Venture-backed fintechs raised a record $30.8 billion in the second quarter of this year, up 30% over the same quarter last year. And they’re raising more, and faster, than ever — the average deal size stands at $47 million this year.

So, with fintech founders now sitting on mountains of cash as a result, just how are they spending it all?

Unfortunately, data across private and public companies generally doesn’t show discernible trends in how these dollars are spent. That said, perhaps some answers to the question of how well capital can be allocated are hiding in plain sight.

Looking to the leaders

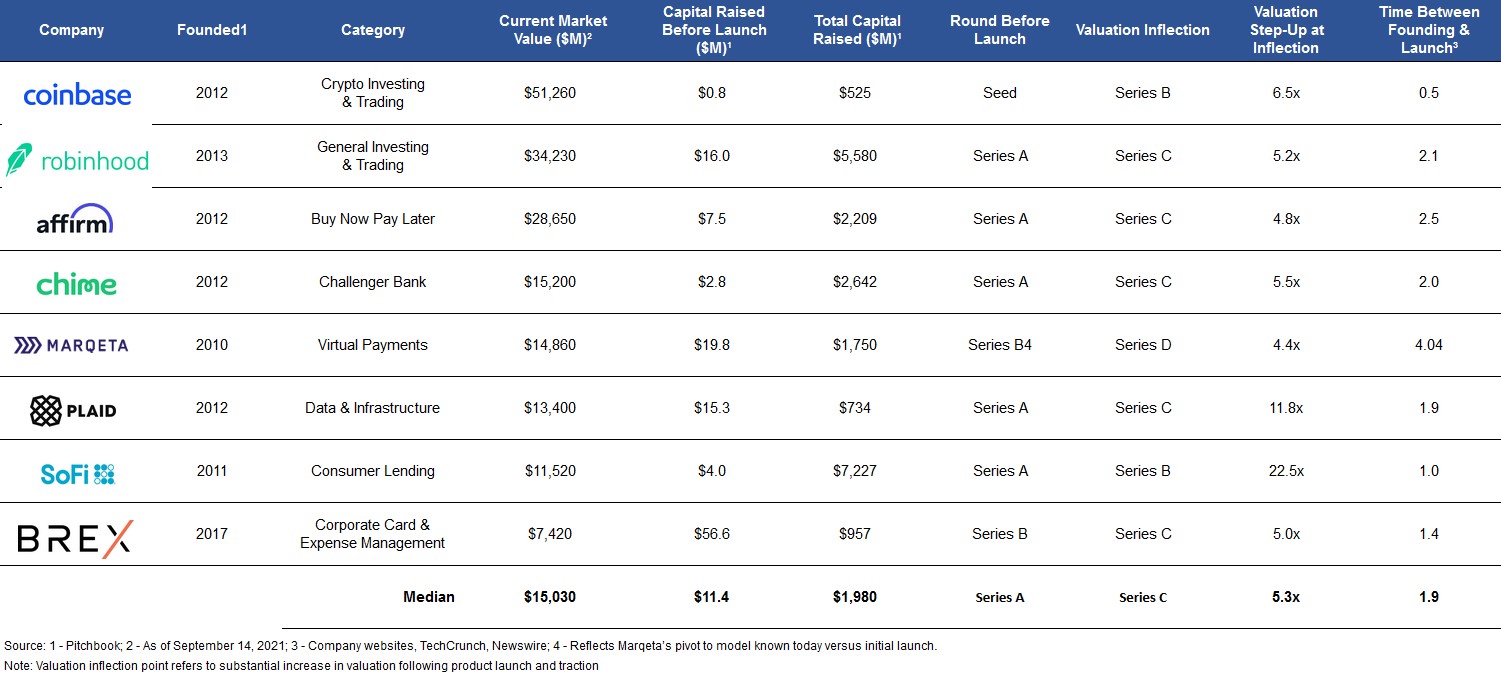

There are now a slew of fintech startups approaching or far surpassing $10 billion in value — the table below has a selection of the most prominent — so we can glean some insight into their capital allocation strategies by considering how they have spent to achieve their position in the ecosystem. Some may argue that the differences in business models among these companies, their disparate markets, and studying a ten-year span of capital raising might make it challenging to extract any relevant insights. But their fundraising and business building behaviors indicate otherwise.

