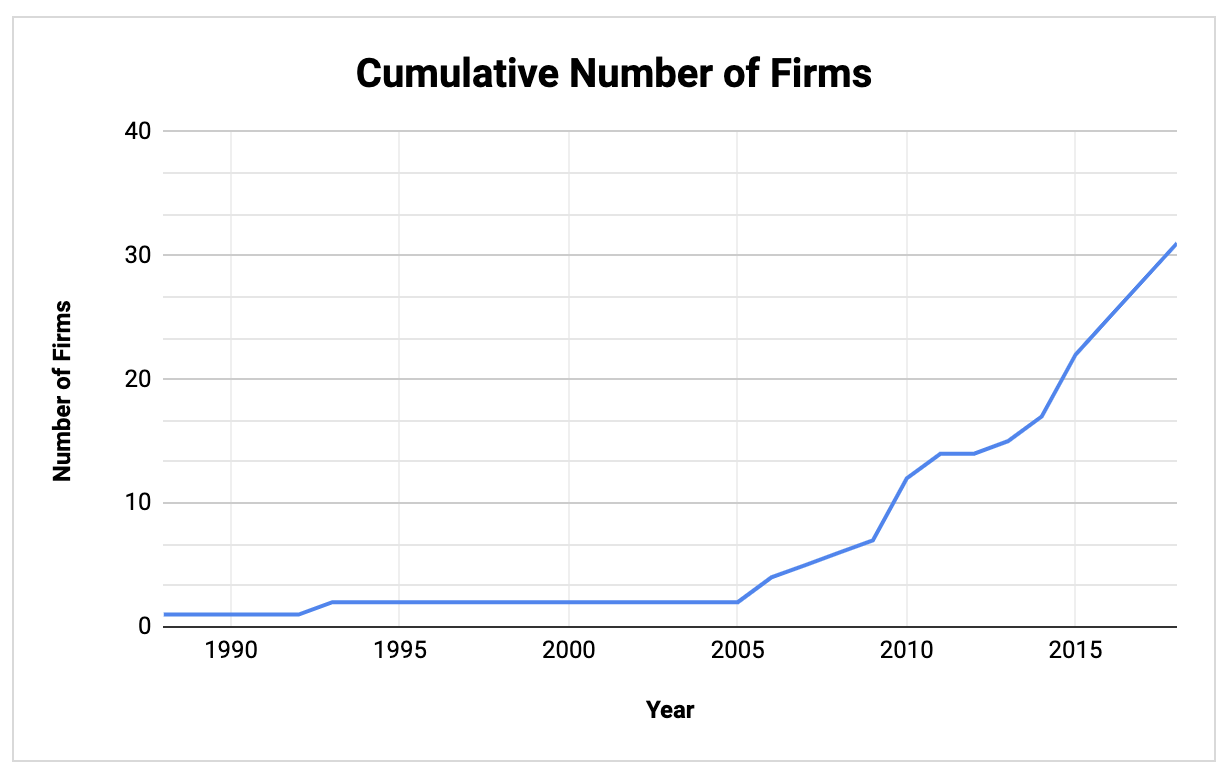

New RBI firms have been founded every year since 2013. In 2010, five firms were founded and in 2015 four additional firms were founded, then from 2014-2019, two or more firms were founded each year.

Clearly, there has been a major uptick in RBI firms being founded since 2005, with a relatively consistent number of new firms being founded over the 15 years since then. In the last 10 years alone, 25 RBI firms have been founded.

Funds raised by RBI investment firms

Since 2015, 35 distinct funds have been formed by the 32 firms in our dataset. This leaves only 16 funds that were formed prior to 2014, and six funds for which we could not confirm the year of formation. With the number of firms entering in the space, it follows that the number of distinct funds would grow accordingly. One particular area of interest, although not addressed in this paper, is whether these new firms are directly competing with traditional venture capital as they fundraise, or if they are perhaps raising funds from other pools of capital.

In regards to capital allocation, the data seems to tell the story that there are a large number of firms still allocating capital from their first fund, as there were 10 firms that formed their first fund since 2017, therefore it’s likely that many, if not all of those firms are actively investing out of their first fund today, depending of course on their individual fund lifecycles. That said, it stands to reason that the number of firms investing out of their inaugural fund is likely to be higher now, in 2020, than it ever has been before.

