Conventional wisdom around AI investment suggests artificial intelligence should be red hot right now with dollars flying at startups building with AI, akin to what was happening last year with web3 and metaverse companies. Well, guess what? According to a new report from CB Insights, conventional wisdom is wrong — dead wrong.

AI has been around for decades, but only recently have we seen a resurgence of interest in the sector with the release of OpenAI’s ChatGPT at the end of last year. Microsoft and Google soon followed with their own intelligent, natural language chatbots.

Since then, cloud infrastructure companies have been making various announcements related to providing the resources that companies need in order to build their own large language models. Meanwhile, enterprise companies like Salesforce, Box, ServiceNow, Zoho and many others have announced generative AI products.

With all these big companies involved, it seems inevitable that startups related to AI should be launching out of the woodwork with investment dollars not far behind. It appears to be the technology everyone wants, one that’s smack dab in the middle of a major hype phase at the moment.

So where’s the investment?

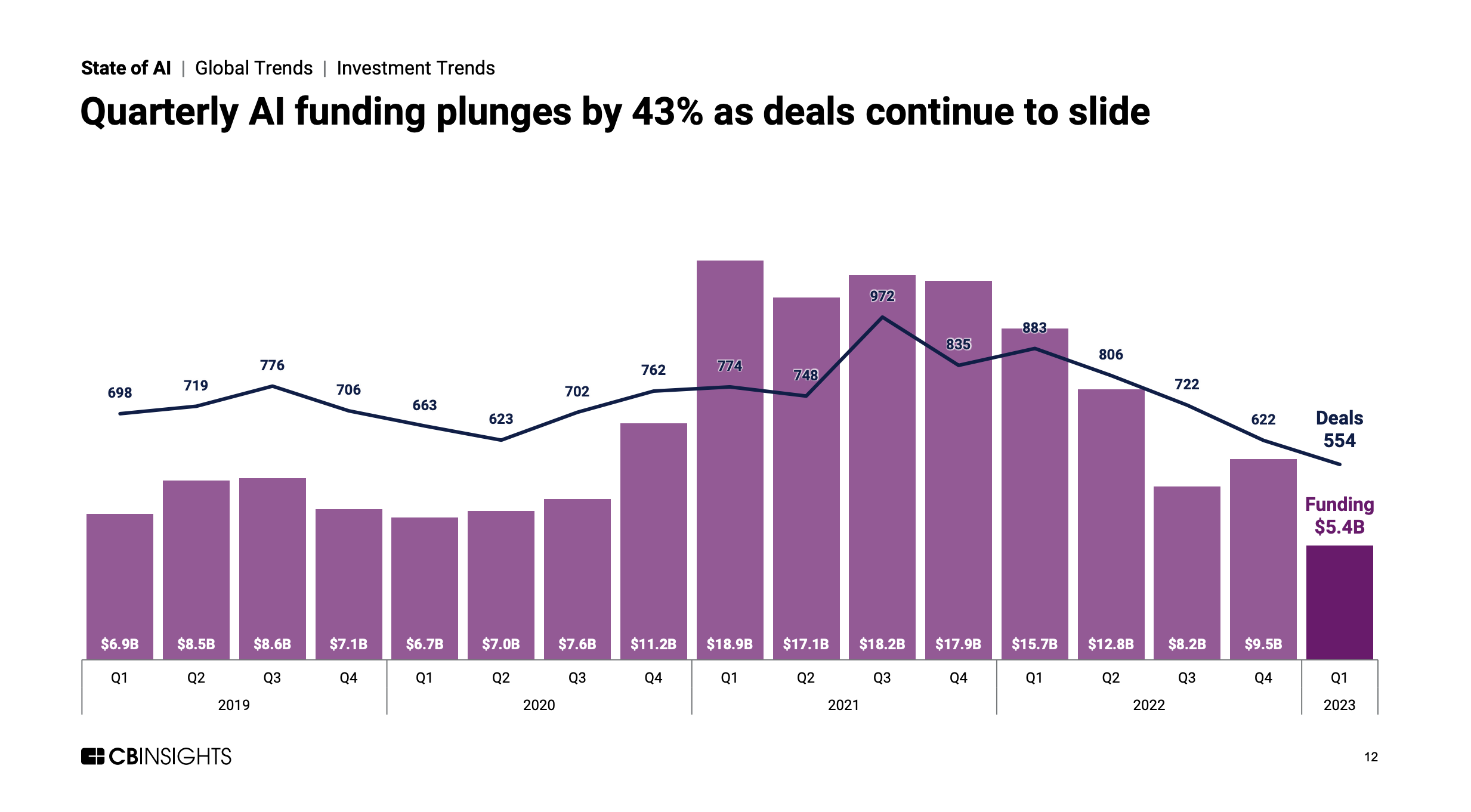

According to CB Insights Q1 2023 investment data, the investment’s not there yet. In fact, it’s downright listless: AI startups altogether raised $5.4 billion in the first quarter, 66% less than they had a year earlier. The number of deals also fell 37% to 554. That’s not supposed to happen in a frothy market.

