It’s usually third-world countries that frequently say they’re experiencing a “brain drain” — the bleeding of talent to other countries or parts of the world. But it seems now the United States is the one seeing talent fleeing to other parts of the world, at least as far as blockchain developers are concerned.

The number of blockchain developers in the U.S. has declined every year since 2017, according to a recent report by Electric Capital. While it’s arguably a bad signal for American innovation, it also points to a globally growing remote crypto ecosystem and workforce in a post-COVID world.

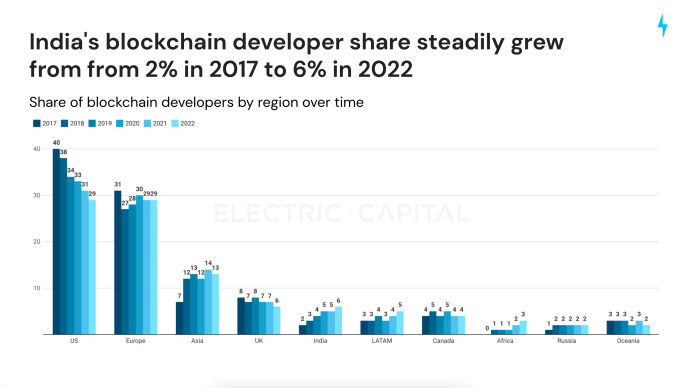

According to the report, the U.S.’ share of blockchain developers has fallen 2% per year in the last five years, dropping to 29% last year from 40% in 2017.

“The question is does it matter and why,” Paul Stavropoulos, CEO of credit-focused platform bridging the Web 2.0 and web3 worlds Archie Finance, told TechCrunch+. “The first and most important thing is overall growth of the ecosystem. That has been constant, which is fantastic, but it’s not good that the U.S. is losing market share.”

Compared to other regions in the world, America’s drop is “a marginal difference,” Maria Shen, partner at Electric Capital, said. Europe (excluding the United Kingdom) maintained a consistent share of around 29% during the five years from 2017 to 2022.

“There’s a counterpoint where it’s not a bad thing that the U.S. is losing market share of developers, but maybe what’s important is the overall number of developers,” Stavropoulos said. “COVID has been a huge help in building remote teams; it’s no longer taboo to build a team with folks all around the world.”

Archie Finance’s engineering team is Slovenian, but it’s still a U.S.-based team, Stavropoulos noted. “It perhaps is not as important that the engineering talent stays in the U.S. as it is that the actual company’s innovation starts in the U.S. I think the scary thing is when innovation doesn’t touch the U.S. at all because of accredited investor rules or people don’t want to be jailed.”

Overall, a significant increase in the number of developers is the most important thing, Stavropoulos said.

The pie is growing

In the last seven years, the crypto industry gained over 22,000 monthly active developers, bringing the total number to 23,343 as of December, up 5% from a year earlier, the report said. About 52% of all monthly active developers began contributing in 2022, marking a big chunk of the people building today.

While the U.S. and Europe are each home to 29% of all crypto developers, regions like Asia, India, Latin America and Africa saw more crypto devs taking up the torch in 2022.

“There’s amazing untapped potential around the globe,” Stavropoulos said. “It’s also cheaper to hire extremely qualified engineers abroad.”

Startups looking to save cash and extend their burn rate might hire engineers outside of the U.S. who don’t command a $300,000 to $400,000 salaries, Stavropoulos said. “That’s justifiable and OK, and I don’t think that means the U.S. is missing out.”

Leaving for safer pastures

Crypto is a “global-first technology,” Austin King, CEO and co-founder of crypto platform Recursive, said. “So we need people across the globe building it. It’s not just like Americans are building it.”

Asia has also seen “friendlier, clearer” regulatory rules for blockchain coming from both Singapore and Hong Kong, Shen noted.

Singapore, in particular, has been leading the charge in the region. Its financial regulatory body, the Monetary Authority of Singapore, passed the Payment Services Act in January 2020, an overarching regulatory framework for traditional and crypto exchanges that put all payment-related services under one umbrella.

And other countries are fast catching up. Last month, Hong Kong proposed rules that would let retail investors trade certain “large cap tokens” on licensed exchanges, contrasting from mainland China, which outright banned crypto-related transactions.

“I’ve seen an uptick and a lot of expats coming in and building products in Asia,” David Gan, founder and general partner of venture capital firm OP Crypto, said. “A lot of these countries provide a high standard of living at low cost and a place where you can find other entrepreneurs.”

There are also more founders starting companies outside of the U.S., Shan Aggarwal, head of corporate development and ventures at Coinbase, noted.