Total amount of capital allocated to RBI funds

Narrowing further to focus solely on investors, we found that the mean fund size is $56.2 million, while the median fund size is $20 million. There are 57 funds associated with the 32 firms in our dataset, with 51 funds being associated with firms that are not outliers. The capital we were able to confirm has been committed to distinct funds is equal to $1.85 billion. This figure overall is low and shows that only $6 million of the $1.8 billion is managed by the firms identified as outliers: Kapitus, United Capital Source, Braavo and Clearbanc. For each of those firms, we were unable to confirm the size of their distinct funds, and therefore this figure woefully underestimates the assets under management for each of those firms, who collectively claim to have allocated several billions of dollars in capital to small businesses.

Out of 57 funds, 33 had a known fund size, while 24 remain unknown. Among those firms with known values we found that the average fund size is $56.2 million, while the median fund size is $20 million.

Dry powder

We estimate a calculated total of $2.18 billion in dry powder across the industry. Reaching this figure was difficult due to the fact that there were 24 funds for which we did not have any concrete total committed capital data. Therefore estimating the amount of unallocated yet committed capital is inherently challenging. However, in an effort of good faith to calculate the amount of dry powder in the industry, we took an oversimplified view of the data and made several assumptions to arrive at the final estimate of $2.18 billion.2

Number of deals executed by revenue-based finance firms

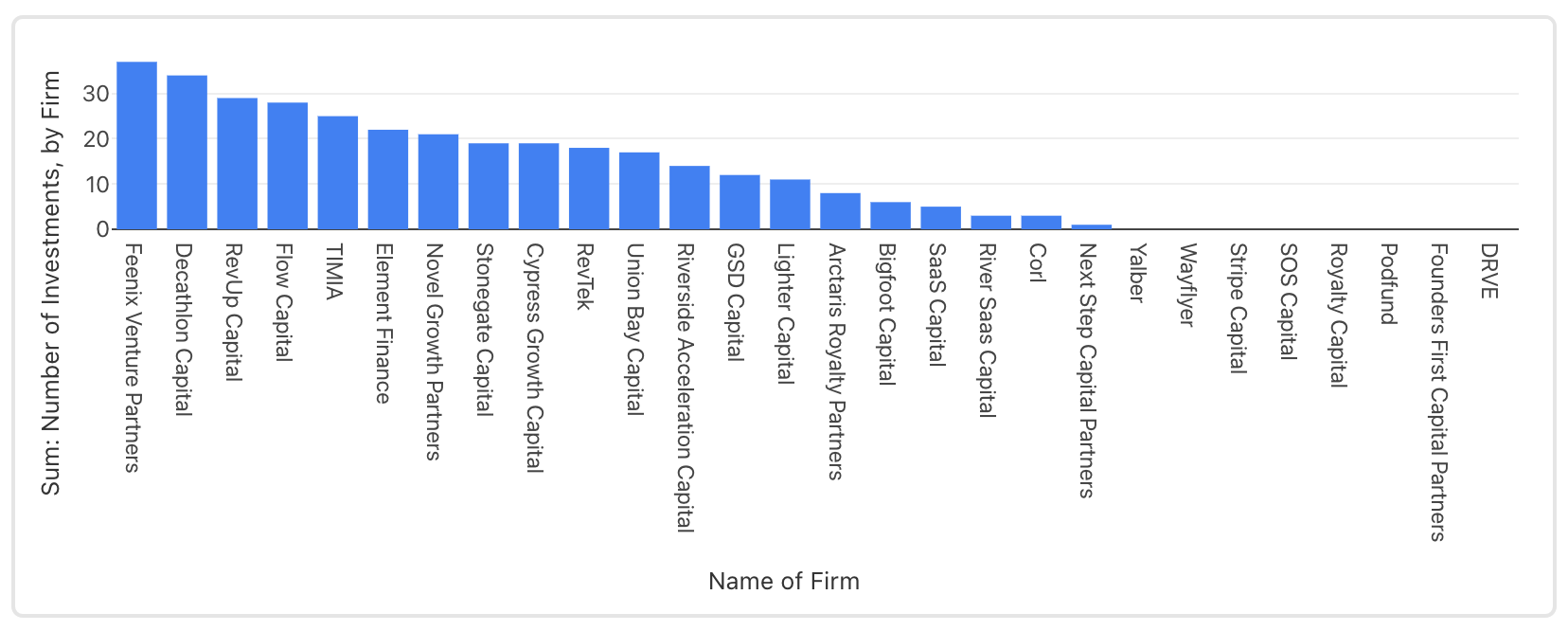

The firms shown in the chart below have all originated less than 40 RBI investments according to our data set. These figures are likely to be underreported as we do not have a comprehensive view of their portfolios. However the authors were compelled to only report the data as it is available and not include data based on assumptions.

