The first quarter was a hot time for crypto-focused startups. According to a recent dataset from CB Insights, crypto startups raised more capital than ever before in Q1 2022 and set records across a host of other metrics.

If you closely watched the first-quarter venture capital cycle, this should not come as a surprise. As The Exchange noted, the crypto startup economy — blockchain technology upstarts, trading platforms, web3 more generally, etc. — was busy partying while the rest of startup land was buckling under a falling stock market, limited exit opportunities and a dramatic repricing of the value of software revenues.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Crypto startups mostly shrugged that off, raising a huge number of rounds worth $100 million in the three-month period and minting a record number of unicorns, CB Insights reports.

The bets may have been poorly timed. In recent weeks, the crypto market suffered from a number of issues, the latest stemming from the collapse of the so-called algorithmic stablecoin Terra and its sister token, Luna. Crypto prices have fallen sharply in recent days, likely harming trading volumes as well.

The contrast between record venture capital totals in the first quarter and crypto’s retrenchment might seem ironic, maybe even humorous if you are the cynical type. Instead, it’s more of a reflection of how even professional investors can get caught up in a moment; a frenzy of checkbooks competing for a limited number of startup bank accounts overbidding their real value.

The contrast between record venture capital totals in the first quarter and crypto’s retrenchment might seem ironic, maybe even humorous if you are the cynical type. Instead, it’s more of a reflection of how even professional investors can get caught up in a moment; a frenzy of checkbooks competing for a limited number of startup bank accounts overbidding their real value.

Even more, we learned this week that investors should have known better, at least a little. Let’s talk about data, declines and early warning signs.

Crypto’s heady Q1 flops into Q2

Briefly, the top-level numbers from Q1, per CB Insights, go as follows:

- $9.2 billion in total investment during Q1 2022, an all-time high that bested the prior record (Q4 2021) by around $400 million.

- 461 total blockchain-focused startup deals in the first quarter of 2022, some 60 deals over the prior record (Q4 2021).

- 28 total rounds worth $100 million or more in Q1 2022, up from the prior record of 18 set in Q3 2021.

- A total of 62 crypto-focused unicorns around the world, up from 49 in the final quarter of 2021.

- Decentralized finance startups raised $2.1 billion in the first quarter, and NFT-focused startups $2.4 billion, both all-time highs.

- Finally, Q1 2022 was the second quarter in a row in which U.S. crypto startups pulled in more than $5 billion.

Hell yeah, you might be saying, crypto is the future, so all of the above makes sense! That perspective is perfectly fine so long as your time horizon is lengthy. For those of us who care about what happens inside the next few years, let alone upcoming quarters, the data above may indicate a peak of sorts.

Why? Because sitting here nearly in the middle of Q2 2022, it’s hard to imagine such exuberance persisting in the rest of the current quarter. With prices in decline for key assets and the NFT market taking a pause from prior growth, it’s not clear where new investor excitement will come from in the near term.

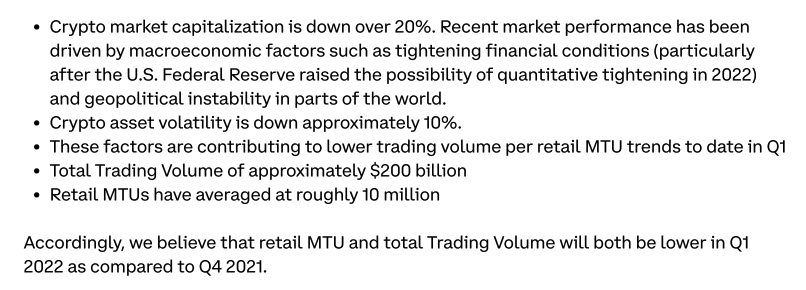

But don’t shed a tear for crypto startup backers; they had early warnings. Recall that in its Q4 2021 earnings, Coinbase said the following:

The former unicorn’s earnings backed up those lackluster results, with the company posting a nine-figure net loss in Q1 2021 against a 27% decline in revenue. The value of Coinbase’s stock — and therefore its total market capitalization — fell sharply in response.

No matter how you feel about Coinbase, the company does a very good job detailing where it is in the market — and is very clear with investors that it expects its results to vary based on external conditions.

It appears, however, that public investors did not really listen, given the wide differential between analyst expectations for Q1 results and what Coinbase wound up detailing. (That gap was around $300 million in revenue during the first quarter, if you were curious.)

Q2 isn’t looking much better for Coinbase, as we noted, which means that the current crypto downturn is not about to snap back to its prior, more bullish position.

This is why the crypto venture boom is so painful to observe in hindsight; so very much money went into a class of startups already in the throes of a decelerating market, a slowdown that seems to be picking up steam as opposed to posting a comeback. Those dollars were disbursed. How much they will return, and when, are open questions.

Don’t think that we are picking on crypto-focused venture investors in particular. Even the more staid SaaS venture market lost its mind last year during a period of record valuations and strong exit liquidity. Software VCs paid simply bonkers prices for some companies last year, pushing ARR multiples to the moon. Then that boom also ran into a public-market correction, and now the entire software startup sector is nursing wounds as it works to conserve cash and grow into valuations that no longer translate to reality.

Comment