But founders are facing potential legal risks, even when they don’t intend on doing anything wrong (but are facing mixed messages), so they’re moving to places like Puerto Rico, the Cayman Islands and Europe because there’s “more safety and comfort,” Aggarwal added.

Stavropoulos said he has also noticed a number of other crypto startups, and their developers, moving to Singapore, Hong Kong and “Cayman Islands-like destinations,” where regulation is less cutthroat.

King agreed, adding Dubai and Portugal as hubs that developers are flocking to.

“Any crypto company that has seen proactive regulation from other nation states are comparing that against the lack of productive regulation being established here in the U.S., especially with how much talent there is across the globe,” King said.

Uncertainty is bad for innovation

Tensions have bubbled up in the U.S. as major government agencies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) crack down on the crypto space, recently targeting two of the biggest crypto exchanges, Binance and Coinbase, among other big players.

That hawkish regulatory stance is dissuading entrepreneurs from risking their futures on American soil.

“Relatively speaking, there’s little innovation in a world where we don’t know what regulation is going to happen when the big boys like Coinbase are victims,” Stavropoulos said. “People are doing the bare minimum until the end of the year to wait for regulatory clarity.”

Many projects being scrutinized are “quite big, but we have to think about the regulatory setup when investing,” Gan said. “For companies being built now, it’s easily preventable, but big ones can’t switch entry points as well.”

But even though U.S. government agencies are outlining regulatory frameworks through enforcement, they’re not presenting a united, uniform front. For example, the CFTC and SEC are not seeing eye to eye on whether or not all cryptocurrencies (aside from bitcoin) are securities or commodities, making unclear waters even murkier.

“U.S. data corresponds really well to what we’ve seen on the ground: that teams are deciding that there’s a lack of regulatory clarity in the U.S. [and] there’s the beginning of regulatory clarity outside of the U.S.,” Shen said. “Still, I don’t think we can draw a straight line between developers leaving and a lack of regulatory clarity… but, for us, we think this is terrible for the U.S.”

The more the U.S. shies away from crypto, the more the rest of the world will get a leg up, Stavropoulos said.

“The opportunity is huge, but the problem is around defining the rules of crypto. The U.S. has been very difficult, because there’s so many different regulatory bodies and different approaches. Some want to regulate crypto, some don’t, then there’s the federal and state level [of legal systems], which creates a system that makes it difficult to have a unified voice for crypto regulations,” Shen said. “But I do think it’s really important for the U.S. to capture that.”

Taking the long view

U.S.-based crypto firms appear to be increasingly apprehensive about their long-term chances of survival in the States, and are contemplating whether they might have to relocate overseas to save their projects (or avoid lawsuits).

“The U.S. is still poised to capture a lot of attention if they wanted to,” Shen said. “A lot of talented teams are still based in the U.S.”

The “main consensus” is that new crypto developers are coming out of U.S.-based colleges and want to stay in the country, she added.

Stavropoulos echoed a similar sentiment: While he’s not freshly out of college, he said his company has thought about leaving the U.S. and launching elsewhere, but a number of obstacles stand in the way.

“You need to know institutions in other countries, and all of our connections are in the U.S. for better or worse,” Stavropoulos said. “And my wife is a doctor; her earning power is a fifth or fourth of what it is here. Doesn’t make sense for us to leave the U.S. even though it might be for me from a career perspective.”

To stay in the country, Stavropoulos’s company expanded its target market and took a direct step away from crypto, because “moving abroad is not an option at the moment.” Since doing so, he says the company has been “better received” and experiencing more success in creating a credit-building product in general that’s not just focused on crypto-collateralized credit.

“If you’re a developer in New York, building a crypto-based application, you can’t even beta-test it in a lot of ways, because there’s a lot of restrictions in that state,” Aggarwal said. Even compared to New Jersey, the developer experience is extremely different due to differing state laws, he added.

“You have a very different experience as a developer that’s just exacerbated if you’re in New York versus Puerto Rico or Mexico,” Aggarwal noted. “So a lot of developers are moving off-shore because they can build better products. And from a personal security standpoint, they feel more safety and comfort.”

But what scares Aggarwal in the long term is the network effect of these movements.

“If you think about how Silicon Valley started, one group of developers started a company, they saw some success, then they split off to start new companies, and then they re-congealed, right? So you see some of these emerging hubs in places like Mexico City, Dubai and the Bahamas and whatnot,” he added. “There becomes a little bit of a network effect, where if one product or project fails, you can move on to the next thing and find really talented people to work on it with.”

Going forward, at minimum, startups, founders, investors and the ecosystem must have productive conversations with regulators, King noted. “Right now, a lot of information being communicated to the crypto industry is through enforcement action. That scares away innovation.”

Comment