The majority of the below investee3 data has been collected through primary research. We gathered data on 134 companies, all of whom have received revenue-based investing.

Average revenue of RBI investees

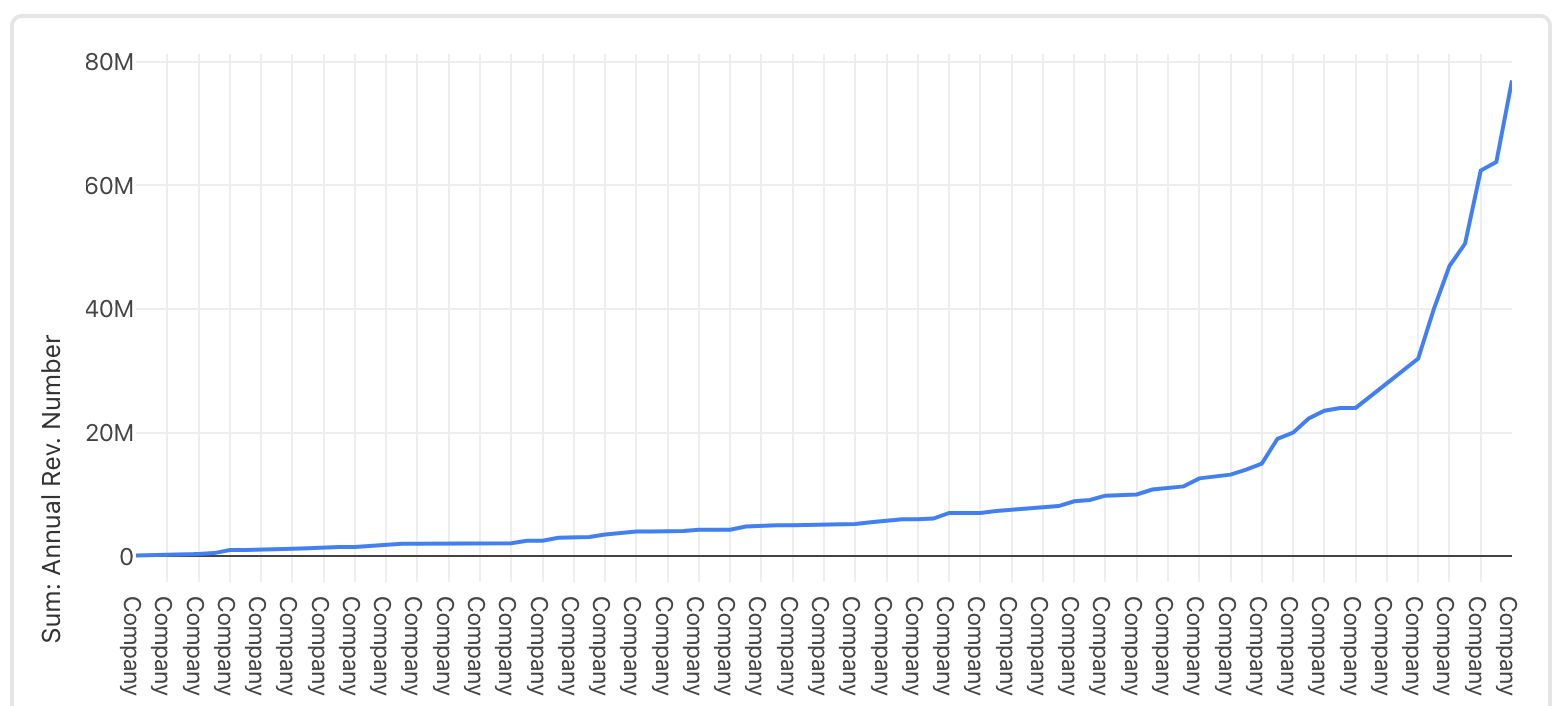

The average annual revenue of the investees in this data set is $33.4 million, while the median annual revenue is $5.4 million. Our hypothesis is that the data set itself is skewed toward larger, high-revenue companies as a result of the larger financings being more publicized than smaller transactions, which are less likely to warrant press coverage or publicizing from investors.

