Julio Vasconcellos

More posts from Julio Vasconcellos

“Cautious optimism” is the mood among founders and investors in Latin America today, amidst an uncertain global scenario.

In this year’s Latin America Digital Transformation Report, the investment team at Atlantico chronicles how the region leaves in its rearview mirror a decade-long boom in tech value creation. Peaking with 2021’s record $16 billion in venture funding, a nearly fourfold increase from the year prior, Latin America broke through to the world stage. But even though we saw the total funding being halved this year, the region still counts on greater investment volumes than any year prior to 2021, fueling that “cautious optimism.”

The past five years saw the birth of Latin America’s first unicorns, marking a long-awaited inflection point in the digital transformation of a region with over 650 million people.

Now, with the dust of market turbulence still settling, local players are left wondering how best to play their hand: Ignoring calls for austerity could mean squandering the gains from these golden years; yet, not capitalizing on the region’s special post-pandemic position could leave much money on the table.

In recent months, we have seen the pandemic-fueled boom in tech adoption fade away in the U.S. and other developed markets. Market darlings of the pandemic period, ranging from Shopify to Peloton, have been forced to reduce headcount as usage levels revert to the pre-pandemic historical trend line.

Distinctively, Latin America has not suffered through this hangover from digital adoption. Instead, a seemingly permanent two- to three-year gain can be observed in a wide range of indicators of tech adoption: E-commerce penetration, grocery delivery volumes and usage of digital banking and telemedicine all have continued to grow rapidly beyond 2020’s step-function gains.

Caution in an uncertain world

Uncertainty is still the order of the day in markets across the globe as tech companies and investors try to figure out how to weather the storm. After a long period of excess liquidity and low interest rates, inflation finally showed up to the party, leading central bankers to step on the brakes.

As once abundant and cheap capital becomes expensive and scarce, investors shy away from the more volatile, longer-term-growth nature of many tech companies. Globally, we’re saying goodbye to a decade-long boom in tech that peaked in 2021.

This very uncertainty looms over Latin America, a region that historically has lacked a tech ecosystem to match the scale of its own economy and acute socioeconomic needs. Beyond its large population and meaningful economy, Latin America has long been a leader in digital consumption, enabled by an internet penetration that surpasses the likes of China and India.

