The Exchange is digging into the Chinese venture capital market this week, but getting folks to chat about business and China on the record is turning out to be slightly harder than we anticipated. More on that later this week.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

While our dives into the Chinese and Indian startup markets are underway, let’s talk about indigestion, namely venture capital indigestion. TechCrunch executed its initial look into the Q3 venture capital market, but it’s still a struggle to get our minds around just how much capital has poured into startups this year.

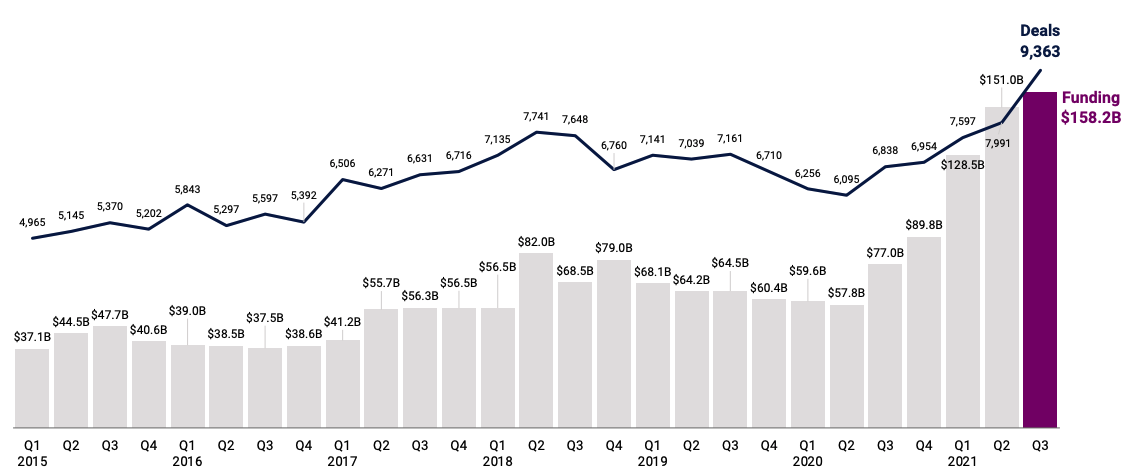

Global venture capital fundraising is at an all-time high, with many countries seeing record results. Q3 2021 saw more than double the dollars that were invested Q3 2020 across thousands of more deals, per corporate data provider CB Insights.

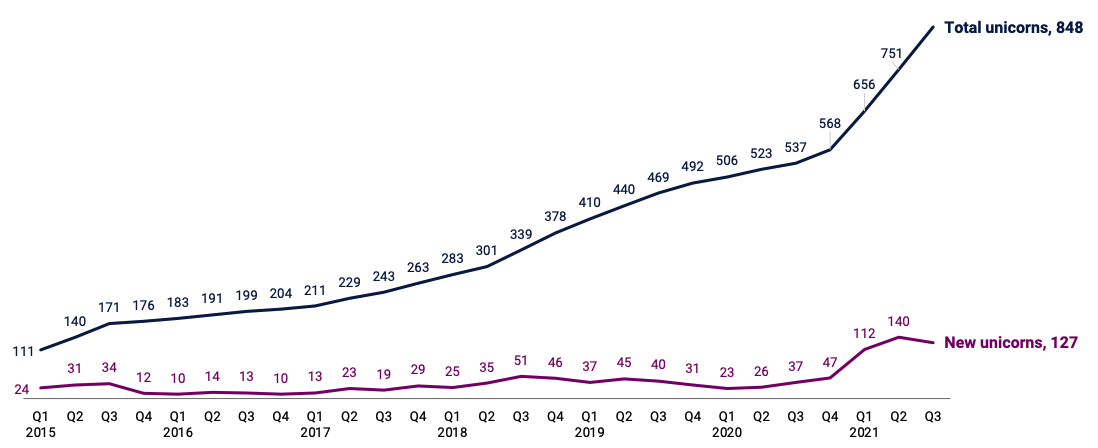

All that capital is leading to more and more unicorns around the world. Which, in turn, boosts the scale of unexited private-market value that will eventually need to exit. And with some U.S. tech giants limiting acquisitions as a way of playing defense against antitrust concerns, there is an implicit expectation that the IPO market will eventually have to make room for a stampede of unicorn debuts.