The vast majority of companies leveraging RBI typically generate less than $20 million in annual revenue, as shown in the chart below. The data included in the chart represents 89 companies (identities redacted) whose revenue was known at the time of writing, and therefore does not include the 45 investees with unknown revenue.

Industry analysis

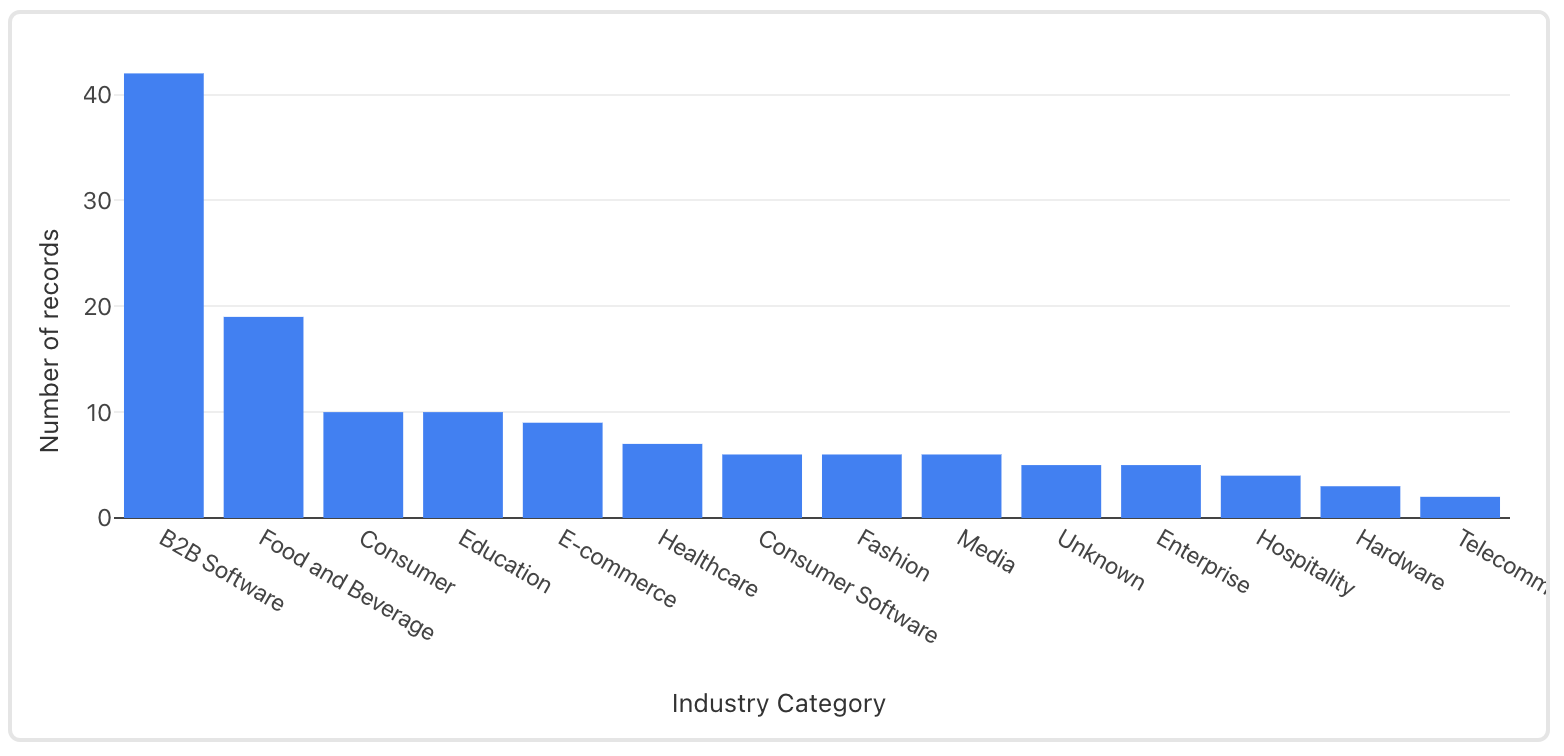

As expected, the industry that received the highest number of RBI loans was B2B software, equating to 42 companies of 134, or 31.3% of all investees. Companies within the “B2B software” category included those who were targeting any type of business customer, including large enterprises, small businesses, independent creators, entrepreneurs, retailers or others.

B2B software was expected to be the leading industry and validates (at least by correlation) several theories that have been shared recently by others closely watching the RBI space. For example there has been a recent focus on SaaS revenue securitization, and the potential for creating a high-yield fixed income product off the back of it. It’s interesting to see the first half of this equation coming to life in the form of this investee data, yet the industry hasn’t matured enough yet where the proposed derivative financial products may benefit from any sort of mass adoption.