The case for optimism

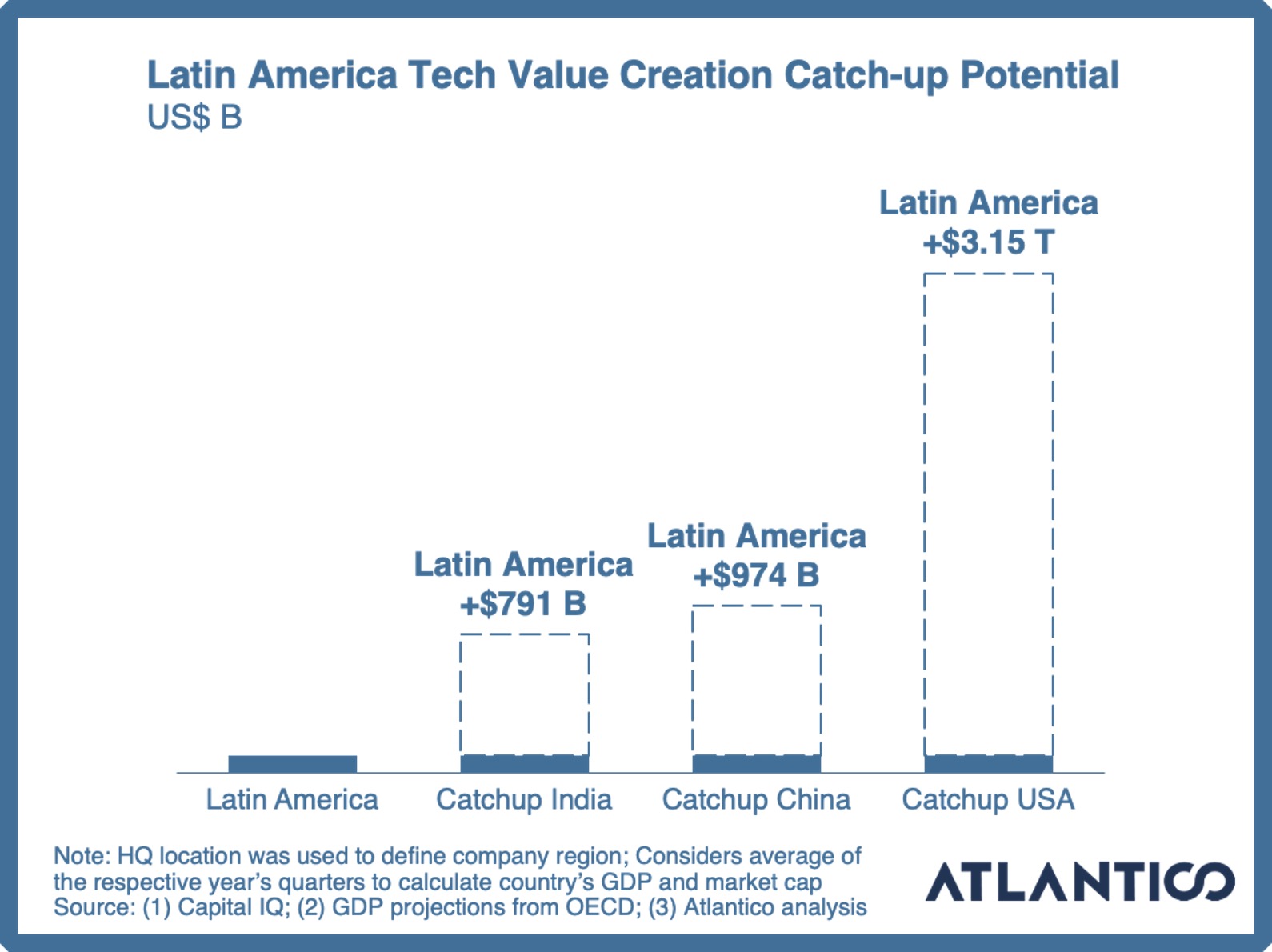

A top-down view of Latin America’s tech landscape reveals a generational opportunity for value creation in the region. The Atlantico Digital Transformation Index, which measures tech penetration by tracking the value of public technology companies in a region as a percentage of its GDP, is at around 1.5% for Latin America and 3% for Brazil, its largest player.

To put this level of digital penetration in context, the index is at 52% for the U.S., 20% for China and 15% for India. It is unknown whether Latin America will hit the tech penetration levels of the U.S. or hover around those of China (whose internet usage we already surpass), but in either case, the potential for value creation in the coming decade could be measured in the trillions of dollars.

It is important to note that much of the growth in the region came about in the last five years, when the first regional unicorns were born. Today, the region’s 34 unicorns span categories as distinct as food delivery (iFood), wellness (Gympass), gaming (Wildlife), logistics (Frete.com), real estate (Loft and QuintoAndar) and the mainstay of fintech (Creditas and many others).

A similar inflection point can be seen in the public markets as more regional tech companies go public and grow in value. MercadoLibre (Argentina), Nubank (Brazil) and dLocal (Uruguay) are just a few examples of local companies that are listed on U.S. stock exchanges, and some of these are valued in the tens of billions of dollars. Additionally, the last few years saw more than a dozen tech IPOs in the São Paulo stock exchange (Bovespa/B3), providing a path to liquidity to comparatively smaller companies.

The view from the top (and from the trenches)

In August of this year, at Atlantico’s Good View Summit in Brazil, unicorn founders were surveyed on their current sentiment about the market. Founders pegged their feelings at timid seven out of 10 in terms of excitement level about market and business prospects.

Curiously, although all recognize the environment as tougher overall, 86% of them believe they will emerge stronger in two years by either reducing burn or being more aggressive against competition.

