“Skio helps brands on Shopify sell subscriptions without ripping their hair out,” explained Skio’s founder, Kennan Davison, when we sat down with him to understand how the product works, how it’s been growing to date and the challenges the company faces.

Skio launched in April 2021 with the goal of eliminating the hacky workarounds that other subscription apps have been using for Shopify. The company lets its clients employ native Shopify checkout along with a passwordless login to provide a seamless experience to their customers.

In the beginning, like many startups, Skio had to do things that don’t scale to acquire its first customers. Kennan would frequent direct-to-consumer communities on Twitter to find upset users of his competitor, ReCharge. After acquiring the first few customers, Skio created case studies to showcase how it improves the subscription process.

As the company began acquiring more customers, word-of-mouth helped the company show how much of an improvement Skio is over ReCharge (and other competitors). Considering the amount of inbound requests the company received to demo Skio, it’s clear it has product-market fit.

Now, Skio has over 100 recurring customers, including brands like Bev, Muddy Bites, Doe Lashes, Krave Beauty and more. The company has nearly zero churn, and it wants to keep it that way. To do that, the team’s goal is to continue acquiring users who are upset with their current subscription solution.

How can Skio continue growing this customer base while maintaining a low churn rate? That’s what we’ll explore in this article.

This post will share why some growth strategies are better than others, introduce growth concepts and explain our approach. The aim is to give you the insights necessary to pattern match a growth strategy to your own startup and begin applying the content right away.

Tech and VC heavyweights join the Disrupt 2025 agenda

Netflix, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just a few of the heavy hitters joining the Disrupt 2025 agenda. They’re here to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch Disrupt, and a chance to learn from the top voices in tech — grab your ticket now and save up to $600+ before prices rise.

Tech and VC heavyweights join the Disrupt 2025 agenda

Netflix, ElevenLabs, Wayve, Sequoia Capital — just a few of the heavy hitters joining the Disrupt 2025 agenda. They’re here to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch Disrupt, and a chance to learn from the top voices in tech — grab your ticket now and save up to $675 before prices rise.

Before we begin, here’s a quick look at Skio:

- Industry: E-commerce.

- Business model: Recurring subscriptions.

- Revenue source: SaaS fee + transaction fees.

- Price point: $399/month + 1% transaction fee + 20 cents.

Acquisition strategy

As previously mentioned, Skio’s target customers include current users of ReCharge, particularly those who aren’t happy with it. Skio charges a monthly subscription fee as well as a transaction fee.

To grow Skio’s revenue, we need to increase the total number of paying customers subscribed to its app. These customers must be low-churn risk, which means the most frustrated ReCharge customers are acquired before we target Shopify owners more broadly.

How to choose a growth strategy

There are three ways startups can acquire customers: inbound, outbound and viral.

Viral growth

Viral growth happens when awareness of a product is spread by customers using that product. Slack and TikTok are great examples of viral products, because users send invites to others to join, and the more users on the platform, the more valuable it is. Product-led growth and referrals are the most common viral-based acquisition strategies.

There are three key factors to consider when assessing if viral growth will work for your startup.

We’ll assess whether a viral growth strategy will work for Skio using a simple scoring method. Each factor will be given a rating of low, mid or high based on the likelihood of success.

Invitations: How many invitations will each user send to non-users?

For an invite to be relevant, Shopify store owners that use subscriptions will have to invite other Shopify store owners that use subscriptions. While founders tend to be well connected, it’s unlikely they will know enough people who fit that subscription for the number of invites sent to reach the critical mass required for viral growth.

Score: Low.

Conversion rate: What percentage of those invitations will convert someone into a new user?

Skio is solving such an annoying problem for their target customers, so referrals will work to a degree. As we mentioned in the intro, word-of-mouth has actually been a successful channel for Skio. But because Skio’s product is only relevant to a niche group of people, the amount of people signing up won’t be significant enough for viral growth to be a main channel.

Score: Mid.

Cycle time: How long does it take for a new user to send invitations to more non-users?

Before new users invite other people, they need to experience the value of the product. According to Skio, onboarding takes less than a week. So, users should experience the value when they see an increase in conversions and fewer customer support tickets. When switching to Skio, users will begin to see this right away, so the time to value for new users is low.

Score: Mid.

This assessment revealed no key factors that scored high. So, viral growth likely won’t be a strong fit for Skio given its market and business model.

