Today, Y Combinator’s latest startup cohort will kick off a two-day presentation cycle. The Exchange loves a demo day, so we keep an eye on accelerators as best we can. We recently covered the latest concerning YC’s rival group Techstars’ geographic footprint as well.

As we wait for the first presentations to begin, this is a good time to take a quick look at the early-stage venture market that companies from accelerators of all stripes will operate in this year. Thanks to some early data from Carta, which many startups use to manage their cap tables, we can sketch a pretty clear picture of the state of venture for young tech upstarts.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

We recently learned that the earliest-stage rounds aligned the quickest to new market norms, while Series A and later “middle-stage” rounds are still adapting to the changed venture market. We are not looking at Series D and later rounds today, saving our fire there for when we have more data and time.

Let’s talk median round sizes and deal values for seed through Series C in the first quarter of this year. How rough has 2023 been so far compared to a year ago? Have we seen any signs of recovery from Q4 2022? Is it getting easier for founders to raise money? The answers to those questions are not incredibly encouraging, except, it turns out, for the very smallest companies — like those we’ll see later today.

State of the early stage

Before we dive headfirst into the numbers, here are some caveats:

First, we’re looking at data pulled from Carta’s users. That comes with considerations around the geography covered and the completeness of the data. Still, as Carta is a popular tool, its data is a strong place to start even if it is, as all datasets are, imperfect.

Second, the market is interesting right now. The general perspective is that the strongest startups often had the best cash balances heading into the current downturn, and many of these have not raised any money since. This means there is likely some adverse selection bias at play in the data. The companies that needed to fundraise and did were perhaps, on average, worse off than the median for their stage. The following data could therefore prove slightly more pessimistic than what we would see if the full range of startups were fundraising today.

Second, the market is interesting right now. The general perspective is that the strongest startups often had the best cash balances heading into the current downturn, and many of these have not raised any money since. This means there is likely some adverse selection bias at play in the data. The companies that needed to fundraise and did were perhaps, on average, worse off than the median for their stage. The following data could therefore prove slightly more pessimistic than what we would see if the full range of startups were fundraising today.

Enough of that. Let’s see what the numbers can tell us about the early-stage market in Q1 2023 and what sorts of deals are being signed today.

