Venture capital activity in Europe and Asia saw a strong return to form in Q3, data indicates.

The two continents enjoyed more venture capital investment into their local startups than in some time, underscoring that strong VC results the United States saw in the third quarter were not a fluke, but part of a broader trend.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Data compiled by CB Insights shows a global acceleration in the number of dollars venture capitalists are putting to work around the globe as 2020 chews through its second half. The record figures that Q3 supplied stand in stark contrast to the fear that overtook startup-land in late Q1 and early Q2, when COVID-19 threw some young technology companies surprise turbulence.

But the dip in venture capital activity was short-lived. As many startups sold software, they found their wares suddenly in greater demand; across a host of verticals, startups benefited from an accelerated digital transformation as the world adapted to a new work environment. Aside from clear winners like video conferencing tools, other categories from remote learning to security tooling also got a bump.

But the dip in venture capital activity was short-lived. As many startups sold software, they found their wares suddenly in greater demand; across a host of verticals, startups benefited from an accelerated digital transformation as the world adapted to a new work environment. Aside from clear winners like video conferencing tools, other categories from remote learning to security tooling also got a bump.

The COVID-tailwind, as it is sometimes called, does not appear to be specific to the United States or North America. Instead, given what the venture capital data states, we can infer that startups the world around are enjoying a similar boost.1

Let’s get into the numbers to better understand what’s up in Europe and Asia. (As an aside, if you have data on African startups’ venture capital results, please email me as I am starting to poke around for a more global picture. Recent deal activity makes it plain that American media needs to do more and better reporting on the continent.)

A strong Q3

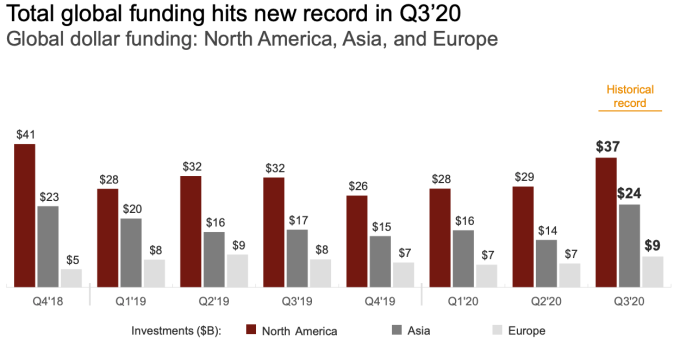

The venture capital world’s center of gravity still lands somewhere in the United States, but here’s how the three continents managed in Q3 2020, looking at their raised venture capital dollars:

- North America: $37 billion.

- Asia: $24 billion.

- Europe: $9 billion.

Asia’s result was its best since at least Q4 2018, as far back as our dataset goes. Europe’s total tied its high-water mark set in Q2 2019. But as a combined pair, venture capital outside North America might have just had its best quarter in years, if not ever.

Here’s the data in graphical format:

Late-stage deals made Q3 2020 a standout VC quarter for US-based startups

In deal terms, the landscape is slightly less wonderful. There was some good news for fans of startups outside the U.S. — in Q3, Asia’s deal volume surpassed North America’s.

Here are the Q3 deal numbers, via CB Insights:

- Asia: 1,585.

- North America: 1,563.

- Europe: 878.

North American deal volume has been in the 1,500s per quarter since Q4 2019, or about a year. European deal volume has been between 800 and 1,000 since at least Q4 2018. Asian deal volume was the real mover.

After rising to 1,654 deals in Q4 2019 (and besting North America at the same time!), deal volume in Asia fell to 1,205 deals in Q1 2020, before bouncing back to take pole position in the third quarter. Still, North America and Asia effectively tied in the quarter, with the American continent raising far more total funding. So, the horse race is not really even, not yet at least.

In aggregate, per CB Insights data, global VC funding rose around 40% from Q3 2019 to Q3 2020, a stark jump in capital raised, implying that there were ample VC-ready companies in the market, despite the COVID-19 pandemic.

So what?

The unicorn era was a hot period for private companies, startups especially; 2020 started off in a similar manner before icing over for a few months. Now, things are back and heating up to new, record temperatures. The aggregate bet made on future startup growth has never been made more aggressively than in Q3, at least from the perspective of dollars wagered by private capitalists.

What are they buying into? A good question to ask is just how fast are startups growing today. Are they growing quickly enough en masse to warrant their current level of investment? Or is a collected belief that cloud is merely a fraction of the way through its growth curve leading VCs to overestimate future revenue growth in their present-day valuation calculations?

Shasta’s Issac Roth is big on startups hitting at least 70% growth this year. Provided that their SaaS metrics are fine and they are going to survive the pandemic, he says that’s enough to make it to the next stage. We’re also hearing about outliers growing above 100%. Are there really enough fast-growing startups to warrant this torrent of cash?

We saw yesterday that there have been a rash of megarounds, or deals worth $100 million or more. Those rounds made up more than half of the funding seen in America during Q3. Another question worth asking: How fit are the startups receiving those checks, and can these hundreds of unicorns survive whatever 2021 brings at similar multiples?

But that’s the pessimist in me; it was a good quarter, and that’s something for startup fans to celebrate.

1The inverse of this point, that investors were pouring capital into moribund startups, or those with decelerating or flat growth, doesn’t really congeal.

Comment