Turning the page from the early-stage venture capital market to the super late-stage exit market, this morning we’re talking about endpoint security company SentinelOne’s IPO in the context of Sprinklr’s own. We’ll have more on the public offering market later today when Doximity and Confluent price their respective IPOs after the close of trading.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

SentinelOne’s IPO, expected to price on June 29 and trade June 30, is a fascinating debut. Why? Because the company sports a combination of rapid growth and expanding losses that make it a good heat check for the IPO market. Its debut will allow us to answer whether public investors still value growth above all else. And this week, the company gave us an early dataset regarding its market value in the form of an IPO price range. This means we can do some unpacking and thinking.

A reminder regarding why we dwell on the exit market for unicorns: We care because the value of late-stage startups when they reach a liquidity point helps set valuation comps for myriad smaller startups. Furthermore, the level of public-market enthusiasm for loss-making, growth-focused companies will determine the scale of returns for many a venture capitalist, founder and early employee.

A reminder regarding why we dwell on the exit market for unicorns: We care because the value of late-stage startups when they reach a liquidity point helps set valuation comps for myriad smaller startups. Furthermore, the level of public-market enthusiasm for loss-making, growth-focused companies will determine the scale of returns for many a venture capitalist, founder and early employee.

So, let’s talk about SentinelOne’s cybersecurity IPO price range; Sprinklr’s social-media software debut will play foil.

The price of growth

It can make good sense to pay up for a quickly growing company’s shares. This is why you may hear of a startup raising an early-stage round at a very high revenue multiple.

Why put a $50 million price tag on a startup that just crossed the $1 million annual recurring revenue (ARR) threshold? If it’s growing sufficiently quickly, the math can pencil out. If that startup was growing at 300% per year, say, the revenue multiple that you paid in the round valuing the startup at $50 million would fall sharply over the next year, at which point other investors would probably scramble to put more capital into the firm at a higher price.

Bingo! You just got a markup on your initial investment, and the company has found someone else to lead their next round at a higher price, giving it even more capital to keep its growth game going and make your early investment appear prescient. See? Venture capital is easy.1

The same general idea applies to companies going public. Growth matters, and the more rapidly a company is adding revenue, the more money it will be worth because investors can anticipate its future scale (within reason). Some companies that sport quick growth can have other issues that impact their value. Extensive debt, for example, a history of uneven growth, or deteriorating economics could come into play. Or simply very high losses.

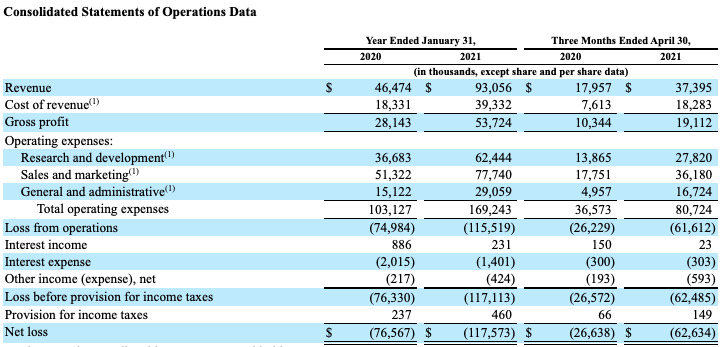

This brings us to SentinelOne. It is growing fast and losing more money as it does so. Here’s its income statement:

Don’t you just love an income statement in the morning? Gets the brain moving.

Anyhoo, what we can see here is roughly 100% growth from its year ending January 31, 2020, to the next. Even more, we can see that the company grew 108% from its most recent quarter (the period ending April 30, 2021) compared to the year-ago period. That’s speedy, and it indicates that the company’s growth is not in immediate danger of rapid deceleration.

We can also see from its net loss line (the bottom one) that the company’s deficits have also scaled rapidly. Notably, the pace at which SentinelOne’s losses grew accelerated into calendar 2021. Its net loss expansion during its most recent full fiscal year was around 54%. In its most recent quarter, net losses swelled by 135%. That’s a lot more!

To its credit, SentinelOne’s share-based compensation costs did rise sharply in its most recent fiscal year and its most recent quarter. So, if you like to discount those costs, the rate at which the company’s losses accelerated is less severe than we just stated. But the fact remains that SentinelOne is growing like a weed and at a pretty high cost.

So, what do investors think of the company’s results? They appear to love them. At a price range of $26 to $29 per share, Renaissance Capital calculates that the company’s midpoint, fully diluted valuation is $8.2 billion. That is sharply higher than where PitchBook estimated the company’s final private valuation, namely $3 billion on a post-money basis set in November 2020.

SentinelOne is set to more than double its valuation in under a year, then, thanks to its IPO. And at that $8.2 billion valuation, the firm could be looking at a valuation multiple of around 55x its most recent quarter’s revenue, annualized. Recall that in our earlier startup valuation example, we discussed an early-stage company with a 50x multiple. SentinelOne is set to get an even better revenue multiple, provided its price range holds up.

In contrast to the apparent enthusiasm for SentinelOne shares in its IPO, we have a few other companies to discuss. Zeta Global, for example, had far slower growth when it went public earlier this year. It priced at the bottom of its range and has lost value since its debut. And Sprinklr just priced its own IPO at $16 per share, under its expected range of $18 to $20, selling fewer shares than anticipated to boot.

Zeta Global grew 25% in its most recent quarter. Sprinklr grew by around 19%.

The IPO market is always a limited-data beast to track. There are only so many public offerings, and fewer that can be compared directly. So we’re always dot-connecting when we talk about the IPO window and public market appetite for one sort of company or another. But the recent message from public market investors does appear to show a strong bias toward growth, a prejudice of sufficient strength to absolve SentinelOne’s sharply expanding losses and value it in the stratosphere of revenue multiples.

Both Zeta Global and Sprinklr, for example, are losing slightly more money over time. But that slower pace of deficit growth was not enough to make their growth rates enticing.

Growth overall, then, appears to be the current IPO market theme. And that bodes super-well for the impending Q3 2021 IPO cycle, during which we could finally get Robinhood’s offering, among a host of others. Strap in!

- I am kidding.

Comment