Tech investments in emerging markets have been in full swing over the past couple of years and their ecosystems have thrived as a result.

Some of these markets like Africa, Latin America and India, have comprehensive reports by publications and firms on trends and investments in their individual regions. But there’s hardly a report to compare and contrast trends and investments between these regions and rightfully so. Such a task is Herculean.

Well, a report released today by data research organization Briter Bridges and global inclusive tech accelerator Catalyst Fund is punching above its weight to offer a holistic representation to the darling sector of these three markets: fintech.

The report “State of Fintech in Emerging Markets Report” has three objectives — to evaluate the investment, product and inclusivity trends across emerging markets.

The team surveyed over 177 startups and 33 investors across Africa, Latin America and India. Though this sample size used is minuscule, the key findings are quite impressive.

Let’s dive in.

Fintechs have raised $23B across the regions since 2017

There’s no stopping emerging markets’ favorite. The sector has continued to receive the largest share of investments year on year for the past five years.

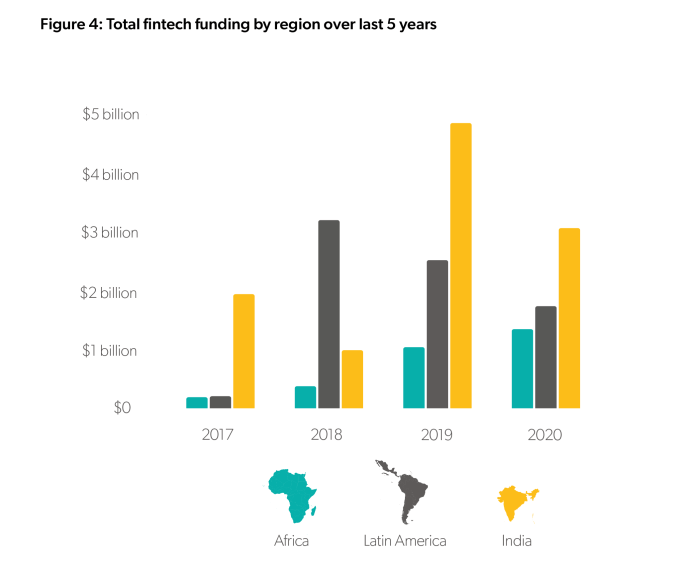

More than 300 million unbanked African adults account for 17% of the world’s unbanked population. So it’s not difficult to see why in 2019, the continent witnessed five mega-deals in Branch, Tala, World Remit, Interswitch and OPay that amounted to a total of over $775 million. While this dropped last year to $362 million, companies like Flutterwave, TymeBank and Kuda have raised sizable rounds during this period.

Latin America is home to a growing base of digital users, enabling regulation and reforms, and vibrant small businesses. Just like Africa, the percentage of unbanked people is high at 70%. Fintechs in the region have seized the opportunity and have been rewarded with mega-rounds that companies like NuBank, Neon, Konfio and Clip have enjoyed. Collectively, fintech startups have raised $10 billion in the past five years.

In 2019 alone, Indian fintech startups raised a record $4.8 billion, per the report. Then last year, the sector brought in $3 billion. Over the past five years, they have totaled $11.6 billion with notable big names like CRED, Razorpay, Groww and BharatPe, among others.

Africa’s average seed rounds stand at $1M, India and Latin America average $4M

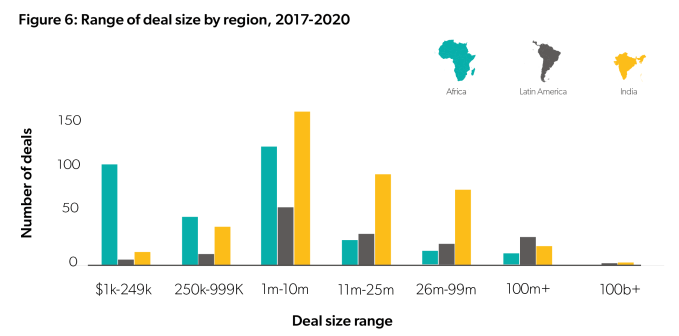

Per the report, early-stage deals in Africa have been increasing over the past five years totaling over $1.6 billion. Their average size, especially for seed rounds, has grown from $750,000 in 2017 to $1 million in 2020.

For Latin America, the average seed deal in the last five years was around $5.7 million while India did approximately $4.6 million. The report says the data for the latter was skewed because of CRED’s $30 million seed round.

Latin America is IPO-hungry, India breeds unicorns while Africa is just getting started with M&A

Last year, Stripe’s acquisition of Paystack was the highlight of Africa’s M&As because of its size and the homegrown status of the Nigerian fintech startup. Other larger rounds that made the headlines include the $500 million acquisition of Wave by WorldRemit (which happens to be the largest from the continent) and the DPO Group buyout by Network International for $288 million.

