Malvern, Pennsylvania-based Savana, a company building financial software products for legacy banks, today announced that it raised $45 million. A portion of the capital — $10 million — was debt, while the rest was a Series A equity tranche led by Georgian Capital Partners.

CEO Michael Sanchez told TechCrunch that the proceeds will be put toward general growth and supporting Savana’s go-to-market and product development projects.

Savana was founded in 2009 by Sanchez, who previously served as the president of the international division of FIS. Prior to FIS, he launched Sanchez Computer Associates, a supplier of core banking systems.

The problem Savana solves pertains to architecture, Sanchez tells TechCrunch. Despite banks’ digital transformation efforts, many haven’t made the switch successfully, he ardently claims.

To his point, a 2022 survey found that — among banks and credit unions who believe they’re at least three-quarters through a transition to digital — less than 25% have seen a meaningful increase in revenue. Moreover, only 11% of finance executives say their organization has modernized systems to the point where they can easily incorporate new digital technologies, according to Deloitte.

“Today’s consumers prefer digital-only banking. This change in consumer behavior has been underway for a number of years and accelerated by COVID-19 shutdowns, which led consumers to complete everyday tasks, such as shopping for groceries, depositing their checks, or managing their bills, all online,” Sanchez said in an email interview. “Despite appearances that banks have all made the transformation to digital, the majority of banks are not ready for this major change in consumer behavior … This is a major problem for banks trying to stay competitive in an environment with tons of fintech pressure.”

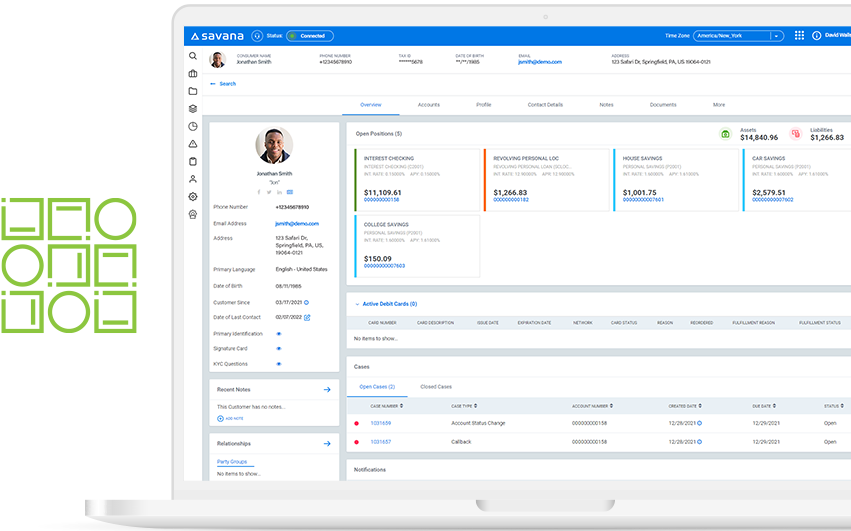

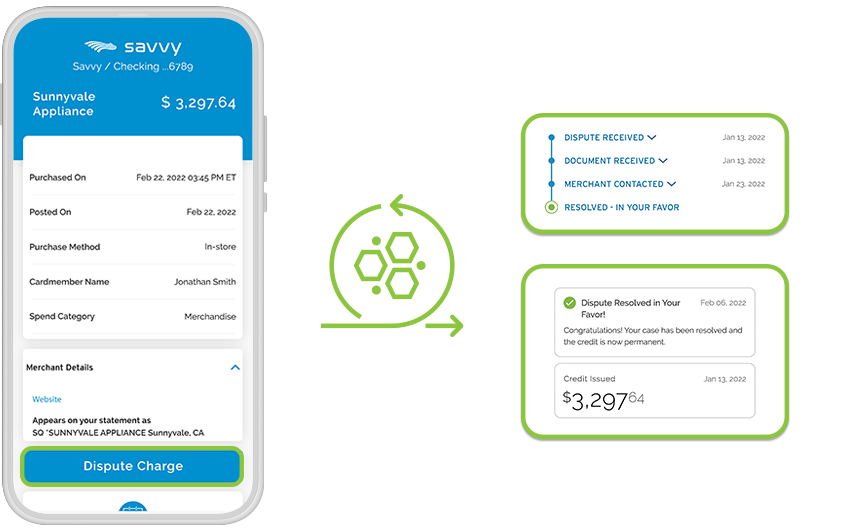

Savana purports to solve this problem through a combination of templates, APIs and integrations engineered to automate back-office and core banking processes. The company’s platform provides a “process architecture” for service spanning various banking and customer channels, ostensibly speeding the time to market for products and ensuring service requests get addressed quickly.

