Montreal-based Equisoft, an insurance and investment software developer, today announced that it raised $125 million in venture equity. It’s a large amount made more significant by the fact that the investment climate for insurtech vendors is growing increasingly challenging. A recent Gallagher Re report found that quarterly insurtech funding for Q4 fell to the lowest level since Q1 2020, decreasing 57% quarter on quarter from $2.35 billion in Q3 to $1.01 billion in Q4.

$70 million of Equisoft’s new tranche came from Investissement Québec and the government of Québec, with the remainder coming from Export Development Canada and Fondaction. CEO Luis Romero says that the funding will be put toward “global expansion,” both “organically and through strategic acquisitions.”

“The funding will strengthen our balance sheet and accelerate further development of our integrated life insurance software platform and wealth products to better serve our global customer base,” Romero told TechCrunch via email.

Romero founded Equisoft in 1994 along with a friend he’d worked with in the IT department of an actuarial consulting firm. They left the company together to pursue a more entrepreneurial path. At the time, custom-built solutions were the trend, and — according to Romero — he and his friend had the opportunity to build an asset allocation software for a mutual fund company. That software formed the basis for Equisoft.

“The original software was delivered on three floppy disks,” Romero said. “We made 1,000 copies of it and packaged it in fancy boxes to send to financial advisors. This product evolved from floppy disk to a software-as-a-service (SaaS) solution, and in the early 2000s, we added system integration into our offering. We then evolved to focus on a core set of solutions where we knew we could be the best.”

Equisoft was a self-funded company for 24 years, up until 2018. In 2018, in order to “accelerate growth” (as Romero puts it), Equisoft opened up to investors, securing around $17 million in its first round of funding.

“Our reasoning back then was we wanted to invest in our core SaaS solutions and the specialized services surrounding them,” Romero said. “We believed that there was a significant opportunity to continue to grow our customer base across the life insurance, wealth and asset management markets in the Americas and beyond.”

It was a prescient move. Today, Equisoft’s annual total revenue stands around $150 million; in 2022, total revenue and annual recurring revenue both grew by 45% year-over-year. With over 250 corporate clients, Equisoft’s solutions are now used by more than 100,000 advisors in North America alone, Romero says.

Acquisitions bolstered Equisoft’s expansion. In 2021, the firm bought Altus, a U.K.-based financial services firm with a transaction platform for pension administrators and asset managers. And in 2022, Equisoft purchased CompuOffice (Equisoft’s eighth acquisition to date), a developer of life insurance analysis and research software.

“Over the past two years we have more than doubled our revenue and now have over 900 employees,” Romero said. “We’re hoping to continue on our growth trajectory this year.”

