The Kenyan fintech Kwara was launched in 2019 to help credit unions (savings and credit cooperatives societies, SACCOs) in the East African country shift to digital platforms by providing them with its proprietary backend-as-a-service (BaaS) software.

The startup’s trajectory has been steep, as its clientele shot up from two to 50 in just over two years. This is as it became clearer to the country’s cooperative credit unions that they needed more technology to remain competitive.

Kwara is now moving a step further to build the next-generation neobank that will give credit union members access to instant loans and third-party services such as insurance, as the startup moves to offer end-to-end solutions to its clients.

The startup has raised $4 million in a seed round to build a neobank app that will enable individuals to sign up with their preferred credit unions to access various financial services.

“We want to make credit unions as efficient as they can be by giving their members the kind of neobank experiences they wish to have,” Kwara co-founder and CEO, Cynthia Wandia told TechCrunch.

This is expected to open up new borderless avenues for the lending institutions to sign up new members and help credit unions shift away from tedious paper-based systems and the need for elaborate brick-and-mortar branches. Members using the app, which is set for launch mid next year, will be able to track their personal financial flows from the app too.

The beta version of the app has been tested for feasibility, with an uptake of between 60% and 90%, Kwara co-founder and COO, David Hwan said.

“The app gives power to the members, who have the ability to view and download their financial statements, apply for loans and make repayments. By giving power to the members, we are extending the freedom that credit unions need to focus on their core business or more value-added tasks,” said Hwan.

Kwara said that its existing clients have experienced a membership growth of over 19% year on year, three times the global average, as the loan base of credit unions using its technologies went up 46%, about five times the national average. On its platform, Kwara supported $40 million in transactions between credit unions and their members.

Credit unions leveraging technology also boast member confidence and trust, which, in turn, yield new signups. Wandia said that Kwara is helping them to run a modern banking business since with the right support they are banks waiting to happen.

“Right from the start, we decided to give our clients something that they could use to become a bank.”

“I think that’s made a big difference in a short amount of time in terms of building up the credibility on the product side because we were able to come to the table with a product that just out of the gate could run a bank, which is unusual, because normally that type of stuff is completely out of their price range,” she said.

Kwara has over the last year entered South Africa and Philippines, as the demand for its services grew beyond Kenya. It hopes to triple the number of credit unions using its software to 150 by the end of 2022. The startup currently serves 60,000 Sacco members but is also looking to cross the 100,000 mark by the end of next year. The startup’s goal is to serve 1 billion people by 2030.