The data

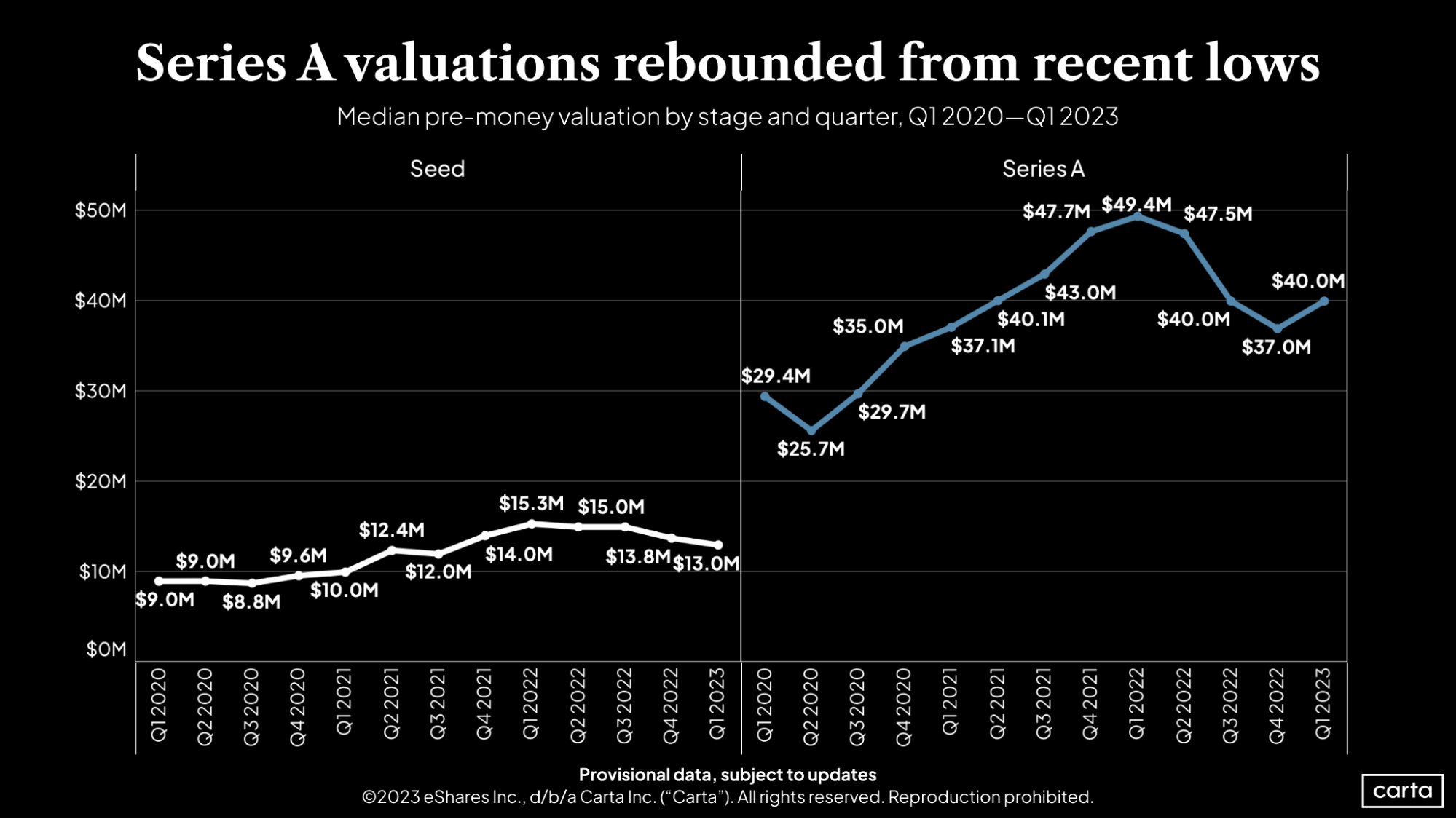

The seed stage is a bit of an outlier compared to later stages because venture funding for very early-stage startups has remained comparatively immune from the woes of the public market. As a result, pre-money median seed valuations have stayed relatively flat. That was true last quarter, too.

Indeed, the median pre-money valuation at the seed stage declined only slightly in Q1 2023 to $13 million from $13.8 million in Q4 2022, per Carta data. That said, $13 million is more than what startups at this stage saw in any quarter between Q1 2020 and Q3 2021. In contrast with other stages, the median seed-stage valuation didn’t peak in 2021 but in Q1 2022.