Age of investees

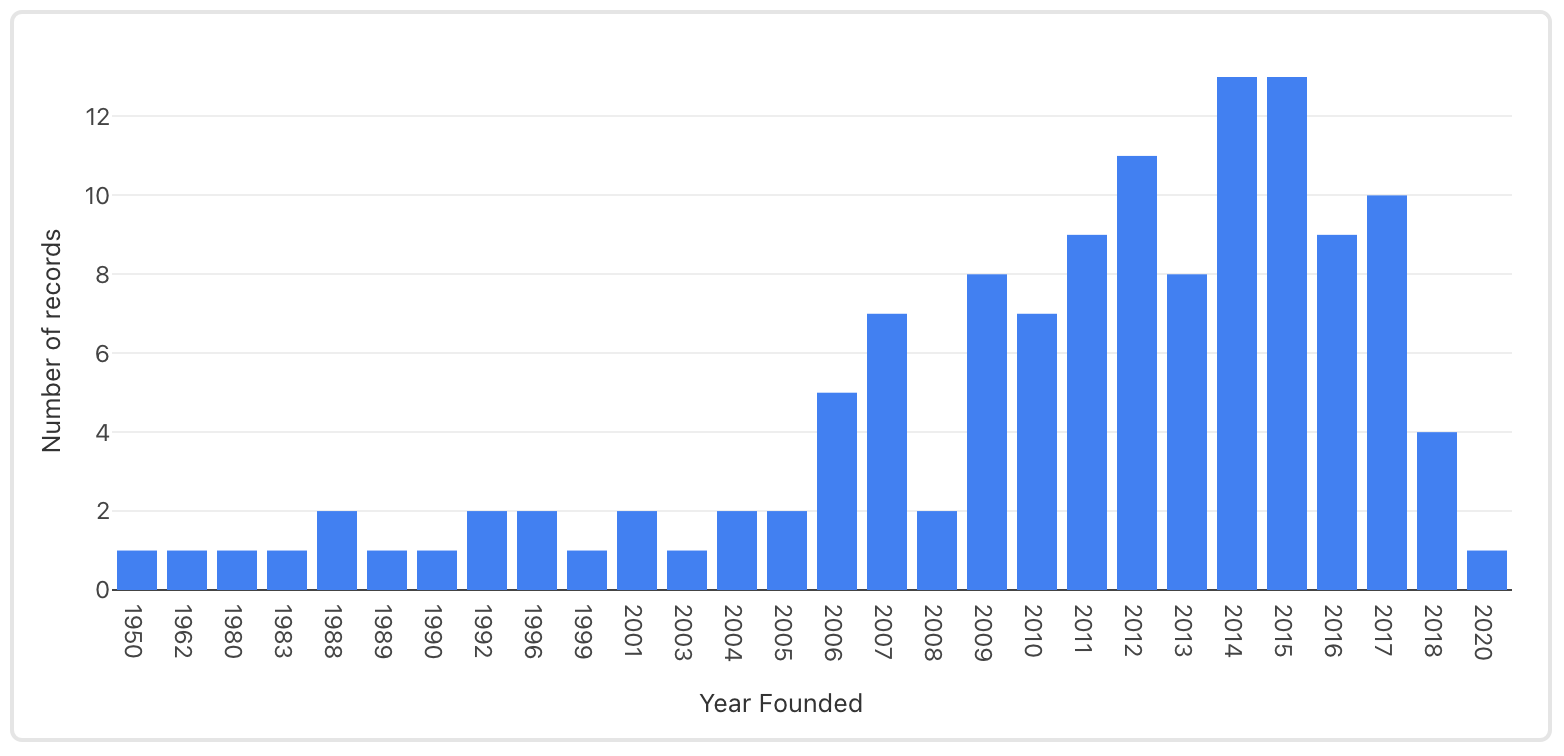

When reviewing the years in which RBI investees founded their companies as a cohort, there is a clear rise in the number of number of investees/companies that were founded in the years from 2011-2015, before the data starts dropping back down, culminating in only one investee who was founded in 2020 and has still managed to execute an RBI deal since then. We were able to obtain the year founded for 127 out of 134 companies, making the data relatively complete for our purposes.