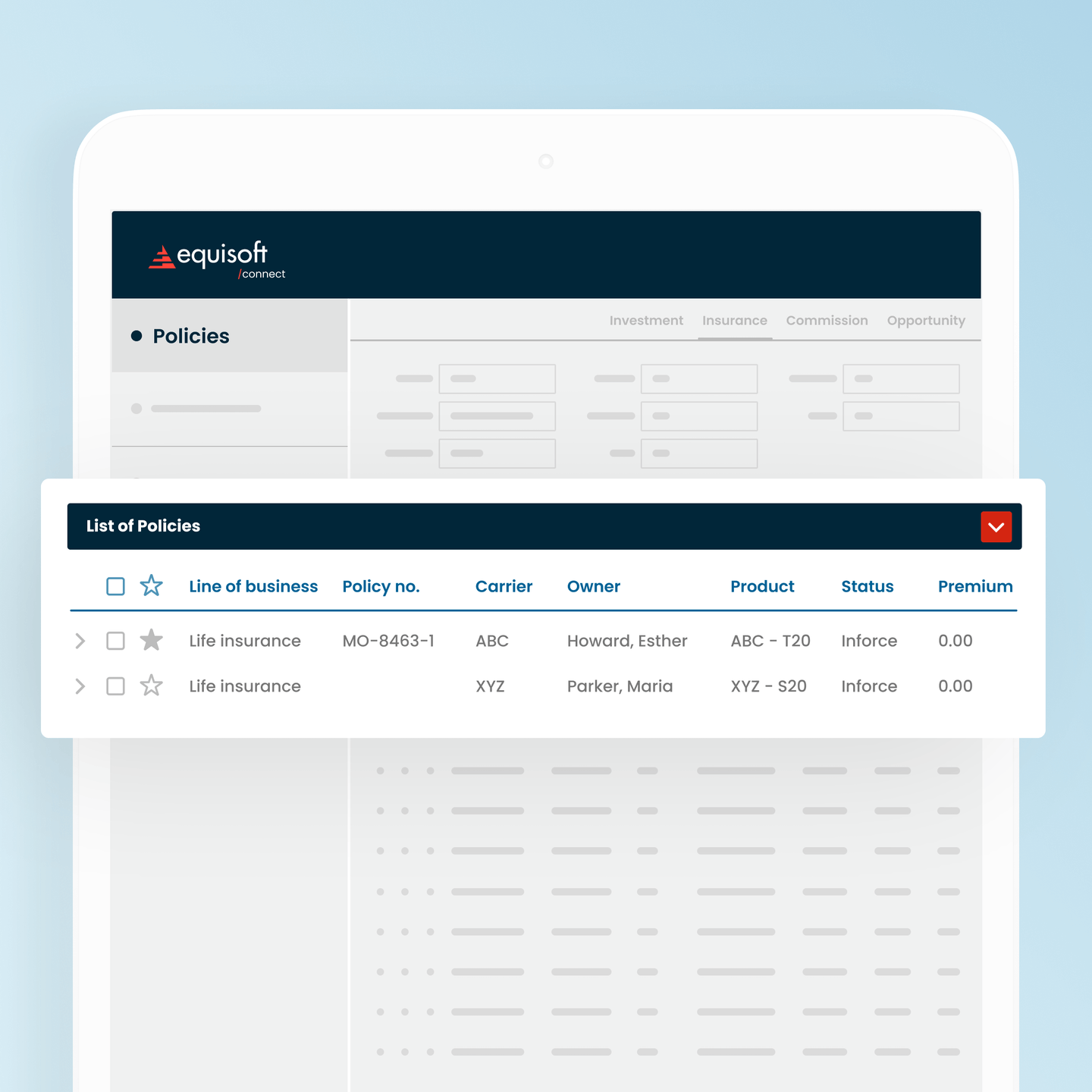

So what, exactly, does Equisoft do? At a high level, the company partners with customers to solve problems of the wealth management and insurance variety. Equisoft’s core offering is centered on back office and policy administration tools for life insurance customers, but the company also sells frontend solutions to complement its bread-and-butter software lineup.

“Our go-to-market strategy is focused on leveraging our digital products to win new customers and provide them with a solution for a faster, more cost-efficient transformation or with a component for incremental value added,” Romero said. “This strategy is supported by our policy administration system and data migration services.”

For example, Equisoft uses AI and machine learning to offer what it calls “data-driven predictions,” or “next best actions,” to promote efficiency and ideally reduce human error in insurance workflows. Think automatically extracting key info from insurance contracts or algorithmically processing customer onboarding documents.

“Equisoft’s offerings enable companies to undergo much-needed digital transformation,” Romero said, citing a McKinsey study that predicts automation will influence 25% of the insurance sector by 2025. “AI can fill in the manual, repetitive and mundane labor gaps and allow insurance industry professionals to do other things that add the most value to policyholders.”

Equisoft positions its software and services as disruptive, but — despite the recent downtrend — insurtech has been a red-hot industry. According to a recent report from BCG, insurtech companies raised $14.4 billion across 644 deals in 2021, surpassing the total raised in 2020 by about 87% and reaching a cumulative 10-year total of $43.8 billion from 2012 to 2021.

Equisoft intends to ride the wave with a renewed focus on mergers and acquisitions, expanded service offerings and geographic expansion,” according to Romero; $138 million in the bank will certainly help.

“The life insurance, wealth and asset management industries are large, highly competitive and fragmented. These markets are subject to changing technology, shifting client needs and introductions of new products and services,” Romero continued. “We believe our global end-to-end platform and deep industry experience differentiate us from competitors who do not necessarily provide an integrated, scalable, configurable and highly efficient platform. Moreover, our global footprint and broad expertise allow us to be among the few players that operate across geographies and languages.”

Comment