Frederik Mijnhardt

Last year was a painful one for startups and their employees. Venture capitalists tightened their investments, thousands of people lost their jobs and company valuations stalled or fell amid a protracted bear market.

An estimated 24% of startups on the Secfi platform reduced their fair market valuations in 2022, according to an internal analysis. For people working at those startups, that means some (in some cases, all) of their employee stock options spent 2022 underwater.

Separately, a Secfi analysis of 1,502 funding rounds at late-stage startups since March 2021 finds that startups are raising more flat rounds and down rounds than before.

A number of startups that raised money in 2022 did not disclose their post-money valuations, suggesting that the true number of startups that lowered their valuations in the past 12 months could be even higher than publicly reported.

Employee stock options are a meaningful factor in startup compensation, and underwater stock options have the potential to negatively impact hiring and retention across the startup ecosystem.

Underwater stock options

An analysis of more than 4,300 stock option grants uploaded to the Secfi platform in 2022 shows that nearly one of every four startups reduced their fair market valuations at some point during the year.

The highest-profile example of this phenomenon was Klarna, which raised venture capital in mid-2021 at a $45.6 billion valuation but was forced to raise a new round of funding in mid-2022 at a $6.7 billion valuation — an 85% decline. Other large companies that cut their valuations (without raising funding) include Instacart and Checkout.com.

Stock options are a high-risk, high-reward form of compensation and remain one of the most compelling drivers of startup employment and retention.

An analysis by Carta of employment data from 2018 suggested that the average startup employee works for just two years at a company before jumping to their next opportunity. Underwater stock options are a problem for people who joined a startup in 2020 or 2021, as they’re now finding that their shares are worth less than when they were hired.

The average startup employee in Silicon Valley received 12% to 14% of the value of their salary in the form of stock options, per Carta. In other words, a startup worker who earns a $150,000 annual salary could expect to earn an average of $21,000 worth of stock options as part of their total compensation package.

When a startup is successful, stock options rise in value — in some cases, by many multiples. Stock options make up 86% of the total net worth of the average startup employee, according to financial data that employees voluntarily shared with Secfi.

Underwater stock options can impact employee retention, as employees instead look to other startups with a stronger valuation growth. As a result, startup leaders who want to retain their employees may need to consider cash and retention bonuses, higher salaries or a stock option repricing program.

The average cost to exercise stock options remains high

Despite economic headwinds, the cost to exercise stock options remains high.

