People in the U.S. reported $8.8 billion of financial fraud in 2022 to the Federal Trade Commission, and while the FTC received fewer reports, 2.4 million versus 2.9 million in 2021, the overall monetary figure is 30% higher than 2021. Bank transfer or payment fraud amounted to $1.6 billion in 2022.

When you expand this globally, Cable’s co-founder Natasha Vernier told TechCrunch that financial crime becomes a $4 trillion problem. And one Vernier, co-founder Katie Savitz and the Cable team have been working on since 2021.

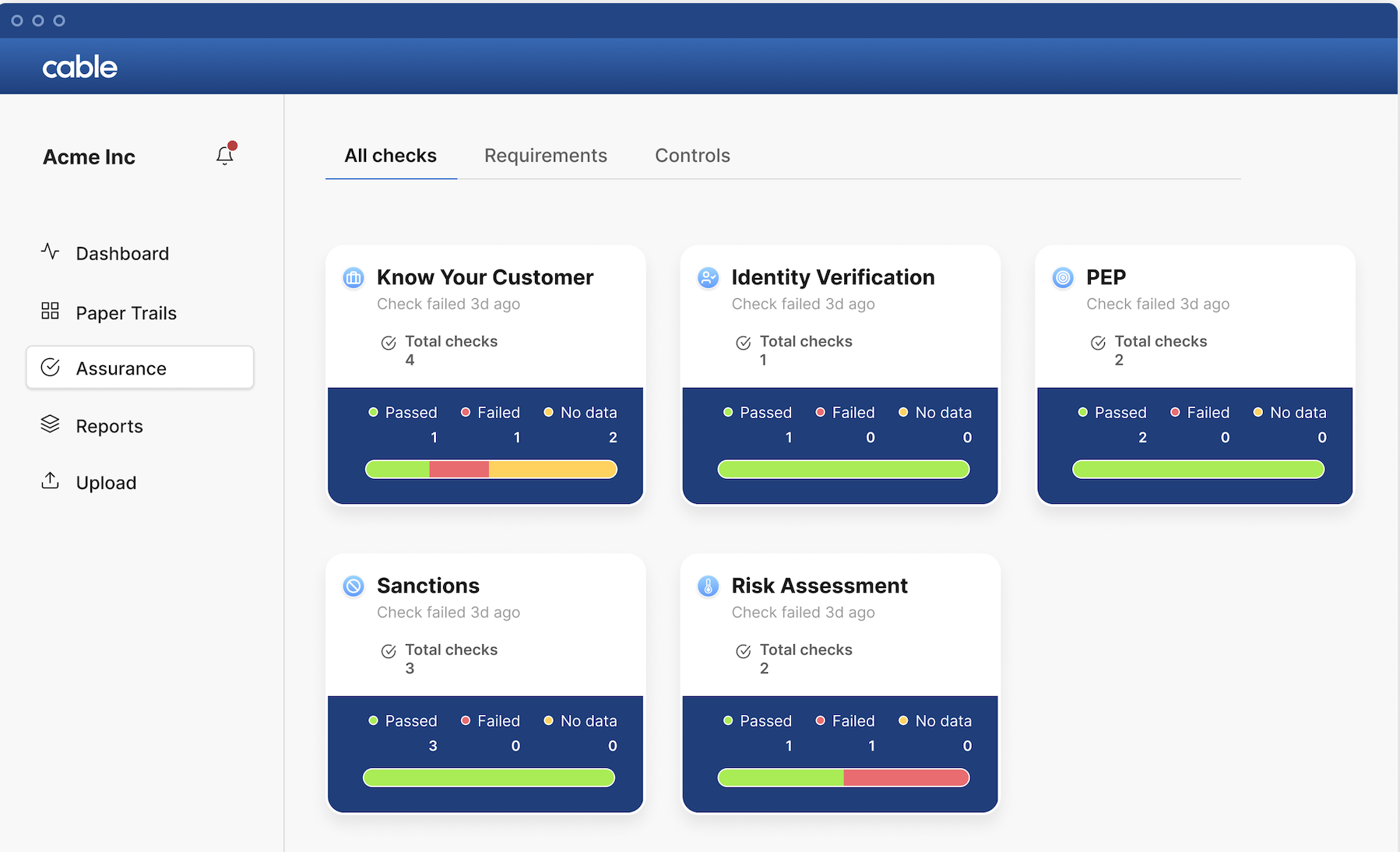

Vernier explained that banks and fintechs need to first have controls in place to mitigate risk. Controls can include Know Your Customer checks, sanctions, screenings and transaction monitoring — all of the offerings that vendors like Unit21 and Alloy do.

About a decade ago, banks were receiving fines by regulators for having “inadequate financial crime controls,” and while the number of those fines dropped off as monitoring vendors came in, some banks are still receiving fines for having “ineffective controls,” Vernier said. That’s because there is a second requirement that regulated financial institutions have to meet, which is to independently test if their controls actually work.

“So far this has been done entirely manually,” she said. “Banks and fintechs manually sample a tiny percentage of accounts to try and see if those controls are working. That’s what we’ve automated, and we believe we’re the first and only automated solution available at the moment.”

Fintech startup Alloy leans on fraud prevention to land new $1.55B valuation

This makes Cable’s platform, which provides automated assurance and risk assessment, complementary to many of the financial crime vendors. It enables banks and fintechs to monitor all of their accounts — not just a fraction as before — to know, in real time, if they are compliant with regulations and if their failure controls are working as expected to combat breaches.

Cable also gives banking-as-a-service organizations oversight on the fintech partners they work with — remember, most fintechs don’t have banking licenses and therefore work with banks to offer financial services.

In the past year, the company increased its revenue five times, and since 2021, attracted customers, including Axiom Bank, Quaint Oak Bank and Griffin on the banking side, and fintech and crypto companies, including Tide and Ramp.

“Fintechs have to work with banks to, in essence, borrow their license,” Vernier said. “That’s where we’re finding real traction and one of the areas that the OCC (Office of the Comptroller of the Currency) is particularly focused on right now: banks that are lending their license to fintechs. They need to understand the effectiveness of the controls at those fintechs, and our product is perfectly suited for that use case.”

Today, Cable announced an $11 million Series A, led by Stage 2 Capital and Jump Capital, with participation from existing investor CRV. The new investment gives the company just over $16 million in total funding.

The capital enables the company to hire across product, engineering, data and go-to-market teams and also accelerate its product development. Vernier said that the company has only built out 1% of the products and features on its two-year roadmap.

Meanwhile, Vernier said as the banking industry moves forward, it will continue to add more ways for consumers to deal with their finances rather than just traditional banks. And with that will be more scrutiny from regulators for improved oversight, which is why she said it is the “perfect time for Cable to raise more money and accelerate.”

“Regulators are particularly interested in effectiveness testing, but also, just the volatility in the banking industry right now, with COVID and if we are in a recession or not, there is increased financial crime,” Vernier said. “We’ve certainly seen, globally, an increase in fraud and other types of financial crime over the last few years. And, as real-time payments get rolled out in the U.S., we’ll see more financial crime.”

Using data to solve key pain points for today’s banking customers

Comment