Carl Niedbala

High-growth companies often set significant goals, knowing full well that the idea of “overnight success” is for the storybooks. However, there is no better time than the middle of a market downturn to start planning for the leap from a private to a public company.

De-risking the path to going public requires strategic planning, which takes time. Companies with goals to go public in less than three years must therefore plan for it now — despite the downturn — to get the running start they’ll need to navigate the open market.

Let’s explore why this adverse economy is ideal for planning an IPO and what to do about it.

Growth investors have recently pulled back

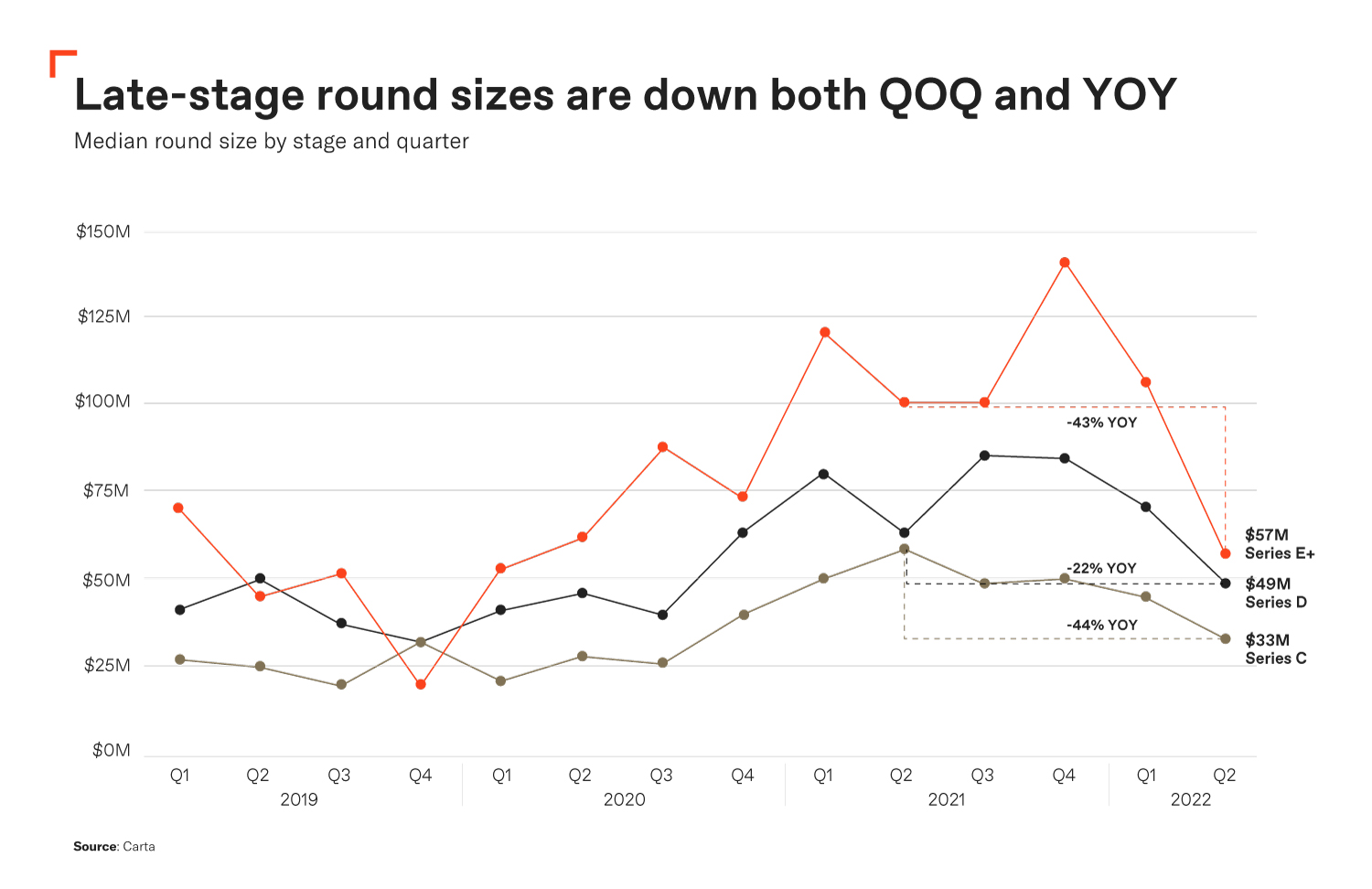

Carta reports that private fundraising levels have declined across the U.S. from a record-breaking 2021. Unsurprisingly, late-stage companies have experienced the brunt of this blow.

Market experts are currently encouraging leaders not to pin their hopes on venture capital dry powder, even though there’s plenty of it. As the graph below indicates, the size of late-stage funding rounds has shrunk.

Although few enjoy market downturns, how this one unfolds can deliver insights to late-stage companies that pay attention. On one hand, many leaders are embracing the message of the Sequoia memo. We can agree with their ideas to prioritize profits over growth — scaling is different from what it used to be, and we must swallow that jagged pill.

On the other hand, cost-cutting and giving up hope of fundraising isn’t all doom and gloom. After all, when there is money to be found, some innovative founder will find it. We see it every day; only now, the path looks different.

