Global fintech funding totaled $15 billion in the first quarter of this year, growing 55% from the fourth quarter, according to CB Insights’ latest State of Fintech report.

While this generally may seem like a win, it’s important to note a few things. First, 2020 and 2021 were unique years where investment in fintech broke records. By comparison, fintech funding amounted to $75.2 billion in all of 2022, down 46% compared with a staggering $131.5 billion raised in 2021. From the numbers for the first quarter, it’s clear that the market is working on a correction.

Second, of the $15 billion raised during the first quarter of this year, $6.5 billion of that was all Stripe. Without that raise, CB Insights said funding would have amounted to $8.5 billion, or a 12% drop in funding from the fourth quarter of 2022.

And third, if we remove Stripe’s round and stick with the $8.5 billion, when comparing this quarter to first quarters of previous years, funding is the lowest it has been since 2019.

Meanwhile, the number of deals is also down. There were 983 deals made in the first quarter, a decrease from 1,007 in the fourth quarter of 2022 and 1,629 in the first quarter of 2022.

A bright spot in the market was “megarounds,” which are deals valued at $100 million or more. These deals accounted for 61% of total funding in the first quarter, a whopping 179% increase quarter over quarter across 16 deals and a total of $9.2 billion, CB Insights reported. Following Stripe’s deal was Rippling, which raised $500 million in mid-March as Silicon Valley Bank was melting down. Notably, deal count was down, dropping 24% quarter over quarter.

Early-stage funding continued to dominate in fintech, however; for the first quarter, it hit a new high, accounting for 72% of deal share in the three-month period, CB Insights reported. Since 2019, that number has been around 65% and rising to 69% in the first quarter of 2022.

Though the United States led across all stages during the quarter, it’s worth noting that six of the top 10 fintech seed and angel rounds were invested outside of the U.S. United Kingdom–based Carbonplace, a carbon credit settlement startup, raised a whopping $45 million seed round during the quarter.

Speaking of the U.S., the region grabbed $10.5 billion in overall funding for the first quarter, which is triple the amount of funding from the fourth quarter of 2022, which was $3.5 billion, and coincidentally a five-year low. The number of deals also rebounded from the fourth quarter, up 23% to 434.

CB Insights notes that excluding Stripe’s round (recall it was $6.5 billion), funding in the U.S. was $4 billion and would have still eclipsed the fourth quarter. Drilling down into deal stage, early-stage deal share in the U.S. increased to 68%, which is a five-year high, according to CB Insights.

Meanwhile, following a steady decrease in funding dollars going into the payments sector, Stripe’s megaround helped turn this around to the tune of a 200% jump to $8.1 billion in the first quarter compared to $2.7 billion in the fourth quarter of 2022. Looking quarter to quarter, it is slightly down from the first quarter of 2022’s $8.3 billion. Meanwhile, the number of deals continued its decline, falling to 161, down from 195 in the fourth quarter. That marked the ninth straight decrease in deal volume, according to CB Insights. The increase in investment dollars was seen most prominently in early-stage deals, which accounted for 74% of the overall deals and a five-year high, up from 66% in 2022.

Other highlights of the report include:

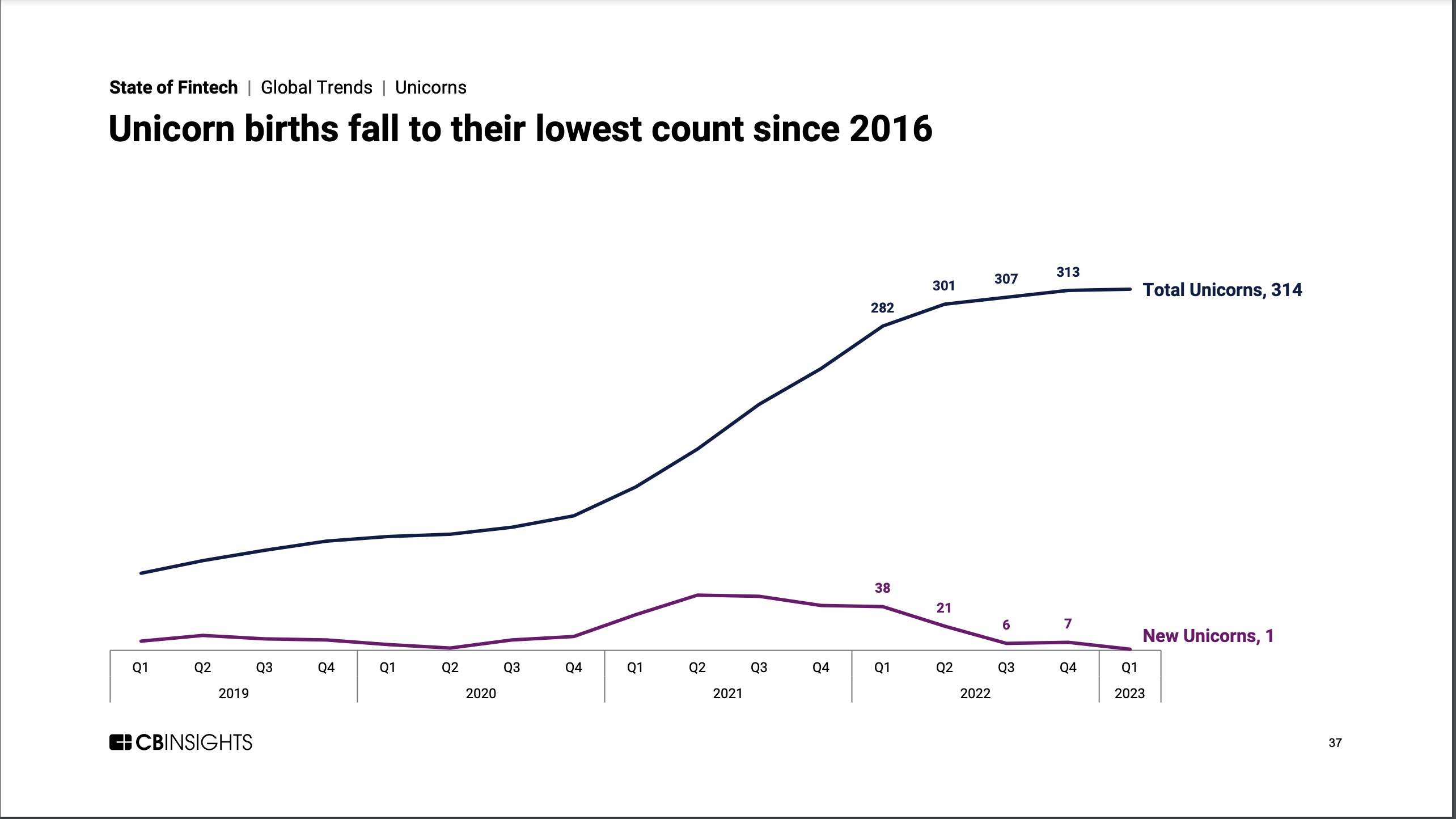

- There was just one unicorn birth in the entire quarter. This is the first time that has happened since the end of 2016. The only unicorn born in Q1’23 was Egypt-based MNT-Halan, which in early February raised $260 million in equity financing at a $1billion valuation. But overall, according to CB Insights, the total fintech unicorn herd still stood at 314 in Q1’23, up 11% YoY.

-

Image Credits: CB Insights - Fintech M&A exits rebounded, but not as much as one might have expected. They were up 15% QoQ to 172 deals. Most of Q1’23’s top M&A deals involved fintechs based outside of the U.S. For the first time in the past year, the top M&A valuation fell below $500 million.

- Banking funding dropped a whopping 64% QoQ to just $500 million in Q1’23, the lowest total since the second quarter of 2017, when banking funding totaled $300 million. This plunge marked the largest quarterly funding drop across all fintech categories. Compared to Q2’21’s record high of $8.2 billion, banking funding was down a staggering 94% in the first quarter. Deal count also slid, declining 16% QoQ and 63% from Q2’21’s record high of 139 deals.

- Total funding for Asia dipped 33% quarter-over-quarter to $1.8 billion in the first three months of 2023, marking the lowest since the fourth quarter of 2017. Deals also fell 18% QoQ to 195. Asia early-stage deal share grew by 7 percentage points from 2022’s year-end share to reach 78% in the first quarter, marking a five-year high. Out of Asia’s top 10 equity deals, one went to an early-stage startup, Indian insurtech InsuranceDekho, which raised $150 million in February.

- Canada was the only region to see late-stage deal share fall to 0%. Also, Canada funding remained flat at $300 million quarter-over-quarter, while deals decreased by 44%. Nine of Canada’s top deals in the first quarter went to early-stage companies. Crypto and blockchain infrastructure firm Blockstream secured the top deal — a $125 million convertible note.

Want more fintech news in your inbox? Sign up here.

Got a news tip or inside information about a topic we covered? We’d love to hear from you. You can reach me at maryann@prod22.techcrunch.com. Or you can drop us a note at tips@prod22.techcrunch.com. Happy to respect anonymity requests.

Comment