But, as we discussed, word-of-mouth has been a strong lever for growth. Therefore, we still recommend incentivizing users to invite others, but it shouldn’t be the primary channel.

Outbound growth

Outbound growth happens when startups actively seek out new customers. Outbound growth works best when the target audience is unaware that your solution exists, or you’re bringing a completely new idea to market. Direct sales and paid advertising are the most common channels for outbound growth.

There are three key factors to consider when assessing if paid growth is right for your startup. For Skio’s assessment, each factor will be given a rating of low, mid or high based on the likelihood of success:

Cost of acquiring a customer: How much does it cost to acquire a new customer?

The customer acquisition cost (CAC) is calculated by adding the total cost of outbound activities (paid ads, direct sales) divided by the number of new customers acquired over a period of time. Skio charges $399/month + 1% transaction fee + 20 cents, and it currently has a near 100% retention rate.

Based on this, we can assume an annual contract value (ACV) of $4,800 or more. This makes both sales and paid marketing, or a combination of both, viable.

Score: High.

Payback period: How long must a customer be retained to cover the cost of acquiring them?

Skio profits in a month so long as the CAC is under $399, making the payback period immediate. This would mean Skio can acquire customers quickly and use the revenue generated to buy more ads right away.

Score: High.

Cost barrier: Is the price of the product going to be a barrier for new customers?

The target audience Skio would reach out to or show ads to already pay for a subscription, so switching to Skio would make no, or very little, difference in cost. A lot of these Shopify store owners are frustrated with their current subscription, so they’re emotionally ready to make the switch, too.

For those who may not have subscriptions but are looking to start, a $399/month price point is not going to break them, but they may need some more context as to why it costs $399/month, so sales will likely be necessary for outbound to work.

Score: High.

Our assessment shows that Skio’s existing business model will make outbound marketing a very viable option. Although acquiring customers through direct sales is costly, the company’s business model and high LTV can make sales quite profitable and scalable.

Inbound growth

Inbound growth occurs when customers know they have a problem and are actively looking for a solution. For inbound acquisition to work, two things must be true:

- There’s existing demand for your solution.

- Your audience can articulate their problem in simple words.

The three most popular ways to spur inbound growth are user-generated content (UGC), search engine optimization (SEO) and paid search ads.

There are three key factors you should consider when assessing if inbound growth is viable for your startup.

Let’s assess whether inbound growth makes sense for Skio. Each factor will be given a rating of low, mid or high based on the likelihood of success:

Time in the market: How long is a prospective customer in need of a solution?

Skio’s target customers will likely be in the market for a solution for a long time. Why? Because they have a solution that keeps their business afloat, but they’d prefer to have a better tool. Although Skio has been successful in acquiring ReCharge’s most upset customers, there are still many users out there who aren’t as loud but are still seeking a solution. Because most alternative subscription apps cost around the same, and onboarding time is relatively low, the switching cost is low. This means the prospect is open to trying solutions for a long time.

Score: High.

Competitive alternatives: How attractive and competitive are alternative solutions?

There are many alternative subscription apps in the Shopify app store, but many of those apps have been around for years, and the underlying tech hasn’t been updated often.

Skio brings new tech to the market with passwordless logins, integrated native checkout and focus on the end-user experience. So even if someone is using a competitor, they’d be able to quickly recognize the benefits of switching.

Score: Mid.

Discoverability: How easily can new customers discover your business?

There is not a lot of existing search volume for subscription apps. Let’s take a look at a few keywords:

- Subscription service: 1,500 monthly results.

- Recurring payments: 1,400 monthly results.

- Subscription manager app: 1,300 monthly results.

So even though people are searching for subscription apps, the volume is not enough to scale quickly.

Score: Low.

Based on this assessment, an inbound growth strategy scored high on one of three criteria, which tells us inbound growth wouldn’t work well for Skio.

Evaluating outbound acquisition channels

Now that we’ve determined that an outbound growth strategy would work best for Skio, let’s take a look at some of the most common channels within the outbound acquisition lane.

We’ll use six criteria to assess each channel:

- Scale: How much of Skio’s target audience is on this channel?

- Targetability: How easy is it to reach Skio’s target audience?

- Effort: How difficult is it to launch and maintain this channel?

- Time to results: How quickly can you expect to see results from this channel?

- Intent: How likely is it that people on this channel will buy?

- Cost: How much does it cost to acquire a customer on this channel?

Each criteria will receive a score, and I’ve provided comments if there was something interesting to say about that criteria.

