Anyone who has worked in a role even tangentially connected to the public markets will at least have heard of Bloomberg Terminal, an industry standard platform used by professionals to gain real-time data and insights into the financial markets.

Indeed, Bloomberg Terminal is an incredibly useful — if expensive — tool for traders, brokers, analysts and others concerned with the public markets. But those more aligned with the private sphere, such as venture capitalists and private equity investors, perhaps aren’t quite as well-served when it comes to funneling in the data they need to carry out their due diligence ahead of making a big investment, or tracking and managing their portfolio through to an exit.

But this is something that French startup Edda is looking to fix, with a platform aimed at helping investors, analysts, chief financial officers (CFOs) and even company founders get the insights they need, and the tools that make working collaboratively on deals just that little bit easier.

Investors invest

Edda was founded initially as Kushim VC back in 2017, but the company has just completed its official rebranding to Edda, while it has also announced $5.8 million in funding from a slew of backers including iPhone co-creator Tony Fadell’s Future Shape, Mucker Capital, Plug&Play, FJ Labs and angel investor Arnaud Bonzom. Its new investors are also fully signed-up members of the Edda platform, as are some 100 other investment firms spanning 26 countries, including French public investment bank BPI France.

“Much like Bloomberg altered an industry’s ability to operate, Edda will transform how investors visualise their fund and manage their dealflow and relationships,” FJ Labs’ founding partner Fabrice Grinda said in a statement. “Venture capital and private equity in general has gone from strength-to-strength over the past decade, spreading into new sectors and becoming the cornerstone of innovation investment.”

So what, exactly, does Edda give those working in the private investment space?

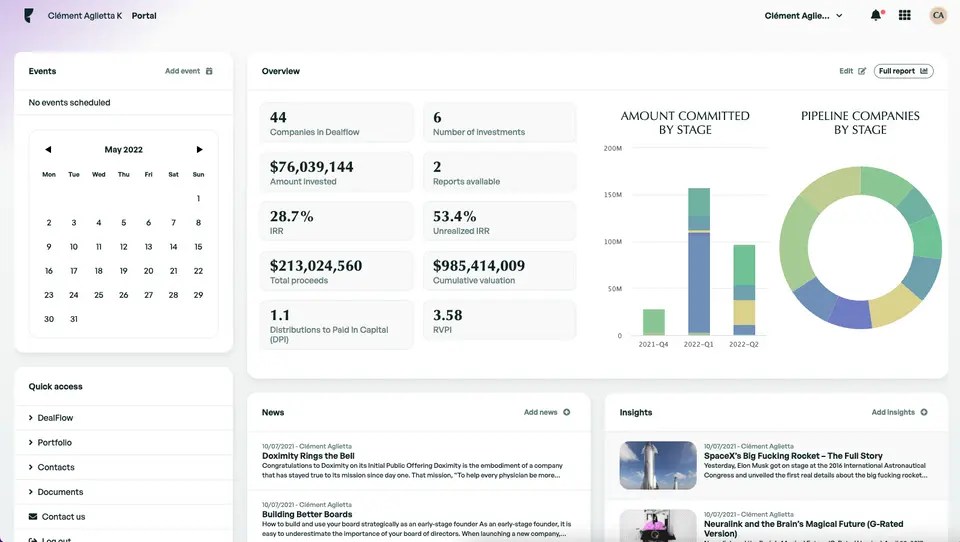

“Edda enables secure transparency for everyone managing an investment portfolio, from deal-sourcing to due diligence and funding through to portfolio management,” Edda co-founder and CEO Clément Aglietta explained to TechCrunch.

Those unfamiliar with the inner workings of the private investment realm may be surprised to learn that spreadsheets play an outsized role in the administration of everything — it’s typically a very manual endeavor, according to Aglietta, who previously plied his trade as chief of staff at New York-based investment firm FJ Labs.

“The lack of solutions for the private markets was the primary reason that I founded Edda,” Aglietta said. “Private equity investors currently manage more than $6.5 trillion — however, the majority of these investors still rely on tools such as Excel spreadsheets to manage their portfolios.”

It’s maybe something of an over-simplification to suggest that investors just use spreadsheets — in truth, they use an array of tools through the entire investment process. This may include Airtable or Salesforce for workflow management, or Affinity, Zaplow and Sevanta for dealflow (the number of potential investment opportunities). Elsewhere, portfolio management software from EFront and Ipreo have proven popular among investors, with both companies acquired in separate deals for a combined total of more than $3 billion in the past few years.

So Edda already has some competition beyond dusty, old spreadsheets, but what it’s pitching is an all-singing, all-dancing tool covering all bases.

“We believe that it’s time for funds to have a dedicated tool with multiple capabilities that helps partners to see the big picture, that does everything they need,” Aglietta said.

