Upstart tech companies delivering their product or service via an API raised mammoth amounts of capital during the final year of the 2021-era startup boom. Things have slowed in the intervening quarters.

New data indicates that while the group of companies raised more capital in 2022 than in 2020, a downward trend in fundraising activity throughout the last calendar year shows that no startup cohort is immune from the venture capital slowdown. That applies to the groupings of new tech companies that were among the hottest before the recent downturn, too.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

GGV, a venture capital firm that invests across sectors, stages and geographies, compiled an index of what it considers API-first companies that it launched last year. TechCrunch covered its launch, as we have a soft spot for trackable baskets of startups that we can observe across time; similar collections from firms like Bessemer provide useful measuring sticks for the startup market, especially in a rapidly evolving venture capital and exit climate.

The venture group recently compiled the last of its 2022 information, sharing the data with TechCrunch+ ahead of its publication. Tiffany Luck and Chelcie Taylor, investors at GGV, sat with us to chat about the data. They also provided a slightly expanded dataset encompassing an even larger group of API-first startups at our request.

How are API-first startups faring in the face of private-market headwinds and some market pessimism about the health of many startups far from their exit point? The answer is mixed. On one hand, venture capital investment in the startup business model is slowing, but there is good news to be found as well. The tech talent market is slowly unlocking as tech titans release waves of experienced personnel, meaning that well-capitalized startups — and API-first startups did raise a lot of money during 2021 — may be able to pick up new staff that were previously out of reach.

We’ve spent ample time in recent years covering startups focused on API-based product delivery over the more traditional, seat-based SaaS model. Today, in our examination of API-first startups we’ll also take stock of their unit economics and how consumption pricing itself is faring, with input from Luck and Taylor to get a nuanced view of the positive and negative trends affecting startups that want you to hook into their product with a developer key.

We’ve spent ample time in recent years covering startups focused on API-based product delivery over the more traditional, seat-based SaaS model. Today, in our examination of API-first startups we’ll also take stock of their unit economics and how consumption pricing itself is faring, with input from Luck and Taylor to get a nuanced view of the positive and negative trends affecting startups that want you to hook into their product with a developer key.

Creating an index

GGV first came up with its API-First Index just over a year ago. One of its goals was to bring more visibility and add data points to the trend showcased by Postman’s annual State of the API reports, which the startup first launched in 2019.

In the first version of its index that it released in March 2022, GGV featured the top 50 API-first companies in terms of dollars raised. It just happened that “the top 50 had actually raised $50 million or more,” Luck said.

In later quarterly updates, though, GGV didn’t want to limit itself to the top 50. It decided to expand its list to include all companies that raised more than this amount, with the reasoning that having raised $50 million is a fairly strong indicator.

At the moment, there are 63 of them, but GGV might broaden its scope again to include more companies that it’s already tracking. “One thing that we’re thinking about for the next update is actually expanding the list to 100,” Luck said. GGV already has the data handy, Taylor added: The firm already tracks 102 companies that fall into the API-first category, from Stripe to early-stage companies that raised a few millions.