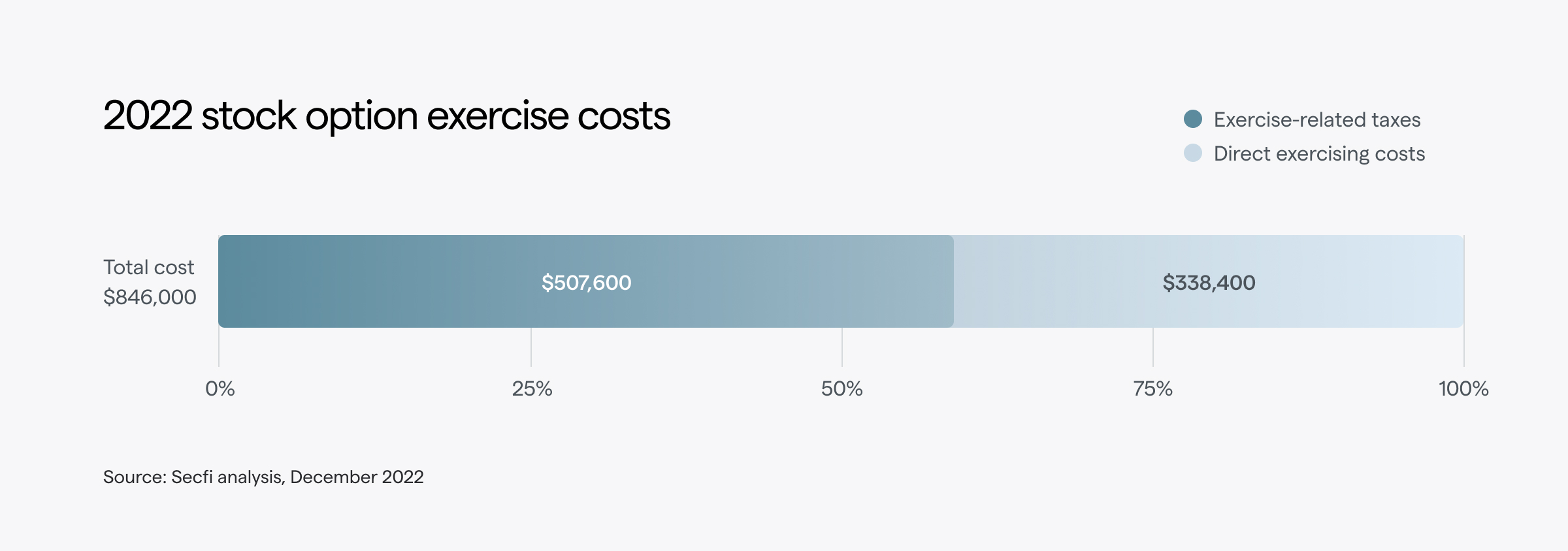

In 2022, the average Secfi client required $846,000 to exercise their stock options and pay associated taxes. Like in previous years, taxes continue to make up the majority of the total cost to exercise.

High costs remain a major reason why startup employees fail to exercise their stock options.

In 2022, startup employees abandoned 36% to 54% of their vested, in-the-money stock options, forfeiting them back to their employer’s equity pool. In doing so, the average employee walked away from $10,000 to $96,000 worth of assumed gains at the time of exercise, depending on their seniority level, per Carta data.

The silver lining to a year of flat, and declining, company valuations is that a lower company valuation typically means that employees can exercise their stock options in a more tax-efficient manner.

For employees earning the most common type of stock options — incentive stock options — lower valuations mean that they can exercise a greater number of shares without triggering the alternative minimum tax.