More specifically, Savana attempts to decouple third-party components of banking systems and abstract them into APIs that encapsulate not only the components, but also the rules, workflows, automations and integrations required to perform business tasks. The APIs serve as a library of customer and account servicing functions that are reusable and complementary to Savana’s enterprise content management system, a repository of a bank’s content related to customers and accounts. Beyond this, Savana offers a low-code UI framework to build internal and customer-facing apps that interface with the aforementioned APIs.

“Through pre-configured processes and integrations, [bankers using Savana] gain a real-time, holistic view of all customer accounts, cards, communications, and more, while customers benefit from better, more personalized service,” Sanchez continued. “It eliminates process silos by automating processes between systems and people and eliminates the need for multiple, siloed vendors. [The] turnkey, end-to-end platform is pre-configured with hundreds of APIs enabled.”

Of course, Savana doesn’t stand alone in the market for banking modernization tools. Amount recently raised $99 million at an over $1 billion valuation for its suite aimed at helping banks better compete with fintech companies. There’s also MANTL and Bankjoy, two startups developing technology to make it easier for people to open accounts digitally at community banks and credit unions. One fintech that competes almost directly with Savana is London-based 10x Future Technologies, which helps larger, established banks build both next-generation services and tools to help their older services work more efficiently.

The competition is likely to grow fiercer as economic headwinds reach gale force. Deloitte reported last week that fintech investment decreased to $52.9 billion in H1 2022, down 24% from $69.6 billion in H1 2021. Bank tech vendors in particular suffered, observing a 14% decrease in the first half of 2022 compared to the same period last year.

But Sanchez isn’t concerned — even despite Savana’s relatively small customer base of about 10 client banks and fintechs. Sanchez said that “a number of entities” will go live with Savana between now and the end of 2022, although he wouldn’t say how many — or what to expect on the revenue front.

“Savana’s digital delivery platform is the first and only technology solution to help banks overcome the operational challenges of meeting evolving customer expectations,” Sanchez boldly claimed. “The banking industry is going through incredible transformation. Digital banking is quickly evolving from just being defined by a consumer mobile banking app, to an end-to-end digitally enabled enterprise. Getting all the right pieces in place from the core to the customer is the new imperative for banks aspiring to be digital banking enterprises.”

Regardless of the strength of Savana’s platform, it’ll have to contend like any vendor with the challenges that banks face in implementing new technologies. According to a study by the Monetary Authority of Singapore, it takes six to eight months for a bank to research, vet and develop a prototype with a fintech. One of the biggest obstacles holding banks back is the upfront investment in technology — Forbes reports that it can amount to 10% of a bank’s annual expenditure.

Sanchez argues that Savana has an advantage in its experience building digital systems for banks and financial institutions. For instance, Mike Wolfel, the company’s president and CTO, formerly led the design of process automation systems across mortgage origination and serving, corporate administration and finance as a consultant.

Many of Savana’s competitors have experts in finance among their ranks, too. But — broadly speaking — there might be something to Sanchez’s point. One poll of financial services executives found 70% believe a lack of skills or insufficient training remains the biggest barrier to a new digital initiative within their organization. In other words, outsourcing remains appealing.

“According to the Digital-First Banking Tracker, nearly 50% of today’s consumers prefer digital-only banking,” Sanchez said. “It will be essential for banks to upgrade their technology infrastructure to meet … evolving expectations. Ensuring a frictionless customer experience will be the difference between the banks that thrive and those that do not survive.”

To date, Savana has raised $54.2 million in capital. (The company previously closed a seed round in April 2010 and a small venture round in February 2020; the Series A is its first round since the latter.) Its headcount stands at 200, which Sanchez expects will grow to nearly 400 people by the end of the year.

Comment