As tech companies large and small shed staff in hopes of better aligning their income statements to a new market reality, it’s clear that cutting costs to delight investors is the new norm. But there are other ways to make the investing public happy, including smashing growth and profitability expectations.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

That’s what UiPath did last week when it reported its trailing financial performance, which included a top- and bottom-line beat compared to analyst expectations. Its shares soared.

It turns out that while slashing staff, curtailing projects and treating cash with more respect is fashionable among tech companies and many of their customers today, there’s a wrinkle in the trend. One way to make your staffing cheaper is to reduce it. Another is to make it more productive, making your spend more effective on a per-dollar basis.

That’s where UiPath and the larger automation market — robotic process automation, or RPA — may have an edge on other software categories. Last month’s positive earnings report from Appian and the lengthy discussions of its automation work during its earnings call underscored that tech companies see strong demand for automation help.

There’s even more data on the point we’ve been chewing on. A recent report on software spend from Battery Ventures that we previously discussed contains even more bullish data.

Tech and VC heavyweights join the Disrupt 2025 agenda

Netflix, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just a few of the heavy hitters joining the Disrupt 2025 agenda. They’re here to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch Disrupt, and a chance to learn from the top voices in tech — grab your ticket now and save up to $600+ before prices rise.

Tech and VC heavyweights join the Disrupt 2025 agenda

Netflix, ElevenLabs, Wayve, Sequoia Capital — just a few of the heavy hitters joining the Disrupt 2025 agenda. They’re here to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch Disrupt, and a chance to learn from the top voices in tech — grab your ticket now and save up to $675 before prices rise.

In short, sure, everyone wants to save a buck on their software spend. But if your startup is building tech to automate tasks and drive quick productivity gains, you might be able to duck the downturn. Let’s talk about it.

What UiPath and Appian can teach us

UiPath went public back in 2021, priced at $56 per share. It started its life worth nearly $80 per share before dropping to a 52-week low of $10.40 over the last year. Given that incredible value shedding, you might think the company was in poor repair. Not really.

UiPath went public back in 2021, priced at $56 per share. It started its life worth nearly $80 per share before dropping to a 52-week low of $10.40 over the last year. Given that incredible value shedding, you might think the company was in poor repair. Not really.

In its most recent quarter, UiPath revenue came in at $308.5 million, up 7% compared to the year-ago period. For the full year, UiPath revenue grew 19%. The figures would have been 12% and 27%, respectively, if currencies had held steady. More importantly, its annual recurring revenue — ARR, a revenue metric popular with modern software companies — grew 30% last year in unadjusted terms.

UiPath’s Q4 results beat analyst expectations and — thanks in part to projecting revenue growth of around 18% for the new year — picked up a good chunk of value. But it was not alone in riding automation to a well-received set of earnings.

Appian also plays in the automation space. In its own Q4 report, which bested revenue and income expectations, Appian repeatedly mentioned automation. The subject also came up during its earnings call, when it noted that some of its longer-standing customers were using its process mining and automation tools in recent months to try and do more with less. Appian CEO Matt Calkins said that a customer that used its automation tools in Q4 2022 would “save hundreds of thousands of labor hours annually” thanks to that work.

This is just a taste of market data, but well-received financial performance sitting next to corporate notes about how customers use process automation to save time and money? That doesn’t feel like a coincidence.

It’s not.

What the buyers are saying

RPA is in the enviable position of seeing sustained demand. That demand was clearly boosted by COVID, which sped up digital transformation. But for some sectors, that wave came and went. Not for automation: Boosted demand is still here. Or, more precisely, it’s back now that companies are seeking to do more with the same amount of resources.