All that capital is leading to more and more unicorns around the world. Which, in turn, boosts the scale of unexited private-market value that will eventually need to exit. And with some U.S. tech giants limiting acquisitions as a way of playing defense against antitrust concerns, there is an implicit expectation that the IPO market will eventually have to make room for a stampede of unicorn debuts.

That impending debit grows larger every quarter, and at an increasingly rapid clip; the second derivative is positive, in other words.

The Exchange has noted the rising unicorn backlog from time to time, but new data makes it clearer than ever that the venture capital world is investing as if there is a future exit wave coming that will put prior IPO cycles to shame in its intensity and length.

Turning back to CB Insights’ Q3 data set, which we’ll mine over the next few weeks, observe the following chart detailing the pace at which capital is being disbursed into the global startup market:

The result of that fundraising explosion is more than simply superlative numbers in a number of global markets.

Startups around the world are raising record sums in recent quarters. And with around 60% of all global venture capital dollars coming in the form of $100 million rounds, the result of all the funding activity is that we just lived through the third straight quarter of the creation of 100 or more new unicorns.

Given that each unicorn is worth at least $1 billion, we’re discussing the addition of a minimum of $100 billion of unexited unicorn valuation added quarterly. Some unicorns exit every quarter, of course, but many more accrete value through successive fundraising, meaning that the total venture wager on eventual unicorn exits shot higher in Q3.

Even more, the pace at which new unicorns are born has never been higher than in the last three quarters. This means that while it’s been true for years that unicorns were piling up ahead of the exits, the crowding is accelerating.

Turning back to unicorn births from the same data set:

Uh-oh.

The conservative perspective of this chart is that it’s a problem. Why? Because there has never been a period (that we can recall) in which there are more unicorn exits than creations. Not at this pace. The negative perspective on the matter is that some unicorns will eventually get jammed up, unable to exit at a price that they like.

The more liberal, or perhaps bullish, perspective is that the number of unexited unicorns has been rising for years with seemingly little penalty to the larger startup market. To which we say sure, thus far.

Inherent to the bullish view that the above unicorn chart is not an issue is the expectation of persisting revenue multiples underpinning technology companies that have made them such attractive bets in recent years. They may not, though to find someone bearish on software valuations in today’s market is essentially impossible.

Chatting with the CEO of a software company who has raised north of $100 million in capital for her company the other day, I asked about the venture capital perspective concerning the balance between growth and profitability; were her VCs still as biased toward growth as they have been, or was there an increasing focus on not losing money? She said they are still growth-focused.

And that makes sense in today’s market. After all:

- The average revenue multiple for public software companies is 21.5x, per the Bessemer Cloud Index.

- Startups can therefore expect to earn around $20 in value for every marginal $1 in recurring revenue they generate.

- This means that they can invest capital at less efficient rates than they might in a more conservative market and still earn lucrative rewards for their efforts.

- So, everyone is investing (because dollars into startups have huge leverage thanks to historically rich revenue multiples) and spending (for the same reason).

Unless the music slows, this is all very good fun; given the high value of startup revenues, investing in them is simply good business, and you can hardly overpay given multiples. Thus, the unicorn backlog grows not only to record levels, but at an increasing pace.

At some point, the business cycle will slow and revert to something more conservative. We know that because it always happens. And if the above keeps up until the last moment, a host of unicorns could miss an attractive exit opportunity. This seems like an especially key concern given that the SPAC wave has shrunk to a mere lapping at the edges of the venture capital world. There is little help coming from blank-check companies. Unicorns are going to have to self-extricate from the private markets.

Ironically, it would probably be healthier for many startups worth $1 billion or more to go public now and grow when they won’t have a future liquidity and pricing hanging over their heads. But with the valuation impact of private capital still so great, and funds so easy to get (and inexpensive), who is going to take medicine over candy?

Comment