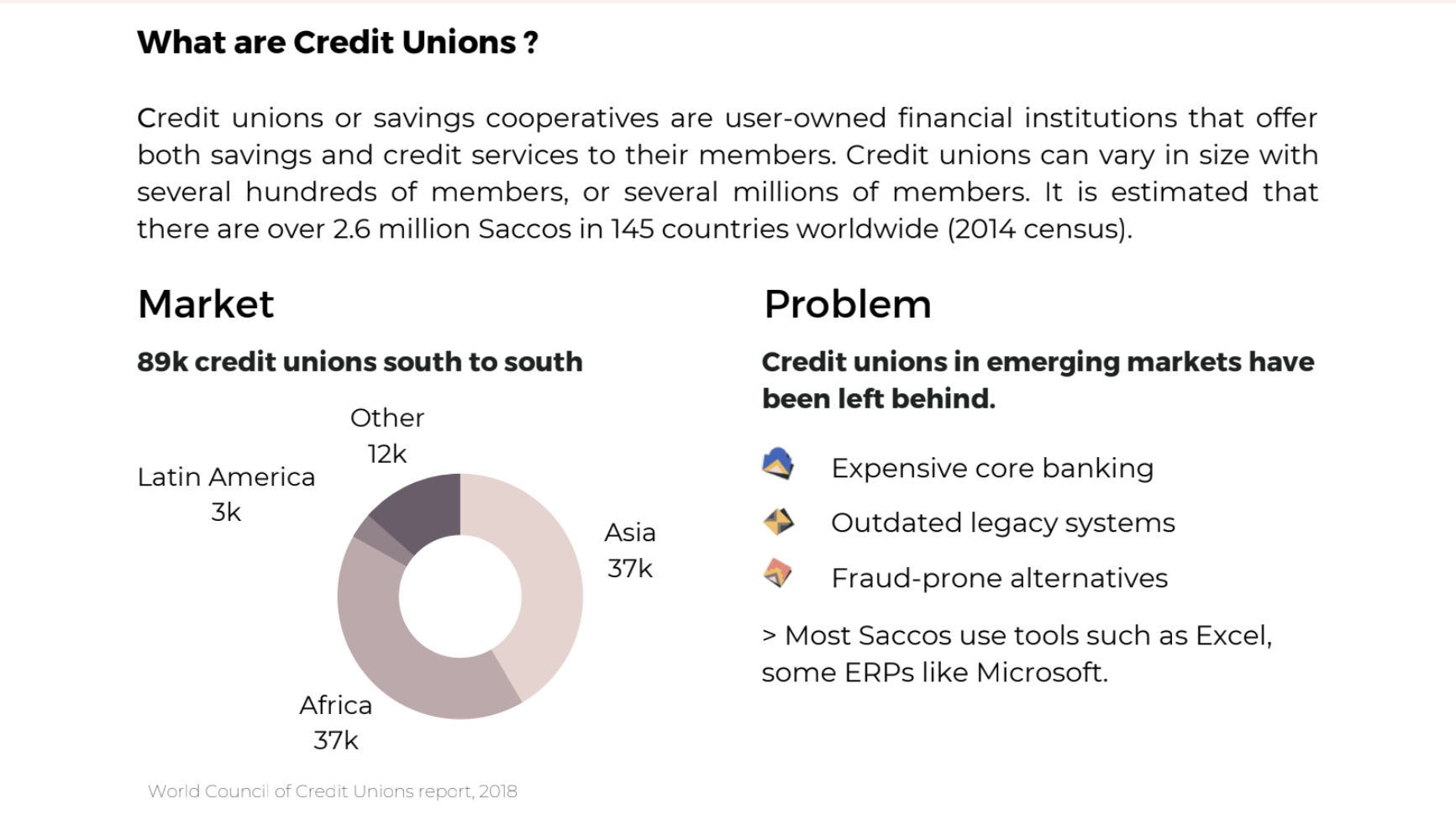

Wandia said that from the onset, it was clear that Kwara would expand beyond Kenya as they quickly discovered that most credit unions, especially those in emerging markets, had not caught the wave of technology.

Kwara has also started forging alliances with companies, to offer third-party services on its app. The startup recently partnered with Lami Technologies, a Kenyan-based digital insurance company, to make accessible a wide range of insurance products including health, property, business and life covers on the app. This is as the startup continues to perfect its app in readiness for a full launch next year.

The seed round was led by Breega VC firm, with participation of SoftBank Vision Fund Emerge, Finca Ventures, New General Market Partners, Globivest and Do Good Invest. Other investors include Rabacap, Launch Africa, Norrsken Impact Accelerator, Future Africa, Samurai Incubate, DOB Equity and fintech angels.

“Over the years, we’ve seen an increasing interest in how to build wealth through community, as well as a shift in consumer preferences toward digital-first banking. Kwara’s unique approach is a catalyst for a new way of retail banking through digital-first credit unions,” said Breega’s founding partner, Ben Marrel.

Credit unions are usually formed by people with a common interest or members of an industry, like farmers or teachers, who buy shares in the institution, save money and take loans. They are popular in Kenya owing to their low-interest-rate loans and ease in accessing credit when compared to conventional banks. About 175 credit unions are licensed in Kenya to serve nearly 4.1 million members countrywide — a vast majority remain unlicensed.

According to Kenya’s monetary authority, the Central Bank of Kenya (CBK), the total assets of licensed credit unions grew 13.5% last year to reach $5.6 billion. Member deposits and the appetite for loans also continued to grow but they also became vulnerable to cyberattacks due to their weak technology. The regulator recommended that they shift to better technologies to protect member deposits, solutions that Kwara is now providing.

“We are building the infrastructure and rails for the credit unions and their members to connect to everything that’s already out there,” Hwan said.

Comment