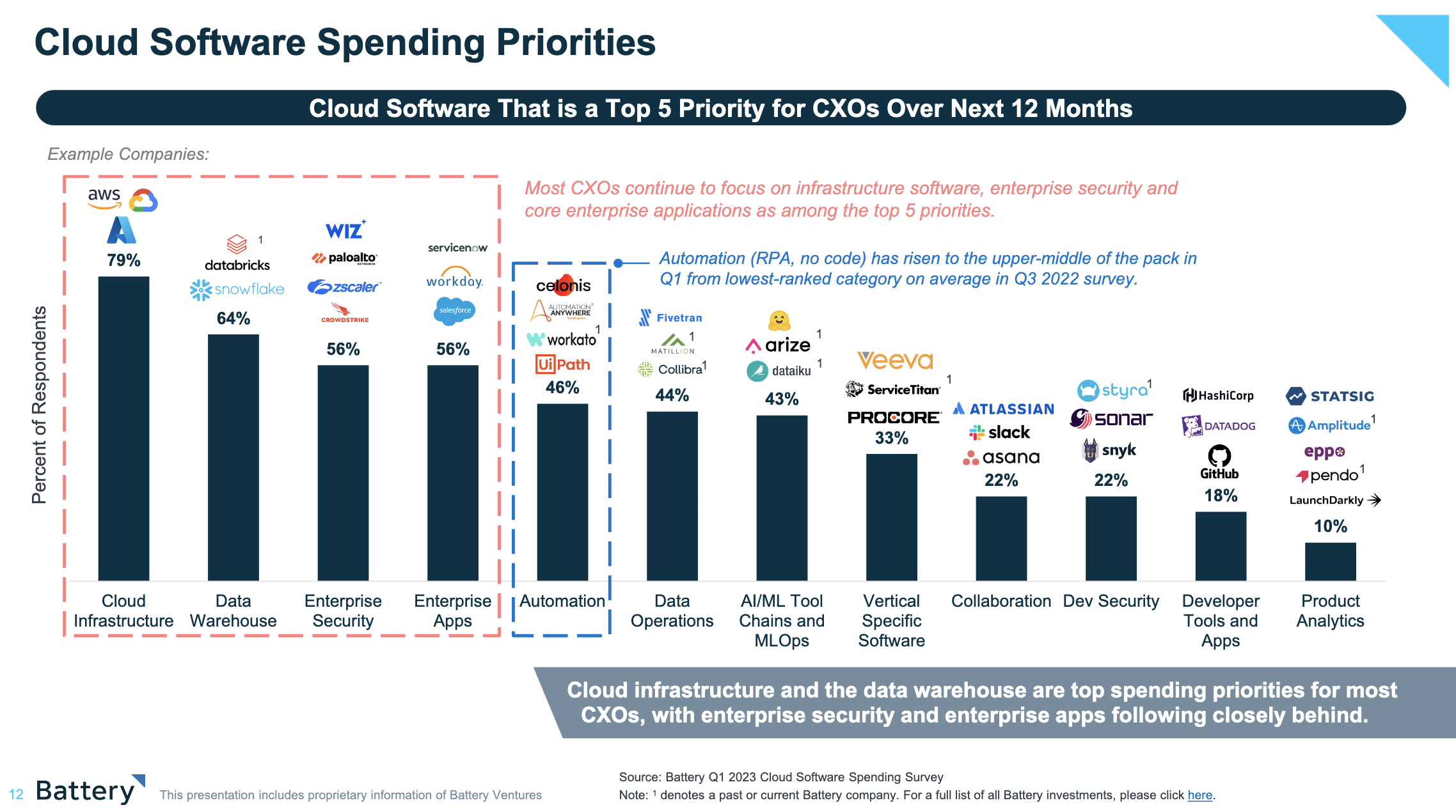

Battery Ventures’ state of cloud software spending report has an interesting data point on this: It shows that among cloud software spending priorities, automation — including RPA and no code — “has risen to the upper-middle of the pack in Q1 from lowest-ranked category on average in Q3 2022 survey.”

Battery’s report is based on a sample of CXOs it periodically surveys about their cloud software spending. In Q1 2023, 46% of respondents mentioned automation as one of their top five priorities, which is definitely noteworthy. (Although we understand that it is less than in August 2022, where it added up to 58%, the VC firm points out that it has increased compared to Q3 2022 findings we couldn’t immediately access.)

Renewed demand for RPA seems to confirm that the sector still has space for growth.

When our own Ron Miller surveyed investors on the sector in 2021, several of them said that the category was still in its early days and showing promise.

“RPA adoption is still in its early infancy when you consider its immense potential. Most companies are only now just beginning to explore the numerous use cases that exist across industries. The more enterprises dip their toes into RPA, the more use cases they envision,” CapitalG general partner Laela Sturdy, a UiPath backer, told TechCrunch+ at the time.

Wider adoption of RPA also creates new problems for startups to address. For instance, RPA Supervisor raised a Series A round last year to “solve real problems that were plaguing RPA operations,” its CEO said.

While RPA isn’t always easy to implement and run, companies are still keen to do so. This generates tailwinds for RPA providers, especially those who can focus their pitch on efficiency. “Our platform offers an effective solution to reduce the total cost of ownership of an automation program, thus making it very appealing in times of economic uncertainty when enterprises are asked to do more with less,” RPA Supervisor CEO Erik Lien told TechCrunch’s Kyle Wiggers a few months ago.

So what?

What’s fun about all the above is that the automation industry is not done. It’s just getting started. Sure, existing technologies have a good bit of room to run, but what comes next could be super cool. And even better, with AI tools improving rapidly, there could be ample room in the automation market for startups to make an impact.

Here’s Appian CFO Mark Matheos during its earnings call on the impact of AI and automation coming together, with some caveats thrown in (edited and condensed by TechCrunch+ for clarity):

AI has broken through in a big popular way lately. And I think there’s still a vast misunderstanding about where it can really add value. I’ll repeat the long-standing belief that AI belongs lower in the stack than most people believe. I think AI is going to be at its greatest value when it is coordinated [with] other decision-makers, which is to say when work is routed and balanced among a portfolio of decision-makers of which AI is only one and not the final decision-maker.

If you believe that, then you believe that process automation is a really essential part of leveraging AI as a valuable part of work because you can’t stand alone. You can’t just delegate your decisions to AI, you need to balance it, check its work, review it, approve it, that sort of thing, which means that AI is part of the orchestra and the orchestra needs a conductor. So I think that in the end, AI adds a lot of momentum to the process automation industry, and I think that it’s going to elevate us. But in the meantime, people have to shake out their understanding of what AI can really do.

That last bit is where startups might find some interesting work to be done. Mix together sustained market demand for a known, if slightly aging, category like RPA and new tech like AI that has yet to fully mature? That’s startup heaven. We have our eyes out for which new tech companies will take advantage of the moment.

Given how many Y Combinator companies in the current batch are said to be using AI tooling, well, we might get a look sooner rather than later concerning which companies are the ones to watch.