In terms of dealflow, Edda integrates with email inboxes and calendars to support workflow automation with tasks and reminders. It also sets out a clear schedule and layout for what stage each potential investment is at through a dedicated watchlist.

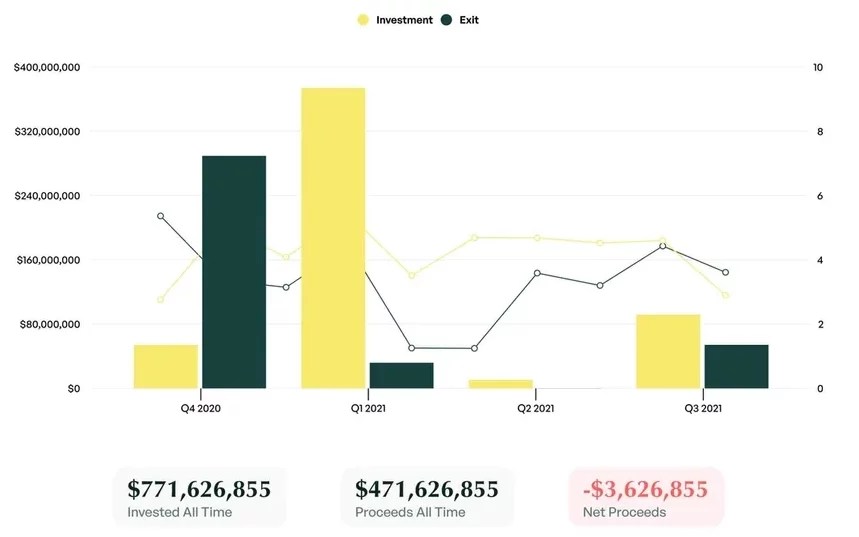

For the existing portfolio, Edda allows investors to record historical valuations for all their companies, run valuation comparisons and calculate IRR (internal rate of return) on an individual company basis or for the entire fund. It also serves investors with analytics that show how well their portfolio is aligning with their core investment focus.

Show me the data

Edda reels in data from publicly available sources including Crunchbase and PitchBook, while it also packs a feature that automatically pulls in additional data from emails, documents and files stored in cloud-based repositories such as Dropbox. And on top of that, Edda has also developed an API that tracks news relating to companies, funds and everything related to the deal-making process.

“All of this information, and data points, are then used to generate a profile on the company,” Aglietta said. “Investment decisions are increasingly driven by multiple data points, so you need as much information as possible to ensure you make good decisions — this is what Edda provides.”

To illustrate how this might all play out in a real-world scenario, Aglietta highlighted an example that involved an investment fund partner who received an email about a potential investment opportunity. Given that this partner was using an email plugin provided by Edda, the platform automatically captured the name of the company, and checked if it was “already in the pipeline” at the fund, and then synchronized this with public information from Crunchbase and PitchBook.

“The deal is automatically sent to the pipeline for the rest of the investment team to start working on it collaboratively, by adding comments, reading the documents and the emails already exchanged with this company,” Aglietta said.

Edda then generates a slide for each company in the pipeline, which is reviewed weekly until the investor decides to invest — at that point, Edda pushes the company into the portfolio management section where it generates a profile with key information such as revenue and capitalization table. At this point, the company founders can be invited to collaborate through Edda, where they can update information themselves and communicate with all the main stakeholders.

And this highlights the core business community management facet of the Edda platform. It reflects the reality of today’s investment landscape, where financiers may put their money into any number of companies around the world, which requires having to work with partners (including other investors) and founders from all backgrounds and levels of technical expertise.

“The market is getting more and more complex — investors invest globally, and there are more and more deep technologies that investors need to be knowledgeable about to make good decisions about where to deploy capital,” Aglietta said. “We all know that it’s not possible to be an expert in everything, that’s why investors are heavily focused on co-investment opportunities, communicating more with companies founders, using the expertise of the LPs (limited partners), and so on.”

Edda supports this by serving as a centralized conduit for investors to upload documents, keep LPs up-to-date about deals, generate reports, share statistics and more. And portfolio company founders can use Edda to ask questions and solicit advice, while investors can request specific updates and new metrics from the founders.

Market opportunity

To give some idea of the potential for Edda, Bloomberg reportedly generates around $10 billion in revenue annually, the vast majority of which apparently emanates from its Bloomberg Terminal-driven Professional Services division.

The private equity markets are predicted to grow to $12.5 trillion by 2025, and for many investors it’s a far more alluring proposition. Edda, for its part, currently works with investors with just $22 billion in assets under administration, which gives some indication as to how much further it could grow.

“This [private] market is huge and is booming — it’s now bigger than the public market,” Aglietta said. “There are more companies, the total valuation is higher, and the amount invested is also higher.”

Comment