A pullback in venture capital activity

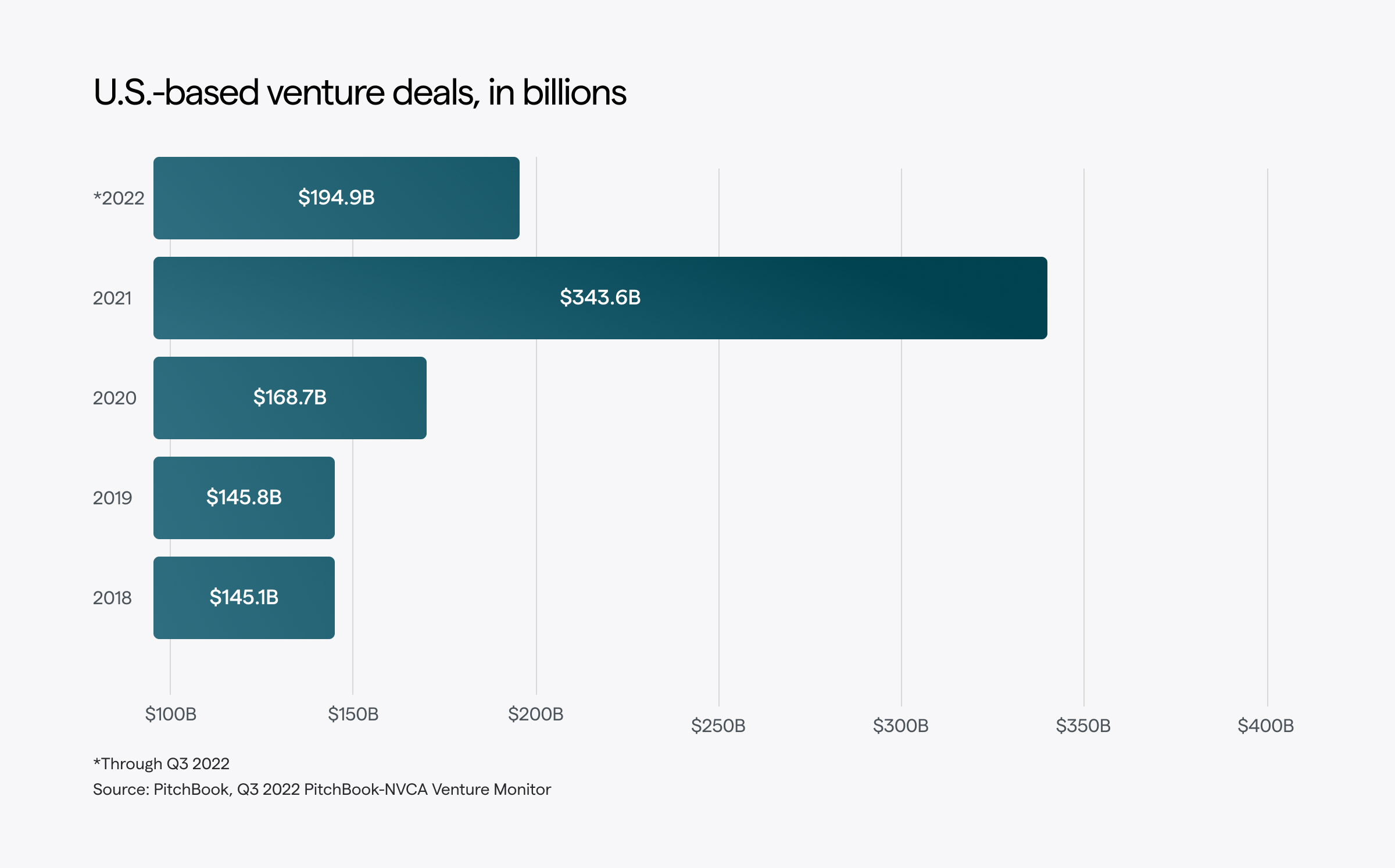

For startups, 2021 represented a high water mark, with U.S.-based venture capitalists investing an estimated $343.6 billion in startups, across 17,867 separate deals. That’s roughly $28.63 billion invested each month.

According to Crunchbase, 586 new unicorns were created in 2021 alone — or roughly 11 new unicorns every week.

Startups experienced a pullback in investments in 2022, raising $194.9 billion from U.S.-based venture capital firms in the first 3 quarters of the year — or roughly $21.65 billion per month.

It’s estimated that there were 280 new unicorns created in the first three quarters of 2022 — roughly seven new unicorns every week.

A Secfi analysis of 1,502 venture rounds completed by late-stage companies (valued at $500 million or more) between March 2021 and September 2022 found that valuation step-ups fell month over month in 2022.

Since the market frenzy of 2021, an estimated 60% of late-stage companies that raised capital in 2021 sought and found willing investors again in 2022. However, the average valuation step-up in the third quarter was close to flat, at around 1.1x, according to a Secfi analysis of publicly available data.

The data suggests these flat valuations could have been driven by the highly structured concessions that founders made with investors in 2022. In order to maintain high valuations, some startups are promising high returns to investors — conceding up to 2x in liquidation preference rights, meaning that new investors would be entitled to a return of twice their investment before common shareholders (and in some cases, previous investors) receive any money if the company exits through an acquisition.