Market downturns spur valuation corrections

Course-correcting is a concept frequently discussed amid market downturns. The pendulum swings one way for a period, then begins its journey toward a more balanced standard. In this case, the open market thrived on bloated valuations — most startups were overvalued before 2021.

Furthermore, many stated that 2021 was a miracle year, especially as VC investment nearly doubled to $643 billion. The U.S. sprouted more than 580 new unicorns and saw over 1,030 IPOs (over half were SPACs), significantly higher than the year before. This year has only welcomed about 170 public listings.

However, experts argue that in the wake of a devastating pandemic, market expectations and the valuation model inflated valuations. Investors, leaders and employees were riding a wave that would soon be flushed in the second half of 2022 as severe valuation corrections took hold and inflation scared heads into the sand.

What does all this mean for high-growth companies?

Another path to fundraising

If late-stage companies can’t source funding from private investors, the open market could be the next best place to look to. The dynamics of the current lag in growth funding makes filing for an IPO seem more attractive and realistic — that’s the message of hope.

It only makes sense that people lose their appetite for IPOs during market downturns, and investors are also bound to rethink risky investments. Although IPOs might be off the table currently, 2023 will be jam packed with first-movers.

Sensible companies are de-risking their public path now. Here’s why:

Telling benchmarks signal an upcoming IPO season

Private financing isn’t the only route to fundraising, but it’s the path many private companies think is the next logical step. This strategy is great when it works out, but like all strategies, it only leads to setbacks when it doesn’t.

Don’t leave money on the table by not going public, especially when growth investors hit the brakes. Remember that the IPO market will bounce back once investors stop running for cover.

Companies go public for the wrong reasons frequently, and it’s often a train wreck. However, when you have a proven growth strategy and there’s appetite in the market, filing for an IPO is often the next logical step, regardless of whether going public was part of your initial plans.

Over the past year, the information technology, healthcare, construction and food services industries saw significant growth. Many companies in these sectors will find telltale signs that an IPO is in their future.

Some key benchmarks include:

- Market appetite: The market fit is spot on.

- Financials: Financial intelligence signals ongoing growth.

- Revenue: Growth potential supports your equity story.

- EBITA: Above-average margins point to premium valuations.

- GAAP standards: Sophisticated handling of financial statements paves the path to IPO.

- Compensation plans: Forming your key team requires establishing long-term incentives now.

- Total debt: Disclosing debt helps investors leverage your capital structure.

- Separate financial statements: Companies ready to IPO have audit-ready reports.

For high-growth companies that need to reach these milestones, a down market is a fantastic opportunity to get these ducks in a row. While operations don’t necessarily need to be flawless right now, having IPO-ready goals is vital to setting off on the path to profitability.

Creating a powerful IPO team takes time

Due diligence during a market downturn is like viewing a potential home alongside your realtor just after a terrible rainstorm — it’s a tell-all situation and only the best will pass the test.

As you likely know, filing for an IPO is a painstaking process that requires having the right people in your corner. Strangely enough, the best time to understand their actual skill sets is when things aren’t comfortable or going as planned, such as during a recession.

Furthermore, assembling an IPO team involves attracting “critical hires.” These people will manage the necessary forms, reports and statements. A word from the wise: audit your team before filing for an IPO and choose individuals who’ve been through the process before.

These people might include:

- SEC consulting team

- Legal counsel

- Finance and accounting team (i.e., director of finance, CFO, etc.)

- Information technology

- External auditors

- Tax firm

Also, late-stage companies must refine their equity story — the narrative weaving together the financial history and the story of the business. Engaging with the right investment bank will also bolster an organization’s credibility and soften receptivity.

Remember, due diligence with an underwriting partner is a two-way street, but downturns will help leaders read between the lines.

Risk management requires savvy strategizing

There’s no putting it gingerly: The D&O insurance market has been a beast to navigate over the past few years. More ESG (and anti-ESG) issues, cybersecurity cases snowballing into D&O litigation and skyrocketing premiums have discouraged IPO dreams.

However, recent signs of softening have lifted spirits in the private and public sectors.

Private-to-public D&O insurance

New entrants in the space, mostly insurtech startups, are shifting from writing primarily cyber liability to adding D&O coverage to their lineup. We see greater capacity in the management liability space, encouraging a more competitive market. What’s more, less litigation inspires hope.

Securities class action filings peaked in 2017-2019, but they’ve been declining since then. Fortunately, market pricing is catching up quickly. Company leaders can more comfortably relaunch their IPO plans in light of these trends. Plus, the recent lack of IPO activity will impact insurers that want to write this business and force them to become more competitive.

