Earlier this month, TechCrunch argued that startups looking to raise a Series C round were facing a uniquely difficult fundraising threshold. As Series Cs can be considered the first “late” startup stage, companies looking to raise the particular tranche appear to be running into backwash from the public markets, where tech valuations have come down sharply and IPOs are moribund at best.

It’s the last day of the TechCrunch+ Cyber Monday sale! Head here for details, and don’t miss out!

However, further data focused on the U.S. market indicate that the Series A round is also looking green around the gills for domestic startup founders. Data from PitchBook (hat tip to Brex’s Shai Goldman) and Redpoint detail a falling pace for Series A rounds in the United States through Q3 2022. Recent data is even more dismal.

Naturally, during a market slowdown, we anticipate general pressure on startup fundraising. It’s hardly a conservative method of disbursing capital, and so when rates rise and duller investments gleam brighter, venture activity dips and no one is shocked.

It’s also not a surprise that Series A and C rounds appear more crimped than others. They are both gateway rounds, of sorts, with the latter opening the door to the late stage of a startup’s life and the Series A funding event marking the graduation of a startup from — in theory — its pre-product-market-fit days to its early scaling era.

Let’s parse historical Series A data from the U.S. market and then look into what we can see in Q4 2022 thus far. In case you are in a hurry, the TL;DR is this: If December doesn’t massively outperform expectations, Series As are going to end this year with a whimper.

Let’s parse historical Series A data from the U.S. market and then look into what we can see in Q4 2022 thus far. In case you are in a hurry, the TL;DR is this: If December doesn’t massively outperform expectations, Series As are going to end this year with a whimper.

The Series A crunch (again)

In a tweet in our favorite format — a claim, followed by a supporting chart — Goldman argued that Series A rounds are in the process of heading back to the Neolithic in venture terms:

The chart itself doesn’t look too scary. Series A rounds in 2022 as an aggregate appear pretty healthy compared to prior years, right? Not if we segment by month. Goldman’s point is that if you zoom in on the final bar in the chart, you wind up with some unsettling perspectives.

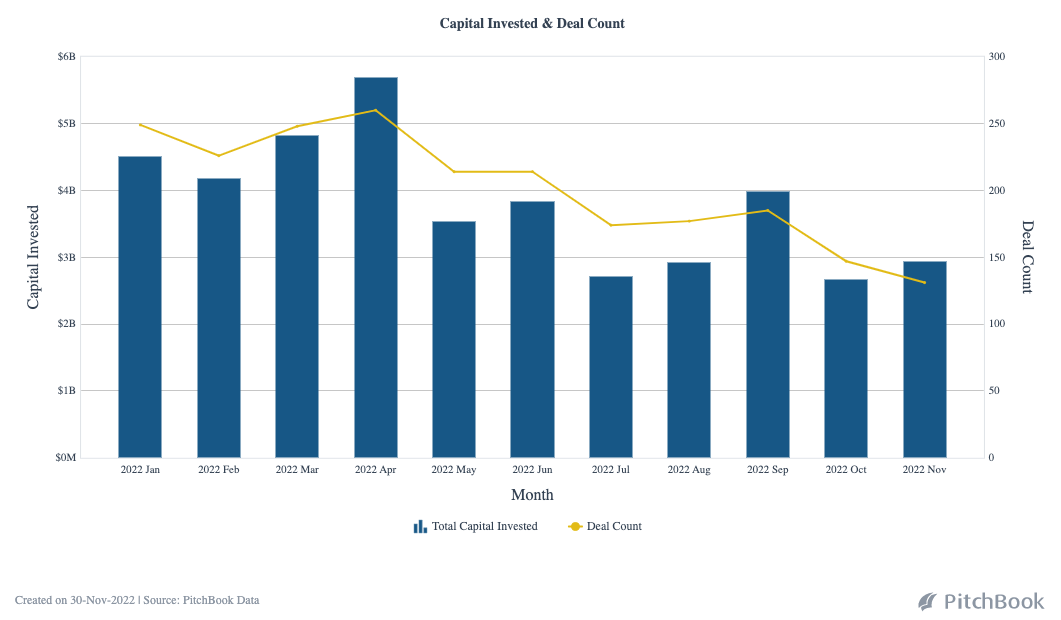

Indeed, per our own PitchBook queries, the pace at which Series A rounds are being executed with U.S.-headquartered startups is set to reach a new low in terms of deal count in November:

More rounds will filter into the above dataset in the coming days, meaning that we’re not seeing the entire November picture yet. But even with a bit more data to come, the image is somewhat bleak.