Studying this selection of fintech “leaders” can give us core takeaways on how they have funded and built their businesses. Most of these companies built their business over the course of two years before launching their product and scaling rapidly with limited capital, sometimes even before a Series A — quite a departure from what’s happening in today’s fundraising environment.

Many of these companies nurtured early champions of their product in both customers and distribution partners, which allowed them to grow and scale without needing to sell to enterprises. All of them eventually raised monster rounds — at an astounding 174x multiple of the capital raised before launch — but they waited to do so until after their product had already been adopted by the market.

All of these businesses share three common traits.

Tech and VC heavyweights join the Disrupt 2025 agenda

Netflix, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just a few of the heavy hitters joining the Disrupt 2025 agenda. They’re here to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch Disrupt, and a chance to learn from the top voices in tech — grab your ticket now and save up to $600+ before prices rise.

Tech and VC heavyweights join the Disrupt 2025 agenda

Netflix, ElevenLabs, Wayve, Sequoia Capital — just a few of the heavy hitters joining the Disrupt 2025 agenda. They’re here to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch Disrupt, and a chance to learn from the top voices in tech — grab your ticket now and save up to $675 before prices rise.

A valuation inflection point

Despite having different business models, end markets, and being founded at different times, this sample showed a consistent valuation inflection point. Generally, these companies launched their product just after the Series A, used their Series B to pour fuel on the fire, and then hit a 5x valuation uptick at the Series C.

For the majority, building a strong product over the course of a couple years before launch allowed them to scale rapidly shortly after launch. Plaid had over 10 million users within six months of being launched, and Brex had over 1,000 businesses in its first year of onboarding customers. This substantial traction was a clear indication of product-market fit, as they spent the little they raised through the Series A to build a solid product, and then scaled using proceeds from the Series B.

It wasn’t until after these companies launched their products and identified champions that they raised substantial capital to fuel the virality.

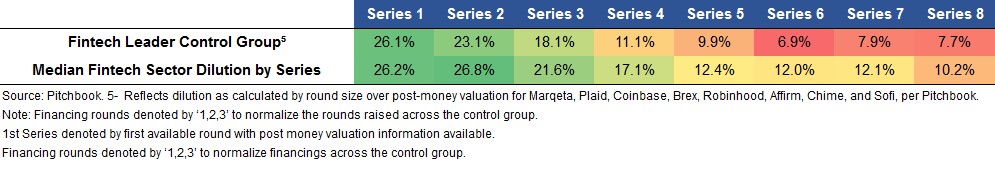

Even when it came time to raise larger rounds, though, these companies executed with less capital than their peers. In fact, median data on up to eight subsequent rounds raised indicates this selection of leaders raised less in every single round, and on average, sold 3% less of their companies across these eight funding rounds.

Data further indicates this frugality did not end at the growth stages of these startups either. Coinbase didn’t even raise capital at IPO — bold in a world where equity raised at public exit can be important to meet the demands of public investors. Brex, for its part, did not sell more than 6% equity after its Series C, a stark contrast to the enormous amount of capital raised by competitors such as Ramp.

Exceptions to this prudence were companies with material capital needs due to a credit or lending-based product offering – specifically Sofi and Affirm, which had models that require variations of debt and equity to sustain balance sheet requirements for lending products.

Frugality drives innovation

All these eight businesses were frugally built in their own times, and certainly by today’s standards. Marqeta thrived during its time of austerity — the company moved to a weekly budget before its 2015 pivot and then proceeded to double revenue every year through its IPO. Despite iterating over three business models, the company maintained a Spartan mindset and ultimately landed on the groundbreaking issuer-acquirer model we know today.

Of particular note are the smaller rounds raised by each of these platforms while they were heads-down building product. There was no hype for Brex to take on the big banks, because it couldn’t be done. There was no way a cryptocurrency trading platform could be a $100 billion company. Banks would never allow Plaid free access to consumer accounts. The $100 million-plus rounds just weren’t accessible for these companies at the time. Further, more capital invested into certain models did not materialize into higher revenue scale among competitors or even larger barriers to entry.