The unicorns’ “view from the top” is consistent with earlier-stage venture-backed startups, which reflect the same feelings perhaps in an even more extreme fashion. When asked about their feelings toward the financing market in the next couple of years, early-stage founders gave it a measly five out of 10, reflecting the apprehension and anxiety in the air. Ironically, and in an enduring sign of chronic entrepreneurial optimism, nearly 90% of founders described themselves being in either a position of strength against competitors (47%) or that they expected to be in a great position to raise more money after some adjustments (42%).

Local investors are also optimistic about the future. When we dig deeper into the funding dip in Latin America since Q4 2021, it helps to note that foreign investors held the purse strings tighter than local ones. Across 2019 and the first half of 2020, foreign funds accounted for around a third of all deals by the most active funds investing in the region.

Likewise, during the pandemic-sparked boom, foreign investors grew more interested in Latin America, expanding their share to as high as 64% of this pool of deals by Q4 of 2021. In 2022, as the tide receded, foreign investors left with it, dropping to 47% of deals (still significantly above pre-pandemic levels) but staying active and committed to the region. Additionally, the consistency of local investors’ relative activity is a testament to the local capacity for financing the MercadoLibres of tomorrow.

Zooming out further, we note that funding levels in the region remain higher than before the pandemic, suggesting that capital shouldn’t be a relevant constraint going forward. It’s not visible in the financing data, but local funds are sitting on record volumes of dry powder waiting to be deployed. Many of the larger funds raised supersized funds last year, and a majority of that capital has still not been deployed.

The stickiness of Latin digitalization

The persistence of Latin America’s digital gains is perhaps most clearly seen through enduring gains in e-commerce penetration. As of January 2022, the online share of total retail sales in the United States had returned to pre-pandemic historic trend lines, at approximately 15%. Companies cut scores of employees and publicly warned that the pandemic boost would fade, revising earnings estimates downward. Nearing a 7% share of total retail, e-commerce in Brazil opened the year at a level that was nearly three years ahead of where the pre-pandemic trend line would be.