Facebook/Instagram ads

- Scale: High.

- Targetability: High — Facebook allows you to target interests like “Shopify,” “Enterpreneur,” “E-commerce,” etc. Skio can also run retargeting ads to people who visited its page but didn’t convert.

- Effort: Medium.

- Time to results: Fast.

- Intent: Medium.

- Cost: Low.

Cold outreach

- Scale: High — In theory, Skio could reach out to its entire target market through cold outreach; it’s just a matter of its ability to acquire contact information.

- Targetability: High — LinkedIn Sales Navigator allows you to filter by industry, job title, company headcount, geographic location and more. Skio can get very specific about who it’s targeting, and then extract their emails using a tool like Phantombuster in combination with Dropcontact.io.

- Effort: High — In order to make cold outreach an effective channel, Skio would need to spend a lot of time writing, rewriting and personalizing their emails, and then nurturing their leads after they respond.

- Time to results: Fast.

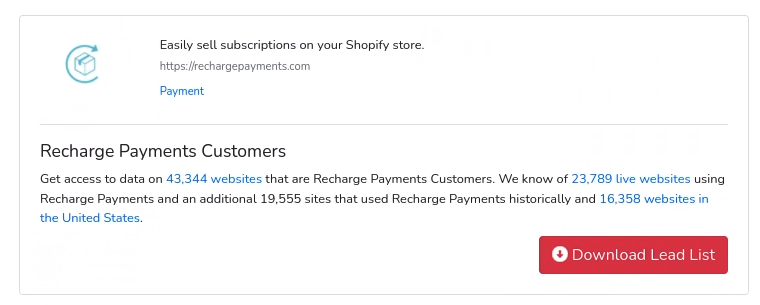

- Intent: Medium — No one likes getting a cold email, and that includes Skio’s target audience. However, Skio could use a tool like Builtwith.com to specifically find companies that use ReCharge and build their lead generation list around that, making their emails more likely to get a response.

- Cost: $0–$300/month + monthly salary for a salesperson — The prospecting tools will cost a monthly fee, which typically increases as you reach out to more people. However, Skio can manually scrape emails or take advantage of free trials, and then work its way up toward a more automated approach. The company can also pitch its free trial in the outreach email, which will potentially minimize the amount of sales calls needed.

Display ads

- Scale: High.

- Targetability: Medium — Skio can target its audience based on certain keywords and topics, like “Shopify subscriptions,” or run ads to people who browse websites similar to ReCharge. (Note that doing this won’t run ads to people who visited ReCharge, but to websites similar to it.)

- Effort: Medium.

- Time to results: Fast.

- Intent: Low — No one likes seeing banner ads, and people often ignore them or use ad blockers.

- Cost: High.

YouTube ads

- Scale: High — YouTube has over two billion monthly active users and appeals to everyone. There’s a good chance Skio’s target audience is on this platform.

- Targetability: Medium — YouTube ads have similar targeting options as display ads, including keywords, topics, demographics, etc.

- Effort: High — YouTube is a video platform, and videos can be expensive and difficult to make. People’s attention spans are very low on YouTube, so Skio will have to make sure their video hooks its audience quickly.

- Time to results: Medium — Making high-quality videos that will capture the attention of the audience will take time. It can take anywhere from a few weeks to a few months to finish making the video.

- Intent: Low.

- Cost: Medium.

Based on this assessment, it’s clear that Facebook/Instagram ads or cold outreach would work really well for Skio, but let’s dig a little deeper into the business to find out which one would work better.

Choosing a main acquisition channel

Now that we’ve narrowed down the acquisition lanes, and used the evaluation framework to assess the most common channels within those lanes, we can narrow our focus to finding a single acquisition channel.

As mentioned in the intro, Skio’s goal is to continue acquiring ReCharge customers while maintaining low churn rate. We’ll keep that in mind when choosing which channel to pursue.

According to Builtwith.com, more than 23,700 websites actively use ReCharge.

If we had to choose one acquistion channel to start with, cold outreach in combination with direct sales would be the winner. This strategy let’s us be spot on with the targeting, and the leads Skio comes in contact with will be of much higher quality than those it runs Facebook ads to.

Skio can use this list in combination with the techniques described in the cold outreach section of this post. Of course, it can also run Facebook ads to generate even more sales leads (which it is, in fact, currently doing), but for the purposes of this post, we wanted to show how Skio can use our frameworks to decide on one main acquisition channel.