The global startup community is currently enjoying a period of fundraising success that may be unprecedented in the history of technology and venture capital. While this is happening around the world, few startup hubs in the world are reveling in a greater boost to their ability to attract capital than Boston.

The well-known U.S. city is a traditional venture capital hub, but one that seemed to fall behind its domestic rivals Silicon Valley and New York City in recent years. However, data indicates that Boston’s startup activity in fundraising terms has reached a new, higher plateau, funneling record sums into the city’s upstart technology companies this year.

And, according to local investors, there could be room for further acceleration in capital disbursement.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

The Exchange wanted to better understand what’s driving Boston’s rapid-fire results, and discover if there is any particular need for caution or concern. Is the market overheated? According to local investors Rob Go from NextView, Jamie Goldstein from Pillar VC, Lily Lyman from Underscore and Sanjiv Kalevar from OpenView, things may be more than warm, but Boston’s accelerating venture capital totals in 2021 are not based on FOMO or other potentially ephemeral trends.

Instead, Boston is benefiting from larger structural changes to at least the U.S. venture capital market, helping close historical gaps in its startup funding market and access funds that previously might have skipped the region. And local university density isn’t hurting the city’s cause, either, boosting its ability to form new companies during a period of rich investment access.

Let’s talk data, and then hear from the investing crew about just what is going on over in Beantown.

A record year in the making

When discussing venture capital data, we often note that it is somewhat laggy, with rounds announced long after they are closed. In practice, this means that more recent data can undersell how a particular quarter has performed. With Boston’s 2021 thus far, all that we can say is that if this data includes normal venture capital lag, it will simply be all the more incredible.

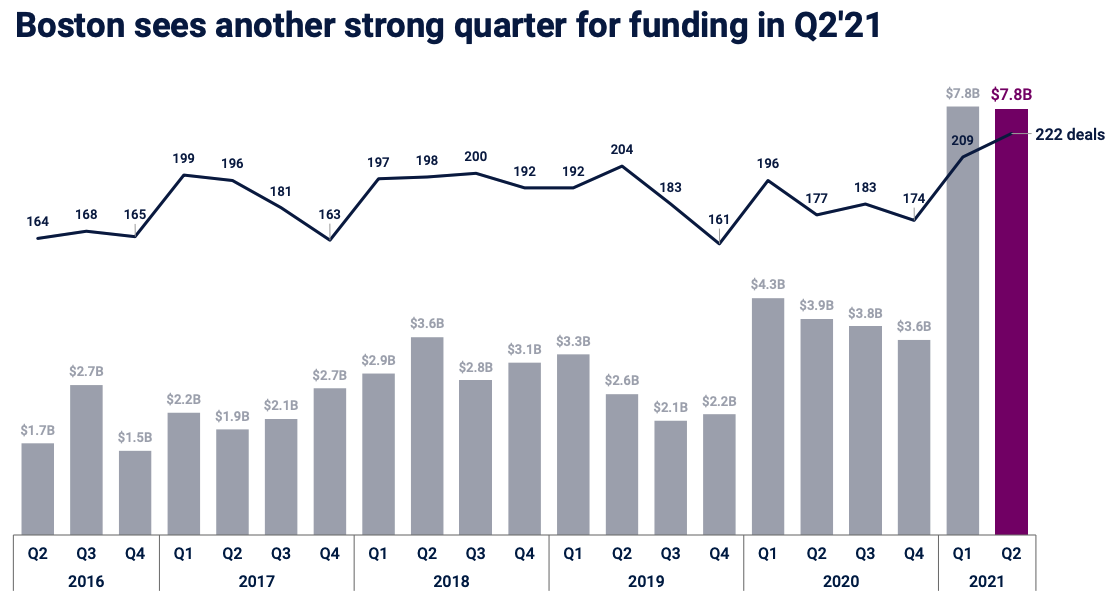

Per CB Insight’s recent venture capital report, the following chart details historical results for Boston-area startups’ fundraising:

Unlike some regions that we’ve observed this year, Boston’s venture capital results are superlative in both deal and dollar terms. Boston has seen more rounds and more dollars invested in those rounds in the last two quarters than any period we have historical data to compare to.

In numerical terms, Q1 2021 saw 81% more capital invested into Boston-area startups across 7% more rounds compared to the year-ago quarter. Q2 2021 capital invested in the city was up 100% year on year from 25% more rounds. Welcome to the good times, Boston. Sorry about Brady, though.

We’ll get into where Boston’s startup fundraising market is the strongest, and where venture capitalists say historically missing activity has been colored in. But a riff from Pillar’s Goldstein helps paint the picture of what the City of Notions’ venture capital scene is truly like.

