Rhys Spence

Even as recently as 2019, the edtech ecosystem could have been likened to a shallow well. Funding and activity were centered in a couple of markets and there were just a few growing companies gaining interest.

But that’s no longer the case. Gone are the days when pitches to VCs would have to overcome skepticism on market size, and consumer readiness to adopt tech-enabled learning solutions.

2020 will be remembered in education circles for the tumult it caused at schools, universities and workplaces. But it will also be remembered as the year when the sector woke up to the solutions being developed by edtech companies to help people learn faster, more affordably, efficiently and effectively.

Not surprisingly, 2021 saw a boom in edtech investment across a spectra of investors. Indeed, edtech investment in 2020 and 2021 equaled the amount raised during the entire 2014-2019 period.

To carry on the initial metaphor, the edtech ecosystem is now a deep, thriving lake. Exciting companies are spawning across geographies and verticals, and even generalist investors are building conviction that the sector is capable of producing the same kind of outsized returns generated in fintech, healthtech and other sectors.

Our 2021 funding report, released today, highlights key global growth and activity metrics in edtech with a focus on Europe. We used data primarily from Dealroom, with which we’ve developed an edtech-focused data platform.

A year of records

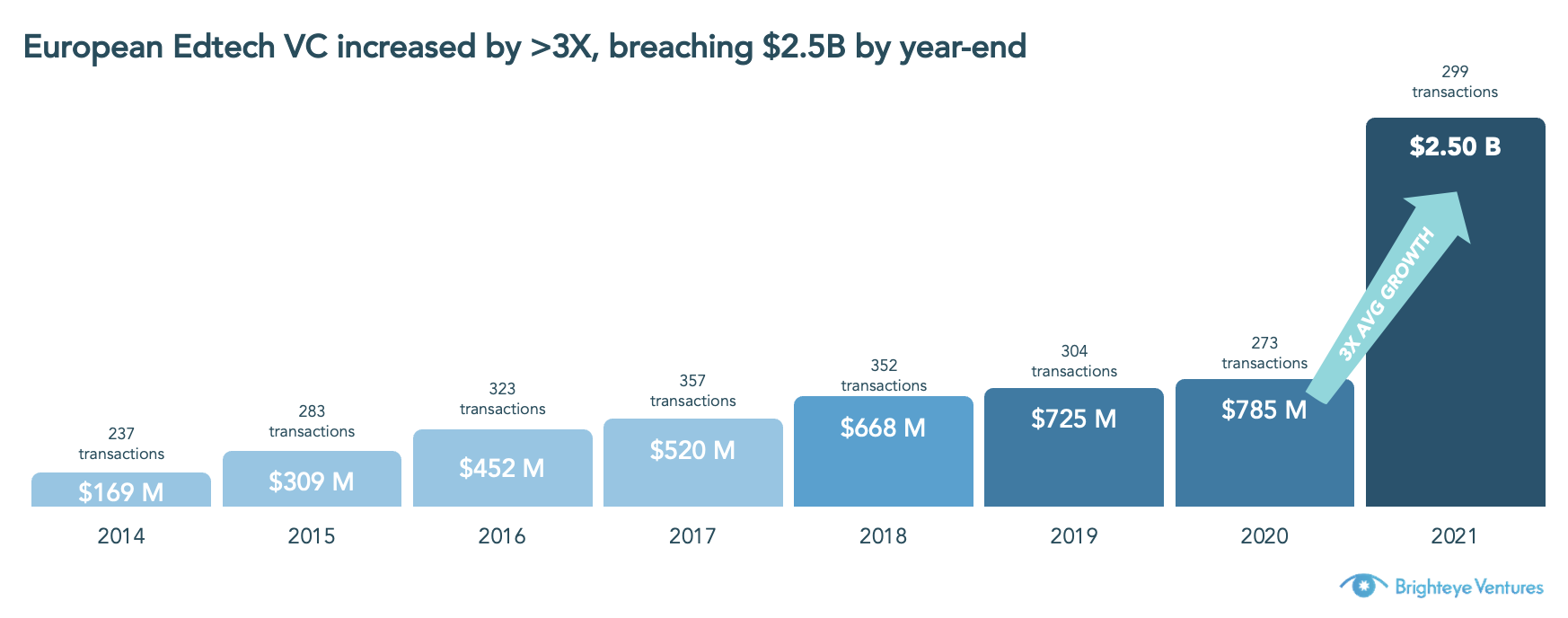

Firstly, European edtech VC investments tripled to $2.5 billion in 2021 from $790 million in 2020, compared to global funding growth of 34% to $20.1 billion in 2021 from $15 billion in 2020. The continent’s ecosystem is becoming more robust as well — the number of edtech deals in Europe accounted for 31% of all deals in the sector, up from 21% in 2019.

This growth wasn’t restricted to the usual geographies: Six European markets raised more than $100 million in 2021, compared to only one in 2020. Most of these markets are in Northern Europe, so we hope, and expect, to see some major players breaking out in Southern Europe in 2022 (particularly in Spain, Portugal and Italy).

All the markets that raised over $100 million are home to a company that raised more than $50 million. Such dominance of a single deal within a market’s total investment highlights how much the European edtech market still has to grow. Except the U.K., other markets remain like wells, rather than lakes.