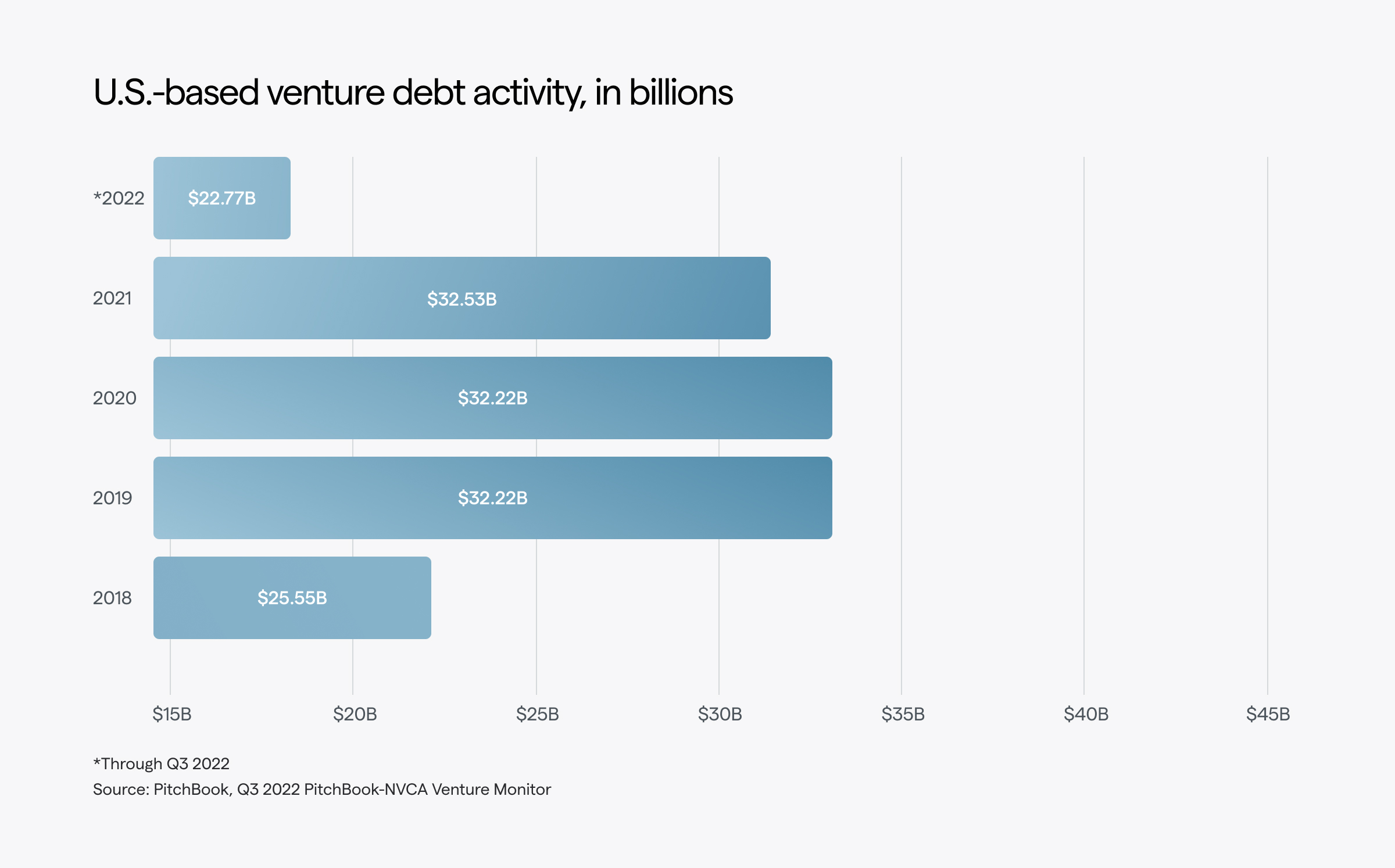

Meanwhile, U.S. venture debt activity saw fewer deals per quarter last year, but larger amounts of debt per deal, according to PitchBook. In 2022, startups completed an average of 641 deals per quarter that involved venture debt, with the average deal representing $11.8 million in debt. That’s a significant uptick from 2021, which saw 922 deals per quarter including venture debt, with the average deal representing $8.85 million in debt.

The bear market chilled new IPOs

Global markets started 2022 by setting new all-time records. But rising inflation, rate hikes, the war in Ukraine and other economic pressures sent the major indexes into a bear market by the summer.

The pullback meant there were an average of six IPOs per month in 2022 — the lowest rate of IPO activity since 1990. In 2021, that rate was a little over 25 new listings per month.