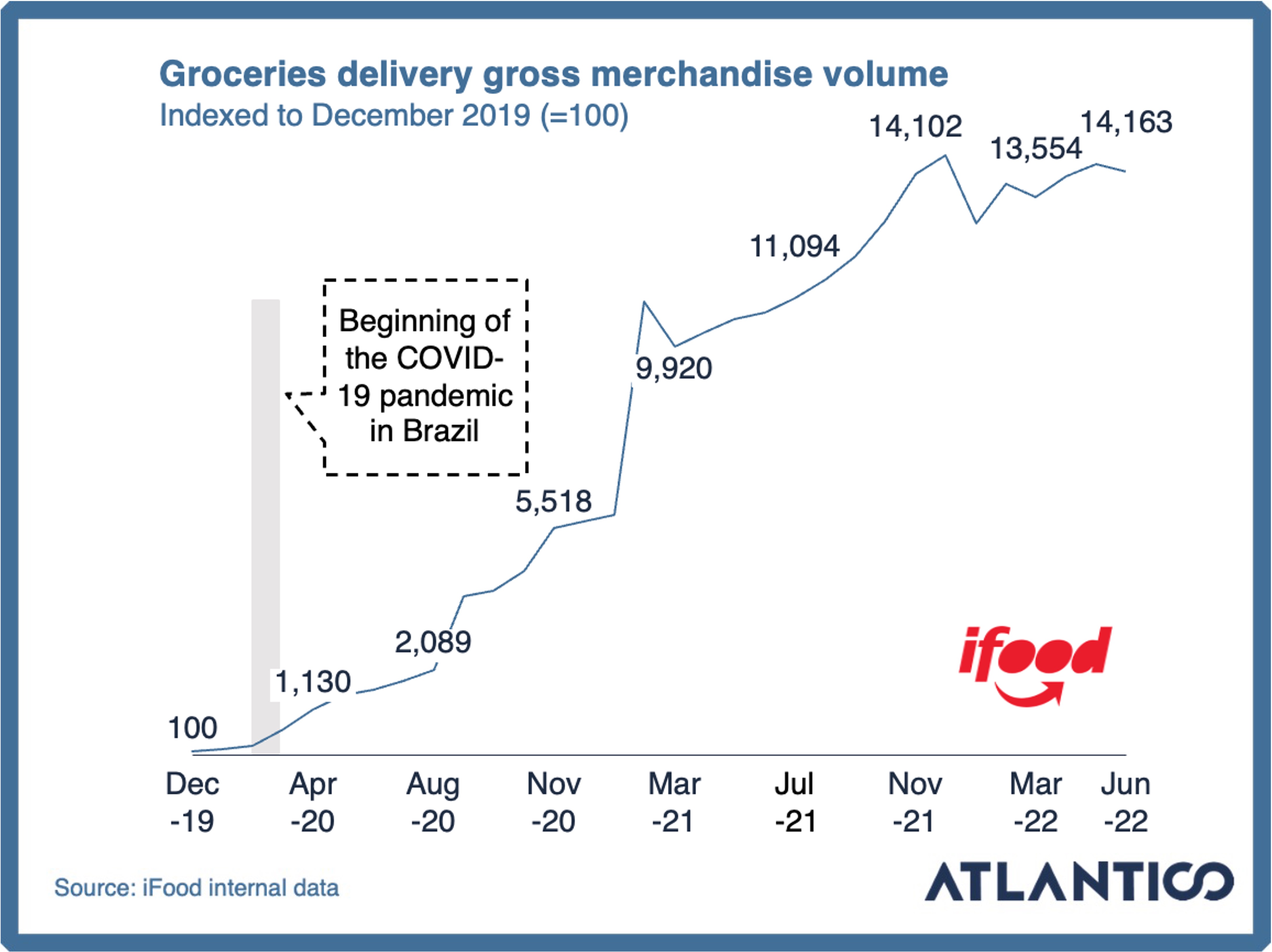

Data supporting the “sticky digitalization” hypothesis abounds. iFood, Brazil’s food and grocery delivery leader, has maintained more than 30% overall growth from 2019 levels (different from U.S. comparables like DoorDash that lost pandemic-era gains), while online grocery uptake grew more than threefold and shows no sign of slowing down as American peers like Instacart have.

As Latin Americans grow more accustomed to a digital-native, improved customer experience, we are also seeing sustained digital migration in more traditional spaces like digital banking and telemedicine that go beyond making purchases online.

Conexa Saúde, a leading telemedicine platform in Brazil, has seen consistent high growth since the pandemic hit. In the first quarter of the pandemic, it saw a sudden sixfold increase in its customer volume, which has since grown an additional threefold.

Telemedicine also greatly benefited from pro-innovation regulatory changes that enabled its adoption on a mass scale. The increasing adoption of online “neobanks,” exemplified by poster child Nubank’s ever-rising customer numbers (now surpassing 60 million), is another compelling portrait of this trend.

Above all, the region continues to be fertile ground for innovation and lasting companies, as hungry talent aspires to tackle the region’s demands and opportunities. In a survey of students at top universities, we confirmed the desire to work in tech (be it at large “big techs” or emerging startups) now surpasses historically popular careers in finance and management consulting.

Opportunities at hand

Latin America has plenty of headwinds and tailwinds to contend with. Channeling that whirlwind of energy into concrete offerings requires narrowing down the opportunity into a few themes that might best represent the moment we are in. To do this, we decided to focus on three spaces: web3, SMB digitalization and a new wave in fintech.

The recent debate in web3 has circled around real use cases for web3 solutions. If web3 use cases are to prove out in practice, there may be no better place for them than Latin America.

When we think about crypto as a better store of value, our region’s history of currency devaluation, hyperinflation and political instability makes it one of the best markets for early adoption. In fact, we see greater adoption and interest in crypto in more economically unstable countries like Argentina and Venezuela.

As a more efficient medium of exchange (and even of investment), DeFi protocols may have found demand in Latin America, where transferring money is cumbersome and expensive. Mexicans are world leaders in remittances and have increasingly turned to companies like Bitso to move around money with less effort and cost than their neighborhood Western Union provides.