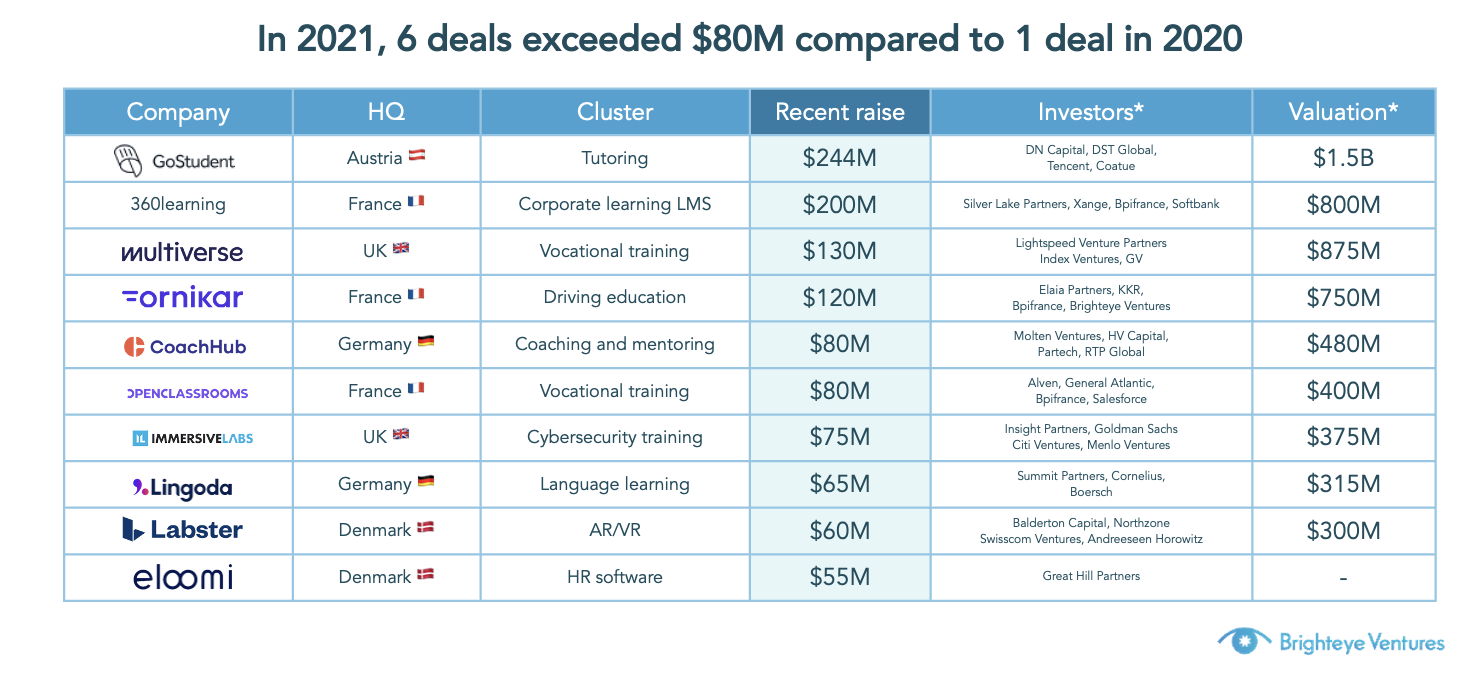

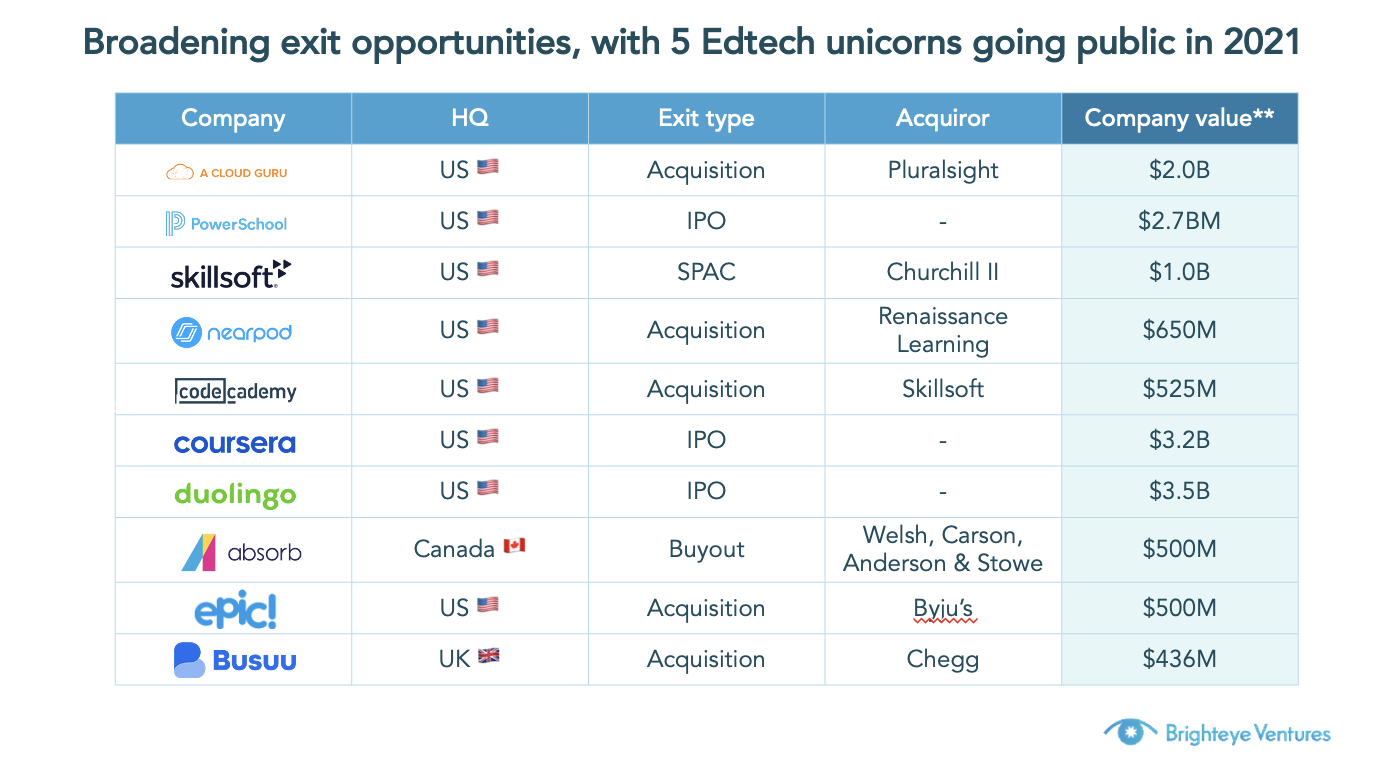

Average deal sizes in Europe also increased significantly, reaching $8.4 million in 2021 compared to $3 million in 2020. There are a number of reasons for this increase: Firstly, rapid product development and greater demand has cast light on verticals that have found product-market fit. Second, startups today have more exit opportunities, including high-value acquisitions and IPO listings. Lastly, generalist investors are taking interest in the sector due to both financial and positive impact returns, providing more competition to specialist funds.

This is clear in the data we have compiled. While edtech specialists hold four of the top 10 spots in terms of most new deals done in 2021 (Owl Ventures, GSV, Brighteye Ventures and Reach Capital), a growing number of influential generalist investors are entering the fray. For example, Gaingels, Tencent, Goodwater Capital, Juvo Ventures and Sequoia Capital China all made the top 10. Brighteye Ventures was the most active fund in Europe by number of edtech deals.