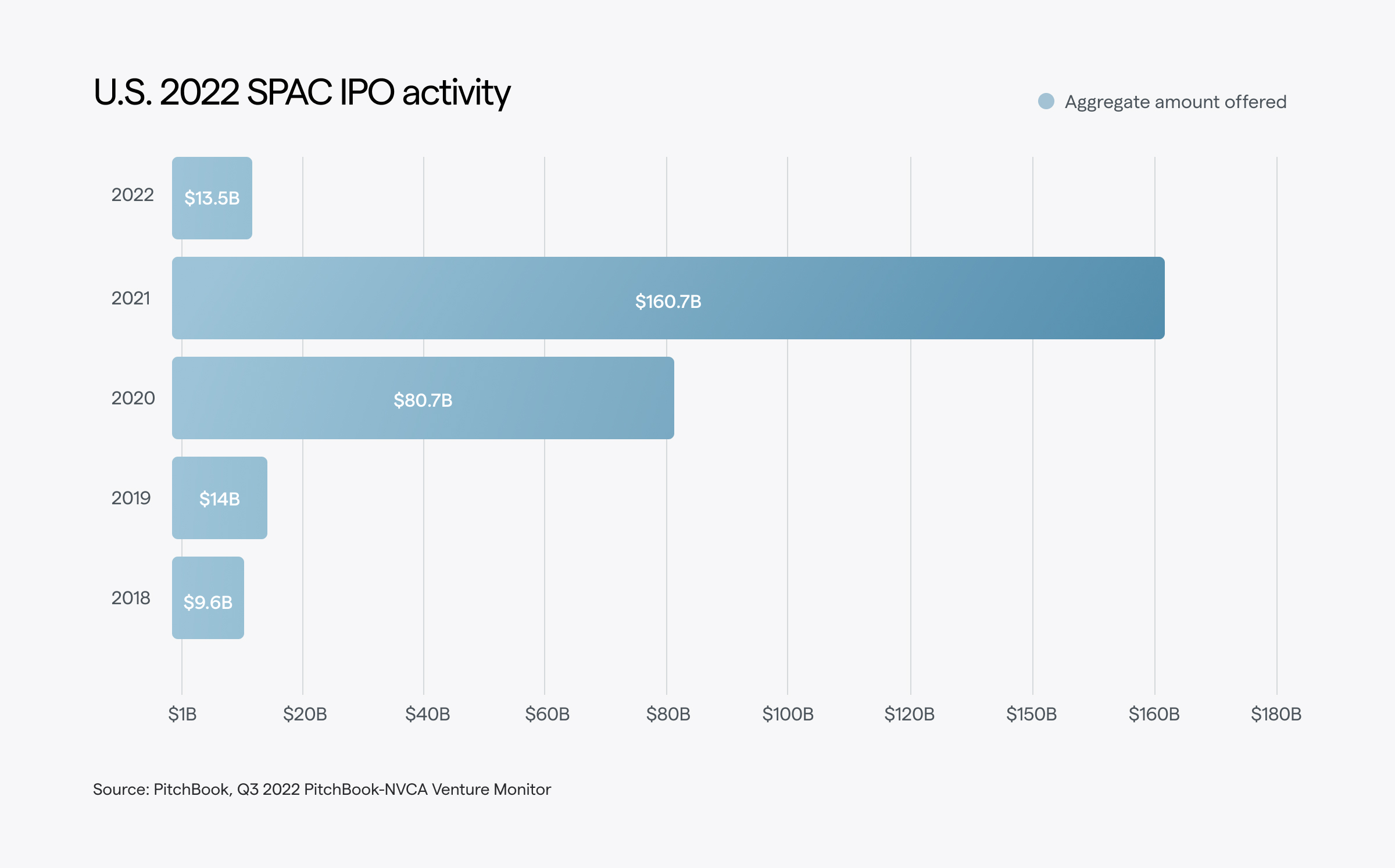

One big factor contributing to the pullback in new IPOs was the collapse of SPACs, which faced fresh headwinds in 2022. SPAC offerings have plunged deeply from their all-time high in early 2021, when there were a little over three new SPAC offerings per day, to today, when we don’t even have one new SPAC offering per week, per S&P Global data.

Nearly 800 of the 1,288 SPACs raised since 2020 have failed to find a suitable target company to merge with, and the majority of those will need to complete a merger in 2023 or face expiration.

The road ahead

Looking ahead, the data suggests that 2023 will continue to be challenging for late-stage startups, squeezed by unfavorable public market conditions for an IPO, dwindling cash runways and investors who may aggressively negotiate down rounds and structured deals to reduce their risk.

Historically, during economic downturns, the IPO window closes and largely remains shut for 18 to 24 months, according to Secfi analysis.

For startup employees who are bullish on their company’s future prospects, opportunities will exist to earn more stock options during down rounds and to strategically exercise their existing stock options in a tax-efficient manner.

Comment