Finally, if we are to see NFTs as a potential mechanism for creators to facilitate ownership and participation in what they produce, we should expect to see creative applications in the region. Latin America is a global leader when it comes to the creator economy: We have more digital creators, reaching more people and exerting more influence than pretty much anywhere else in the world. However, those very creators have been unable to monetize their influence and output in a meaningful manner. Perhaps web3 will finally serve as the bridge to a productive monetization solution.

On the investment side, Latin America has minted several unicorns in the crypto space over the last few years. These include on-ramps and exchange platforms, such as Mercado Bitcoin and Bitso in Mexico, as well as payments company CloudWalk in Brazil. We also see regional talent at the forefront of thriving global projects in the web3 space. One prominent example is FingerprintsDAO, a global DAO focused on championing blockchain art by collecting NFT artworks.

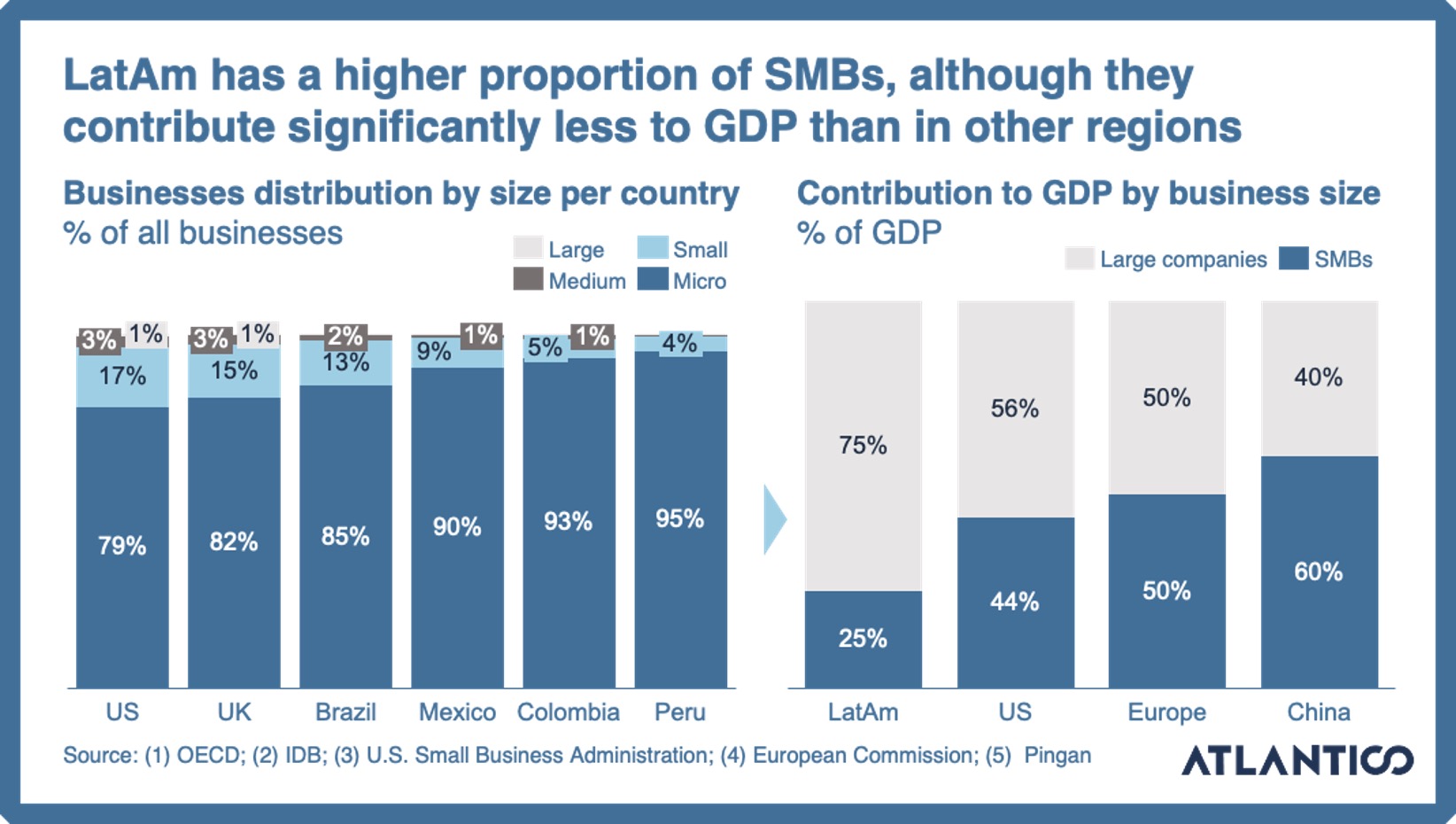

The digitalization of small and medium-sized businesses (SMBs) is another space where we have seen plenty of innovative approaches to some of the largest challenges. While the U.S. has 79% of its businesses in the micro-size space, in Latin America, this share ranges from 85% to 95% of all businesses across the main economies in the region. Despite this relevance, SMBs only account for 25% of Latin America’s GDP, while the U.S. and China have this number at 44% and 60%, respectively. This sharp contrast is a clear indication of the struggles small businesses face when it comes to different aspects of growth, productivity and access to capital.

We identified SMB struggles can be grouped into four main categories:

- Limited access to capital and financial services.

- Difficulty driving sales online and building a loyal customer base.

- Dependent on processes that are in large part still manual, further driving inefficiencies.

- Limited access and negotiation power with major suppliers.

If addressed, these challenges can pave the way to extensive value creation in the Latin America SMB space.

Finally, it’s impossible to talk about Latin American tech and ignore its booming fintech space. Financial services remain the largest industry for venture funding in the region by far, accounting for 42% of all money raised in 2021 and encompassing many of Latin America’s unicorns.

The digital transformation of financial services in Latin America began with B2C models, aimed at disrupting existing traditional models by offering superior experiences and driving higher inclusion, enabled by a pro-innovation and pro-competition regulatory agenda. The rise of neobanks is probably the most cited byproduct of this movement, helping to drive forward the financial inclusion of the Latin American population. Now, in a second wave of fintech disruption, the same playbook is being applied to the B2B space, further propelled by the increasing availability of fintech infrastructure providers.