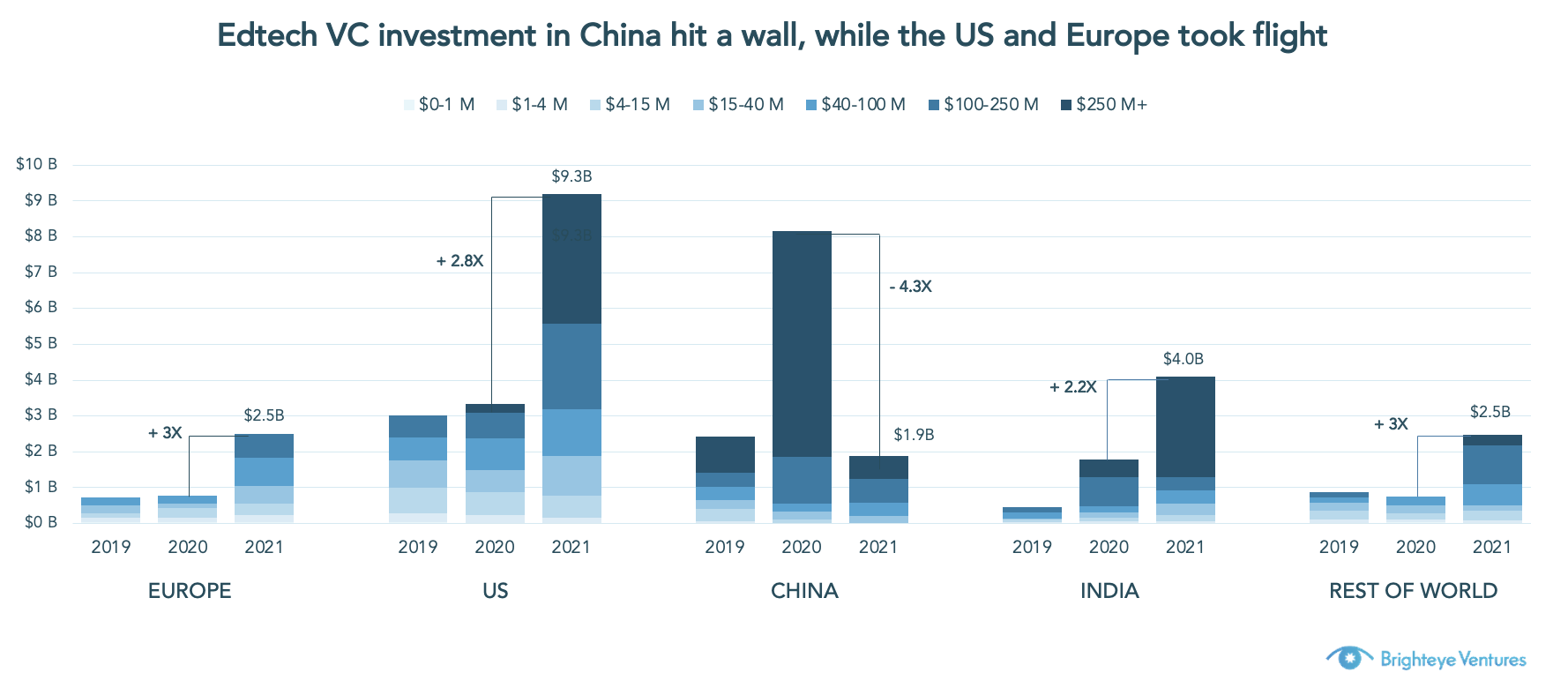

Edtech in North America saw similar meteoric increases, but on a larger scale: Funding increased to $9.3 billion in 2021 from $3.3 billion a year ago. India saw similar growth, with investment rising to $4 billion in 2021 from $1.8 billion in 2020, and Australia got its first edtech unicorn (Go1).

This growth contrasts the severe contraction in edtech investments in China, which fell to $1.9 billion (only 9% of global VC) from $8.1 billion in 2020 (54% of global edtech VC), highlighting the growing regulatory risks in the country’s tech sector. Interestingly, two of the firms most active in global edtech are based in China, suggesting that Chinese investors are turning away from their home markets for the best investment opportunities.

Despite these increases in investment, deal count fell below levels seen in 2014, which caused the average deal size to rocket to $20.7 million in 2021 from $12.7 million in 2020. High-value deals also took up more of the pie — 62% of the capital raised in 2021 happened in rounds over $100 million.

Lower VC deal counts when the ecosystem is undeniably growing suggests that pre-Seed and Seed funding is being sourced from non-VC investors, particularly angel investors, accelerators and incubators, which are not captured in this data. This is supported by the fact that the number of deals under $1 million fell to 350 in 2021 from 802 a year ago, while there were 52 deals worth over $100 million, compared to 13 in 2019.

Edtech startups flock to the promise and potential of personalized learning

The gender gap

For the first time, our report also considered edtech funding by the gender composition of startups’ founding teams. It was disappointing to see that only 2.6% of global edtech VC funding went to female-only teams, whereas male founders accounted for 77.8%, and mixed founding teams accounted for 19.6%. On average, male-only teams raised $22.7 million, while mixed teams raised $22.6 million, and female-only teams raised $5.5 million.

On the bright side, the data tells us that mixed teams were more likely to raise large rounds. For example, 41% of funding to mixed teams was secured in rounds worth more than $250 million, compared to 34% of male-only teams. This is difficult to explain, but it might reflect mixed teams’ advantages in both developing their businesses and in securing investment. The equivalent figures for Europe paint a similar picture: Male founding teams raised 27 times as much across six times as many deals as female-only teams.