Moreover, a vast majority of these platforms were not even first movers in their respective categories. Their market dominance today is downright impressive when you consider the catching up they had to do with their limited capital pool. Founded in 2009, Simple had a three-year head start on Chime and access to BBVA’s balance sheet after raising almost $16 million, but never reached the scale that Chime did, and was eventually wound down. Finicity had already raised $80 million by the time Plaid was founded in 2012, according to PitchBook data, and Robinhood exploded onto a scene already occupied by eToro, among others.

Fundamentally, the multi-year head starts and nine-figure capital cushions raised by first movers did not guarantee success. While category creating narratives exist — like Marqeta and Affirm — the mixed outcomes from this fintech control group present a clear message: Capital raised and early entry do not equate to market leadership and may not replace the innovation derived from the pressures of frugality.

Growing with champions

A large part of the success of many of these fintechs was identifying a champion early on and growing with them. The most obvious example is Marqeta’s contract with Square, which now represents a $357 million annualized revenue account that’s only growing.

Similar success stories played out across models: Just a year into launch, Affirm’s partnership with Shopify in 2015 turbocharged its growth across merchants, and Brex’s champion in Y Combinator helped it access and gain credibility with hundreds of startups that fueled its adoption. For SoFi, the founder’s alma mater, Stanford University, enabled a beta test that would help the company form over a hundred university partnerships within a few years of founding.

Though seemingly obvious, nurturing early champions in customers or distribution partners was integral to the rapid adoption, scale and ensuing valuation inflection point for these fintech giants. Leaning into this natural growth component of fintech or scaling with the growing payment and transaction volume of customers, has enabled some corners of the category to trade at 20x-plus forward multiples in public markets.

Show them the money

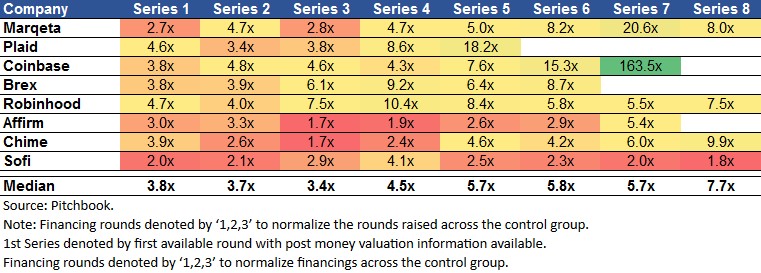

Of course, nothing drives a point home like cold, hard returns. From all of this, the most impressive outcome is the money-on-money achieved by these fintech leaders across stages.

After their initial financing rounds, median dollars returned on invested capital was consistently above 3.4x and hit north of 7.5x with the successful exits and last rounds of Marqeta, Robinhood, Chime and Sofi. When compared to the S&P 500’s average 10-year return of 14%, these figures are positively astounding. With a return profile like this, it’s no wonder that fintech hauled in $30.8 billion in the second quarter of 2021.

Naturally, the broader data set has a few outliers. Nothing can replicate the right-time-right-place positioning of Coinbase headed into its IPO and the staggering 163.5x return on invested capital at exit. And Sofi’s lower return on investment reflects an inherently more capital-intensive business.

That said, in a world where public and private markets are rational, the consistent strength of the return on investment throughout these startup lifecycles might just speak to how efficiently these companies’ have deployed capital across stages.

While this money-on-money outcome may not serve as a true proxy for business fundamentals such as recurring revenue or unit economics, the consistency and magnitude of these returns craft a compelling narrative. Frugality is as woven into these companies’ DNA as the technology driving their rise to the top.

Takeaways

These historical data points could be just that, historical, particularly in today’s ever-changing innovation economy. However, the conclusion remains the same and is even more relevant today, with investors and founders chasing massive outcomes to accommodate for rising round sizes and increasing valuations: Dollars may buy growth, but they can’t guarantee a good business.

One thing is clear, though: A disruptive idea, an unyielding founder and a product built for a terrific customer outcome are the core pillars of success. That invaluable combination isn’t something a splashy headline and a $100 million round can buy.

Disclaimer: views are my own and may not reflect those of SVB Capital.