Here’s a chart from CB Insights’ report to illustrate the dearth of deals and capital going to AI startups in the first quarter this year compared to prior years:

But one chart can’t tell the whole story, of course. We decided to dig into the numbers to try and explain this seemingly paradoxical report.

What exactly is going on here?

Matthew Marwick, who works in the Intelligence Unit at CB Insights, says part of the problem is related to the general slowdown in venture investing that we’ve seen over the last year. AI, in spite of the hype cycle we find ourselves in, isn’t exempt.

“Like with the rest of the venture space, money poured into AI from all angles in 2021 and we’re still seeing the come-down from that as economic conditions soured. While the growing excitement around generative AI is already translating into real dollars being invested — including several $100M+ mega-rounds in Q1 2023 — it wasn’t enough last quarter to make up for falling global investment in AI companies more broadly,” Marwick told TechCrunch+.

But we could start to see this change in the coming quarters as investment begins catching up with the enthusiasm, he said.

“It’s common for there to be a bit of lag between a burst of excitement about a tech and subsequent investments — some deals can be in motion for months before actually closing. In generative AI’s case, investment momentum is still growing, and we expect this to be more pronounced in the Q2 2023 venture numbers,” he said.

That said, he cautioned that we shouldn’t expect a return to 2021’s frothy investment market anytime soon. “A return to the sky-high funding levels seen in 2021 is probably off the table for now, but it wouldn’t be surprising if Q2 comfortably outperforms Q1 for AI funding and deals.”

Macroeconomic factors could explain why investors are moving more carefully than you might expect. “Economic conditions are definitely dampening venture investment broadly (and by extension, AI investment). Given these conditions, venture deals are simply a less inviting prospect in terms of risk vs. reward — especially for the nontraditional venture investors that helped push activity in 2021 up so high. The generative AI boom will probably lure some of these investors back, but others will remain wary of being swept up by a gold rush mentality.”

What’s up with AI, anyway?

With CB Insights’ report in hand, we decided to dig more deeply into the data.

The dataset is global, so the above headline numbers are for all AI startups everywhere. Given that the current venture slowdown is not being experienced evenly around the world, we should expect to see variations between countries. The data backs up that view, with American AI startups raising $3.7 billion in the first quarter, 27% less than what we saw in Q4 2022, and 60% less than Q1 2022’s total of $9.4 billion. The global figure, in contrast, is off a sharper 43% compared to the final quarter of last year.

Narrowing our view, AI-focused venture funding in Silicon Valley, a single American region, improved in the first quarter: Capital raised by AI startups in Silicon Valley rose 41% compared to the final quarter of 2022, dollars sourced from 20% more deals to boot. Compared to year-ago totals, however, even Silicon Valley’s AI totals are down.

From a very high level, it makes sense that AI-focused venture capital is in decline, because all venture activity is in decline, as Marwick pointed out. Would it be more bullish to see, say, a flat number in the first quarter when compared to Q4 2022 venture activity for global AI startups? Heck yes, but that might not be the right metric to tune for.

This decline is less surprising than it first seemed, especially if we consider both the inertia that a global venture slowdown brings to investment totals in any technology subcategory, and the fact that generative AI is so new that many companies are just starting to build with it.

But that doesn’t mean we should dismiss the numbers simply because the U.S. market seems to be comparatively well-financed. The global picture matters, too.

That’s because the entire world will benefit from AI tooling. Yet, startups in the United States raised nearly 70% of all the capital that went to AI startups in the first quarter. Europe saw just $1 billion, and Africa, Asia, Latin America and Australia together raised less than $1 billion in the quarter.

Sure, OpenAI and other leading lights in the space are U.S.-based, but it isn’t very encouraging to see other markets raise little more than pennies. The previous VC boom brought with it some silliness, but also did a lot of work to spread venture capital more broadly.

The next chapter of the larger global startup saga, call it the Annals of AI, is not starting off on very equitable footing.

Still, there are reasons to be optimistic that AI-focused funding for startups will pick up both in the United States and elsewhere around the world. Data from Carta — a unicorn that helps companies manage their cap tables — indicates that valuations and round sizes are trending better for AI startups than those building with other tool sets.

That fact will naturally push more startups and founders in that direction, so we should see more founders in more places pursue AI-powered ideas in hopes of getting a bite of the capital on offer.

A lot of the downturn was predicated on the collapse of $100 million and larger venture rounds for AI startups, which we have seen elsewhere. It’s hard to match former venture capital totals when only 8 nine-figure AI-focused startup rounds were raised in the first quarter, as CB Insights reports. The last time it was that few was Q1 2019.

“Down but not out” is how we are viewing these latest AI numbers. And, like Marwick, we expect them to perk up as time passes.

Comment