Welcome to The Interchange! If you received this in your inbox, thank you for signing up and your vote of confidence. If you’re reading this as a post on our site, sign up here so you can receive it directly in the future. Every week, I’ll take a look at the hottest fintech news of the previous week. This will include everything from funding rounds to trends to an analysis of a particular space to hot takes on a particular company or phenomenon. There’s a lot of fintech news out there and it’s my job to stay on top of it — and make sense of it — so you can stay in the know. — Mary Ann

Despite the economic turbulence of the past year, I think it’s safe to say that many of us did not see the sudden full-on implosion of Silicon Valley Bank coming. While we could have guessed the storied financial institution was struggling, we did not anticipate that it would shut down so soon after announcing said struggles. The impact of this event will be severe, widespread and — for fear of being dramatic — potentially catastrophic for many. Already, businesses are worried about making payroll, which could lead to unanticipated closures and layoffs. As one VC put it: “It’s bad.” Our hearts go out to all impacted.

Natasha Mascarenhas and I talked to several competitors in the space and unsurprisingly, they’re seeing a ton of increased demand. You can read all about that here. We also teamed up with other TC staff and talked to several founders who bank(ed) there to get their perspectives.

Outside of TC’s multiple (and fabulously reported, if I may add) stories on the topic, which you can find bundled here, there is some other chatter I’ve heard related to the news:

- One fintech investor told me that he is aware of a single company that moved over $80 million out of Silicon Valley Bank on Thursday.

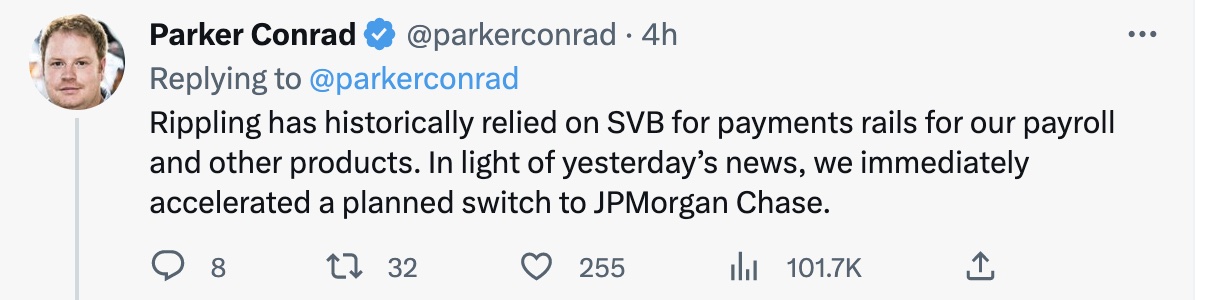

- Rippling co-founder and CEO Parker Conrad on March 10 tweeted that his company had historically relied on SVB for payments rails for its payroll and other products but in light of the news, “immediately accelerated a planned switch to JPMorgan Chase.” Later that day, he added that his company was not able to process payroll for some company’s employees and issued an apology, noting that while future payroll runs will be processed with JPMorgan Chase, any payroll funds processed for the day’s check date “were debited from clients earlier in the week,” and that the company was “currently stuck with SVB, which is now in FDIC receivership.”

- Unlike many other VCs encouraging companies to move their money out of SVB, fintech-focused Restive Ventures’ Ryan Falvey urged people to “stay calm.”

- Some have speculated that a “bank run” ultimately led to SVB’s demise.

- Brazilian fintech Trace Finance launched a new checking account for startups in the wake of the news. Via email, a spokesperson told me on Friday that balance withdrawals totaling $200 million had been initiated from SVB through Trace Finance since the news broke on Thursday, and that $100 million had already been moved from SVB and deposited in new checking accounts with Trace Finance. Customers for the new checking account include Rocket.chat, Mercado Bitcoin, Rentbrella, The Coffee, and Gringo.