Asked if any particular stage was weaker than its peers in terms of capital access in the city, Goldstein said that the answer depends on how we might “define strength.” Looking at PathAI’s $165 million Series C or Circle’s pre-IPO journey, “it’s hard to not conclude that late stage is very strong,” he said, but rhetorically asked if those results are truly stronger than “a seed company raising $9 million at $20 million [pre-money valuation] when a year ago they may have raised $4 million at $12 million [pre-money valuation].”

Simply: The later stages of Boston’s startup market are doing well, but so are younger startups looking for smaller checks.

So, what’s driving the wave of investment?

Remote investing puts Boston on the radar

Just like Chicago, Boston startups greatly benefited from the rise of Zoom investing, our sources agreed. Now that traveling is no longer required to close a deal, VCs from other geographies are able to invest in Boston — and they do, although it’s mostly U.S. funds rather than international ones, Kalevar told TechCrunch. “I haven’t seen too many international VCs coming to Boston specifically to invest. However, I have seen a lot of California VCs, or just larger VC firms.”

Go confirmed this trend, and the fact that it is new: “We’ve seen companies in our portfolio raise rounds from West Coast funds that previously have not been active locally.”

Goldstein also took notice of California VCs’ interest in Boston and thinks that local investors still have cards to play: “A number of the seed rounds we are doing have West Coast investors, sometimes with them as the lead. While they are comfortable communicating mostly over Zoom, they like the fact that we are on the ground and able to meet the founders face-to-face and help with recruiting locally.”

Boston founders also value this relationship aspect more than their Bay Area counterparts, Kalevar said: “There’s this famous line that it’s harder to divorce your VC than your actual partner — and in Boston, a lot of entrepreneurs treat this as such.” Kalevar is currently based in California, but set to return later this year to Boston, where OpenView has its HQ. He noted that where possible, “it definitely helps to be able to meet [founders] face-to-face in a socially distant, safe manner.”

In-person advantage aside, we can’t help but think that local investors also find peace of mind in the fact that there is plenty of fish for everyone — and that is in great part due to Boston’s academic credentials.

Boston’s supply edge

Education is one of Boston’s great strengths — and this translates into deal flow, Kalevar said: “There’s a lot of great educational institutions [in Boston] — obviously, MIT and Harvard, and beyond that, a lot of other universities with really strong talent coming out of [them].”

Local VCs have already taken advantage of this; for instance, founders emerging from the Boston academic community account for more than 25% of Underscore’s portfolio, Lyman said, noting that they are no longer the only ones investing in the local university deal flow.

“With the rise of Zoom investing, the Boston academic startup community seems to be attracting even greater attention,” she said. “The talent coming out of these institutions are taking on big ideas and attracting the capital to go after them.”

What kind of big ideas, exactly? A wider range than you may think, it turns out. “There’s a lot happening in Boston, but it’s not all in one sector,” Kalevar said. Sure, “industries that tend to have relationships with those kinds of universities are doing well,” and this tends to benefit “hard tech” — from robotics with Kiva and Boston Dynamics, to deep AI and neural networks, to engineering and manufacturing software, as well as cybersecurity. But Boston also benefits from having talent in both life sciences and tech, resulting in “health-related software and services” being one of its hottest sectors, according to Go and others.

Interestingly, Go also named consumer startups as one of Boston’s strongest segments, and Lyman pointed out that Boston is often underestimated in that respect.

If you want proof that Boston’s tech scene has variety, look no further than this year’s standout funding rounds: AI was represented, with DataRobot raising a $300 million Series G, as was health tech, with Adagio Therapeutics’ $336 million Series C. But $440 million also went to cryptocurrency unicorn Circle, while Perch ($775 million Series A) and Klaviyo ($320 million Series D) are arguably both adjacent to e-commerce.

“Despite the large amounts of capital in the industry, we think Boston remains underserved,” Goldstein told TechCrunch. If he believes that Boston has “a lot of running room,” it’s because local universities “are cranking out entrepreneurs more than ever” — helped in part by lowered capital requirements thanks to computation, which “opened up the space to many more potential founders.”

These newly minted founders may also be less likely than their predecessors to leave town after starting their company, Kalevar predicted.

“In the past, Boston has maybe suffered from what I’ll call a bit of a brain drain — Facebook started in Boston and went to California, Dropbox started at MIT and went to California — and a lot of that has been due to the risk appetite of the local investors. So one of the things that I hope to see as part of COVID, with a lot of investors being very much more open to investing in Boston and other geographies remotely, is that brain drain won’t necessarily happen.”