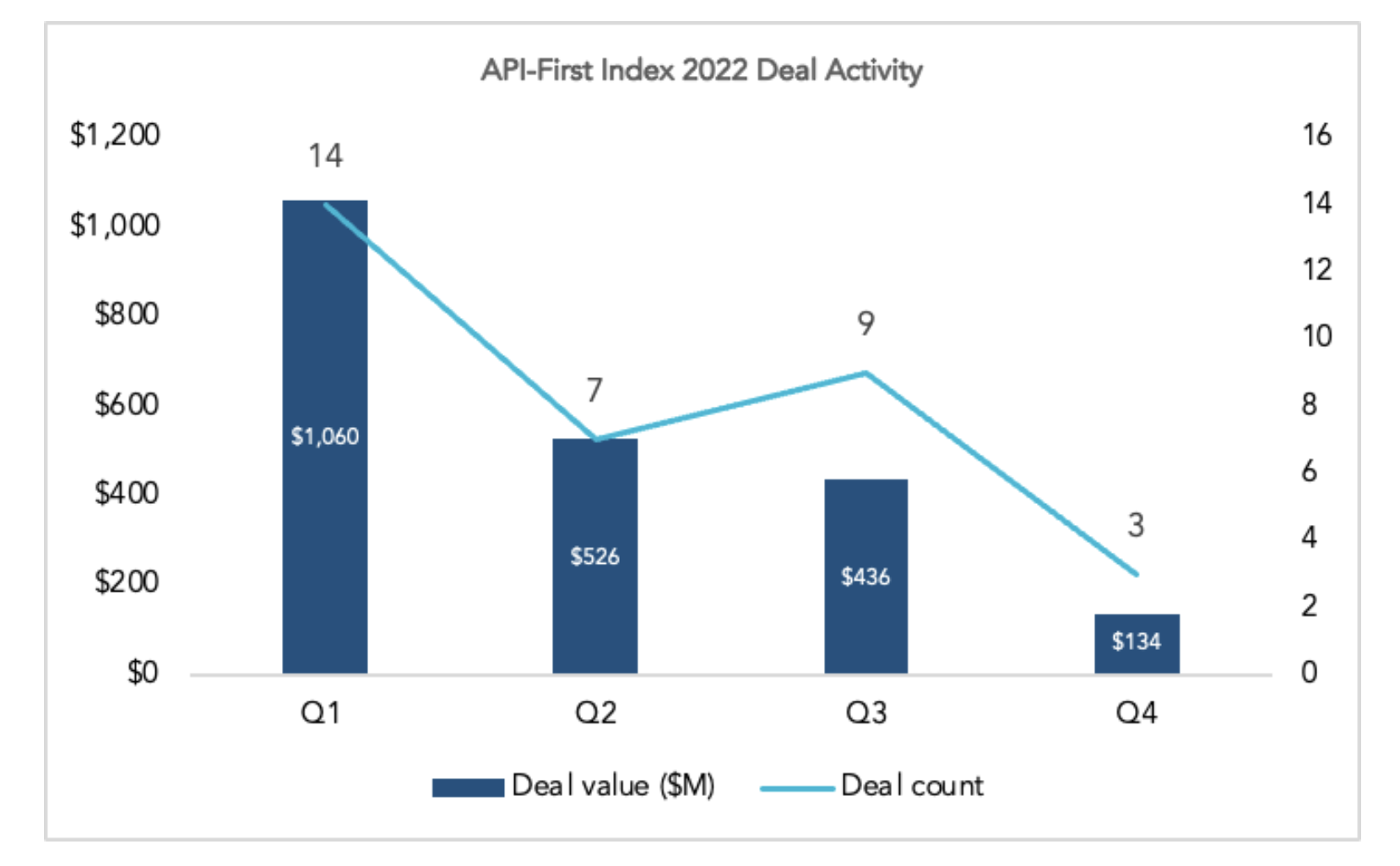

This would likely mean lowering the bar quite below $50 million, as funding isn’t flowing as fast as it used to. API-first companies on GGV’s index have been raising less funding in 2022 than in 2021: a collective $2,156 million across 33 deals, compared to $7,100 million across 74 deals the previous year. That’s still more than in 2019 and 2020, but the quarterly trend is also worth keeping in mind.

Per GGV’s analysis, the 63 companies on its index raised $134 million in Q4 2022, which is lower than in the year’s previous three quarters. Deal count was also at its lowest of the year in the last quarter, with only three deals. Here’s a chart of that dataset:

Expanding the list could make sense; API-first startups have been hot for a while, and we predicted that their rise would continue this year. However, they are in no way immune from the broader context other technology companies are exposed to, and which we expect to impact them both positively and negatively in 2023. (GGV re-ran its analysis with a wider dataset of API-first companies, including those that had not raised $50 million, and while the quarterly trends held, the Q4 figure was a more winsome $237 million across 14 deals.)

Headwinds and tailwinds

When it comes to API-first startups in the current context, “you’ve actually got battling tailwinds and headwinds,” Luck said. Some of this conflicting context has to do with the business model itself.

Usage-based pricing is a rising trend in SaaS, but even more common for API-first businesses. After all, charging based on seats rarely makes sense when your product is an API.

Does this pricing model leave API-first more exposed to budget cuts than their more traditionally priced peers? It’s complicated. On one hand, it is easier to reduce spending that’s not tied to contract commitments. On the other, an API-first business might be more protected by the very nature of its business.

“In one sense, and I think this is true for all of infrastructure, including API-first,” Luck said, “if you have something that’s core to your product built in, you’re really not going to rip it out. So you’ve got retention (asterisk, unless your customers are going out of business).”

Retention, especially net dollar retention, isn’t the only KPI on which these companies stand a good chance at overperforming their peers. “Overall, we feel like unit economics are pretty good for API first,” Luck said.

The category an API-centric company operates in also plays a role in how it will weather the downturn, as “certain things are flying off the shelf.” For anything tied to generative AI, for example, “usage is up drastically,” Luck said.

Layoffs, which are on everyone’s mind at the moment, might be less worrying for API-first companies than for tech companies more broadly. Among companies that GGV tracks in this category, “everyone’s still hiring,” and that task is now easier than it used to be, Luck said.

2021 was tough on the hiring front for startups, as the increase in remote opportunities made it hard for them to compete against tech giants for talent. This year is different. “The candidate pool for job openings across the board has been really strong,” Luck said, and “companies are getting access to candidates they wouldn’t have had access to otherwise.”

Looking ahead

Data for the Q1 2023 venture capital market is still trickling in, meaning that we cannot yet say that the period will wind up being strong or weak for API-first startups compared to Q4 2022 results. But there is some data that may point to continued venture interest in the startups we are discussing.

Taylor and Luck cited a few rounds that could fill out venture results for API-led startups, including Finch raising a $40 million Series B. Of course, gaps between closing and announcement dates for venture rounds makes it a messy job to track near-term changes to investment flows. All the same, TechCrunch has covered a number of other API-related rounds in recent weeks that could hint at a positive climate for API-first startups, as well as companies building tech for the cohort and paid API access more generally:

- Archetype, which is building a billion service for APIs, raised $3.1 million recently.

- Twitter is moving to charge more for its own APIs.

- Tweed raised $4 million for its Web3 wallet API. Coinbase is making similar moves.

- Blobr, which is building an API marketplace, recently raised $5.4 million.

- Berlin-based Monite raised a $5 million seed round for its API-based B2B payments platform.

- And, of course, the recent launch of the ChatGPT API shows that even the most cutting-edge private companies are considering offering their service in ways that are distinct from traditionally cloud-delivered software.

We’ll report back when we have more firm Q1 data. If it shows a rebound from what we saw in the final quarter of 2022, we may be heading out of the API-first startup venture slowdown that we can see in data from last year. But as we never want to trust any single quarter as too predictive, we’ll really need to wait for full H1 2023 to call a comeback.

Our perspective is that the move toward consumption-based pricing over more rigid seat-based sales by startups around the world won’t abate. That’s because just as SaaS never gave back its gains to traditionally sold software, once a new, more flexible model of selling software takes hold, it tends to only get disrupted by an even newer, more flexible method. And so far, consumption-based pricing delivered via APIs is still the leader in that race.

Comment