Charlie Graham-Brown

Even after the unprecedented year that we had in 2020, the VC markets picked up in 2021 and founders raised 157% more capital in the second quarter of 2021 compared to the previous year. Global VCs have invested $268.7 billion as of July 2021, already passing the total investment amount in 2020.

In emerging markets, where our company Seedstars focuses its attention, VC capital flow has been growing 40% year on year but still represents less than 4% of global volumes, despite accounting for the majority of the world’s population. Whether you think this is a bubble, one fact remains true: Capital is a commodity.

Some capital will flow faster than others and investment terms must be considered, but assuming all things are equal, the real value lies beyond the capital. It lies in the knowledge, network and support an investor brings to the table.

It is not only a matter of market perception or an identified trend. De Santis Breindel asked CEOs what was the top evaluation criteria when choosing a VC firm. Reputation of the firm came first place, followed by the ability to add value to portfolio companies beyond funding. So how has the industry responded to this?

“Smart money” and the VC platform

At some point, the concept of “smart money” slipped into the VC vernacular referring to the idea that some money also came with highly sought after expertise and the likelihood of crowding in other investors.

Today, the evolution of the concept has brought us the VC “platform.” Smart money was definitely a catchier phrase but not institutional enough to be turned into something official. The concept of a platform, on the other hand, gives more room for innovation but still leaves most founders (and even some platform managers) confused. So, the big questions are: What exactly is a platform? How does it bring value? Do you need it as a startup? How can you evaluate it? Read on.

T-shaped platforms and the Tetris fit

Keep two rules in mind:

- No individual or VC firm is good at everything.

- What a startup needs the most will change over time.

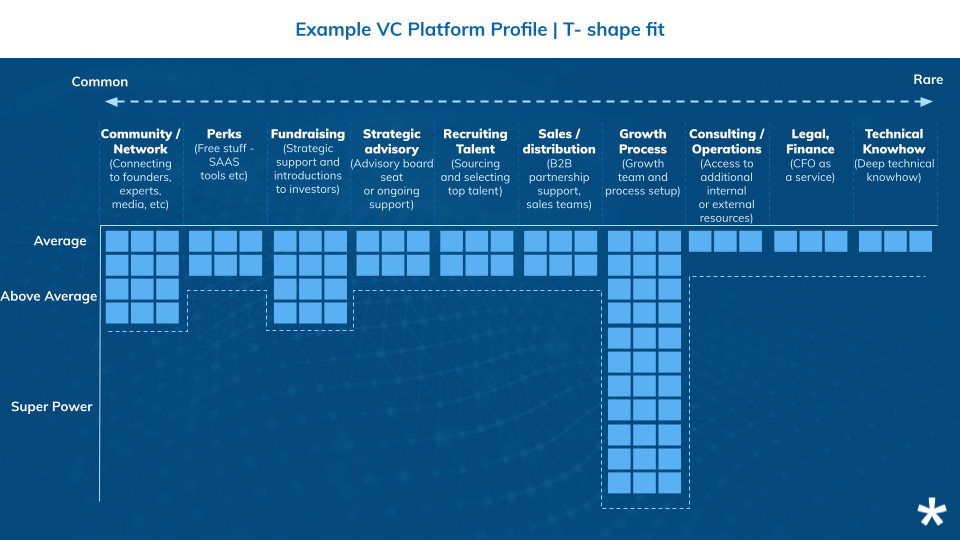

A VC platform can add value in multiple ways: network access, fundraising support, talent recruitment, sales, technical know-how and the list goes on with both common and rarer startup needs. See the image below on a breakdown of services we typically see in a VC platform from the most common to the rarest.

VC firms running a platform need to figure out what skills to focus on and develop a T-shaped profile. For example, Y Combinator would probably put fundraising as their superpower, Coinbase Ventures might cite their technical know-how and at Seedstars International, the focus is on growth.

The value-adding components listed in the above image are all fairly high level and each one can be broken down further. For example, all VCs will be able to support with fundraising, but when you dissect this value further, you can cite various components: pitch deck review, fundraising strategy, investor intros (by region and country), cap table reviews and exit advisory.

Whatever the T, it should be clearly explained to you as the founder so you can judge the fit. Each investor will have their own T profile and each startup will have needs that evolve over time. A good startup/investor fit would be like scoring a few lines in Tetris.

Founders: Do your homework

As a VC, we ask several hundred questions when we do due diligence on a startup. In return, we probably field an average of five questions per founder. Of course we are the ones putting the risk capital on the table and have a fiduciary responsibility, but we really enjoy and respect when a founder does their homework by asking questions, doing some founder referral calls and maybe even talking to core members of the platform team.

To better evaluate the human touch, don’t just reference check the success stories. Try and talk to failed companies in the portfolio too and discover how founders were supported through their final hours. This is probably a more telling sign as to who will have your back through thick and thin.

Don’t forget the human touch

We scoured reviews founders had written on VCs online and the most common comments were regarding soft skills. VCs who were respectful and trustworthy stood out most. Given that a startup/VC relationship is destined to last many years, the human touch should not be underestimated.

Capital is a commodity, the VC platform the differentiator, but working with the right people may have the most profound impact.

Comment