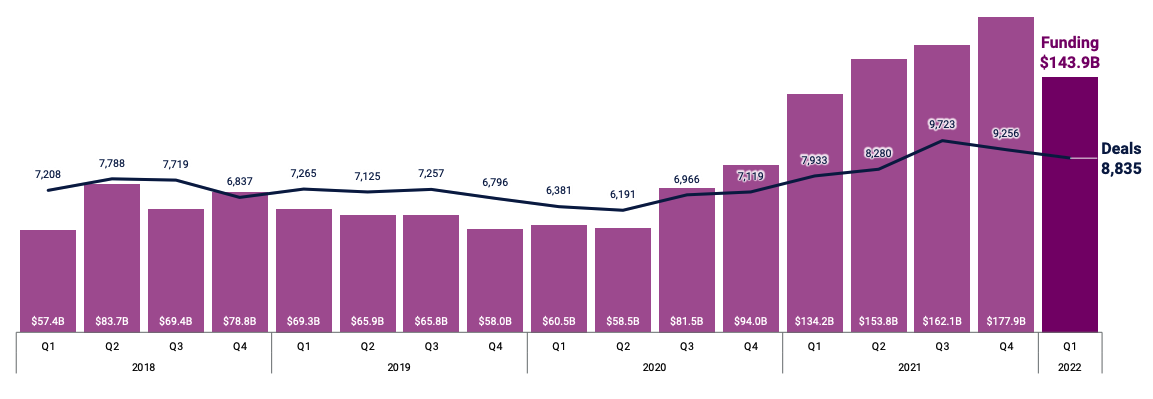

The first quarter of 2022 brought a historically huge sum of investment for global startups, with the three-month period outclassing any quarter in 2018, 2019, and 2020, according to CB Insights data.

But despite the fact that Q1 2022 posted historically elevated results, venture capital investment decelerated from Q4 2021 levels. And it may be that late-stage startups are those under the most fundraising pressure, data indicates.

Through the lens of the pace of unicorn creation, how frequently we’re seeing nine-figure rounds, and late-stage deal sizing more generally, we can see that the most mature startups — or at least the startups priced as if they were among the most mature technology upstarts — are seeing the market shifting underfoot.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

This is not a forecast of doom, mind. There isn’t anything that we can see in market data that indicates that the startup fundraising market is collapsing; indeed, there’s plenty of strength to be found in select markets and regions, something that TechCrunch+ will explore next week.

But for the huge cohort of startups worth $1 billion or more, new market conditions could force hard decisions in the quarters ahead. And if Q1 trends continue, we could see the pressure on late-stage startups ratchet higher. What is today a headache could become a migraine in short order. Let’s explore the data.

But for the huge cohort of startups worth $1 billion or more, new market conditions could force hard decisions in the quarters ahead. And if Q1 trends continue, we could see the pressure on late-stage startups ratchet higher. What is today a headache could become a migraine in short order. Let’s explore the data.

How rapidly is the late-stage startup fundraising market cooling?

To understand how the late-stage market is slowing, let’s observe trends in data that we tracked during the 2021 venture capital bonanza. From the Q1 2022 CB Insights global venture capital data download, the following stood out as key metrics in flux:

- New unicorn creation fell to 113 in Q1 2022, the slowest pace since Q4 2020, and 33 new $1 billion startups under the record set in Q2 2021.

- Mega-round volume, or the dollar value of nine-figure investments into startups, fell 30% in Q1 2022 from Q4 2021 levels, to $73.6 billion from $104.9 billion. Again, this was the smallest result since the end of 2020.

- Mega-round velocity, or the number of nine-figure rounds, set a slower-than-average pace in Q1 2022 when compared to 2021 results, with 364 deals in the quarter.

- Global late-stage median deal size also fell in Q1 2022, from $50 million in 2021 to $40 million to start the new year.

Depending on your perspective, the above data is either troubling or not that bad. To decide which perspective is more correct, we have to look ahead.

If the above decelerations are the new baseline for 2022, we’re in for more of a haircut than a decapitation of late-stage startup valuations. But if we see the data continue to deteriorate, things could become more difficult for the richly valued startups of the world. From that perspective, Q2 could become a greater bellwether for what happens to the more than 1,000 unicorns currently skating around the global late-stage private market.

What should we expect for Q2? Recall that yesterday we noted that during Q1, DocSend data indicated that the market for startup investment got worse as the quarter went on. That’s a signal that things are not getting better as the year continues, though a modest indication.

In better news, CB Insights data agrees with what we’ve seen from Crunchbase, PitchBook, and others: The Q1 2022 venture capital result set was pretty darn strong, if under prior records. Observe the following chart tracking quarterly global venture capital flows from the group’s report:

As a final thought, it’s notable how such a small dip from historic highs is altering the dynamics for late-stage startups. The layoffs, implosions, and valuation changes that we have seen are part and parcel of a — thus far — modest change to the aggregate venture capital landscape. How much more pain a sharper correction would bring is not clear, though early data from 2022 doesn’t augur well.

Why? Fragility is our general perspective. So many startups that raised in 2021 priced at extremes, leading to narrow paths to success even before the market changed; the more valuations were maximized in 2021, the steeper the terrain for a startup that wants to take on more capital in 2022.

In summary: The slowdown is here, but where the market bottom might be is far from clear. Buckle up!

Comment