European insurance tech startup Wefox has raised $400 million in a series D round of funding, giving the German company a post-money valuation of $4.5 billion. This represents a 50% increase on last year’s $3 billion valuation at its Series C round.

Founded out of Berlin in 2015, Wefox sells various insurance products through a combination of in-house and external brokers, bypassing the direct-to-consumer model of insurtech competitors which include rival German startup Getsafe. This way of growing users, by getting third-party brokers to use Wefox to advise their own customers, is how CEO and founder Julian Teicke reckons helped the company double its revenues to $320 million last year. Moreover, it has already generated $200 million in the first four months of 2022, putting it on target to hit $600 million in turnover by the end of the year, and recently passed 2 million customers across the board.

To date, Wefox said it has built a network of around 3,000 independent brokers in its native Germany, while in other markets such as Switzerland, Germany and Austria, it has trained its own brokers.

“Wefox’s ‘secret sauce’ is in its business model of indirect distribution, which has enabled the company to scale faster than any other insurtech in the world,” Teicke told TechCrunch. “Our model is unique in the insurtech space, since all others go direct to consumer.”

Customer acquisition

The main benefit to this model lies in the cost of acquiring customers, which becomes significantly lower given that its brokers, agents and other partners do much of the spade-work for Wefox. Moreover, this also allows Wefox to enter new markets more quickly.

“We can then focus on enabling our brokers, agents, and affinity partners to target the most profitable customers, which improves our loss ratios and customer lifetime value,” Teicke added. “Our model enables Wefox to drive a superior financial profile which puts us on a clear path to profitability.”

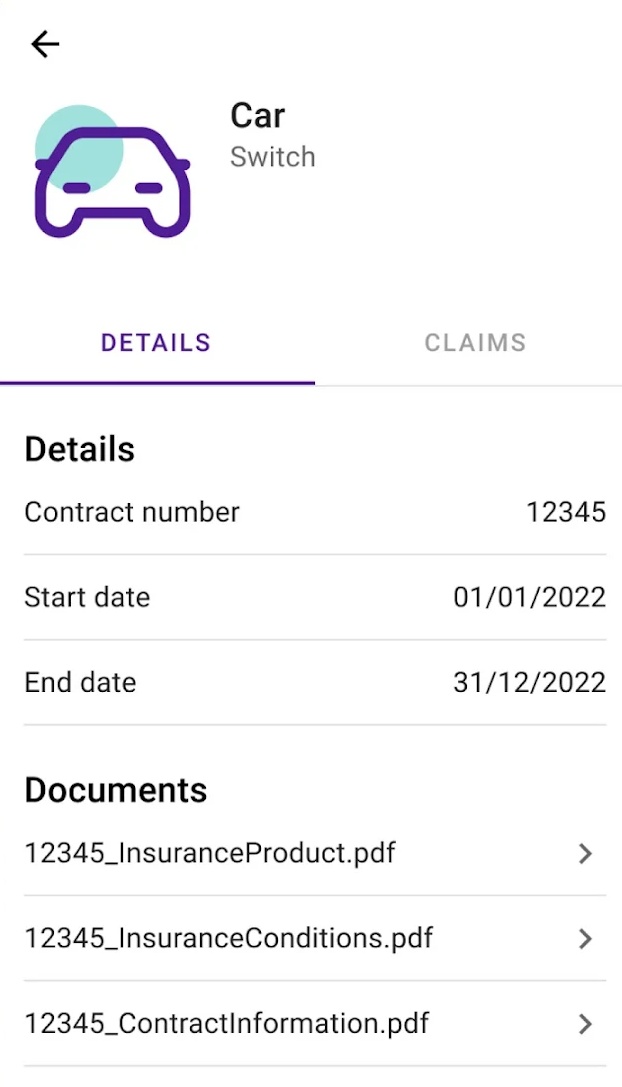

The approach is built on the basic notion that insurance is an inherently complex subject, and people would rather chat with a human and get personalized advice. And only then does the technology kick in, with all the usual mobile apps and online dashboards for registering and filing claims.

Downturn

Few industries are impervious to the economic downturn, and insurtech is no different. In the past month alone, Policygenius cut a quarter of its workforce shortly after raising $125 million, while Next Insurance is scaling back by around 17%. Elsewhere, a host of publicly traded insurtech companies are trading way down on their initial IPO price, including Root, Hippo and Lemonade, the latter also reportedly laying off a portion of its staff back in April.

On the flip-side, we have seen some bumper investments in the insurtech space, with Branch recently attracting a $147 million Series C tranche at a $1.05 billion valuation, while YuLife snagged $120 million at an $800 million valuation just last week. Throw into the mix the steady stream of smaller investments in the space and it’s clear that even if 2022 doesn’t follow in the footsteps of the bumper 2021, insurtech isn’t exactly dead in the water.

From Wefox’s perspective, it has only been a year since it raised a $650 million round of funding, so it’s difficult to imagine that it could’ve burned through that much cash in such a short period of time. And, it seems, it hasn’t — according to Teicke, it wasn’t desperate to raise again, it’s simply future-proofing itself should it need the funds.

“We don’t need any more cash, however, following our Series C round, investors approached us and under the current economic climate we believe it was prudent to review the situation and take advantage of the current economic downturn — because we see this as an opportunity to grow even faster,” Teicke said.

Wefox’s Series D round, which is compromised of equity and debt, was led by Mubadala Investment Company, with participation from LGT, Horizons Ventures and Omers Ventures. Flush with cash, the company said that it plans to enter new European markets in 2022, with longer-term plans to expand into the U.S. and Asia in 2024.

Comment