Note: I had a totally different intro planned today based on a super interesting conversation I had with a neobank founder but I’m going to save that for another day, as we’ve had to jump on the impact of Silicon Valley Bank’s shuttering on the startup and venture world.

Image Credits: Twitter

Weekly News

I conducted a survey of 7 fintech investors: Charles Birnbaum, partner, Bessemer Venture Partners; Aunkur Arya, partner, Menlo Ventures; Ansaf Kareem, venture partner, Lightspeed Venture Partners; Emmalyn Shaw, managing partner, Flourish Ventures; Michael Sidgmore, partner and co-founder, Broadhaven Ventures; Ruth Foxe Blader, partner, Anthemis; Miguel Armaza, co-founder and general partner, Gilgamesh Ventures. Not just saying this because I conducted the survey, but I was really impressed with how detailed and thoughtful their answers were. Spoiler alert: B2B payments and infrastructure remain on fire and most investors expect to see more flat and down rounds this year. Plus, they were gracious enough to share some of the advice they’re giving to their portfolio companies.

While the public market correction has been widespread, tech and fintech stocks have seen the largest declines, according to a recent report. Specifically, the Fintech Index — which tracks the performance of emerging, publicly traded financial technology companies — was down a staggering 72% in 2022, according to F-Prime Capital’s State of Fintech 2022 report. After hitting a peak of $1.3 trillion in late 2021, the F-Prime Fintech Index slid to $397 billion by the end of 2022. Currently, the Fintech Index comprises 55 companies across B2B SAAS, payments, banking, wealth and asset management, lending, insurance and proptech. I dug DEEP on the topic here.

Reports Christine Hall: “From the people who brought you credit monitoring services now comes Credit Karma Net Worth, a new product to help people know, grow and protect their wealth. The new feature brings the 16-year-old company closer to becoming an end-to-end personal finance management platform, also offering debt, credit building and checking and savings products, Credit Karma founder and CEO Kenneth Lin said in an interview. As Credit Karma members moved through their credit journey of establishing credit and getting their credit score in check, they are now thinking about the next stage of their life: “financial goals and outcomes, he said.”

A follow-up to our Better.com news from last week (a collaboration with the brilliant Alex Wilhelm): Even if the Better.com SPAC combination closes, the transaction has been all but neutered from a cash perspective. From the company’s pursuant SEC filing: “About 92.6% of the company’s Class A ordinary shares were redeemed and approximately 7.4% of the Class A ordinary shares remain outstanding. After the satisfaction of such redemptions, the balance in Aurora’s trust account will be approximately $20,931,627.” While the drop-dead date to go public via a SPAC is September 30, it will likely be apparent by summer whether Better.com will be able to move forward with the transaction. A source familiar with internal happenings at the company told TechCrunch that is probably when the “death spiral will begin.” With no incoming equity financing and likely no faith on the part of creditors, the source added, the company will most likely have to consider filing for bankruptcy by late 2023 or early 2024. CEO Vishal Garg told The Information that more layoffs and a down round might be in the company’s future, too. Meanwhile, multiple sources familiar with the background on Better.com’s “agreement” with Amazon told TechCrunch that the deal did not in fact represent a partnership between the two companies. Rather, Better apparently announced its new Equity Unlocker tool last week, and it rolled it out saying that it was initially exclusively available to Amazon employees. The news was framed to imply that there was some sort of partnership forged between the two, presumably to boost Better.com’s credibility.

According to KPMG’s latest Pulse of Fintech report, the U.S. continued to drive fintech investments last year, accounting for $61.6 billion across 2,222 deals during 2022, including $25.2 billion in the second half of the year. Seed-stage fintech deals saw record investment as valuations of late-stage VC-backed companies saw significant downward pressure, attracting a record $4.5 billion, up from 2021’s $3.4 billion. Says KPMG via e-mail: “We’re also seeing a continued focus on BNPL, AI offerings/tools, and M&A activity remaining slow through the first half of 2023.”