Because the number of RBI deals have consistently dropped since 2015, if viewed in isolation this data may lead an individual to infer that RBI is declining in popularity. However, that line of thinking does not take into account the fact that companies may simply need 3-5 years to establish a repeatable business model and gain enough traction before they qualify for substantial RBI loans. The other side of the coin is that companies must mature to a point where they fit the risk profiles of RBI investors as well.

Therefore, the fact that the number of companies that were founded in years 2016-2020 is lower than previous years is likely attributable to this fact, and furthermore, that the administrative and transaction costs of applying for, managing and paying down an RBI loan may not be worth it for companies that are only one to three years old.

The oldest company within the data set, a well-known hospitality brand, was founded in 1950, whereas the company founded most recently was formed in 2020. We found that the median year of a company’s founding in our data set was 2012, while the average year founded is 2009.

- 85 RBI investees, or 63.4%, were founded in the years 2010-2020.

- 114 RBI investees, or 85.1% of investees were founded in the years 2000-2020.

This is an interesting counterpoint to our understanding of the age of investees above, which illustrates that although RBI investees typically must be more than three years old, they also are almost never more than 20 years old.

Conclusion

The goal of this report is to increase the transparency of the overall RBI market, and to provide both investors and investees with concrete data and industry insights. We believe that nearly all of the data point to a growing RBI industry with increasing amounts of capital, higher frequency of originations, specialization among investment firms, and perhaps most importantly, the standardization of investment terms and industry norms, which will allow for even greater transparency and price-competitiveness, ultimately benefiting entrepreneurs.

Bootstrapp developed this extensive analysis on revenue-based investing for the purpose of accelerating the shift toward greater transparency and standardization within the industry. As we build a platform that automates fundraising for nondilutive capital, it’s become clear that one of the foundational issues that exists for founders today is simply information asymmetry, which this analysis aims to address head on.

To that end, we’ve been able to confirm several of the common hypotheses that are shared within the broader RBI community:

First, the number of firms and the amount of capital entering the RBI industry are both increasing, and we expect this trend to continue as the industry matures. Despite not being directly addressed in this report, the awareness of RBI among entrepreneurs and small businesses is still low, and we expect that, as this awareness increases, the demand for this type of financing instrument will grow proportionally.

Second, among all investees, B2B software companies are the most active subset, theoretically confirming that their business model is best-suited to RBI and that predictions of the industry effectively securitizing recurring revenue will continue to ring true over time. Investees are also relatively younger companies, with over 63% of RBI investees being founded in the past 10 years.

Third, there was a surprising amount of activity across industries that are not typically associated with revenue-based investing. Food and beverage, consumer products, fashion, and healthcare were unexpected, and we believe that the use of RBI in these industries may prove it to be a more flexible instrument than previously thought. Anecdotally, we include impact investing in this category of other investment areas as well, although we unfortunately did not have impact investment investees included in our database.

Ultimately, we believe that the overarching lesson to be derived from this work is that the demand-side (investees) of the RBI market will greatly benefit from greater transparency. It is therefore our recommendation to founders, CFOs and executives to demand greater transparency from their RBI investors. More specifically, we recommend that companies work to remove confidentiality provisions from investors’ term sheets and/or contractual agreements before executing them. These confidentiality terms solely benefit the investors and hurt the overall efficiency of the market.

1 Despite the popular nomenclature of “revenue-based financing” the authors determined that “revenue-based investing is more accurate and inclusive. Due to the fact that RBI instruments often include equity, warrants, and/or a convertible right to equity, we felt that the term investing was more appropriate.

2 More information on the method used to arrive at this figure can be found in the Methodology section of the full report.

3 To clarify the terminology being used, we are referring to all recipients of RBI as investees. However, there is certainly a possibility that some of these companies entered into agreements with a number of variations, including purely being debt-based instruments, warrants or other instruments that may convert into equity for the investors. In other scenarios, firms may structure the RBI instrument itself as an equity instrument, though one that is entitled to revenue-based dividends (rather than dividends computed by reference to share count). Then, typically, the investor-return payments change in characterization from dividends to redemption payments, e.g., after about five years.

Authored by Thomas Rush and Daniel Birmingham, with a massive and well-deserved thanks to all those who contributed to the creation of this analysis, especially David Teten, John Berger, Dan Birmingham, Brian Parks, Jonathan Bragdon, Zack Mueller, Brian Mikulencak, Samira Salman and Marco Cesar Solinas.

SaaS securitization will disrupt VC’s biggest returns this coming decade

Comment