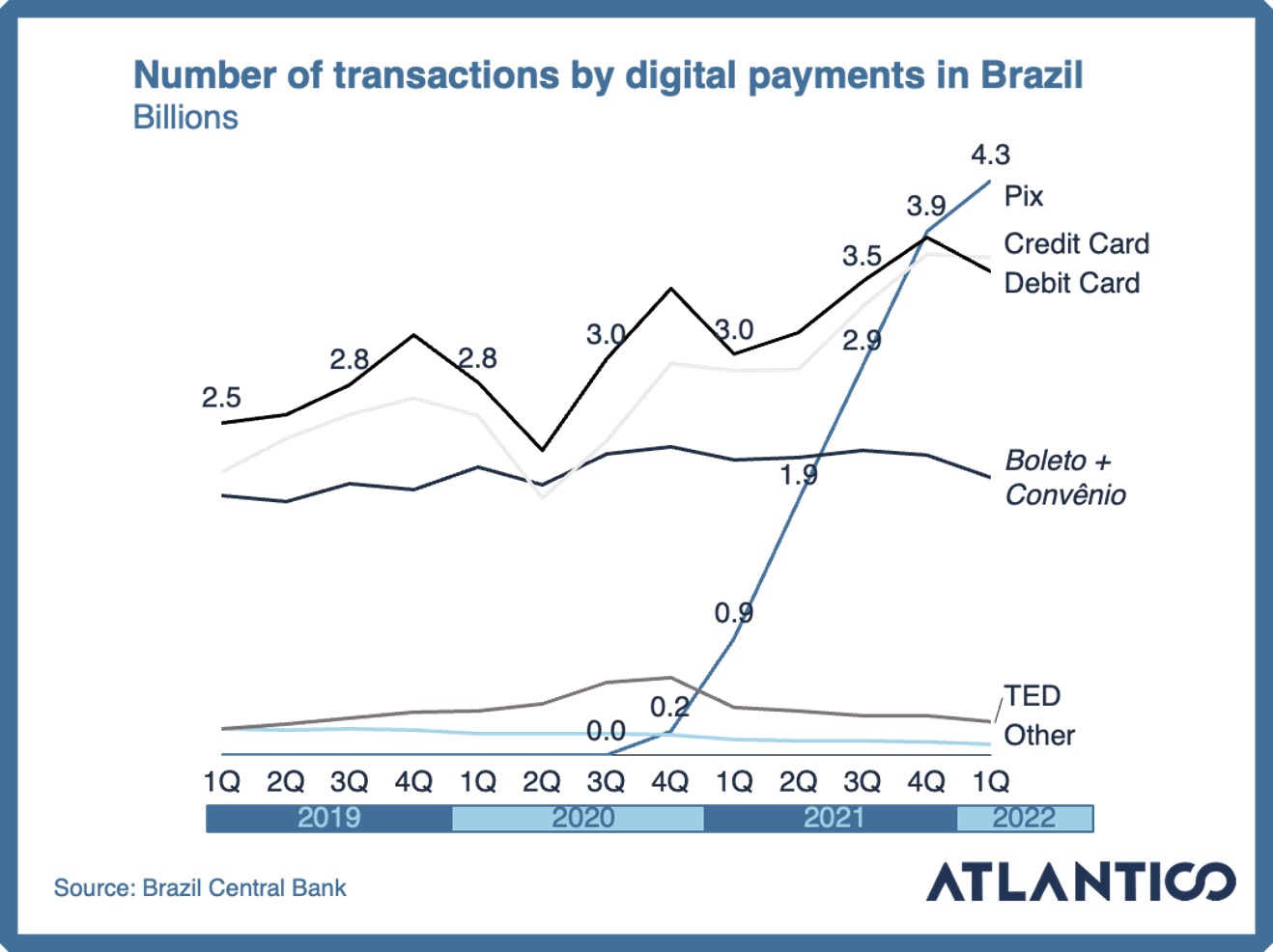

From all the innovation in the fintech space, nothing has been as transformative as the rise of Pix, the Brazilian Central Bank’s instant payments system. Pix is free to use, available 24/7 and can be used by individuals, businesses and the government. Launched in November 2020, it has taken the country by storm. Less than two years later, Pix is processing a monthly volume of nearly $200 billion and has displaced all other digital payments as the most used in the region.

