Regardless of your perspective on blockchain-centered projects, venture capitalists appear to have made up their minds about the sector: Investments into crypto-themed companies — the web3 space, as its supporters call it — set records in 2021, records that could be beaten in 2022 if early data indicates where capital will flow this year.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Data from a new venture capital fund and recent funding rounds underscore the pace of deal flow the crypto market has ahead of it, indicating that bets placed on blockchain-related startups will continue despite some wobbly indicators from the decentralized market.

That there are believers in crypto in the market is not a surprise. The pace of investing may prove to be. For example, early PitchBook data relating to startups it categorizes in the “Cryptocurrency/Blockchain” sector raised around as much this January as all startups in Africa did last year — despite the fact that the African startup investment market is accelerating, as TechCrunch has noted.

This morning, let’s take a look at a few data points showing how rapidly the current pace of investment into crypto-focused startups is shaping up in 2022 and cast a quick glance at issues in the blockchain market that could, but are not, giving investors pause.

This morning, let’s take a look at a few data points showing how rapidly the current pace of investment into crypto-focused startups is shaping up in 2022 and cast a quick glance at issues in the blockchain market that could, but are not, giving investors pause.

To the moon

The recent fundraise by FTX drew a host of headlines. Any time a private company scales its private-market valuation to the range of dozens of billions, it’s hard to ignore. That FTX raised $400 million for its main business — at a $32 billion valuation — less than a week after the company raised $400 million for its U.S.-based operations at an $8 billion valuation did not garner the shock that it should. That’s a simply tectonic sum of cash, and at prices that indicate that FTX sold a total of around 2% of the shares in both companies, or $800 million worth of investment into $40 billion worth of equity value.

But that’s not the only recent news event that underscores how big the crypto bets may prove in 2022. Alexis Ohanian’s Seven Seven Six venture firm just announced $500 million in two funds, that, per The Wall Street Journal, it will “invest primarily in crypto startups.”

Huge rounds and new funds, however, are just the start. PitchBook data indicated that VCs “poured a record $30 billion — more than every other year combined” into crypto startups, according to a Business Insider summary of the information. If January is any indication, that figure is going to get crushed this year.

A quick search of PitchBook data indicates that nearly $4.4 billion was invested by PE and VC investors into blockchain startups thus far in 2022. If that pace holds for the year, startups in the market sector would raise more than $50 billion, a huge increase on what was already a record-setting 2021.

Sure, SaaS valuations are coming back to Earth, and some investors are taking things a bit more slowly than before — at least so we’re told — but that newfound, or perhaps reforged, conservatism does not appear to be taking hold in the crypto market. At least not yet.

And yet

Journalists are trained to treat bias and inside-dealing in their work with revulsion. In the business world, such matters are called “having relationships.” This means that the issue of Coinbase investing in tokens that it then lists — along with its former backer and now occasional co-investor, a16z — may not bother you. It sits oddly with me. The FT has more here, but the issue I think goes to show how centralized, ironically, the crypto market is. It remains driven by traditional companies and traditional capital-backers.

Thematic issues aside, there are other things to keep in mind. Early leading crypto-based game Axie Infinity is dealing with economic issues by shaking up its internal economy by fiat, leading to a rapid decline in the value of activity on its service; that such a well-known member of the blockchain gaming subsector is flatlining as much as Axie is today doesn’t bode extremely well for its peers.

The value of Coinbase has also given up ground in recent months, now trading below its direct listing reference price. For such a profitable crypto concern, the valuation decline is not encouraging. Robinhood, another company that enjoyed a boom in crypto-driven revenues during the 2021 industry cycle, has also seen that growth evaporate.

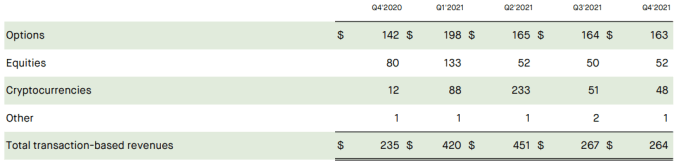

Indeed, Robinhood crypto incomes from trading have collapsed from prior highs:

A fall of $233 million to $48 million is a decline of a little more than 79%.

Recent declines in the value of major crypto assets also brought value dips in more minor tokens and chains. The value of the Solana chain token crested the $250 mark in late 2021 before falling under $100 in the last week. SOL has since recovered somewhat, but its declines remain material.

We’ve become accustomed to crypto price swings, of course. Stocks go up and down, yes, but cryptos go way up and way down. I think this sort of high variance that certain crypto assets have long shown has inured us to the capital flowing into the blockchain industry. It shouldn’t. Yes, crypto assets fluctuate, but business cost structures don’t, or at least not as much.

This could lead to some uncomfortable situations for crypto startups that raise during today’s bull cycle but fail to find long-term product-market fit before the next bear cycle. So far, investors don’t seem to be seriously considering this possibility, so founders aren’t, either. But sentiment always turns, and the business cycle always reverts.

Comment