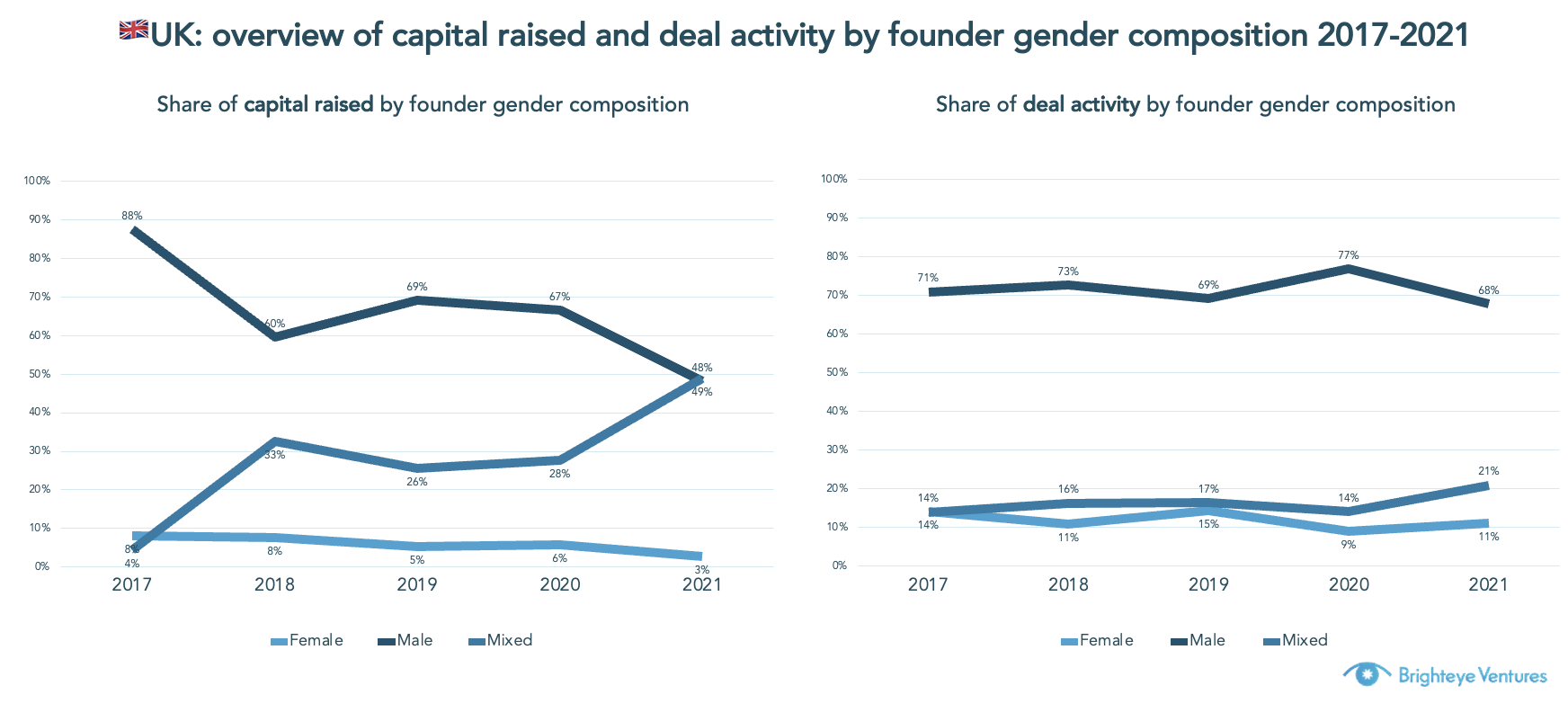

Given the limited maturity of the sector across the continent, we focused on the U.K. and France, the most mature European markets. The picture was better here: Mixed founding teams raised 49% of edtech investment in the U.K. in 2021, almost identical to the portion raised by male-only teams. However, the portion of funding raised by female-only founding teams has steadily fallen in recent years, and now sits at 2.8%.

We should also note that male-only founding teams secured 68% of deals, relative to 11% for female-only founding teams, and 21% for mixed teams.

The data for France is quite different. Deal activity here grew more equitable, with male-only teams accounting for 54% of all French deals, mixed teams taking home 32%, and 14% secured by female-only teams. However, the picture is different when you look at the share of capital raised — due to a few large deals secured by male-only founding teams, male teams accounted for 90% of the capital raised, while mixed and female-only teams scored 8% and 2%, respectively.

Excluding the two largest French rounds, both secured by male-only teams, results in male-only teams accounting for only 71% of the funding raised.

While the figures for the U.K. and France suggest an improving balance in funding, there remains a lot of work to be done to support female founders, both within female-only and mixed teams, to seek and secure VC funding.

The edtech ecosystem in Europe and most parts of the world is increasingly robust. With increasing funding, higher average deal sizes, climbing deal counts, more investors, and attractive exit opportunities are broadening, the lake is expanding, and hopefully, so too will the pool of successful founders.

Comment