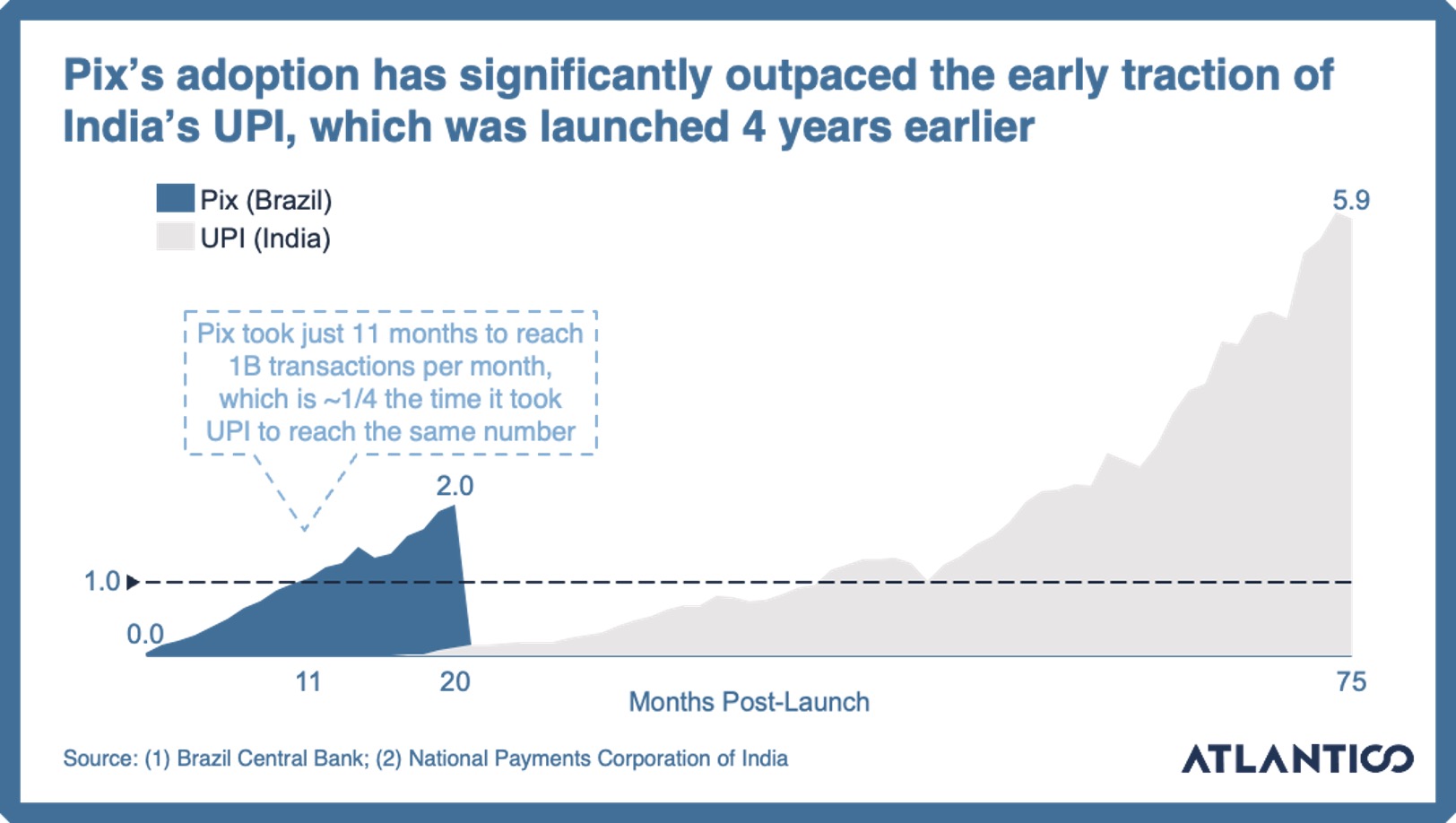

Truth be told, Pix is eating all payments in Brazil. The payment method is already tied with cash as the most used daily payment method by Brazilians and shows no signs of slowing down. When compared to what was perhaps the most successful instant payments system until then, India’s UPI, Pix adoption is nothing short of amazing. Pix took less than a year to process one billion transactions a month, a threshold UPI would achieve only when operating for almost four times as long. On a per capita basis, Pix monthly transactions volume is now more than twice as large as UPI’s volume, as measured in June 2022.

Pix is used by more than half of the country’s population already, and it is impossible not to expect it to continue gaining traction. Brazil’s Central Bank has ambitious plans for the future of Pix, and it has built a roadmap of initiatives that include features such as collections, payments with installments (buy now, pay later) and international transfers. Brazil’s most successful fintech is nowhere near done disrupting the local payments landscape, and we are eager to see how that will continue to evolve.

As we contemplate the current state of the market, we have conviction that down times like these are also times for opportunity. As Churchill would say, “Never let a good crisis go to waste.”

According to our research, companies funded during bear markets were the ones with the highest chance of going public (IPO) when compared to the average trend. Across Latin America, structural challenges spread across many industries will continue to attract great talent interested in solving our region’s most pressing pains. They’ll impact the lives of millions of citizens and create hundreds of billions in value on their way to building long-lasting companies.

Venture capital, like entrepreneurship, is a long-term game. In the end, 2022 will help us become more resilient and focused on fundamentals. We are more optimistic than ever about what’s next for Latin America as we continue to build upon the increasing and persistent digitalization of the region. The future we longed for is here, and we are excited to be a part of it.

Comment