Meanwhile, according to PitchBook, enterprise fintech startups are capturing more of the broader fintech VC pool. The company’s latest Emerging Tech Research found specifically that global VC investment in the broader fintech space reached $57.6 billion across 2,747 deals in 2022, declines of 40.7% and 18.1% year-over-year, respectively. Within the vertical, enterprise fintech startups raised 60.9% of capital from investors compared to their retail counterparts. In 2020, that number was 48.2% of capital.

Reports Ingrid Lunden: “Startups are facing a moment of reckoning in the current economic climate, and today one of the more promising in the world of fintech has cracked under the pressure. Railsr, the U.K.-embedded finance startup formerly known as Railsbank and once worth nearly $1 billion, has been acquired by a shareholder consortium; and as part of the deal, it’s going into administration so that it can continue [operating] . . . as it restructures. The consortium, which trades under the name Embedded Finance Ltd, includes previous Railsr’s investors D Squared Capital, Moneta VC and Venture Capital. The company is not disclosing the value of the deal. It was valued, when still solvent, at around $250 million back in October 2022, so that is one starting point.”

According to TC’s Tage Kene-Okafor: African fintech Moniepoint (formerly known as TeamApt Inc), has appointed Pawel Swiatek as its chief operating officer. Pawel joins the business from Capital One, where he served as managing vice president for over four years. At Capital One, he was responsible for the bank’s financial inclusion program. He was also part of the management team at the world’s largest hedge fund, Bridgewater. At Moniepoint, Swiatek’s experience in financial inclusion will be brought to bear in building an execution operating system, driving strategy and execution by building policies and tools. Moniepoint offers payment, banking, credit and business management tools to over 600,000 businesses and processes a monthly TPV of over $10 billion. The fintech is backed by Lightrock, Novastar and QED, the global fintech investor whose managing partner Nigel Morris co-founded Capital One.

Payments giant Stripe appears to still be trying (hard) to raise venture funding. Eric Newcomer reported last week that the company is now raising 6 BILLION DOLLARS instead of the $2 billion to $3 billion it was believed to be trying to secure, according to previous reports. According to Eric, Thrive Capital, General Catalyst, Andreessen Horowitz, and Founders Fund are participating in the round along with Goldman Sachs private wealth clients. Meanwhile, there was chatter on Twitter about the company’s decision to no longer return a $15 dispute fee for successfully contested disputes. Meanwhile, there also seems to be some chatter about how FedNow, a real-time payments system that the Federal Reserve is rolling out in the next couple of months, could impact Stripe negatively. Oh, and for one fintech observer’s opinions on why the company, despite its challenges, “can’t lose,” head here.

Construction tech startup Kojo is expanding into fintech. The materials management company has launched a new Invoice Matching product designed to help contractors manage their spend, eliminate billing mistakes and simplify payments. Led by 31-year-old founder and CEO Maria Davidson, Kojo says it is used by 11,000 construction professionals across the country. The company has raised more than $84 million. TechCrunch covered its last raise here.

Funding and M&A

Seen on TechCrunch

Indian fintech unicorn Slice acquires stake in a bank

Why unicorn Socure chose to take a $95M credit facility

Fynn raises $36M for a platform to finance students in vocational education

Synctera raises $15M to help companies launch embedded banking products in Canada

Elyn slightly delays online payments so you can try before you pay

Open banking startup Abound nabs $601M to supercharge its AI-based consumer lending platform

Candidly picks up student debt relief where new US policies leave off

And elsewhere

FilmHedge closes $5M Series A funding; $100M credit facility

French fintech Aria bags €50m debt facility

Brazilian B2B payments platform Barte raises $3M

SaaS fintech Growfin lands $7.5M

Tiger Global leads $6.5M Monnai deal

Insurify to acquire Compare.com

Okay, well, with that, I’m out of here for now. Next week is spring break for my family, so I will be mostly out and the amazing Christine Hall will be taking over the newsletter for me. But I’ll be back for the March 26 edition! Until then, take good care!! xoxo, Mary Ann

Comment