Brain drain aside, it may also save them from suffering a premature death. “There used to be a Series A cliff where many many seed companies failed to raise a Series A. We are not seeing that in the portfolio right now,” Goldstein said.

Go seconded this perception: “One of the shortages in this market has been ample Series A and B capital and the difficulty of gaining attention from NY and West Coast-based investors. That challenge is greatly reduced with the prevalence of Zoom investing.”

While outside capital is helping solve the post-Series A challenge, Boston is also collecting fruits from the ecosystem’s long-term work on early-stage deals. According to Goldstein, “if the idea is to plant seeds in [the] early stage and those mature in five years, Boston looks solid.”

Lyman also expects recent efforts to pay off, and new capital to recycle into the system: “As Boston continues to have more and more great outcomes — there are over 80 private and public companies valued at over $1 billion in the Boston area — I look forward to those experienced operators reinvesting that success in the form of time and capital as angels.”

One impact of more investors paying attention to Boston’s startups has been the closing of the valuation gap that the city’s tech upstarts previously had to endure. Per OpenView’s Kelevar, “the geographic discounts have gone away.” That means that Boston startups no longer have to take a valuation cut to stay put.

With the valuation gap fading, are Boston-area startup valuations rising? Yes, and rapidly.

What about valuations?

Lots of capital flowing into fractionally more rounds means that the average deal size in Boston is going up. The median too, we reckon. As you can imagine, the result of the market dynamic is rising prices for startups, translating into ever-larger post-money valuations.

Here Boston is not unique; instead, it is a constituent player in the larger market, surfing the same wave as other ecosystems. So the risks that we may see in Boston are not specific to its results, though they may still have an impact.

We asked our investor panel about local valuations, specifically around how sane they may or may not be. Underscore’s Lyman said that “sanity” is “hard to anchor when it comes to valuations” today “as the data shows what feels beyond sanity has now become ‘market.’”

But there’s some reason for that. The investor added that the venture capital industry is “experiencing valuations that indeed far exceed what we’ve seen in the past due to more capital available and bigger upside with larger total addressable markets than anticipated” before.

This matches The Exchange’s prior work decoding rising valuations, and how investors anticipate being able to match prior returns. In short, long-term growth expectations have risen as TAM estimates have grown; longer, steeper growth curves imply greater valuations down the road, allowing for price inflation among startup funding rounds. At least in theory.

Lyman agreed, saying that “in this climate, expectations on pace of growth have also risen.” She added that while the “Boston ecosystem has traditionally been branded as ‘slow and steady,’ [with] growth rates and solid underlying economics as the path to [building] iconic companies,” the city’s startups are seeing their pace of growth accelerate. Today’s Boston startups may not be growing as fast as those in San Francisco, but they are now comparable to upstart tech companies in New York City or LA, she added.

The valuation explosion is not all bad news. There’s a lot of upside in the funding craze for early-stage investors. Pillar’s Goldstein told The Exchange that in his firm’s most recent letter to its LPs, they called “the current pricing environment ‘nuts,’” adding that his firm is largely benefiting from the market change.

Why? Per the investor, “six of our first 24 companies have already reached unicorn status.”

Rising prices are not all good news for early-stage investors, however, with Goldstein noting that the price inflation present in the later stages of startup investing is “starting to affect the earliest stages as well,” leading to checks that might have been $250,000 pre-seed deals becoming $3 million to $4 million transactions.

If there is a larger valuation crunch, Boston will be impacted. But perhaps not more than other markets around the world. So Boston is getting more of the upside than some markets, at the expense of what could be just average downside risk. That’s a winning trade.

What’s ahead?

NextView’s Go doesn’t see a slowdown in Boston’s future, calling the fundraising market “definitely sustainable.” He argued that in “addition to overall new company formation” that could lead to more deals getting done, “there are quite a few growth-stage companies that are accelerating quickly, and will likely announce significant financing rounds in the coming months.”

His “bet is that H2 funding dollars will be higher than H1,” which caught our eye.

Lyman said that her firm is “feeling the heat and leaning in” to the whirlwind environment. Underscore is “buckling up for several more quarters of operating at breakneck speeds,” though she did add that her firm does expect “some form of market adjustment” in the “midterm,” though she was hesitant to say when that correction might come.

So it’s full speed ahead for Boston, with little on the horizon beyond continued strong results in venture capital terms or some form of acceleration. We’ll have Q3 data in a little over a month, but given all that we’ve heard, we have a guess what the data will eventually show.

Comment