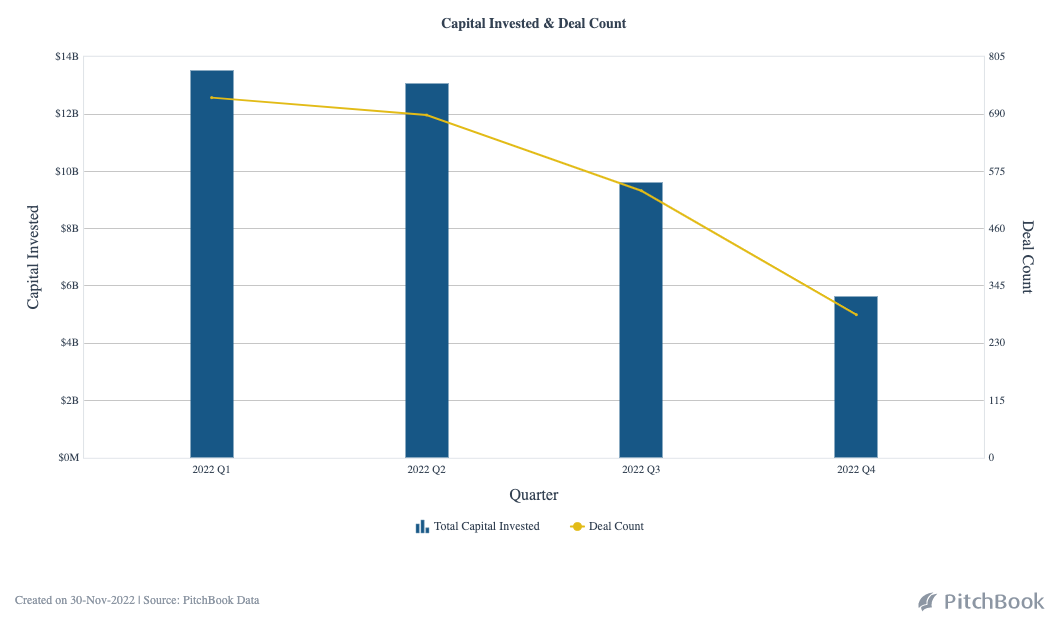

The same chart looking at quarters instead of months better encapsulates the trend:

The above decline is something that investors are noticing. In a recent analytical run, Redpoint Ventures noted the falling pace of Series A deal-making this week, crossing the data with median pre-money valuations of the same company set. The result? Series A deals are getting cheaper as they become less frequent.

Is the news all bad? Mostly, even if our quarterly chart above does Q4 a little bit dirty. After all, we’re merely wrapping up the penultimate month of the quarter, meaning that we have another entire month ahead of us; could the final few weeks of 2022 rectify the Q4 picture of the health of U.S. Series A rounds?

Sure, it could. But it won’t. There could be an explosion of deal-making in the final weeks of 2022, but I have yet to hear from anyone that that’s in the offing. To get close to matching Q3 Series A results in Q4, December — as we can see in our monthly chart — is going to have to pop off.

Provided that it doesn’t, we’ll have a third straight quarter of Series A declines from a domestic perspective.

The last question we need to ask is whether the slowdown in Series A deals is material. Redpoint reports that from a Q3 2021 peak of 242 Series A deals in the United States and Canada (note that the charts above do not include the United States’ northern neighbor), that figure has fallen to just 120 in the third quarter of this year. With a possibly slimmer Q4 on the horizon, the Series A slowdown matters due to the pace of change.

Seeing A deals decapitated by changing market conditions and venture reticence to get too busy while the later stages (Series C included!) are uncertain means fewer startups graduating to the later stages. That adds up to an early bottleneck on the way to eventual liquidity for all seed-stage investors. For seed-stage founders, that steep fundraising road now has two guard towers placed at the A and C stages, meaning extra work will be required to advance.

It was never easy to start and scale a startup. But it’s now harder, and we generally know where the crunch is biting the most deeply.

Comment