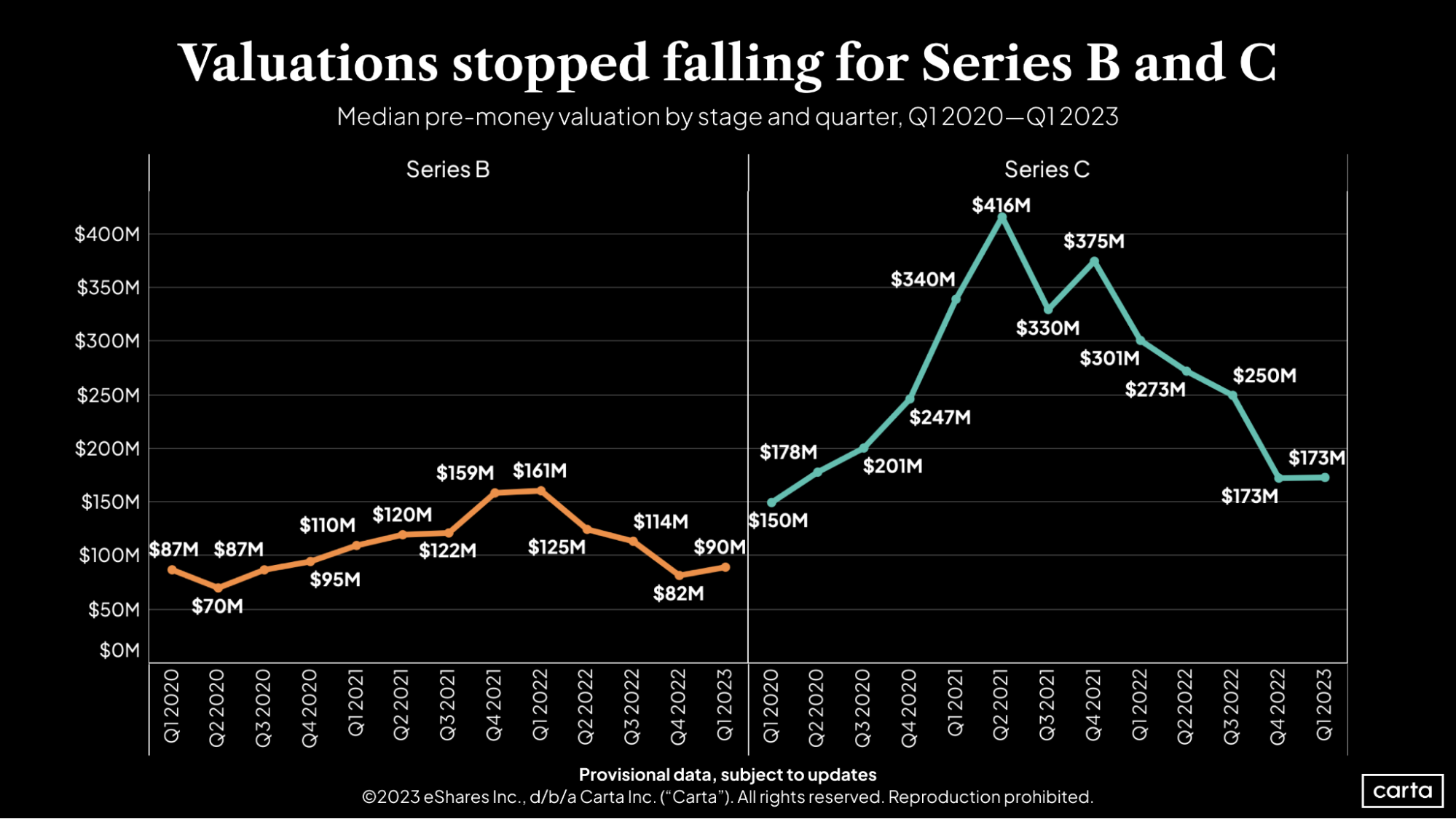

Valuations for Series A, B and C rounds tell a different story: These stages have clearly been affected by the slowdown in recent quarters but seem to be showing signs of recovery.

An important caveat here is that deal count is likely down as well. More to come on that front when certain datasets unlock due to publishing embargoes, but we’d like to note that the domestic venture deal count chart is not trending upward.

Per Carta, “Series A valuations rebounded from recent lows.” In Q1 2023, the median pre-money valuation of startups that closed a Series A round reverted to Q3 2022 levels: $40 million, up from $37 million in the last quarter of 2022.

The median valuation for Series B rounds was also higher in Q1 2023 than in Q4 2022, rebounding from $82 million to $90 million. Both amounts are still lower than in any quarter of 2021, but we have a feeling the decline might be over now.

Another data point in that direction is that while valuations for Series C rounds didn’t rebound just yet, they flatlined at $173 million, the exact same amount as in Q4 2022.

The fact that valuations stopped falling or even recovered might be encouraging. However, deals between the Series A and D stages don’t look the same as they used to if we look at another data point: Deal size.

In Q1 2023, the median Series A was $6.9 million, which is lower than in any quarter since 2020. Median cash raised in Series B and C rounds also kept declining, respectively, to $12.9 million and $22.3 million.

Rounds getting smaller while investors becoming increasingly picky means that companies have to do more with less to hit their next fundraising milestones.

But according to Redpoint, falling venture results in general may indicate a silver lining: “Fewer funded competitors in any given category as fewer companies are able to raise and stay in business, leading to marginally easier hiring and less expensive growth.”

Quicker hiring and perhaps less expensive talent combined with lower competition could help early-stage startups do just what is needed at this time: get farther with less. Smaller-dollar rounds may therefore not be as limiting as they first seem to be. For the companies launching this week from Y Combinator, that could be a welcome change. Still, who would rather build in a downturn than during a frenetic boom?

But if the venture chestnut of “great companies are built in bad times” is more than a cliché, we should expect pretty big things from at least a handful of the new Y Combinator class.

Comment