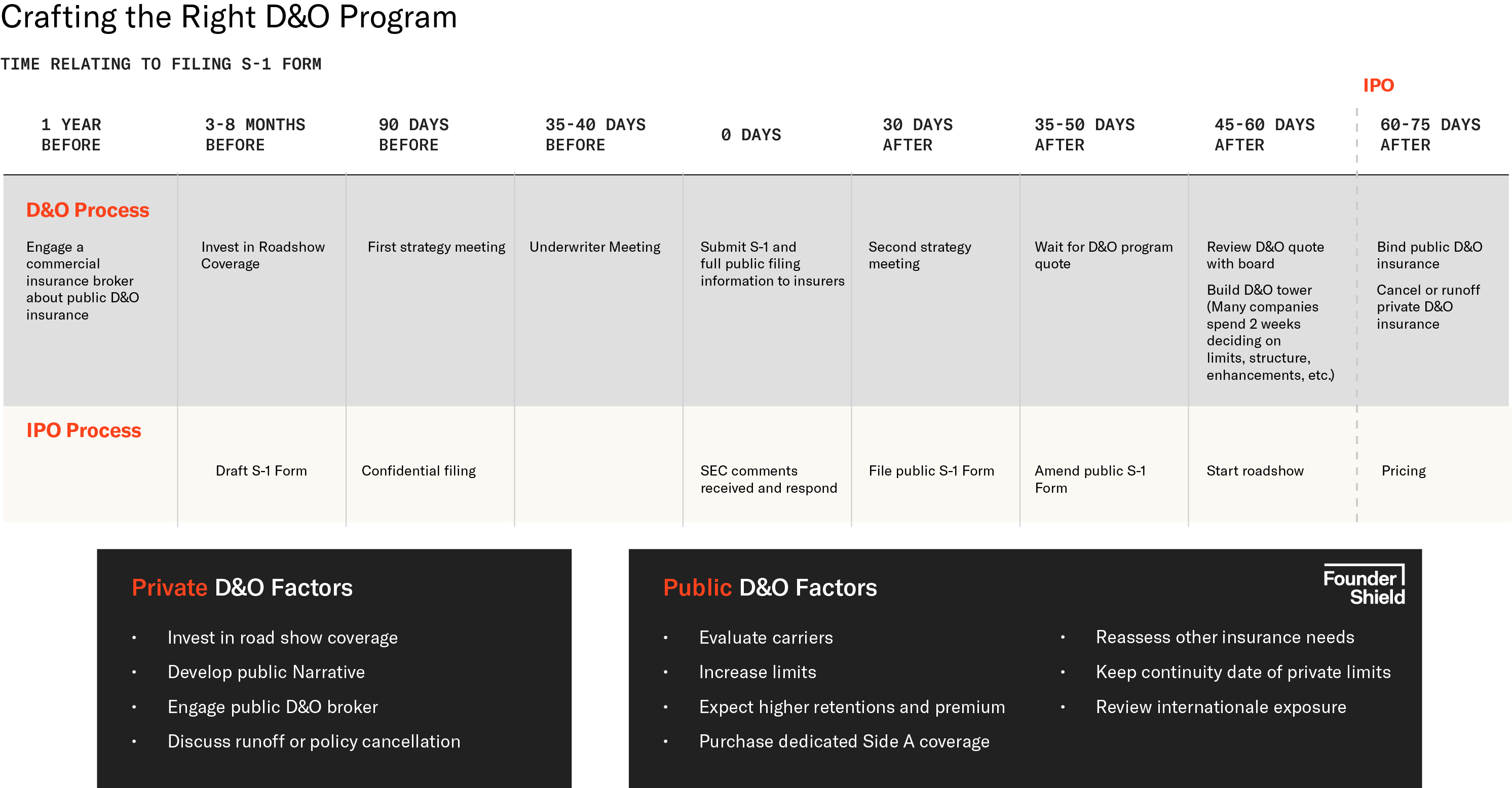

Still, building a strong D&O tower takes time, as seen in the timeline below.

Several factors can impact a company’s public D&O program, including:

- Market cap

- Industry

- Size of the offering

- Trading market (i.e., OTC, Nasdaq, etc.)

- BOD composition

- Risk tolerance

- Limits

- Structure

- Coverage needs

Management liability considerations

Public companies face risks that private companies don’t. Aside from fiduciary responsibilities, leaders must manage greater pressure to adopt cybersecurity best practices. We’ve experienced an uptick in cyber-liability premiums in the wake of the pandemic as businesses worldwide ward off vicious cyberattacks.

Furthermore, social movements like #MeToo and the Fight for $15 have also created an interesting landscape. Employment-related lawsuits are rolling in steadily, with workplace safety the most common employment practices liability (EPL) claim. Going public makes companies more vulnerable to scrutiny from employees, shareholders and investors.

Then there’s the SEC to manage, a task we’ve recently witnessed a cryptocurrency leader completely and utterly mangle. Briefly, the FTX bankruptcy was more than breaking news — it was an eye-opener about how wide-reaching the SEC regulations are. For companies de-risking their path to going public, it’s imperative to become familiar with ever-changing SEC standards and common requests regarding S-1 filings.

Summary

Market downturns might not be the time to scale as usual, but they’re undeniably the ideal time to plan for an IPO. With growth investors reining back their investments, consider if you can hit key benchmarks and build an IPO network successfully.

Finally, while some companies delay their IPOs, others can play catch-up and prepare for the time when the open market itches to invest again. Companies that keep due diligence and legal documentation moving forward during a crisis can face the open market more confidently when the timing is right.

Comment