Unlike the African fintech market that has noticed mega acquisition deals and many undisclosed seven-figure deals, the Latin American fintech market is a sucker for IPOs. Per the report, fintechs in the region have several $100 million rounds (Nubank, PagSeguro, Creditas, BancoInter and Neon) and M&A activity is sparse. But a number of them have gone public recently including Arco Educacao, Stone Pagamentos and Pagseguro.

On the other hand, India has more than 25 billion-dollar companies and keeps adding yearly. Just last month, the country recorded more than eight. These unicorns range from established companies like Paytm to new ones like CRED.

Payments, credit and neobanks lead fintech activity

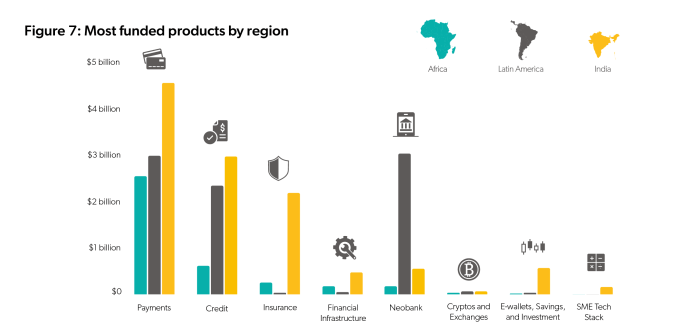

The report shows that payments companies are the crème de la crème for fintech investment across the three regions. Within that subset, B2B payments reign supreme. The next two funded fintech categories are credit and digital banking.

In Africa, payments startups have seen more investments than credit and neobanks. Flutterwave, Chipper Cash, Wave, Paystack and DPO come to mind.

Latin America’s most funded fintechs are neobanks. And it is the only region with all three product categories closely funded at $2 billion-$3 billion each. Some of these companies include NuBank, Creditas and dLocal.

India’s top-funded fintech startups are in payments. But it has notable representation in credit and neobanks, some of which have raised nine-figure rounds like Niyo, Lendingkart and InCred.

Investors are enthused about the future of insurance, payments and digital banks

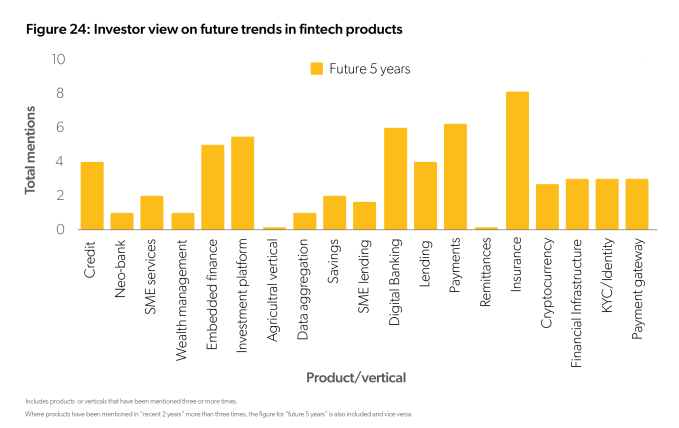

From the handful of investors surveyed in the report on their view on future trends in fintech products five years from now, most of them chose insurance, payments and digital banking models.

Investment platforms and embedded models are also areas of interest. They were less keen on agriculture and remittances while wealth tech platforms and neobanks were also ranked lower in priority. How is it that digital banking and neobanking are at two ends of the spectrum of investor choice? I can’t say for sure.

Parts of the report talk about underserved consumers in these regions and how fintech startups are serving them. It also discusses whether these fintech startups promote financial inclusion and what features and products would get them to that point.

In all of this, the glaring fact, which is no news, is that Africa is lagging years behind Latin America and India. Talking with Briter Bridges director Dario Giuliani, he pointed out that he’d lean on five years for the continent to get to where Latin America and India are at the moment. He added that what makes India a better market at this stage is because it isn’t a continent like the other markets and operations are uniform across board.

“It is easier to manage one country than 54 countries in Africa and 20 in Latin America,” he said to TechCrunch. “In Africa, we use the label ‘Africa,’ but we’re very much talking about 4-6 countries. Latin America is basically Brazil, Mexico, Argentina and Colombia who are seeing massive companies rise. India is one.”

One key detail the report mentions is that most fintechs across emerging markets are crossing over to different sectors like crop insurance, credit lines for distributors and vendors, KYC, e-commerce payment gateways, medical finance and insurance. Guiliani says he expects this to continue.

Rising African venture investment powers fintech, clean tech bets in 2020

Comment